ERISA, or the Employee Retirement Income Security Act of 1974, is a federal statute that governs certain types of employee benefits, including life insurance policies. It sets minimum standards for most voluntarily established retirement and health plans in private industries to provide protection for individuals in these plans.

ERISA imposes a fiduciary duty on administrators of these plans, requiring them to act in accordance with plan documents, prudently, and with the skill and diligence expected from an ethical expert in the life insurance industry.

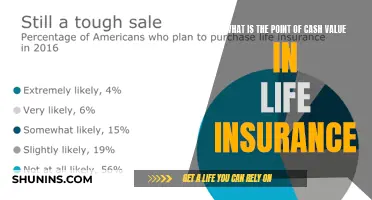

Life insurance policies purchased through employers are often cheaper, but they come with a higher risk of claim denials. If a claim denial occurs, ERISA sets out the procedural requirements for an appeal. ERISA also limits what beneficiaries can do after a claim denial, including restricting their ability to sue for breach of contract or bad faith, and preventing them from taking their trial before a jury.

ERISA appeals have specified deadlines and procedural rules, and it is necessary to determine if your ERISA-covered plan requires you to go through up to two rounds of administrative appeals. This is a critical aspect of your ERISA claim because your legal counsel will be able to submit new evidence for consideration during the appeal process.

One of the benefits of asset protection with life insurance is that it bypasses probate. Life insurance policies are considered contractual obligations and are, therefore, uncollectible assets. While laws vary from state to state, life insurance proceeds are often protected from most judgments and liens.

| Characteristics | Values |

|---|---|

| What is ERISA? | The Employee Retirement Income Security Act of 1974. |

| Who does ERISA apply to? | ERISA applies to employee pension benefit plans and employee welfare benefit plans. |

| What does ERISA do? | ERISA sets minimum standards for retirement and health plans in private industry to provide protection for individuals in these plans. |

| What does ERISA require? | ERISA requires plans to provide participants with plan information, fiduciary responsibilities, a grievance and appeals process, and the right to sue for benefits and breaches of fiduciary duty. |

| What are ERISA's amendments? | The Consolidated Omnibus Budget Reconciliation Act (COBRA), the Health Insurance Portability and Accountability Act, the Newborns' and Mothers' Health Protection Act, the Mental Health Parity Act, the Women's Health and Cancer Rights Act, the Affordable Care Act, and the Mental Health Parity and Addiction Equity Act. |

| What does ERISA not cover? | ERISA does not cover group health plans established or maintained by governmental entities, churches for their employees, or plans which are maintained solely to comply with applicable workers' compensation, unemployment, or disability laws. |

| What are the four essential components of ERISA's imposed fiduciary duty? | 1. Act in Accordance with Plan Documents 2. Act with Prudence 3. Diversify Plan Assets 4. Minimise Unnecessary Risks and Losses |

What You'll Learn

ERISA and the protection of employee benefits

The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for most voluntarily established retirement and health plans in private industry to provide protection for individuals in these plans. ERISA imposes administrative obligations on employers with employee benefit plans. It covers both pension and welfare benefit plans.

ERISA requires plans to provide participants with plan information, including important information about plan features and funding. It also sets minimum standards for participation, vesting, benefit accrual, and funding. It provides fiduciary responsibilities for those who manage and control plan assets. Plans are required to establish a grievance and appeals process for participants to obtain benefits and gives participants the right to sue for benefits and breaches of fiduciary duty.

ERISA was enacted to protect the interests of employees covered under employee benefit plans. Congress was concerned with the mismanagement of funds accumulated to finance employee benefits and the failure to pay such benefits. It also aimed to address the varying and often conflicting state laws regarding employee benefits, which left employees' rights inadequately protected.

ERISA preemption means that almost all employee benefit plans that provide benefits such as health insurance, life insurance, or disability insurance are regulated under federal ERISA law. However, plans sponsored by governmental employers and churches are usually not preempted by ERISA.

