Life insurance agents are mostly paid by commission. This means that for every policy sold, the agent earns a large upfront commission, which can be up to 100% of the first year's premium. This commission is usually between 40% and 90% of the premium paid during the first year, and is followed by smaller renewal commissions in subsequent years. These commissions are usually under 5% of the annual premium and can last up to 10 years.

However, some life insurance companies pay their agents a base salary, which is usually the case if the agent is a captive agent (selling policies from one company). In this case, the agent will likely earn a lower commission rate. Independent agents, on the other hand, can sell policies for multiple insurance companies and are paid solely through commissions.

What You'll Learn

- Hart Weller life insurance agents are likely paid a commission of 40-100% of the first-year premium

- After the first year, agents receive smaller commissions for each year the policy is renewed

- Commissions are based on the size of the policy and the product type being sold

- Agents may also receive bonuses, benefits, expense allowances, and support services

- Captive agents are employed by a single company, while independent agents can offer products from multiple companies

Hart Weller life insurance agents are likely paid a commission of 40-100% of the first-year premium

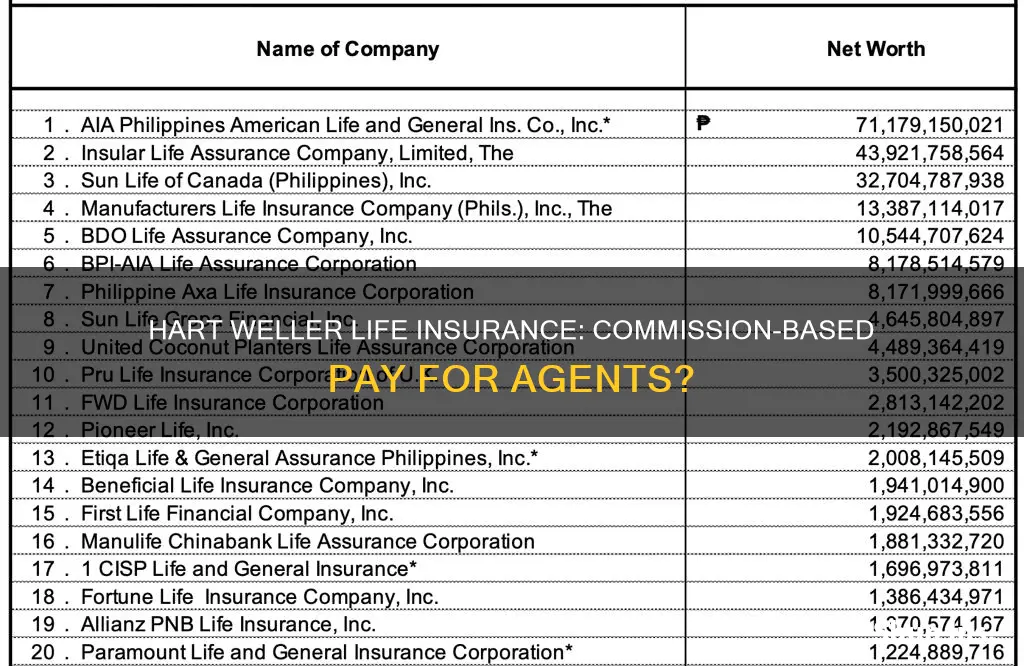

Life insurance agents are typically paid via a commission structure, and Hart Weller life insurance agents are no exception. While the exact commission structure is not publicly available, it is likely that Hart Weller life insurance agents earn a commission within the standard range of 40-100% of the first-year premium. This is further supported by the fact that the whole life insurance policy is considered the "bread and butter" product of most life insurance companies, and Hart Weller agents are likely to be well compensated for selling these policies.

The commission structure for life insurance agents can vary depending on the company, policy type, and state regulations. Commissions are usually higher for the first-year premium and subsequently decrease for each year the policy is renewed. This is because the first-year commission is meant to incentivize agents to bring in new clients, while renewal commissions reward agents for maintaining long-lasting relationships with existing clients.

In addition to the commission structure, life insurance agents may also receive additional compensation in the form of service fees, financing arrangements, and other benefits such as retirement plans and insurance coverage. These benefits can vary depending on whether the agent is an independent agent or a captive agent working for a single company.

While life insurance agents have incentives to sell certain types of policies, regulations require them to offer policies that meet suitability standards. Customers can also request information about the agent's commission to ensure they are getting the most suitable policy for their needs.

Haven Life: Insuring Innovation for the Reporter's Life

You may want to see also

After the first year, agents receive smaller commissions for each year the policy is renewed

Life insurance agents' earnings are largely commission-based. Commissions are calculated as a percentage of the policy premium paid in the first year and each year the policy is renewed.

After the first year, agents receive smaller commissions, usually under 5% of the annual premium, for each year the policy is renewed. The specific percentage depends on the policy type, the state the policy is being written in, and the insurance company. These are known as renewal commissions, and they can last up to 10 years, depending on the company. For instance, an agent might receive 10% annually for the first five years of renewals, and 2.5% to 5% annually for the next five years.

