When it comes to choosing between Protectiv Life and Pacific Life Insurance, it's important to consider your individual needs and preferences. Both companies offer comprehensive coverage options, but the decision ultimately depends on what you value most in a life insurance policy. Protectiv Life is known for its competitive rates and customizable plans, making it an attractive choice for those seeking affordable coverage. On the other hand, Pacific Life Insurance stands out for its strong financial stability and a wide range of policy features, including riders and additional benefits. By evaluating factors such as coverage options, customer service, and financial strength, you can make an informed decision that aligns with your specific insurance goals and priorities.

What You'll Learn

- Cost Comparison: Evaluate premiums, coverage, and benefits for both options

- Financial Security: Understand the long-term financial protection offered by each

- Policy Flexibility: Compare the flexibility of premium payments and policy adjustments

- Customer Service: Assess the quality and responsiveness of customer support

- Reputation and Trust: Research the financial stability and reputation of the insurers

Cost Comparison: Evaluate premiums, coverage, and benefits for both options

Protectiv Life and Pacific Life are both reputable insurance companies offering life insurance policies, and choosing between them often comes down to understanding the cost implications and the value they provide. Here's a detailed cost comparison to help you decide:

Premiums:

- Protectiv Life: Their premiums are generally competitive and can be lower than some other providers. The specific rates will depend on factors like your age, health, lifestyle, and the amount of coverage you choose. Generally, they offer a range of term life insurance options, which typically have lower premiums than permanent life insurance.

- Pacific Life: They also offer competitive premiums, but their rates might vary depending on individual factors. Pacific Life is known for its focus on long-term financial planning, and their policies often include features like cash value accumulation, which can impact the premium.

Coverage and Benefits:

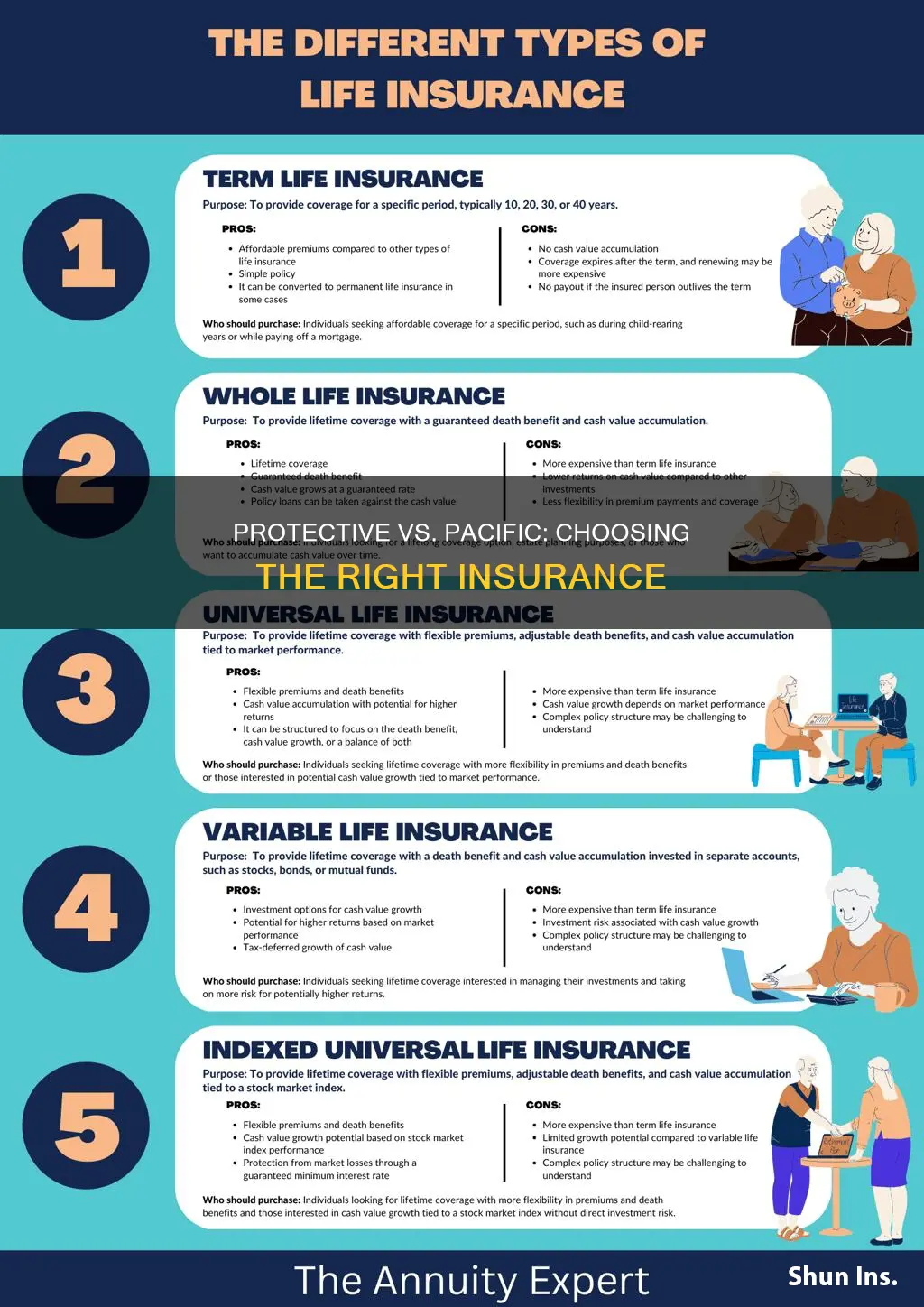

- Protectiv Life: They offer a variety of coverage options, including term life, whole life, and universal life. Term life insurance provides coverage for a specific period (e.g., 10, 20, or 30 years), while whole life offers lifelong coverage. Universal life allows for flexibility in premium payments and potential cash value growth.

- Pacific Life: Pacific Life's policies often include features like:

- Accidental Death Benefit: Provides an additional payout if the insured dies as a result of an accident.

- Living Benefits: Some policies offer living benefits like long-term care or accelerated death benefits, allowing policyholders to access a portion of their death benefit early if they face a critical illness or need long-term care.

- Cash Value Accumulation: This feature builds cash value within the policy, which can be borrowed against or withdrawn tax-free.

Additional Considerations:

- Financial Strength: Both companies are financially strong and have a history of paying claims. However, it's always a good idea to review the latest financial ratings from independent agencies like A.M. Best or Moody's.

- Customer Service: Compare the customer service reputation of both companies. Look for reviews and ratings to gauge their responsiveness and overall satisfaction.

- Additional Fees: Be aware of any additional fees associated with each policy, such as surrender charges (for permanent life insurance) or administrative fees.

The best choice between Protectiv Life and Pacific Life depends on your individual needs and priorities. If you're primarily focused on finding a cost-effective option with straightforward coverage, Protectiv Life's competitive premiums and term life options might be ideal. Pacific Life, on the other hand, excels in offering comprehensive policies with additional benefits and long-term financial planning features. Carefully review the specific details of each policy, including premiums, coverage amounts, and benefits, to make an informed decision.

Celebrities' Life Insurance: Who Benefits and How?

You may want to see also

Financial Security: Understand the long-term financial protection offered by each

When considering long-term financial protection, it's essential to understand the benefits and differences between Protectiv Life and Pacific Life Insurance. Both companies offer various insurance products designed to provide financial security for individuals and their families. Here's a detailed breakdown of the long-term financial protection each company provides:

Protectiv Life Insurance:

Protectiv Life is a well-known insurance provider that offers a range of life insurance policies tailored to meet different financial needs. Their long-term financial protection is designed to ensure that your loved ones are financially secure in the event of your passing. One of the key advantages of Protectiv Life is their focus on providing comprehensive coverage. They offer various policy options, including term life insurance, which provides coverage for a specified period, and permanent life insurance, which offers lifelong protection. Term life insurance is particularly useful for those seeking affordable coverage for a specific duration, such as covering mortgage payments or providing financial support for children's education. Permanent life insurance, on the other hand, builds cash value over time and offers a guaranteed death benefit, ensuring financial security for your beneficiaries.

Protectiv Life's policies often include additional benefits like accelerated death benefits, which allow policyholders to access a portion of their death benefit if they are diagnosed with a terminal illness, providing financial relief during challenging times. They also offer flexible payment options, allowing policyholders to choose the most suitable payment plan that fits their budget. This flexibility ensures that individuals can secure the necessary financial protection without compromising their financial stability.

