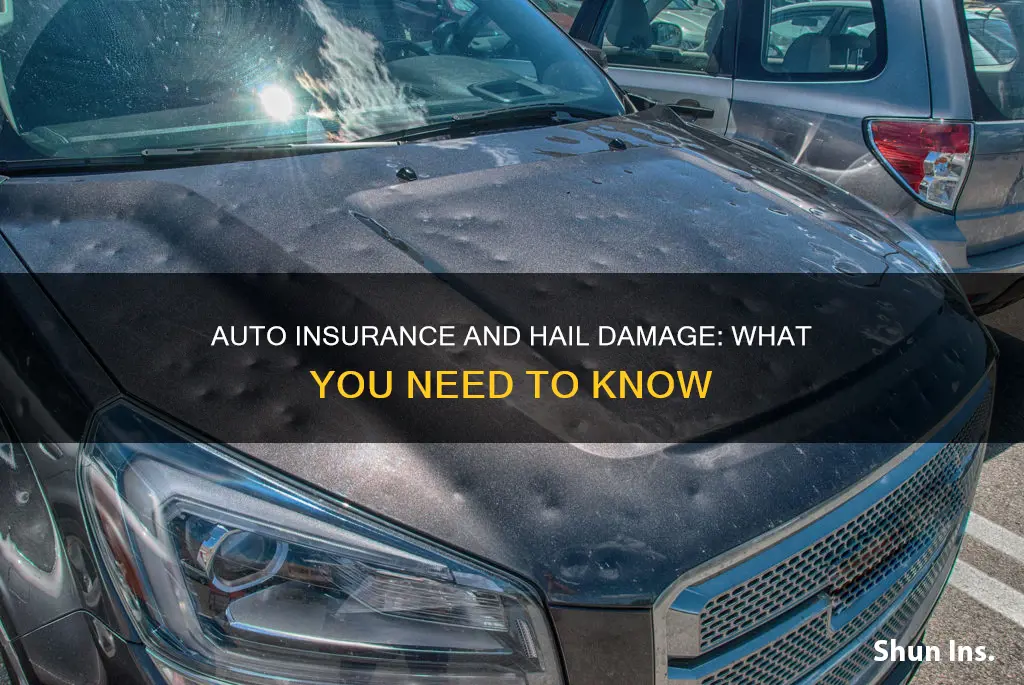

If you're worried about how hail damage will affect your auto insurance, you're not alone. The good news is that filing a claim for hail damage generally won't cause your insurance rates to go up, as it's considered an Act of Nature and is outside of your control. However, if you have a history of frequent claims or live in an area prone to hailstorms, your rates may increase. To be covered for hail damage, you'll need comprehensive insurance, which is optional and will cost you extra. If you don't have comprehensive insurance, you'll have to pay for hail damage repairs yourself. When deciding whether to file a claim, compare your comprehensive deductible with the repair estimate, as it may not be worth claiming if the repair cost is less than or close to your deductible.

| Characteristics | Values |

|---|---|

| Will hail damage increase my auto insurance? | No, hail damage is considered an "Act of Nature" and is out of the policyholder's control. However, if you have a history of hail damage claims or live in an area prone to hailstorms, your insurance company may increase your rates. |

| What type of car insurance covers hail damage? | Comprehensive insurance covers hail damage. Comprehensive insurance is optional and covers damage from severe weather, fire, floods, vandalism, theft, crashing into animals, and falling objects. |

| How much does comprehensive insurance cost? | The average cost of comprehensive insurance is about $170, but it can vary by state. |

| What is the process for filing a hail damage claim? | Contact your insurance company, provide details and documentation of the damage, and get repair estimates from licensed shops. An adjuster will assess the damage and determine the repair cost. Your insurance company will then send you a check for the repairs, minus your deductible. |

| Can I repair hail damage without filing a claim? | Yes, if the repair cost is less than or close to your deductible, you may choose to pay for the repairs out of pocket to avoid a potential rate increase. |

What You'll Learn

Comprehensive insurance covers hail damage

Comprehensive insurance is an optional coverage that you can purchase to protect your car from hail damage. It covers damage to your vehicle from events outside of your control, including hail and other weather-related damage. If you live in an area prone to hailstorms, comprehensive insurance is a wise investment.

Comprehensive insurance, also known as "other than collision" coverage, protects your car from damage that is not related to a collision. This includes severe weather events like hail storms, as well as floods, vandalism, theft, and animal collisions. Comprehensive insurance is optional, but it provides valuable protection for your vehicle in the event of unforeseen circumstances.

If your car is damaged by hail, you can file a claim with your comprehensive insurance provider. Make sure to start the claim as soon as possible and include photos or videos of the hail damage. An adjuster will assess the damage and provide a repair estimate. Comprehensive insurance will cover the repair costs, minus your deductible, up to your policy's limit, usually the cash value of your car.