ERISA also does not cover plans maintained outside the United States primarily for the benefit of nonresident aliens or unfunded excess benefit plans. Additionally, self-employed individuals or partnerships where only the owners are covered under the plan are not subject to ERISA.

Finding Life Insurance After a Loved One's Death

You may want to see also

ERISA and the role of the employer

ERISA, or the Employee Retirement Income Security Act, is a federal law that sets minimum standards for certain types of employee benefits, including life, health, and short-term and long-term disability policies. It was enacted in 1974 to protect the interests of employees covered under employee benefit plans.

ERISA applies to employer-sponsored retirement and health plans, including defined benefit plans and defined contribution plans such as 401(k)s, 403(b)s, employee stock ownership plans (ESOPs), and profit-sharing plans. It also covers certain private-sector health plans.

The role of the employer under ERISA is to act as a plan administrator and named fiduciary, assuming most fiduciary responsibilities. The employer typically has the authority to:

- Determine eligibility for coverage

- Make decisions on the formation, design, amendment, and termination of the plan

- Manage the day-to-day operations and administration of the plan

The employer is responsible for:

- Ensuring compliance with ERISA's reporting, disclosure, and fiduciary obligations

- Prudently selecting and monitoring the MEP sponsor and getting periodic reports on the fiduciaries' management and administration of the MEP

- Ensuring that the MEP sponsor adheres to the terms and provisions outlined in the plan documents

- Forwarding required contributions to the MEP

MetLife Insurance: Accidental Death Coverage and Exclusions

You may want to see also

ERISA and the rights of the employee

The Employee Retirement Income Security Act (ERISA) is a federal law from 1974 that sets minimum standards for most voluntarily established retirement and health plans in the private industry to protect individuals enrolled in these plans. It also governs how employers provide benefit plans to employees.

ERISA ensures that employees are notified of benefit plan terms, including funding, coverage, and costs. It also offers protections against fiduciary misconduct. If plans are mismanaged or if plan fiduciaries engage in prohibited conduct, employees may sue for unpaid benefits.

ERISA provides a range of protections for participants in employer-sponsored health plans, ensuring their rights are upheld. For example, participants have access to special enrollment rights, which allow them to enroll in or modify their health plan coverage outside of the usual enrollment periods under specific circumstances, such as the birth of a child or marriage.

ERISA also prohibits discrimination in health plan coverage based on an individual's health status, ensuring that participants have equal access to healthcare benefits, regardless of their health history.

In addition to retirement and health plans, ERISA also governs certain types of employee benefits, including life, health, and short-term and long-term disability policies issued to employees by their employers.

ERISA provides that all plan participants are entitled to receive information about their plans and benefits, examine documents governing the operation of the plan, and obtain copies of these documents upon written request.

ERISA also outlines the procedures for adverse claims decisions, ensuring that participants receive written notification of any adverse benefit determination, including specific reasons for the decision and a description of the plan's review procedures.

Overall, ERISA plays a crucial role in protecting the rights and benefits of employees participating in employer-sponsored plans, ensuring they receive the benefits they deserve.

Globe Life Insurance: Accidental Overdoses Coverage?

You may want to see also

ERISA and the role of the insurer

The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for most voluntarily established retirement and health plans in the private sector. It ensures that these plans are managed in the best interests of the participants.

ERISA requires plans to provide participants with plan information, including important details about plan features and funding. It also outlines fiduciary responsibilities for those who manage and control plan assets. This includes specific expectations for those who oversee employee benefit plans, such as plan administrators, employers, investment managers, and service providers. They are required to act with care and prudence in managing plans, making financial decisions with the interests of plan participants and their beneficiaries in mind.

ERISA also requires plans to establish a grievance and appeals process for participants to receive benefits. It gives participants the right to sue for benefits and breaches of fiduciary duty. Additionally, it provides a process for reporting violations of their rights.

ERISA's impact on the relationship between employers and employees is significant. It mandates that employers provide plan information, uphold fiduciary duties, and provide avenues for participants to seek remedies. This includes setting up a grievance and appeals process for participants to get benefits from their plans.

