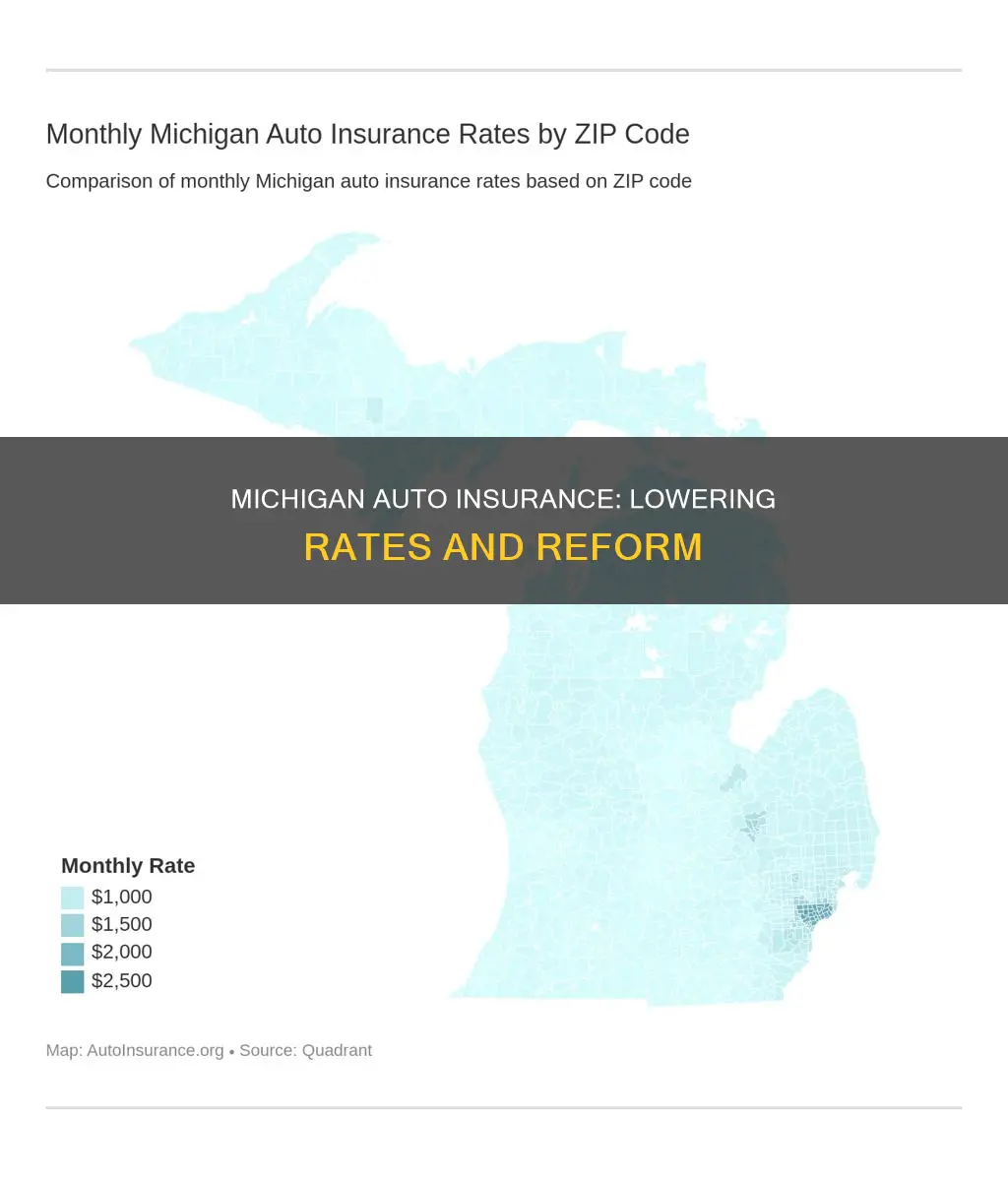

Michigan has some of the highest auto insurance costs in the US, with residents paying an average of $5,471 per year for a full coverage policy. In 2020, Governor Whitmer signed bipartisan auto no-fault legislation to lower costs for drivers, maintain high coverage options, and strengthen consumer protections. The new law gives drivers more options for personal injury protection (PIP) coverage levels and requires insurance companies to reduce premiums. However, the savings have been disappointing for consumers, and insurance companies have reported record profits. Michigan's high insurance costs are driven by factors such as its no-fault status, extensive minimum coverage requirements, a high rate of uninsured drivers, and insurance fraud.

