Filing an auto insurance claim will almost always result in an increase in your insurance rates, even if the accident was not your fault. The decision to file a claim can have a major impact on your insurance rates, and the more claims you file, the more your insurance will cost. The increase in rates can be anywhere from 3% to 40% and can last for up to five years. However, there are no hard-and-fast rules, and the impact on your rates will depend on several factors, such as the type and amount of the claim, your insurance company, your claims history, and your location.

| Characteristics | Values |

|---|---|

| Number of claims filed | The more claims filed, the more likely rates will increase |

| Severity of accident | More severe accidents will cause higher rate increases |

| Cost of claim | More expensive claims will cause higher rate increases |

| Driving record | A bad driving record could be more affected financially |

| At-fault vs. no-fault | At-fault accidents will result in higher rate increases |

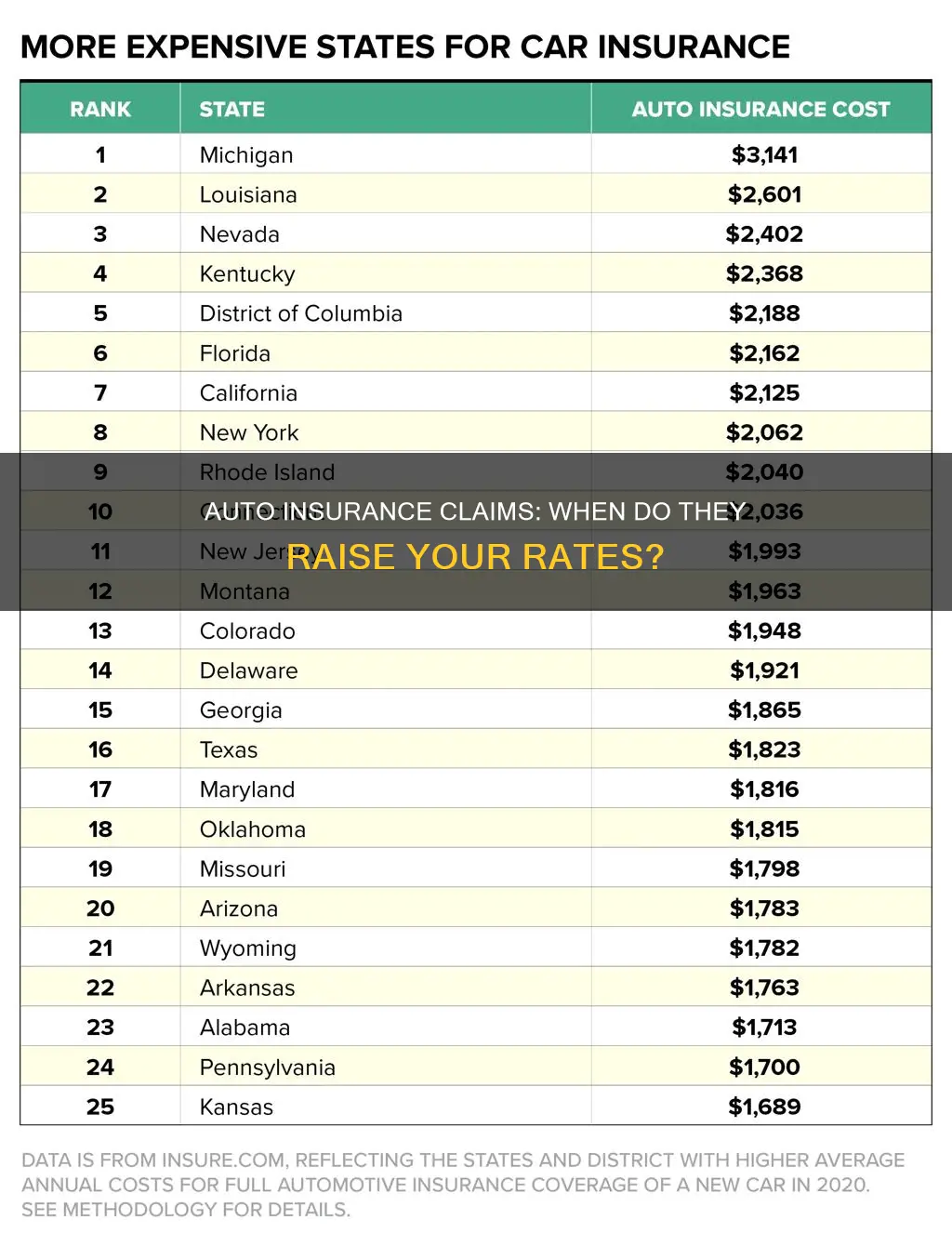

| State | Rate increases vary by state |

| Type of claim | Certain types of claims, such as dog bites or slip-and-fall incidents, can have a significant impact on rates |

| Insurance company | Some insurance companies charge more than others after accidents |

| Accident forgiveness | Some companies offer accident forgiveness, which means rates won't increase after the first at-fault accident |

What You'll Learn

Comprehensive insurance covers property damage from non-collision incidents

Comprehensive insurance is a type of automobile insurance that covers damage to your car from causes other than a collision. It covers damage to your car from animals, falling trees, natural disasters, theft, and vandalism. It does not cover damage to other vehicles or people.

Comprehensive insurance is designed to pay for repairs to your vehicle caused by things other than a collision. This includes natural hazards such as deer strikes and falling limbs, as well as fire, weather, natural disasters, theft, and acts of vandalism. However, it does not cover damage caused by a collision with another vehicle, liability when you are at fault for an accident, or injuries to a passenger or another person.

