Auto insurance rates have been rising steadily since 2022, with a 2.6% increase in March 2024 and a 22% increase from the previous year. This has put car owners under financial strain and contributed to inflation. One of the factors driving up insurance rates is the increase in car repair costs. As vehicles become more technologically advanced, the cost of repairs has risen, with overall maintenance and repair costs increasing by 8.2% in March 2024 compared to the previous year.

In response to rising insurance rates, consumers may consider raising their auto insurance deductibles to lower their premiums. A deductible is the amount a driver must pay out of pocket before their insurance company covers the remaining cost of repairs or medical expenses. While a higher deductible leads to lower insurance rates, it also means the driver will have to pay more if they need to make a claim. Therefore, it's important for drivers to carefully consider their financial situation and risk factors before choosing a deductible amount.

| Characteristics | Values |

|---|---|

| Auto insurance rates | Up 2.6% in March 2024 and 22% from a year ago |

| Premium costs | Steadily increasing since 2022 |

| Car ownership costs | A "sticking point" for consumers and the Federal Reserve |

| New vehicle prices | Started spiking during the pandemic due to a computer chip shortage |

| Repair costs | Jumped 8.2% in March 2024 from a year ago |

| Insurance profits | Surging |

| Deductibles | The amount a driver pays towards a claim; higher deductibles usually mean lower premiums |

What You'll Learn

How do auto insurance deductibles work?

Auto insurance rates have been rising, with premium costs marching steadily higher since 2022. Deductibles could be a major factor in determining monthly premium costs. But how do auto insurance deductibles work?

An auto insurance deductible is what you pay "out of pocket" on a claim before your insurance covers the rest. Collision, comprehensive, uninsured motorist, and personal injury protection coverages all typically have a car insurance deductible. You usually have a choice between a low and a high deductible. A low deductible means a higher insurance rate, whereas a high deductible means a lower insurance rate.

Unlike health insurance, there are no annual deductibles to meet with auto insurance. You're responsible for your policy's stated deductible every time you file a claim. After you pay the car deductible amount, your insurer will cover the remaining cost to repair or replace your vehicle.

For example, if you have a $500 deductible and $3,000 in damage from a covered accident, your insurer will pay $2,500 to repair your car, and you'll be responsible for the remaining $500.

Comprehensive and collision are the two most common car insurance coverages that include deductibles. You may also have a deductible for personal injury protection or uninsured/underinsured motorist property damage in some states. Auto insurance deductibles work exactly the same for all coverage types.

Some insurers offer a "disappearing deductible" program that lowers your deductible by a set amount for each violation- and claim-free policy period. After a certain number of policy periods, you can end up with a $0 deductible for comprehensive or collision claims. However, your deductible typically resets to its original amount after filing a claim.

You pay your deductible any time you file a claim under a coverage that carries a deductible, assuming the damage is covered and costs more than your deductible amount. If your claim is approved, your deductible will typically be applied when your insurance company issues your payout. They simply subtract your deductible amount from your claim's approved payout.

Prescription Insurance: Filling the Gap

You may want to see also

Why are auto insurance rates rising?

Auto insurance rates have been rising steadily since 2022, and while the rate of inflation has cooled, insurance costs continue to soar. There are several factors that have influenced this trend.

Firstly, the cost of repairing and replacing vehicles has increased significantly. This is due to the higher value of cars, as well as the more advanced technology and intricate parts used in modern vehicles. As a result, insurance companies have had to increase premiums to cover the rising costs of repairs and replacements.

Secondly, natural disasters and severe weather events have become more frequent and costly. In 2023, there were around two dozen storms in the US with billion-dollar price tags, causing extensive damage to homes and vehicles. These events have led to a surge in insurance claims, which has, in turn, contributed to rising insurance rates.

Thirdly, factors such as population density and geography can also impact insurance rates. Drivers in areas with a high population density or those located in regions prone to natural disasters, such as tornadoes and hurricanes, often face higher insurance premiums. For example, drivers in Louisiana and Florida, where severe weather events are common, pay a larger share of their paychecks towards car insurance compared to other states.

Additionally, insurance companies consider driver characteristics when determining insurance rates. Younger and less experienced drivers, as well as those with a history of traffic violations or accidents, typically face higher rates. Other factors that can influence rates include gender, credit scores, and the value of the vehicle being insured.

While consumers may not have control over all these factors, there are still ways to mitigate the impact of rising insurance costs. Shopping around for insurance providers, comparing rates, and taking advantage of discounts offered by insurers can help drivers save money on their insurance premiums.

Smart Auto Insurance Savings

You may want to see also

What is a deductible?

Auto insurance rates have been rising, and deductibles are a major factor in determining monthly premium costs. But what exactly is a deductible?

In simple terms, a deductible is the amount of money that the insured person must pay out of pocket towards a claim before their insurance policy starts covering the remaining costs. For example, if you have a $500 deductible and $3000 in damage from a covered accident, your insurer will pay $2500, and you will be responsible for the remaining $500.

The amount of the deductible varies depending on the type of insurance policy, the level of coverage, and other factors. Typically, you have a choice between a low and high deductible. A low deductible means a higher insurance rate, while a high deductible results in a lower insurance rate. For instance, with a high deductible, you will pay less each month for your premium but more for your out-of-pocket costs. On the other hand, a low deductible means a higher premium but lower out-of-pocket expenses.

It's important to note that deductibles only apply to covered expenses. If an expense is not covered by the insurance policy, it cannot be counted towards the deductible. Additionally, deductibles usually reset at the beginning of each policy period. For example, if you have a health insurance policy with an annual deductible, you will need to pay that amount every year before your insurance starts covering expenses.

