Protective life insurance is a type of policy designed to provide financial security and peace of mind to individuals and their families. It is a valuable tool for those seeking to protect their loved ones and ensure their financial well-being in the event of unexpected life changes or emergencies. This insurance can be tailored to meet specific needs, offering coverage for various life events, such as death, critical illness, or disability. Understanding where and how to access this insurance is essential for anyone looking to secure their future and the futures of their dependents.

| Characteristics | Values |

|---|---|

| Company Name | Protective Life Insurance |

| Location | United States (Headquarters in Birmingham, Alabama) |

| Year Founded | 1889 |

| Products Offered | Life insurance, annuities, and other financial products |

| Market Presence | Operates in 49 states and the District of Columbia |

| Financial Strength | Rated A++ by A.M. Best, indicating an exceptional financial strength and ability to meet claims |

| Customer Service | Offers 24/7 customer support, online resources, and a mobile app |

| Special Features | Focuses on providing personalized service, long-term care solutions, and retirement planning |

| Awards and Recognition | Received numerous awards for customer satisfaction, financial performance, and innovation |

| Online Presence | Has a user-friendly website and active social media accounts |

What You'll Learn

- Protective Life Insurance Distribution Channels: Where is it sold, and who are the main distributors

- Regulatory Environment: What laws and regulations govern the sale and operation of protective life insurance

- Market Share and Competition: Who are the major players, and how does the market compare

- Product Offerings: What types of protective life insurance products are available, and what are their features

- Customer Demographics: Who are the typical buyers, and what are their financial profiles

Protective Life Insurance Distribution Channels: Where is it sold, and who are the main distributors?

Protective Life Insurance, a prominent player in the insurance industry, offers a range of life insurance products, including term life, whole life, and universal life insurance. Understanding the distribution channels through which this insurance is sold is essential for both consumers and the company itself. Here's an overview of where Protective Life Insurance is distributed and the key distributors:

Direct Sales Force: One of the primary distribution channels for Protective Life Insurance is its extensive network of insurance agents and financial advisors. These professionals are employed directly by the company and are trained to provide personalized advice and guidance to potential and existing policyholders. They offer in-depth consultations, helping customers understand their insurance needs and recommending suitable products. The direct sales force is particularly effective in building long-term relationships with clients, ensuring ongoing support and service.

Independent Brokers and Agents: In addition to the direct sales team, Protective Life Insurance also relies on a network of independent brokers and agents. These individuals often work with multiple insurance providers, including Protective Life, and offer a wide range of products to their clients. Independent brokers and agents have the freedom to choose the products they represent, providing customers with a diverse selection of insurance options. This channel is valuable for the company as it allows for a broader reach and caters to various customer preferences.

Retail Financial Institutions: Another significant distribution channel is through retail financial institutions, such as banks, credit unions, and brokerage firms. These institutions often offer insurance products as part of their financial services, providing customers with a one-stop solution for their financial needs. By partnering with these institutions, Protective Life Insurance gains access to a large customer base, including those who may not typically seek out insurance directly. This channel is particularly effective in cross-selling and upselling additional financial products.

Online and Digital Platforms: In the digital age, Protective Life Insurance has also embraced online distribution. The company has developed an online presence, allowing customers to access information, compare policies, and even purchase insurance directly through their website. Additionally, they may partner with online insurance comparison sites, providing customers with a convenient way to explore their options. This digital approach caters to the growing number of consumers who prefer the convenience and accessibility of online services.

The success of these distribution channels lies in the company's ability to reach a wide range of customers, from those seeking personalized advice to those who prefer the convenience of online services. By utilizing a combination of direct sales, independent brokers, retail financial institutions, and digital platforms, Protective Life Insurance ensures that its products are accessible to a diverse market. This multi-channel approach also allows the company to maintain a strong presence in the insurance industry, catering to various customer needs and preferences.

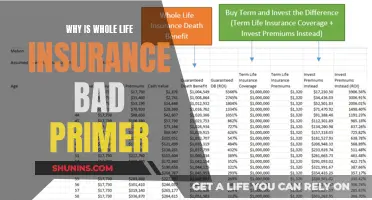

Whole or Term Life Insurance: Which Mix Works?

You may want to see also

Regulatory Environment: What laws and regulations govern the sale and operation of protective life insurance?

The regulatory environment surrounding protective life insurance varies by jurisdiction, but it is essential to understand the legal framework to ensure compliance and protect both consumers and insurance providers. In the United States, the sale and operation of protective life insurance are primarily governed by state insurance laws and federal regulations. Each state has its own insurance department or commission that regulates the insurance industry, including the issuance and marketing of life insurance policies. These state regulators set rules and guidelines for insurance companies, agents, and brokers to follow, ensuring fair practices and consumer protection.

