Adjustable life insurance, also known as universal life insurance, is a type of permanent life insurance that offers flexibility in terms of premium payments and death benefits. It allows the policyholder to adjust the terms of the plan as needed, including the coverage amount, payment schedule, and cash value. This flexibility can be beneficial for those who want to make decisions throughout the life of their policy to ensure it remains the best choice for them, even as their financial situation changes. However, adjustable life insurance is generally more expensive than term life insurance and may not be the best option for those who only need a simple and inexpensive policy.

What You'll Learn

- Adjustable life insurance is a hybrid policy that combines features of term life and whole life insurance

- It is also known as flexible premium adjustable life insurance

- It is a type of permanent life insurance

- It is more expensive than term life insurance

- It is also referred to as universal life insurance

Adjustable life insurance is a hybrid policy that combines features of term life and whole life insurance

Adjustable life insurance, also known as universal life insurance, is a hybrid policy that combines features of term life and whole life insurance. It is a form of permanent insurance that lasts your entire life, provided you keep paying the premiums. It is designed to allow policyholders to adjust certain features of their policy after signing up.

Adjustable life insurance policies include an interest-bearing savings component called the "cash value" account, which you can tap into while alive. The cash value grows based on market interest rates and the financial performance of your insurer's portfolio. You can take out the cash value through a withdrawal or loan, or use it to pay your premiums.

There are three key elements you can adjust in an adjustable life insurance policy: the premium, the death benefit, and the cash value. You can change the amount or frequency of premium payments, increase or decrease the death benefit, and increase or decrease the cash value. However, the insurance company decides when and how often you can make these adjustments.

Adjustable life insurance offers more flexibility than other insurance options, allowing you to adjust your coverage based on changing life events. However, it is more expensive than term life insurance and may be more complicated to manage due to the need to plan and make adjustments.

Life Insurance and Vaccines: What's the Connection?

You may want to see also

It is also known as flexible premium adjustable life insurance

Adjustable life insurance, also known as flexible premium adjustable life insurance, is a hybrid policy that combines features of term life and whole life insurance. It is a permanent insurance policy designed to last your entire life, provided you keep paying the premiums. It is also referred to as universal life insurance.

Flexible premium adjustable life insurance policies offer the flexibility to adjust your premium payments according to your budget and financial needs. You can increase, decrease, or stop your premiums altogether. This type of policy is ideal for individuals who want more control over their insurance coverage and the ability to adapt to changing financial circumstances.

In addition to flexible premiums, adjustable life insurance also offers a cash value component. A portion of your premium payments goes into a savings account that earns interest over time. This cash value can be used to pay premiums, take out a loan, or be withdrawn. However, if the cash value drops to zero, the policy may lapse.

The death benefit of an adjustable life insurance policy can also be adjusted. You can increase or decrease the coverage amount as your needs change. However, a large increase may require additional underwriting and result in higher premiums.

While adjustable life insurance offers flexibility, it is important to note that it is generally more expensive than term life insurance. The interest earned on the cash value may also be modest compared to other investment options.

Becoming a Life Insurance Agent in Georgia: A Guide

You may want to see also

It is a type of permanent life insurance

Adjustable life insurance is a type of permanent life insurance that can last your entire life, provided you keep paying the premiums. It is a hybrid policy that combines features of term life and whole life insurance. It is designed to be permanent and last your entire life, as long as premiums are paid.

Adjustable life insurance, also known as universal life, differs from other products like whole life insurance because it offers a lot more flexibility to change the policy terms after signing up. For example, whole life insurance always charges the same monthly premium, whereas adjustable life insurance lets you change how much you pay each year, provided you at least cover the underlying cost of insurance. This flexibility means that you can pay more during years when you're earning a lot and decrease the premium while on a restricted budget, such as after a job loss.

Like other permanent life insurance, adjustable life insurance has a cash value savings component that earns interest. The cash value grows based on market interest rates, and the return can fluctuate each year. You can take out the cash value through a withdrawal or loan, or you can save it to cover future premiums on adjustable life insurance.

Adjustable life insurance is the most flexible type of insurance available. It is attractive if you want the protection and cash value benefits of permanent life insurance but need or want some flexibility with policy features.

Three factors can be changed in an adjustable life insurance policy: the premium, cash value, and death benefit. All three elements can be adjusted because this policy is a permanent life insurance policy and does not expire, as a term life policy does.