Understanding your insurance deductible is crucial as it significantly impacts your out-of-pocket expenses. When choosing an insurance policy, consider your financial situation and individual circumstances. If you have a medical condition that requires frequent doctor visits, you may opt for a lower deductible to manage out-of-pocket costs. Conversely, if you lead a healthy lifestyle and rarely need medical care, choosing a policy with a higher deductible can result in savings.

GAP vs GPP: What's the Difference?

You may want to see also

How to choose a deductible?

Choosing a car insurance deductible is a highly individual decision that depends on your financial situation and risk tolerance. Here are some factors to consider when selecting your deductible:

- Value of Your Car: If your car is older or has a low value, you may benefit from choosing a plan without a deductible or a lower deductible. This is because older or devalued cars have lower insurance payouts, and you could end up paying most of the repair bill even with a higher deductible. On the other hand, if you have a newer, more expensive car, a higher deductible may make more sense as it can lower your insurance premium.

- Your Savings and Risk Tolerance: Evaluate how much you can afford to pay for repairs after an accident. If paying a large sum would be a financial burden, opt for a lower deductible, even if it means paying slightly higher insurance premiums. Conversely, if you have sufficient savings and are comfortable taking on risk, a higher deductible can help lower your overall insurance costs.

- Likelihood of Filing a Claim: Consider your driving history and the likelihood of filing a claim. If you have a history of accidents or engage in high-risk driving behaviours, you may be more likely to file a claim. In this case, a lower deductible might be preferable to avoid high out-of-pocket expenses.

- Cost Difference: Compare the cost difference between policies with high and low deductibles. Calculate your potential out-of-pocket expenses if you file no claims, one claim, or multiple claims. A high-deductible policy may offer significant savings if you don't file any claims, but a low-deductible plan could be more cost-effective if you anticipate filing multiple claims.

- Loan or Lease Requirements: If you have taken out a loan or leased a new car, check the terms of your agreement as it may require a specific deductible amount.

Remember, a car insurance deductible is the amount you pay out of pocket before your insurance coverage kicks in. The most common deductible amount is $500, but you can typically choose anywhere between $100 and $2,500, depending on the insurance provider and type of coverage. A higher deductible generally leads to lower insurance premiums, while a lower deductible results in higher premiums. Ultimately, the decision comes down to your financial comfort and how much risk you are willing to take.

Insurance Payouts: Total Loss Calculations

You may want to see also

How to save on auto insurance?

Auto insurance rates have been rising, with some sources stating that they are up 22% from the previous year. This is due to a variety of factors, including the higher costs of vehicle repairs and maintenance, more frequent accidents, and increased litigation. While some factors that determine insurance premiums are beyond the control of the consumer, there are still ways to save money on auto insurance. Here are some strategies to help reduce your auto insurance costs:

- Shop around for quotes: Compare insurance quotes from multiple companies, as the cost of coverage can vary significantly between insurers. Don't rely solely on insurance company advertisements claiming to offer savings.

- Bundle insurance policies: Consider bundling your auto insurance with other types of insurance, such as homeowners or renters insurance. Many insurance companies offer discounts for customers who purchase multiple policies.

- Look for discounts: Insurance companies offer a range of discounts, including multi-car discounts, good student discounts, and safe driver discounts. Ask your insurance agent for a discount review to ensure you are taking advantage of all the discounts you qualify for.

- Choose a higher deductible: Opting for a higher deductible can lower your insurance premium. However, be cautious when raising your deductible, as it will increase your out-of-pocket expenses in the event of a claim. Evaluate your financial situation and choose a deductible that you can comfortably afford.

- Improve your driving record: Maintaining a clean driving record can help keep your insurance rates low. Avoid speeding tickets, accidents, and moving violations, as these can lead to higher premiums.

- Choose a cheaper car: The cost of insurance can vary depending on the vehicle. Contact an insurance agent before purchasing a car to get an estimate of the insurance premium. Opting for a vehicle that is less expensive to insure can help reduce your overall costs.

- Defensive driving courses: Enrolling in a defensive driving course can help you obtain discounts on your insurance. These courses are usually offered in-person or online and can provide you with the skills to become a safer driver.

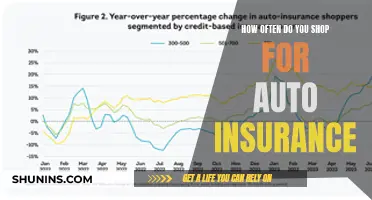

- Improve your credit score: Insurance companies often use credit-based insurance scores to determine insurance rates. By improving your credit score, you may be able to secure lower auto insurance premiums.

- Pay premiums upfront: Paying your insurance premium in full for the entire policy term can sometimes result in a discount. Paying annually instead of in installments may help you save money.

- Low-mileage discounts: If you drive fewer miles annually, you may qualify for a low-mileage discount. Consider pay-per-mile insurance programs, which charge a daily or monthly rate plus a per-mile charge, which can be beneficial for low-mileage drivers.

Insurance Law: Fixing Damaged Vehicles

You may want to see also

Frequently asked questions

An auto insurance deductible is the amount of money you pay out of pocket before your insurance company covers the remaining cost to repair or replace your vehicle.

Unlike health insurance, there are no annual deductibles to meet. You are responsible for your policy's stated deductible every time you file a claim.

The most common deductible for car insurance is $500, but what's best for you depends on your budget and insurance needs. If you choose a low deductible, you'll usually pay a higher insurance premium.

Choosing a deductible comes down to understanding your financial situation. Consider how likely it is that you will need to file an insurance claim. The higher your risk, the more likely you are to be stuck with a large bill.