Pacific Life Insurance:

Pacific Life is another reputable insurance company known for its commitment to financial security. They offer a wide array of life insurance products, each designed to cater to specific needs and preferences. Pacific Life's long-term financial protection is comprehensive and often includes various features to ensure policyholders' peace of mind. Their policies typically offer a death benefit, which is paid out upon the insured individual's passing, providing financial support to beneficiaries. Pacific Life's term life insurance is highly customizable, allowing policyholders to choose the coverage period, death benefit amount, and payment options that align with their financial goals.

One of the unique aspects of Pacific Life is their focus on providing long-term financial solutions. Their permanent life insurance policies, such as whole life or universal life insurance, offer lifelong coverage and build cash value over time. This cash value can be borrowed against or withdrawn, providing financial flexibility and a potential source of funds for various purposes. Pacific Life also provides various riders and optional benefits, such as waiver of premium riders, which ensure that your policy remains in force even if you become unable to make payments due to illness or injury.

In summary, both Protectiv Life and Pacific Life Insurance offer robust long-term financial protection. Protectiv Life's term and permanent life insurance policies provide comprehensive coverage with additional benefits, ensuring financial security for your loved ones. Pacific Life, on the other hand, emphasizes long-term solutions with customizable term life insurance and permanent policies that build cash value. When choosing between the two, it's crucial to assess your specific financial goals, budget, and the level of coverage required to make an informed decision that best suits your needs.

Unraveling the Mystery: Why Suicide Voids Life Insurance

You may want to see also

Policy Flexibility: Compare the flexibility of premium payments and policy adjustments

When considering life insurance options, understanding the policy flexibility offered by different providers is crucial. Let's delve into the comparison between Protective Life and Pacific Life, focusing on premium payments and policy adjustments.

Premium Payments:

Protective Life offers a range of payment options, allowing policyholders to choose from level, increasing, or decreasing premiums. This flexibility ensures that individuals can tailor their payments to their financial capabilities and goals. For instance, a level premium option provides consistent payments over the policy term, making budgeting easier. Conversely, increasing premiums might be suitable for those with stable income growth, ensuring adequate coverage as their financial situation improves.

Pacific Life also provides various payment structures. They offer level premiums, which provide a fixed cost for the entire policy term, making it a straightforward choice for those seeking simplicity. Additionally, Pacific Life's increasing or decreasing premium options cater to different financial scenarios. For example, a young professional might opt for increasing premiums to start with, gradually increasing coverage as their income rises.

Policy Adjustments:

Both companies offer policy adjustments to accommodate changing circumstances. Protective Life allows policyholders to increase or decrease coverage amounts, ensuring that the policy remains relevant over time. This flexibility is particularly valuable for individuals who want to adjust their insurance coverage as their needs evolve, such as when starting a family or purchasing a home.

Pacific Life also provides policy adjustment options. They allow policyholders to make changes to their coverage, including adding or removing riders, to customize the policy to their specific needs. This level of customization ensures that the insurance plan remains adaptable, whether it's enhancing coverage for a new baby or adjusting for changes in health status.

In summary, both Protective Life and Pacific Life offer policyholders a degree of flexibility in premium payments and policy adjustments. This flexibility is essential for individuals to make informed decisions based on their current and future financial situations. By understanding these options, consumers can choose a life insurance provider that aligns with their specific needs and preferences.

Unraveling the Complexities of the Life Insurance Market

You may want to see also

Customer Service: Assess the quality and responsiveness of customer support

When considering insurance options, it's crucial to evaluate the customer service provided by different companies to ensure you receive the support and assistance you need. In this context, let's compare the customer service aspects of Protective Life and Pacific Life Insurance.

Protective Life, a well-established insurance provider, offers a comprehensive customer support system. Their website provides a dedicated customer service section with a live chat feature, allowing policyholders to instantly connect with a representative for immediate assistance. Additionally, they offer a 24/7 customer service hotline, ensuring that clients can reach out at any time for help. The company's commitment to accessibility is evident in their multiple contact options, including email and social media support. Protective Life's customer service team is known for its professionalism and expertise, addressing inquiries and concerns promptly and efficiently.

On the other hand, Pacific Life Insurance also prioritizes customer satisfaction through various support channels. Their website features an extensive FAQ section, covering a wide range of topics, which can be a valuable resource for quick answers to common questions. Pacific Life also provides a customer service portal where policyholders can manage their policies, view documents, and make payments online. While their online resources are impressive, Pacific Life also offers a customer service team that is responsive and knowledgeable. The company's representatives are trained to handle various inquiries, ensuring that clients receive accurate and timely information.