One of the key pieces of legislation in the US is the Insurance Regulatory Act, which empowers state insurance regulators to oversee the insurance industry. This act allows states to establish standards for insurance practices, including the sale of life insurance. Additionally, the National Association of Insurance Commissioners (NAIC) plays a significant role in developing model regulations and guidelines that states can adopt to ensure a consistent regulatory approach across the country. The NAIC's model regulations provide a framework for states to create their own rules, covering various aspects of insurance sales, including protective life insurance.

Protective life insurance, also known as term life insurance, is regulated to ensure that it is sold appropriately and that consumers understand the benefits and limitations of the policy. State insurance departments often require insurance companies to provide detailed policy documents, including clear explanations of coverage, premiums, and exclusions. These documents must be easily understandable for the intended audience, often requiring a simplified language approach. Furthermore, insurance regulators may impose restrictions on the marketing and sales practices of insurance agents and brokers to prevent misleading or deceptive tactics.

In addition to state regulations, federal laws also impact the insurance industry. For instance, the Employee Retirement Income Security Act (ERISA) regulates group health and welfare plans, including those that offer life insurance coverage. ERISA ensures that participants in these plans receive accurate and timely information about their benefits. The federal government also enforces the Fair Credit Reporting Act (FCRA), which protects consumers' personal information and ensures the accuracy of credit reports, indirectly affecting the insurance industry's data handling practices.

Internationally, the regulatory landscape for protective life insurance can vary significantly. Different countries have their own insurance regulatory bodies and laws. For example, in the European Union, the Insurance Mediation Directive sets out rules for the conduct of insurance intermediaries, ensuring a high level of consumer protection. Each country within the EU may have additional national-level regulations that further govern the insurance industry. It is crucial for insurance companies and intermediaries to understand and comply with the specific laws and regulations of the jurisdictions in which they operate.

Understanding Conditional Receipt Life Insurance: Purpose and Benefits

You may want to see also

Market Share and Competition: Who are the major players, and how does the market compare?

Protective Life Insurance, a leading insurance provider in the United States, has established a strong presence in the market, particularly in the Southeast region. With a focus on individual life insurance, annuities, and group insurance solutions, the company has carved out a significant share of the market. As of the latest financial reports, Protective Life Insurance holds a substantial market share in the life insurance sector, especially in the areas of term life insurance and fixed annuities. This success can be attributed to its strategic partnerships, innovative products, and a deep understanding of its target market.

In the life insurance industry, the competition is fierce, with several major players dominating the market. Some of the key competitors include State Farm, MetLife, and Prudential Financial. These companies have a nationwide presence and offer a wide range of insurance products, making the market highly competitive. However, Protective Life Insurance has managed to differentiate itself by catering to specific market segments and offering tailored solutions. For instance, their focus on providing affordable term life insurance to young families has been particularly successful.

One of the critical aspects of Protective Life Insurance's strategy is its ability to adapt to changing market trends and consumer preferences. The company has been quick to introduce new products, such as index-linked annuities, which have gained popularity among retirees seeking stable income streams. By staying agile and responsive, Protective Life Insurance has been able to maintain its market share and even expand into new territories. This adaptability is a key differentiator, especially in a market where consumer needs and preferences are constantly evolving.

In terms of market comparison, Protective Life Insurance's performance has been impressive, especially when compared to its direct competitors. The company's strong financial position, as reflected in its solvency ratios and investment returns, sets it apart. Protective Life Insurance has consistently demonstrated a commitment to financial stability, which is crucial for building trust with customers and maintaining a competitive edge. Moreover, the company's focus on customer service and education has fostered long-term relationships with policyholders, leading to higher customer retention rates.

The competitive landscape of the life insurance industry is characterized by constant innovation and product diversification. Companies are increasingly offering customized solutions to cater to individual needs. While this trend has increased competition, it has also created opportunities for niche players like Protective Life Insurance to thrive. By focusing on specific market segments and providing specialized products, the company has successfully captured a loyal customer base. As the market continues to evolve, Protective Life Insurance's strategic approach and commitment to innovation will be vital in maintaining its position as a major player in the life insurance industry.

Unlocking the Cash Value: Understanding Life Insurance Payouts

You may want to see also

Product Offerings: What types of protective life insurance products are available, and what are their features?

Protective life insurance, also known as term life insurance, is a type of coverage designed to provide financial protection for a specific period. It is a popular choice for individuals seeking affordable and straightforward insurance solutions. Here's an overview of the product offerings and their features:

Term Life Insurance: This is the most common and affordable form of protective life insurance. It offers coverage for a predetermined period, typically 10, 20, or 30 years. During this term, the policy provides a death benefit to the beneficiary if the insured individual passes away. The key features include simplicity, affordability, and a clear-cut coverage period. Term life insurance is ideal for individuals who want to ensure their family's financial security for a specific duration, such as covering mortgage payments, children's education, or business startup costs.