Whether or not comprehensive insurance is worth it depends on the extent of the hail damage and your deductible amount. If the repair cost is only slightly higher than your deductible, you may be better off paying for the repairs out of pocket. However, if the damage is significant and the repair cost is much higher than your deductible, filing a claim can save you a substantial amount of money. Additionally, comprehensive insurance can provide peace of mind, knowing that you are protected in the event of unforeseen circumstances.

Will a Hail Damage Claim Increase My Insurance Rates?

Filing a single hail damage claim will generally not increase your insurance rates. Hail damage is typically considered an "Act of Nature" or "Act of God," meaning it is beyond your control. However, if you have a history of frequent claims or live in an area with consistent hailstorms, your insurance rates may be impacted. Insurance companies consider your claims history and the likelihood of weather-related claims when determining rates.

Auto Insurance in Riverside: How Much Does It Cost?

You may want to see also

Liability insurance doesn't cover hail damage

Liability insurance does not cover hail damage to your car. This type of insurance is a minimum requirement in most states and only covers damage to other people's property and injuries to other people if you are found to be at fault in an accident.

Liability insurance is there to protect you from financial liability if you harm someone else or their property while operating a vehicle. It consists of two types of coverage: bodily injury liability and property damage liability. Bodily injury liability covers the medical expenses of the other party if you are found at fault in an accident, and may also cover lost wages and legal fees if the injured party sues. Property damage liability covers damage to property resulting from a covered accident in which you are at fault. This may include the other party's vehicle repair or replacement costs, as well as damage to other property, such as fences, buildings, and phone poles.

Hail damage is covered by comprehensive insurance, which is optional and covers damage to your own vehicle from events outside of your control. Comprehensive insurance is also known as "other than collision" coverage because it covers damage that isn't related to a collision, such as severe weather, fire, vandalism, and falling objects. If you live in an area prone to hail storms, insurers may charge a higher rate for comprehensive coverage due to the higher likelihood of weather-related claims.

Best Auto Insurance: HSH Policy Options and Benefits

You may want to see also

Filing a claim for hail damage

Document the Damage

The first step is to gather evidence of the damage. Take clear and detailed photographs or videos of the damage from multiple angles, capturing close-ups and wide shots to show the full extent. If possible, also measure or estimate the size of the hail to establish the storm's severity. It is crucial to do this as soon as it is safe, to prevent further damage and complications with your claim.

Review Your Insurance Policy

Before filing a claim, review your insurance policy to understand what is covered and what your financial responsibilities are. Check your deductibles, coverage limits, and the claims process outlined in your policy. Knowing what your policy includes and what to expect from the claims process will help you be more prepared.

Contact Your Insurance Company

Report the damage to your insurance company to start the claim process. Most companies offer a 24-hour claim filing service, and many have apps or websites that allow you to submit your claim online. Provide them with detailed information, including the date of the storm, type of damage, and any emergency repairs made. Submit all necessary paperwork, photos, and other relevant documentation.

Collect Repair Estimates

Contact several licensed local repair contractors or roofing specialists to obtain independent estimates for the cost of repairs. It is recommended to get at least three quotes from different contractors to ensure you are getting a fair price. If possible, arrange to have a trusted contractor present during the adjuster's visit to help ensure a thorough damage assessment.

Meet the Adjuster

Your insurance company will assign an adjuster to assess the damage and determine the repair costs. Share your notes, photographs, and repair estimates with the adjuster. They will then submit a report to your insurance company for approval or denial of the claim. If the settlement offered does not cover all necessary repairs, be prepared to negotiate with the adjuster and provide additional documentation if needed.

Finalize the Claim

Once you receive a settlement offer, carefully review the details to ensure it covers all necessary repairs. If the offer is insufficient, you may need to negotiate with your insurer or seek assistance from a public adjuster or legal advisor. After finalizing the claim, you will receive a payout for the cost of repairs, minus your deductible.

Additional Tips

- Act quickly after the hailstorm to minimize damage and potential rate increases.

- Keep detailed records of all correspondence, phone calls, emails, and letters related to the claim.

- Be prepared to pay your deductible before receiving the insurance payout.

- Be wary of unscrupulous contractors or public adjusters who may try to take advantage of you after a hailstorm.

By following these steps and staying organized and proactive, you can effectively manage your hail damage insurance claim and ensure you receive the compensation you are entitled to.

Auto Insurance: Credit Card Primary Offers Explained

You may want to see also

Repairing hail damage

Documenting the Damage

The first step is to thoroughly document the hail damage to your vehicle. Use your camera or smartphone to capture clear and detailed photos and videos of all the damage from multiple angles, ensuring that no damage is overlooked. Proper documentation is crucial for supporting your insurance claim and can streamline the claims process. It is also important to act promptly, as most insurers require you to file hail damage claims within a specific timeframe, typically ranging from 30 days to a year.