Assessing the quality of customer service involves considering factors such as response time, knowledge, and overall satisfaction. Both companies excel in providing multiple contact methods, ensuring customers can reach out through their preferred channel. However, the key differentiator might be the level of personalization and empathy in their interactions. Protective Life's live chat feature allows for immediate and personalized assistance, while Pacific Life's representatives are known for their friendly and empathetic approach.

In summary, both Protective Life and Pacific Life Insurance demonstrate a strong commitment to customer service. They offer a range of support options, ensuring accessibility and responsiveness. The choice between the two could depend on individual preferences, such as the need for immediate assistance or the convenience of online resources. Ultimately, evaluating these companies based on personal experiences and specific requirements will help determine which insurance provider aligns better with one's needs.

Navigating Denial: Strategies for Life Insurance Rejection

You may want to see also

Reputation and Trust: Research the financial stability and reputation of the insurers

When considering insurance options, it's crucial to delve into the financial stability and reputation of the insurers to ensure you're making an informed decision. Pacific Life and Protective Life are both established insurance companies, but a closer look at their financial health and public perception can help you choose the right fit for your needs.

Financial stability is a cornerstone of trust in the insurance industry. Pacific Life, with its strong financial position, has consistently maintained a 'A' (Excellent) financial strength rating from A.M. Best, indicating its ability to meet its financial obligations to policyholders. This stability is further reinforced by Pacific Life's robust capital and surplus, which allows it to navigate economic downturns and market fluctuations effectively. On the other hand, Protective Life has also received positive financial ratings, with A.M. Best assigning a 'A-' (Excellent) financial strength rating, reflecting its financial stability and ability to fulfill its commitments.

Reputation plays a significant role in the insurance market. Pacific Life has cultivated a positive image over the years, with many customers praising its customer service, competitive rates, and comprehensive coverage options. Their commitment to innovation and digital transformation has also earned them recognition in the industry. In contrast, while Protective Life has a solid reputation, some customers have reported challenges with policy administration and customer service, which could be a concern for those seeking a seamless experience.

Online reviews and ratings provide valuable insights into the experiences of real customers. Pacific Life consistently receives high ratings for its responsiveness, claim processing efficiency, and overall satisfaction. Their focus on customer-centric policies has likely contributed to their positive reputation. Protective Life, while also receiving positive feedback, has some reviews highlighting delays in claim settlements and less responsive customer service, which could impact the overall satisfaction of policyholders.

Additionally, it's essential to consider the insurer's track record in handling claims and their overall customer service. Pacific Life's commitment to transparency and fair practices has likely contributed to its positive reputation in this area. Protective Life, despite its financial stability, may need to address customer service concerns to enhance its overall reputation and trustworthiness.

In summary, both Pacific Life and Protective Life have strong financial foundations, but a closer examination of their reputation and customer feedback reveals distinct differences. Pacific Life's positive reputation, financial stability, and customer-centric approach make it an attractive choice for those seeking a reliable insurance provider. Meanwhile, Protective Life, while financially stable, may need to improve its customer service and claim handling processes to match the industry standards set by Pacific Life.

Life Insurance: Unraveling the Complex Web of Coverage

You may want to see also

Frequently asked questions

Both companies are reputable insurance providers, but they specialize in different areas. Protective Life offers a wide range of life insurance products, including term life, whole life, and universal life policies. They are known for their competitive rates and comprehensive coverage options. Pacific Life, on the other hand, focuses on providing retirement planning solutions and offers various annuities and life insurance products tailored to meet specific financial goals.

The choice depends on your individual requirements and preferences. If you are looking for a comprehensive life insurance policy with various coverage options, Protective Life might be a better fit. They offer a wide range of plans to suit different needs and budgets. Pacific Life, however, excels in retirement planning and may be more suitable if you prioritize annuity options and long-term financial security.

Yes, Protective Life has several advantages. They are known for their competitive pricing, especially for term life insurance, which can be a cost-effective way to secure coverage for a specific period. Additionally, they offer a range of riders and add-ons to customize policies, providing flexibility and additional benefits. Their financial strength and ratings are also impressive, ensuring a stable and reliable insurance provider.

Pacific Life stands out for its focus on retirement planning. They offer a variety of fixed and variable annuities, providing individuals with options to save for retirement and ensure a steady income stream during their later years. Their annuity products often come with guaranteed income riders, offering peace of mind and financial security. Pacific Life also has a strong financial background, allowing them to provide long-term stability and reliable customer service.