| Characteristics | Values |

|---|---|

| Reason for high insurance costs | Michigan is a no-fault state, requiring drivers to have personal injury protection (PIP) coverage, which covers financial losses regardless of who is at fault in an accident. |

| Average insurance cost | $5,471 per year for a full coverage policy |

| Percentage increase in insurance rates from 2015 to 2020 | 51% |

| Insurance requirements | PIP coverage, property protection insurance (PPI), and a minimum of 20/40/10 in liability coverage |

| Unlimited PIP coverage | Guaranteed for Michigan residents |

| Average amount paid by auto insurance providers in Michigan for lifetime medical benefits for injured parties | $555,000 |

| Percentage of uninsured drivers in Michigan | 26% |

| Percentage of no-fault insurance claims that are fraudulent in Michigan | 10% |

| Time period for insurance companies in Michigan to reimburse claims | 30 days |

| Percentage increase in personal injury lawsuits in Michigan in the past ten years | 130% |

| Average car insurance premium increase in Michigan from 2015 to 2020 | $477 per year |

| Average annual premium in Michigan in 2019 | $2,610 |

| Average premium in Detroit, Michigan | $5,414 per year |

| Percentage of insurance coverage fraud in Michigan made up of auto insurance fraud in 2020 | 81% |

What You'll Learn

Michigan's new auto insurance law

One of the most notable changes under the new law is the introduction of a tiered system for Personal Injury Protection (PIP) coverage. Previously, Michigan drivers were required to purchase mandatory unlimited PIP coverage, which proved too costly for many. Now, drivers have the option to choose from different PIP coverage levels, including $50,000, $250,000, $500,000, or unlimited. This change allows drivers to select a coverage level that suits their needs and budget, with the potential for significant premium reductions, especially for those who opt for lower PIP coverage.

Another important aspect of the new law is the elimination of certain non-driving factors in determining insurance rates. Auto insurance companies are now prohibited from using factors such as sex, marital status, home ownership, credit score, educational level, occupation, and zip codes when setting rates. This ensures that rates are based primarily on driving-related factors, such as an individual's driving record and claims history.

The new law also introduces a fee schedule between auto insurers and medical providers, similar to that used in health insurance. This measure is designed to control costs and make PIP medical coverage more affordable for policyholders, without affecting the services provided to accident victims. Additionally, the law establishes a Fraud Investigation Unit to address criminal and fraudulent activities related to insurance and financial markets.

While the new auto insurance law in Michigan offers drivers more choices and the potential for lower costs, it's important to note that the impact on individual premiums may vary. Insurance companies are required to reduce statewide average premiums, but this does not guarantee a reduction for every driver, as it depends on their chosen coverage and personal circumstances. Overall, the new law aims to provide Michigan drivers with more flexibility, lower rates, and enhanced consumer protections within the auto insurance market.

State Farm Auto Insurance Refunds: What You Need to Know

You may want to see also

Personal Injury Protection (PIP) Choice

PIP is a type of "no-fault insurance," which covers medical bills and related costs resulting from a car accident, regardless of who is at fault. It covers the policyholder and their passengers, even if they don't have health insurance. PIP also often covers lost income, childcare, and funeral expenses related to the accident.

The new law in Michigan allows drivers to choose from several PIP medical coverage options:

- $500,000 per person per accident

- $250,000 per person per accident

- $250,000 per person per accident with exclusions (this option requires that the named insured who is excluding PIP medical has qualified health coverage that is not Medicare, and any resident relative or spouse who is excluding PIP medical also has qualified health coverage)

- $50,000 per person per accident (to choose this option, the insured must be enrolled in Medicaid, and any spouse and resident relatives must have qualified health coverage, be enrolled in Medicaid, or be covered under another auto policy with PIP medical coverage)

- No PIP medical coverage (to choose this option, the insured must have coverage under both Medicare Parts A and B, and any spouse and resident relatives must have qualified health coverage or be covered under another auto policy with PIP medical coverage)

If a driver does not make a PIP medical coverage selection, their policy will be issued with unlimited PIP medical coverage, and they will be charged the premium for this coverage.

The new law also requires insurance companies to reduce statewide average PIP medical premiums for eight years, with specific reductions for each coverage option. For example, there must be an average reduction of 45% or more per vehicle for the $50,000 PIP option and an average reduction of 10% or more per vehicle for the unlimited PIP option.

The changes to PIP coverage in Michigan aim to lower costs for drivers while still offering a choice of coverage options, including unlimited lifetime PIP medical benefits.

AAA Auto Insurance: Is It Worth the Hype?

You may want to see also

Premium Reduction

Michigan's new auto insurance law, which came into effect in July 2020, mandates premium reductions for drivers. The law requires insurance companies to reduce average PIP medical premiums for eight years. The specific reductions are as follows:

- An average 45% or greater reduction per vehicle for the $50,000 PIP option

- An average 35% or greater reduction per vehicle for the $250,000 PIP option

- An average 20% or greater reduction per vehicle for the $500,000 PIP option

- An average 10% or greater reduction per vehicle for the unlimited PIP option

The new law also establishes a fee schedule between auto insurers and medical providers to control costs and make PIP medical coverage more affordable for policyholders. This is similar to cost control provisions used in health insurance. Additionally, the Michigan Catastrophic Claims Association (MCCA) has lowered its per-vehicle assessment, resulting in savings of at least $120 per car for Michigan drivers.