The cost of a comprehensive insurance policy will vary based on the value of the vehicle, the zip code where it is registered, and the driver's past insurance history, among other factors. Costs can range from about $134 annually to about twice that much.

Comprehensive insurance is particularly useful if you live in an area where collisions with animals are common, or in an area that is prone to hail or other stormy weather. It is also useful if you live in an area with high crime rates and break-ins and theft occur regularly.

While filing an insurance claim can provide financial protection in the event of loss or damage, it may also impact your insurance rates, even for minor events. The number of claims filed is directly linked to an increase in rates. Comprehensive claims can lead to increased rates, although the impact is less than for at-fault accidents.

Understanding False Auto Insurance Claims: What You Need to Know

You may want to see also

Filing a claim may increase rates for 3-5 years

Filing an insurance claim can have long-term consequences, such as an increase in your premium or difficulty switching providers in the future. The number of insurance claims filed is directly linked to an increase in rates. The more claims filed, the more likely rates will rise. File too many claims, especially in a short amount of time, and the insurance company may decide not to renew your policy.

The decision to file a claim can significantly impact your insurance rates, even if the accident was minor or not your fault. The severity of the accident will also affect the increase in your premium. More serious accidents will result in higher rate hikes.

The increased attention to your risk profile usually lasts three to five years. However, the length of time that you'll need to pay increased car insurance rates depends on your state's laws, your insurance company's rules, the severity of your accident, and your prior accident history.

Some companies may implement rate hikes for about two years, while others may charge higher rates for up to five years. If your insurer drops your coverage, you may be forced to purchase high-risk insurance, which can be extremely expensive.

NAIC Number: Auto Insurance's Secret Code

You may want to see also

Accidents that aren't your fault may still increase rates

Even if an accident isn't your fault, your insurance rates may still increase. This is because insurance companies will view you as a high-risk driver, someone they believe is more likely to file claims in the future. The more claims you file, the more your insurance will cost, even if the losses were not your fault.

In the case of car accidents, the at-fault driver's insurance company is typically responsible for covering the expenses. However, if the at-fault driver's insurance company denies responsibility for the accident, or if their insurance was invalid, you may need to file a claim with your own insurance company. In this case, your rates may increase, even though the accident was not your fault.

Additionally, certain types of claims can have a significant impact on your rates. For example, dog bites, theft, water damage, and fire claims can result in higher premiums.

It's also important to note that if you have multiple claims in a short period, insurance companies may view you as a high-risk customer and may not renew your policy. Therefore, it's generally advisable to report accidents to your insurance company, even if they are not your fault, to ensure coverage and protect your interests.

The Fine Print: Understanding Auto Insurance and Part Replacement

You may want to see also

Some companies offer accident forgiveness

Accident forgiveness is an auto insurance benefit that may prevent insurance rates from increasing as a result of a driver's first at-fault accident. It can be added to a policy or awarded to those with a good driving record. Accident forgiveness may allow drivers to save on their premiums and retain good driver discounts.

Accident forgiveness is available in most states, except California, Connecticut, Massachusetts, Hawaii, New York, and South Carolina. It is worth noting that in California, offering accident forgiveness is prohibited as it would increase prices too much, breaking Proposition 203, which mandated that insurance companies decrease rates by 20%.

Some companies that offer accident forgiveness include:

- GEICO

- Liberty Mutual

- Progressive

GEICO's Accident Forgiveness can be earned or purchased in states where it is available. It applies per policy, not per driver. If you have multiple drivers on your policy, any of the eligible drivers may use this benefit once.

Liberty Mutual's Accident Forgiveness is available to drivers with 5 years of accident-free driving. Drivers under 25 must have five consecutive clean years before their first accident is forgiven.

Progressive offers three types of accident forgiveness: Small Accident Forgiveness, Large Accident Forgiveness, and Progressive Accident Forgiveness. Small Accident Forgiveness is automatically included for new customers in most states, and Large Accident Forgiveness is available to customers who have been with Progressive for at least five years and have remained accident and violation-free for up to five consecutive years. Progressive Accident Forgiveness can be purchased when buying or renewing a policy.

Auto Insurance Rates for Women at 40: What's Average?

You may want to see also

Filing a claim may be unnecessary for minor incidents

For instance, if you have backed into a pole and dented your bumper, it may be more cost-effective to pay for the repairs yourself rather than filing a claim and risk higher premiums. If you have collision coverage, weigh the possibility of your rates going up at renewal time because of the claim. If you don't have collision coverage, there is no reason to contact your insurer.

If the damage is only minor and the accident only involves you and your car, you may not need to file a claim. For example, if you back into your mailbox, leaving a small dent on your bumper, you could choose not to file a claim to avoid increased premiums. In this case, the question becomes how much it would cost to repair your vehicle compared to your deductible.

If the repair cost is lower than your insurance policy's deductible, it's probably not worth filing a claim, as your out-of-pocket cost will be higher than the amount your insurer will cover. In this case, you may want to foot the repair bill yourself to avoid paying premium increases at your next renewal.

If you have collision coverage and the damage is minor, you can get a quick repair estimate. If the repair costs less than your deductible, there's no point in filing a claim. The deductible is the amount you pay out of pocket toward a repair.

Gap Insurance: Florida's Ultimate Car Protection

You may want to see also

Frequently asked questions

Yes, your rates may still increase even if you're not at fault. However, the increase is likely to be less than if you were at fault.

The increase depends on several factors, including the type and amount of the claim, your insurance company, your claims history, and your location. On average, rates increase by 3% to 32% for three to five years.

The costliest types of claims are bodily injury claims, followed by property damage claims.

Some insurance companies offer "accident forgiveness", where rates won't increase after the first at-fault accident. However, these policies are generally more expensive.