Understanding Your Insurance Policy

Before filing a claim, review your car insurance policy to determine if hail damage is covered and understand your financial responsibilities. Comprehensive insurance coverage typically includes hail damage, whereas a state minimum or liability-only policy usually does not. Knowing what your policy covers will help you navigate the claims process effectively.

Contacting Your Insurance Company

After you've assessed the damage and reviewed your policy, promptly contact your insurance company to report the hail damage. Provide comprehensive details, including the date of the hailstorm and a thorough description of the damage. Follow their instructions for submitting any necessary photos, videos, or documentation to support your claim.

Obtaining Repair Estimates

It is advisable to get multiple quotes from licensed repair shops or contractors to make informed decisions about the repair process. Each quote should provide a detailed breakdown of the repair costs, allowing you to compare prices and understand the expenses involved. Taking immediate steps to prevent further damage, such as temporarily covering broken windows, is also essential.

Scheduling an Inspection

To initiate the insurance claims process, schedule an appointment with an insurance adjuster to conduct a thorough inspection of the damage. It is recommended to be present during the assessment to accurately point out all the affected areas. Provide complete documentation, including photos, videos, and detailed repair estimates, to support your claim.

Finalizing the Claim

When you receive a settlement offer from your insurance company, carefully review the details. Ensure that the offer includes coverage for all necessary repairs and aligns with the estimates you've gathered from repair shops. If you find discrepancies or believe the offer is insufficient, be prepared to negotiate with your insurer. Seeking assistance from a public adjuster or legal advisor can be beneficial in navigating the negotiation process and securing a fair settlement.

Repair Options

Once your claim is approved, you can explore repair options. Mechanics can sometimes repair hail damage using "paintless dent removal," a technique where dented areas are gently pushed back to their original positions without affecting the vehicle's structure or factory finish. Conventional repair methods, such as filling and repairing dents or replacing damaged panels, may be more time-consuming and expensive.

Payment Arrangements

You will typically be responsible for paying your comprehensive deductible, and your insurer will cover the remaining repair costs up to your policy's limit, usually the cash value of your car. Some insurers may pay the repair shop directly, while others may reimburse you after you have paid for the repairs.

By following these steps, you can effectively navigate the process of repairing hail damage to your vehicle, ensuring that your car receives the necessary repairs and that your insurance claim is handled smoothly.

Auto Insurers and Personal Data: Why Your Info Matters

You may want to see also

Preventing hail damage

Hail can cause significant damage to your car, leading to costly repairs. While the best way to protect your car is to park it in a garage, this is not always possible, especially when you are out and about. Here are some tips to prevent hail damage to your car:

- Get a heads-up about the weather: While weather reports can be inaccurate, it's good to stay informed. Knowing that a hailstorm is coming might give you just enough time to pull your car into a carport or any other shelter.

- Use a car cover: A car cover is a cheap investment that offers reasonable protection from small hailstones. It is made of thick, sometimes padded, protective fabric that can easily be thrown over your car in an emergency. Some car covers are even inflatable, forming a balloon layer of protection around your car.

- Use blankets: If you don't have a car cover, blankets, quilts, and comforters can be used to reduce car damage. The thicker the blanket, the better the protection. Gather as many blankets as possible and layer them over your car, securing them with duct tape or something similar.

- Use moving blankets: Moving blankets are heavy-duty and designed to absorb shock and provide an impact cushion. Layer as many moving blankets as you can over your car and weigh them down with objects so they are not blown away.

- Use floor mats: If you don't have any other protective materials, your car's floor mats can be used to cover the fragile parts of your car, such as the windshield and windows. Place the floor mats on the glass with the spiky portion in contact with the surface to provide friction.

- Find cover: If you are caught in a hailstorm while driving, it's important to pull over somewhere safe. Look for any structure, such as a building, that you can park next to. Hail rarely falls in a straight line and usually hits the ground at an angle, so parking on the opposite side of the building from the wind direction can provide some protection.

- Get comprehensive auto insurance: While this won't prevent hail damage, it can give you peace of mind and help cover the costs of repairs if damage occurs. Comprehensive insurance covers damage from "Acts of Nature," which are events beyond your control.

U-Haul Parade Float Conundrum: Is Your USAA Auto Insurance Enough?

You may want to see also

Frequently asked questions

No, a single hail claim won't increase your premium because hail damage is considered an "Act of Nature", which is outside your control. However, if you have a history of hail damage claims, your insurance company may increase your premium.

Comprehensive insurance covers hail damage to your car. Comprehensive insurance covers damage from events outside of your control, including hail and other weather-related damage.

Contact your insurance company to file a claim. Provide comprehensive details, including the date of the hailstorm and a description of the damage. Submit photos and/or videos of the damage to support your claim.

The average cost of comprehensive insurance is about $170, according to the National Association of Insurance Commissioners. However, the cost may vary depending on your location and other factors.

If possible, park your car in a garage or covered area to protect it from hail damage. If your car has already been damaged, document the extent of the damage with photos or videos, and contact your insurance company to initiate the claims process.