While renewal commissions are smaller than the initial commission, they serve several purposes. They provide ongoing compensation for agents, rewarding them for their long-term service and loyalty to the company. They also incentivise agents to provide ongoing services to customers during the life of the policy. Finally, they reward agents for bringing in loyal clients and encourage them to remain with the company.

Herpes and Life Insurance: What's the Real Impact?

You may want to see also

Commissions are based on the size of the policy and the product type being sold

There are two forms of commission payments: first-year commission payments and renewal commission payments. First-year commission payments are typically a higher percentage, ranging from 60% to 80% of the premiums paid in the first year. Renewal commissions are paid in subsequent years and are usually under 5% of the annual premium. The specific number of years that renewal commissions are paid varies by company but can last up to 10 years.

The type of policy also affects the commission rate. Whole life insurance policies generally have the highest commissions, followed by flexible premium or universal life, and term insurance. Whole life insurance is considered the "bread and butter" product of most life insurance companies, and agents are well-paid for selling these policies. Variable universal life insurance, variable insurance, and universal life insurance also tend to have high-profit margins for the insurance company and, therefore, pay higher commissions. Term life insurance policies usually carry the smallest commissions because they are the least expensive and have smaller margins for the insurance company.

Independent agents, who can sell policies for multiple insurance companies, typically only earn income through commissions. Captive agents, who only sell policies for one insurance company, may be paid a base salary, commissions, and benefits. As a result, captive agents may have lower commission rates than independent agents.

Life Insurance: Haven's Affiliate Program Explained

You may want to see also

Agents may also receive bonuses, benefits, expense allowances, and support services

Firstly, bonuses may be paid to agents who reach certain sales targets or maintain employment with the company for a specified number of years. These bonus thresholds are outlined in bonus compensation schedules, which detail the criteria for bonus eligibility.

Secondly, agents may receive benefits, such as profit-sharing plans, individual life and health insurance coverage, and retirement plans. These benefits can be provided either at a reduced rate or fully paid for by the company.

Thirdly, some companies offer expense allowances to cover sales expenses, such as new computer equipment, advertising, or office space. This financial support can help agents manage their sales-related costs.

Lastly, life insurance companies often provide support services, including administrative staff, secretaries, national service lines for clients, and access to office equipment like photocopiers and printers. While these services may be overlooked, they can add significant value to an agent's business and day-to-day operations.

These additional forms of compensation—bonuses, benefits, expense allowances, and support services—complement the commission-based structure of life insurance agent remuneration. They provide agents with incentives, financial support, and essential resources to facilitate their sales activities and long-term career sustainability.

Life Insurance and Suicidal Death: What Employers Cover

You may want to see also

Captive agents are employed by a single company, while independent agents can offer products from multiple companies

Life insurance agents are typically paid via a combination of salary, commission, and benefits. While commissions are a common way for insurance agents to make money, there are three other ways they can be paid: service fees, financing arrangements, and "other" compensation. Commissions are based on the size of the policy and the type of product being sold.

Captive agents are employed by a single company, whereas independent agents can offer products from multiple companies. Captive agents are paid by that one company, usually with a combination of salary and commission, plus benefits. They are limited to the products of that company. Independent agents, on the other hand, can offer consumers the best deals because they are not restricted to a single company. They receive an IRS 1099 Form, and their books of business belong entirely to them.

Captive agents have the advantage of working for a company, which provides benefits such as administrative support, a national advertising budget, and a client list. They also have in-depth knowledge of their company's products. However, they are bound by cumbersome contracts, can only sell specific products, and may be pushed to sell policies that are not in the best interest of the client.

Independent agents have access to a wider range of policies and can find the best match for their clients' needs. They have a higher earning potential due to their higher commission rates. They also have control over their work hours and can choose to work from home or part-time. However, they may need to work more than 40 hours a week initially, create their own marketing plans, and build trust with clients from scratch.

Life Insurance for the President: Who Pays the Premium?

You may want to see also

Frequently asked questions

Some insurance companies pay their agents a base salary, but most agents work as independent contractors and are paid primarily through commissions.

Commissions vary depending on the policy type, the agent's experience and certifications, the state, and the insurance company. Commissions can range from 40% to 100% of the first-year premium and are typically lower for renewals, usually under 5% of the annual premium.

Yes, agents may also receive bonuses, employee benefits, expense allowances, and support services from the company. Additionally, captive agents may receive a base salary and benefits such as retirement accounts and health insurance.

Commissions are built into the policy premium, so you'll pay the same premium amount regardless of whether you buy from an agent or directly from the insurer.

Commissions provide agents with an incentive to sell certain types of policies. However, regulations require agents to offer policies that meet suitability standards, and you can file a complaint if the recommended policy is inappropriate for your financial situation. It's always a good idea to consult a financial advisor to determine the best insurance options for your specific needs.