Life Insurance and Skydiving: What's Covered in Accidents?

You may want to see also

It is more expensive than term life insurance

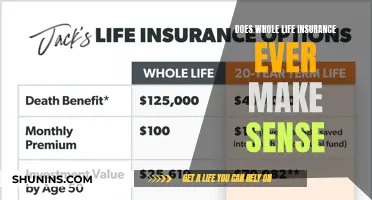

Adjustable life insurance, also known as universal or flexible premium adjustable life insurance, is more expensive than term life insurance. Term life insurance is usually the least costly form of life insurance available because it provides a death benefit for a limited period and does not include a cash value component like permanent insurance.

Term life insurance is often 5 to 15 times cheaper than permanent life insurance with the same death benefit amount. Term life insurance is designed to provide a death benefit for a specified period, typically between one and 30 years. The premiums are usually fixed throughout the policy's term, and there is no cash value component, making it a more affordable option.

On the other hand, adjustable life insurance is a type of permanent life insurance that offers more flexibility. It allows you to adjust the death benefit, premium amount and frequency, and cash value. While it provides lifelong coverage, the flexibility comes at a cost. The initial premiums for adjustable life insurance are typically higher than those of term life insurance.

Additionally, adjustable life insurance policies take more effort to manage than term life insurance. The flexibility to adjust premium payments and other features requires careful planning and management to ensure the policy remains in force.

In summary, adjustable life insurance is more expensive than term life insurance due to its permanent nature, flexibility, and the additional features it offers.

Life Insurance: Can Husbands Remove Their Wives?

You may want to see also

It is also referred to as universal life insurance

Adjustable life insurance, also known as universal life insurance, is a type of permanent life insurance that allows you to change the death benefit, cost and frequency of premiums, and cash value on your policy. It is a hybrid policy that combines features of term life and whole life insurance. It is designed to last your entire life, provided you keep paying the premiums.

Universal life insurance is a flexible option that allows you to customise your policy based on your current needs and financial situation. It offers a death benefit for the beneficiary, which is usually tax-free, and the premiums are paid monthly or annually. A portion of the premiums goes towards the cost of insurance, such as administrative fees and death benefit coverage, while the rest is put towards the cash value.

The cash value component of universal life insurance grows over time and can be used in various ways. It can be used to take out a loan, pay premiums, or be withdrawn as cash. The cash value earns interest, which can be at a minimum guaranteed rate or based on the financial performance of the insurance company's portfolio. However, the interest rates are typically modest compared to other investment options.

Universal life insurance provides flexibility in terms of premium payments. You can choose the amount and frequency of your premium payments, within certain limits set by the insurer. This flexibility can be beneficial if your income fluctuates or if you want to adjust your payments based on your financial situation. However, it is important to note that there is a minimum premium payment required to keep the policy active and comply with tax regulations.

Universal life insurance also allows you to adjust the death benefit. You can increase or decrease the coverage amount as your needs change, although a substantial increase may require additional underwriting and a medical exam. Adjusting the death benefit will also impact your premiums.

Overall, universal life insurance is a good choice for individuals who want the flexibility to customise their life insurance policy and adjust it over time. It offers lifelong protection, a cash value component, and the ability to choose the amount and frequency of premium payments. However, it is important to carefully consider the limitations and potential risks, such as the need to monitor the cash value and the possibility of modest interest rates.

Becoming a Licensed Health Life Insurance Agent: A Step-by-Step Guide

You may want to see also

Frequently asked questions

Adjustable life insurance is a type of permanent life insurance that allows the policyholder to adjust their coverage amount, payment schedule, and cash value. It is also known as flexible premium adjustable life insurance.

The main benefit of adjustable life insurance is its flexibility. It allows policyholders to make changes to their coverage as their financial situation evolves. This includes adjusting the death benefit, premium payments, and cash value contributions.

Adjustable life insurance combines features of term life and whole life insurance. It offers permanent coverage and includes a cash value component that grows over time. Policyholders can use the cash value to take out loans, pay premiums, or surrender the policy and receive the accumulated cash value.

Adjustable life insurance is suitable for individuals who want flexibility in their life insurance policy and the ability to make changes as their needs change. It can be particularly beneficial for parents or guardians of individuals with disabilities or special needs, high-net-worth individuals, and those with a family history of serious health conditions.