In Michigan, insurers cannot use credit information or credit-based scores to determine rates when setting auto insurance rates, renewing an auto insurance policy, or underwriting a new policy. This means that cancelling your auto insurance will not affect your credit score in Michigan. However, it is important to follow the proper cancellation procedures, such as providing proper notice to your insurance provider, to avoid penalties and fees.

| Characteristics | Values |

|---|---|

| Can you cancel your auto insurance at any time in Michigan? | Yes |

| What happens if you cancel your auto insurance in Michigan? | You will no longer have any coverage under the policy. You will be entitled to a refund of any prepaid premiums for the balance of the policy term. |

| Do you get a refund when you cancel car insurance in Michigan? | Yes |

| Does cancelling your auto insurance affect your credit score in Michigan? | If you give your insurance provider proper notice and follow the necessary cancellation steps, cancelling your auto insurance will not affect your credit score. However, if you don't officially cancel and instead stop paying your premiums, it will harm your credit. |

What You'll Learn

- Michigan law allows drivers to cancel their insurance at any time

- Michigan insurers must provide a minimum of 10 days' notice before cancellation

- Cancelled policies can be reinstated, but it's tricky

- Michigan insurers cannot use credit scores to determine rates

- Driving without insurance in Michigan is a misdemeanor

Michigan law allows drivers to cancel their insurance at any time

Firstly, it's important to give proper notice to your insurance provider. This means informing them that you're cancelling the policy rather than simply stopping payment. Some companies require 15 or 30 days' notice, so it's a good idea to check with your provider to ensure you follow their specific cancellation requirements.

Secondly, if you've paid any premiums in advance, your insurance provider should refund you for these. You may also be entitled to a prorated refund on your current premium, although any cancellation fees will usually be deducted from this amount. These fees tend to be higher if you cancel your policy soon after purchasing it.

Thirdly, it's important to remember that driving without insurance in Michigan can result in severe criminal penalties and financial consequences. Therefore, if you plan to continue driving, it's crucial to obtain a new insurance policy before cancelling your current one. This will ensure that you maintain continuous coverage and avoid any lapses in protection.

Additionally, your insurance provider is required to notify the local Department of Motor Vehicles (DMV) when you cancel your policy. The DMV will then contact you to request proof of new insurance or confirmation that you no longer own the vehicle. Failing to respond to this request may result in the state suspending your license and registration.

In conclusion, while Michigan law allows drivers to cancel their insurance at any time, it's important to follow the proper steps to avoid penalties and maintain continuous coverage. By giving proper notice, understanding refund and cancellation fee policies, and obtaining a new insurance policy before cancelling your current one, you can ensure a smooth transition and stay compliant with the law.

Insuring Your Vehicle: When is it Mandatory?

You may want to see also

Michigan insurers must provide a minimum of 10 days' notice before cancellation

In Michigan, insurers are required to give a minimum of 10 days' notice before cancelling an auto insurance policy. This is outlined in the Michigan car insurance cancellation laws, which state that a policy can be cancelled by either the company or the driver. The laws also dictate that a refund must be provided and that the cancellation notice must be "peremptory, explicit, and unconditional".

If a policy is cancelled, it means that the policy has been terminated during the policy period and before it has expired. If this happens, the policyholder will no longer have any coverage under the cancelled policy and will be entitled to a refund of any prepaid premiums for the remaining policy term. This is true regardless of whether the policy was cancelled by the insurance company or the driver.

It is important to note that if a policy is cancelled, the policyholder must obtain a new No-Fault auto insurance policy to avoid criminal penalties and severe financial consequences for driving without insurance in Michigan. Additionally, the local Department of Motor Vehicles (DMV) will need to be notified, as they will likely contact the policyholder to ask for proof of new insurance or proof that the car has been sold.

To avoid fees and penalties, it is recommended to look into the insurance provider's cancellation policy. Some companies require 15 or 30 days' notice, and cancellation fees may apply. However, in most cases, a nominal fee or no fee will be charged.

Commission Earnings of Auto Insurance Agents

You may want to see also

Cancelled policies can be reinstated, but it's tricky

Michigan's laws do not address the reinstatement of a cancelled policy. Each auto insurance company will have its own rules to address this. However, auto insurance companies will often allow reinstatement once an insured driver pays all overdue premiums and late payment fees.