While the new law provides for premium reductions, it's important to note that individual savings may vary. Drivers' premiums will depend on their personal circumstances, driving record, claims history, and the coverage they choose. To maximize savings, it's recommended to compare premiums, limits, and deductibles among different insurance companies.

Dropping PIP Auto Insurance in Florida

You may want to see also

Fee Schedule

The new auto insurance law in Michigan has been beneficial for insurance companies, which have reported record profits, but consumers have been left disappointed by the lack of savings. The new law has introduced a fee schedule, which is a required cost control measure between auto insurance companies and healthcare providers. This measure aims to make Personal Injury Protection (PIP) medical coverage more affordable for consumers.

The fee schedule establishes an agreed price list between auto insurers and medical providers, controlling the costs that medical providers can charge auto insurers for their services. This is similar to the cost control provisions used by other types of insurance, such as health insurance. The fee schedule will not affect the services that existing and future accident victims are entitled to.

The new law has also implemented a reduction in PIP medical coverage premiums, with insurance companies required to reduce the statewide average PIP medical premiums for eight years. From July 1, 2020, insurance companies must adhere to the following overall statewide PIP medical coverage premium reductions:

- An average 45% or greater reduction per vehicle for the $50,000 PIP option

- An average 35% or greater reduction per vehicle for the $250,000 PIP option

- An average 20% or greater reduction per vehicle for the $500,000 PIP option

- An average 10% or greater reduction per vehicle for the unlimited PIP option

While the fee schedule aims to make PIP medical coverage more affordable, it has been criticised for potentially reducing the quality and availability of medical care for accident victims. It may also drive medical providers out of business, as many doctors may refuse to accept the new fee schedule rates. This could limit crash victims' access to necessary medical care.

The new law has also introduced a Utilization Review process, where medical care provided to auto accident victims is reviewed by the auto insurer to ensure it is medically appropriate. Healthcare providers can appeal if they disagree with the insurer's decision.

Go Auto Insurance: Can I Cancel?

You may want to see also

Michigan Catastrophic Claims Association (MCCA)

The Michigan Catastrophic Claims Association (MCCA) is a private, non-profit association that reimburses member auto insurance companies for Personal Injury Protection (PIP) claims that exceed a certain amount. This amount is currently $580,000. The MCCA was created by the Michigan Legislature to pay for the car accident-related No-Fault medical expenses of catastrophically injured car crash victims.

Under Michigan law, an accident victim is deemed catastrophically injured and eligible for medical benefits coverage through the MCCA when their crash-related medical expenses exceed the "retention" amount of $580,000 under an auto insurance policy issued or renewed between July 1, 2019, and June 30, 2021. Before this threshold is reached, No-Fault medical benefits are paid by the auto insurance company that issued the policy.

The MCCA raises funds to pay for these expenses through an annual, per-vehicle fee charged to auto insurance companies authorized to sell policies in Michigan. These costs are typically passed on to drivers in the form of higher premiums.

The new auto insurance law in Michigan, effective July 1, 2020, introduced changes to the MCCA. The MCCA is now required to provide an annual report to the Legislature, post an annual consumer statement on their website, and undergo an audit by the Michigan Department of Insurance and Financial Services (DIFS) every three years.

Additionally, the MCCA announced a reduction in its per-vehicle assessment starting July 2, 2020, which will save Michigan drivers at least $120 per car. Drivers choosing less than unlimited PIP medical coverage will not pay any assessment to the MCCA.

Understanding California's Auto Insurance Requirements and Their Importance

You may want to see also

Frequently asked questions

Michigan is a no-fault state, which means that insurance providers have to cover accidents even if they are the fault of the insured person. This, along with the state's high insurance requirements, has led to high insurance premiums.

Michigan requires drivers to have personal injury protection (PIP) coverage, property protection insurance (PPI), and a minimum of 20/40/10 in liability coverage.

The average cost of auto insurance in Michigan is $5,471 for a full coverage policy, making it the most expensive state for auto insurance.

Here are some ways to save on auto insurance in Michigan:

- Shop around for auto insurance rates and compare quotes from various providers.

- Bundle your home and auto insurance policies.

- Ask about discounts that you may be eligible for.

- Use car insurance comparison tools to quickly compare quotes from multiple providers.

- Increase your deductible.

- Consider pay-as-you-drive coverage if you don't drive often.