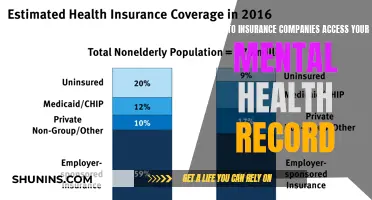

The COVID-19 pandemic saw a decrease in road traffic and accidents, leading to reduced insurance claims. As a result, many auto insurance companies, including USAA, issued refunds to their customers. USAA offered a 20% credit on two months' worth of premiums to its members, which was automatically applied to their bills. However, a lawsuit was filed against USAA in California, alleging that the company continued to charge and collect excessive premiums during the pandemic, in breach of its contract with customers and in violation of California's Unfair Competition Law. The outcome of this lawsuit is not known, but USAA stated that they were confident their auto policy dividends and premium credits, along with a range of other financial relief efforts to help members, were appropriate.

| Characteristics | Values |

|---|---|

| Refund amount | 20% credit on three months of premiums |

| Refund method | Credits applied to customers' bills |

| Who is eligible for the refund? | Members with an auto insurance policy in effect as of March 31, 2020 |

| Action required by customers | None; customers will receive the refund automatically |

What You'll Learn

How to cancel USAA auto insurance

To cancel your USAA auto insurance, you must contact customer service. USAA does not allow policyholders to cancel their insurance online, so you will need to call or write to them.

Cancelling USAA Auto Insurance by Phone

To cancel your USAA auto insurance by phone, call the customer service number listed on your policy paperwork or on the company’s website. Have your policy number handy when you call. Customer service representatives are available Monday through Friday from 8 a.m. to 8 p.m. EST. When you call to cancel, the customer service representative will ask for your name, address, and policy number. They will then ask for your reason for cancelling and verify your identity by asking for your date of birth or Social Security number. Once they have verified your identity, they will process your cancellation request.

Cancelling USAA Auto Insurance by Mail

To cancel your USAA auto insurance by mail, write a letter that includes your name, address, date of birth, policy information, and the day you want your policy to end. Sign and date the letter, then mail it to: USAA / 9800 Fredricksburg Rd / San Antonio, TX 78288.

Cancelling USAA Auto Insurance in Person

You can also cancel your USAA auto insurance in person by visiting your nearest USAA insurance office and speaking with an agent.

Things to Keep in Mind When Cancelling USAA Auto Insurance

- Make sure you have no outstanding payments or claims with USAA before cancelling your policy.

- Obtain a new car insurance policy from another provider before cancelling your USAA policy.

- USAA may ask for the details of your new car insurance policy to verify you won't be driving without insurance.

- If you've already paid your premium for the policy period in full, USAA will refund the unused portion.

- USAA does not impose a cancellation fee or penalty for early termination.

- If you're going through some life changes, such as moving or buying a new car, you can simply have USAA update your mailing address or vehicle information instead of cancelling your policy.

Gap Insurance: When It's Needed

You may want to see also

Who is eligible for USAA auto insurance?

USAA offers auto insurance to active, retired, and separated US military officers if honorably discharged. Their immediate family members are also eligible for coverage, including spouses, children, step-children, and widows. If your parent was a USAA member, you can also qualify for USAA auto insurance.

USAA also offers auto insurance to pre-commissioned officers, such as contracted cadets or midshipmen enrolled in a service academy.

USAA has a straightforward cancellation process, which can be done online, over the phone, or by mail. If you cancel your policy, you may be eligible for a refund.

Tesla's Auto Insurance: In-House Coverage for Electric Car Owners

You may want to see also

Pros and cons of USAA auto insurance

USAA is an insurance company that offers policies to active military members, veterans, and their families. It provides a wide range of insurance products, including auto, home, and life insurance, as well as banking services. Here are some pros and cons of USAA auto insurance:

Pros:

- High customer satisfaction ratings: USAA received high scores in J.D. Power's studies for claims reliability and customer satisfaction. It also earned the top spot in the 2024 J.D. Power U.S. Auto Insurance Study in every region of the country.

- Competitive rates: USAA's auto insurance rates are lower than the national average, especially for drivers with less-than-stellar credit or those with accidents, speeding tickets, or DUIs on their records.

- Unique coverage options tailored to the military community: USAA offers exclusive eligibility and discounts for veterans, active military members, and their families. This includes military on-base discounts and deployment/storing discounts.

- Robust policy options: In addition to standard coverage options, USAA offers extras like roadside assistance and car rental reimbursement. They also have a SafePilot program that rewards safe driving with significant discounts.

- Wide availability: USAA's auto insurance is available in all 50 states, Washington, D.C., U.S. territories, and some international locations.

Cons:

- Limited customer service hours: USAA's customer service is not available 24/7 and is closed on Sundays.

- No brick-and-mortar insurance agencies: USAA does not have physical locations, which may be a drawback for those who prefer in-person support.

- Eligibility restrictions: USAA's policies are only available to active military members, veterans, and their families, excluding a large portion of potential customers.

Vehicle Insurance: VAT Included?

You may want to see also

How to contact USAA customer service

USAA offers customer service through various channels, including phone, online chat, and email. Here's how you can contact them:

Phone:

- Customer Service: $(210) 531-8722 or Toll-Free: (800) 365-8722. This number is available 24/7 and works with most carriers.

- Shortcut mobile number: #USAA (8722)

- International customers: Toll-Free in the U.S. and Canada: (866) 509-7711. Collect Calls Outside of the U.S. and Canada: +1-603-328-1720.

Online Chat:

Visit the USAA website and use their virtual agent for assistance. The chat function is available anytime.

Email:

- Log in to your USAA account on their website. Look for the "Contact Us" button located in the top right corner. Choose the topic related to your inquiry and select "Email Us" as your preferred contact method.

- For specific departments or services, refer to the relevant section on their website.

- Customer Service Resources team: [email protected]

Mail:

USAA

9800 Fredericksburg Road

San Antonio, TX 78288

Additional Details:

- Customer service representatives are available Monday through Friday from 8 a.m. to 8 p.m. EST.

- USAA's customer service hours are 24/7.

- The average hold time is less than 1 minute, with the longest wait times on Mondays and the shortest on Sundays. The average call time is 7 minutes.

Auto-Home Insurance: Is AARP a Reliable Source?

You may want to see also

How to get a refund from USAA

USAA offered a 20% credit on three months of premiums to its members with an auto insurance policy in effect as of March 31, 2020. This refund was issued automatically as a credit on members' bills and customers did not need to call to receive it.

If you believe you are eligible for a refund from USAA, you should first check your billing statements to see if you have received it. If you have not, you can contact USAA by logging into your account or calling their customer service line. You will need to provide your name, address, policy number, date of birth, and Social Security number.

If you are considering cancelling your USAA car insurance policy, you should be aware that you may be charged a cancellation fee if you cancel in the middle of your policy term. To avoid this, be sure to cancel your policy before your next billing cycle begins. You can usually do this online or by calling USAA directly.

Wisconsin UTV Auto Insurance Requirements: What You Need to Know

You may want to see also

Frequently asked questions

Yes, you will get a refund if you cancel your USAA auto insurance policy. However, the refund amount depends on various factors, such as whether you paid your premium in full or by the month, and when you cancel your policy.

To cancel your USAA auto insurance policy, you need to contact customer service and may be required to provide written notice. You can usually cancel by logging into your account or calling customer service. Make sure you have no outstanding payments or claims with USAA before cancelling.

There could be several reasons for cancelling your USAA auto insurance policy, including moving to a different country or state, switching to a more affordable or comprehensive plan, or no longer needing to drive.