If you're thinking of cancelling your auto insurance policy, it's important to be aware of the potential consequences. While you can cancel your policy at any time, you may be subject to early cancellation fees or a lapse in coverage. In Michigan, if your policy is cancelled, you will no longer have any coverage under that policy and will be entitled to a refund of any prepaid premiums for the balance of the policy term.

To avoid penalties, it's important to consult your contract and discuss your options with your current insurer before cancelling your car insurance policy. Some providers may require a 30-day notice to avoid early cancellation fees. It's also important to maintain valid insurance coverage, as driving without insurance in Michigan can result in severe criminal penalties and financial consequences.

If you're switching providers, your new company will notify your current insurer for you with a quick insurance cancellation phone call to customer service. However, the company might charge a cancellation fee or not reimburse you for your unused premium. Your current insurer may also try to convince you to stay by offering discounts or other ways to save on your premiums.

Auto Insurance in New Hampshire: Average Monthly Cost Explained

You may want to see also

Michigan insurers cannot use credit scores to determine rates

In Michigan, insurance companies are prohibited from using "credit information or an insurance score as any part of a decision to deny, cancel or nonrenew a personal insurance policy". This is outlined in the Michigan Compiled Laws, or MCL, which states that:

> An insurer shall not use credit information or an insurance score as any part of a decision to deny, cancel, or nonrenew a personal insurance policy under chapters 21, 24, and 26.

However, insurers may use credit information and an insurance score to determine premium instalment payment options and availability. This means that insurance companies in Michigan might be able to consider your credit when deciding which instalment payment options to offer for your policy.

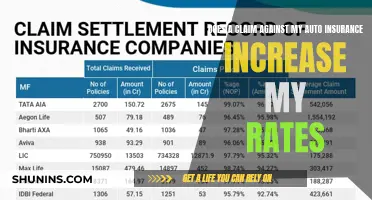

It is important to note that while Michigan insurers cannot use credit scores to determine rates, they can still use other factors such as your claims history and the vehicle or home you are insuring to determine your insurance rates.

New Mexico's Auto Insurance Rates: Why So High?

You may want to see also

Driving without insurance in Michigan is a misdemeanor

In Michigan, driving without insurance is considered a misdemeanor. The penalties for driving without insurance in Michigan are the harshest in the nation. If convicted, you may have to pay a fine of up to $500, face up to one year in jail, and surrender your driver's license for 30 days or until you have coverage, whichever is later. You'll also have to pay a service fee of at least $125 to reinstate your license.

If your license is suspended, you may need to have your insurer submit proof to the Secretary of State that you have the required minimum insurance coverage. The Secretary of State will not allow you to renew, transfer, or purchase a new registration for your vehicle until you can prove you have auto insurance and pay a $50 fee.

If you get into an accident while driving without insurance in Michigan, the consequences can be severe. You will be financially responsible for any injuries or property damage you cause. This includes medical costs and car repair bills for both yourself and the other driver. You will also lose out on compensation for pain and suffering, vehicle damage, and lost wages. As an uninsured driver, you might even have to pay for the other driver's lost income.

It is important to note that Michigan requires every driver to carry car insurance with personal injury and property protection, as well as bodily injury and property damage liability coverage. The state has default limits in place for bodily injury coverage, with policies quoted with a default coverage of $250,000 per person and $500,000 per accident.

In addition to the financial and legal consequences, driving without insurance can also impact your ability to obtain insurance in the future. Insurers tend to increase rates for drivers with a lapse in coverage as they are seen as riskier to insure. Some insurers might even refuse to cover you at all. Therefore, it is crucial to maintain continuous auto insurance coverage to avoid the harsh penalties and difficulties in obtaining future insurance.

Effective Strategies for Filing Complaints Against Safeco Auto Insurance

You may want to see also

Frequently asked questions

No, cancelling your auto insurance will not affect your credit in Michigan. However, if you don't officially cancel and stop paying your premiums, it will harm your credit.

You can cancel your insurance at any time, but only if you are switching insurance companies or no longer own the insured vehicle. You can usually do this with a phone call to your insurance agent, but some companies require written notice.

If you don't officially cancel and simply stop paying your premiums, it will harm your credit. It may also make your next auto insurance provider see you as high-risk and charge you more for insurance.

If you cancel your auto insurance in Michigan and then get into a car accident, you will be unable to claim no-fault benefits.

Yes, you can get your auto insurance back after it has been cancelled in Michigan. The first step is to reach out to your insurer as soon as possible and discuss the reasons for cancellation.