The role of the insurer in ERISA is primarily governed by the requirements outlined above. Insurers must adhere to detailed reporting standards and maintain specific conduct standards. Non-compliance can lead to penalties. They are also required to respond promptly to claims filed by participants and explain any denials.

In summary, ERISA plays a crucial role in ensuring the fair management of retirement and health plans in the private sector, with insurers having specific responsibilities and obligations under this federal law.

Life Insurance: A Loan Guarantor?

You may want to see also

ERISA and the appeals process

ERISA, or the Employee Retirement Income Security Act of 1974, is a federal law that sets minimum standards for most voluntarily established retirement and health plans in private industries to provide protection for individuals in these plans. It requires plans to provide participants with plan information, establishes fiduciary responsibilities for those who manage and control plan assets, and requires plans to establish a grievance and appeals process for participants to receive benefits from their plans.

The ERISA Appeals Process

The ERISA appeals process is a way to establish a factual record of your claim and discover important information in the event that you must proceed to file an ERISA complaint lawsuit. It is important to speak to an experienced ERISA attorney, as the process can be complex.

If your initial claim is denied, ERISA's detailed regulations require that the insurer or plan provides a fair and transparent appeal process within specific timeframes. An appeal must be done before initiating litigation, or the court will not hear your case. If the insurer or plan does not follow ERISA's claims procedure rules, in some circumstances, you may be able to initiate litigation before the appeal is complete.

Crucial Deadlines for an ERISA Appeal

As the claimant, you typically have 180 days from the date of the denial to appeal the decision. However, a statute of limitations for filing a lawsuit may be shorter and run separately from the appeal timeline. It is, therefore, critical to consult an attorney soon after your claim is denied.

The plan administrator must decide on a disability claim appeal within 45 days, with one 45-day extension if properly requested. For health care claims, the decision time frame varies depending on the type of claim. Generally, for a pre-service claim, the response must be within 30 days, and for a post-service claim, the insurer must respond within 60 days of the appeal.

For concurrent claims (an ongoing course of treatment or a number of treatments), notification of any reduction or termination of the course of treatment must be given sufficiently in advance to allow the claimant to appeal and obtain a determination on review of the adverse decision before the benefit is reduced or eliminated.

For all other claims, appeals must typically be decided within 60 days of the plan's receipt of the appeal.

The Administrative Record in the ERISA Appeal Process

If your appeal is denied by the plan and your case is strong enough to warrant filing a lawsuit, your case will be reviewed by a judge, typically through a motion that provides the court with the record put together during the appeal process, called the administrative record. It is critical that you make the strongest appeal possible, not only to overturn the denial but also to prepare for litigation, because your case will rest on the strength of your appeal and any mistakes the plan made in processing your claim. If you have not prepared a convincing administrative record for challenging your denial, it is unlikely you will prevail in court because, typically, you cannot add documentation to your record after the appeal.

FCCU: Life Insurance Options and Availability

You may want to see also

Frequently asked questions

ERISA stands for the Employee Retirement Income Security Act of 1974. It is a federal statute that governs certain types of employee benefits, including life, health, and short-term disability policies.

ERISA was enacted to protect the interests of employees covered under employee benefit plans. Congress was concerned about the mismanagement of funds accumulated to finance employee benefits and the failure to pay such benefits.

For a life insurance policy to be subject to ERISA, it must be established or maintained by an employer or employee organization, provide benefits to participants or their beneficiaries, and be funded through the purchase of insurance or otherwise.

Yes, ERISA does not apply to governmental plans, church plans (unless they opt-in), plans maintained solely for compliance with worker's compensation or disability laws, plans maintained outside the US for non-resident aliens, and unfunded excess benefit plans.

ERISA requires plans to provide participants with plan information, fiduciary responsibilities for those who manage and control plan assets, a grievance and appeals process for participants to obtain benefits, and the right to sue for benefits and breaches of fiduciary duty.