Whole Life Insurance: Unlike term life, whole life insurance provides permanent coverage for the entire lifetime of the insured individual. It offers a combination of death benefit protection and a cash value component. The cash value grows over time and can be borrowed against or withdrawn as a loan. Whole life insurance provides long-term financial security and a guaranteed death benefit. It is suitable for those seeking a more permanent solution and willing to pay higher premiums for the added benefits.

Universal Life Insurance: This type of policy offers flexible coverage and a variable death benefit. Policyholders can adjust their premiums and death benefit amounts over time. Universal life insurance provides a combination of death benefit protection and an investment component. The cash value can grow tax-deferred, and policyholders can make permanent increases to the death benefit. It is a good option for those who want more control over their insurance and investment strategy.

Final Expense Insurance: Specifically designed to cover funeral and burial expenses, final expense insurance provides a fixed death benefit to the beneficiary. It is tailored for individuals who may be considered high-risk by traditional insurance companies. Final expense policies typically have lower coverage amounts and are issued to older individuals or those with pre-existing health conditions. This product ensures that the insured's loved ones are not burdened with the financial stress of funeral costs.

Each of these protective life insurance products offers unique advantages and caters to different financial needs. When considering purchasing life insurance, it is essential to evaluate your specific requirements, such as the desired coverage period, the level of financial protection needed, and your long-term financial goals. Consulting with an insurance advisor can help you choose the most suitable product from the various offerings available.

Life Insurance Sales: Halal or Haram?

You may want to see also

Customer Demographics: Who are the typical buyers, and what are their financial profiles?

Protective life insurance is a type of policy designed to provide financial security and peace of mind to individuals and their families. When considering the typical buyers of this insurance, it is essential to understand the demographics and financial profiles that often align with this product.

One of the primary customer segments for protective life insurance is middle-aged individuals, typically aged 35 to 55. This demographic often has a growing family, a stable career, and a desire to ensure their loved ones' financial well-being in the event of their untimely passing. These individuals often have a moderate to high income, allowing them to afford the premiums for comprehensive coverage. They may also have accumulated some assets, such as a home, investments, or a growing business, which they wish to protect.

Financial profiles of these buyers often include a substantial amount of debt management. Many individuals in this age group have mortgages, car loans, or student loans, and they are keen to ensure that their financial obligations are covered in the event of their death. Additionally, they may have significant life goals, such as saving for their children's education or planning for retirement, which further emphasizes the need for long-term financial protection.

Another group that often seeks protective life insurance is business owners, especially those with growing enterprises. These individuals understand the importance of safeguarding their business interests and the livelihoods of their employees. Business owners may purchase life insurance to ensure the continuity of their company in the event of their death, providing a financial safety net for their partners, employees, and customers. Their financial profiles often reflect a strong commitment to business growth, with investments in business expansion and a focus on long-term financial stability.

Furthermore, individuals with a history of health issues or chronic illnesses may also be attracted to protective life insurance. These buyers recognize the potential challenges they may face in obtaining standard life insurance coverage and seek alternative solutions. Their financial profiles might include a need for specialized coverage, and they may have already invested in health-related insurance or savings to manage potential medical expenses.

In summary, the typical buyers of protective life insurance are often middle-aged, financially stable individuals with growing families and significant financial commitments. They may include business owners seeking to protect their enterprises and employees, as well as individuals with health concerns who require specialized coverage. Understanding these demographics and financial profiles is crucial for insurance providers to tailor their products and services effectively.

Whole Life Insurance: Is SGLI a Good Option?

You may want to see also

Frequently asked questions

Protective Life Insurance is headquartered in Birmingham, Alabama, United States. The company has a significant presence in the Southeast region of the country and operates through various subsidiaries and affiliates.

Yes, Protective Life Insurance products are available in multiple states across the United States. The availability of specific policies may vary by state, and it's recommended to check with the company's local representatives or authorized agents to understand the coverage options in your desired location.

You can locate a Protective Life Insurance agent or office by visiting their official website. They provide an online tool or a directory that allows you to search for agents based on your location. Alternatively, you can contact their customer service team, who will be happy to assist you in finding a nearby representative.

Becoming a Protective Life Insurance agent typically involves meeting certain qualifications and requirements. These may include completing training programs, passing relevant exams, and adhering to the company's licensing and regulatory standards. It is advisable to reach out to their recruitment team or local agents for detailed information on the application process and any specific criteria they look for in potential agents.