Life insurance is a crucial financial safety net for your loved ones, and understanding the tax implications of your policy is essential. While the death benefit is typically tax-free for beneficiaries, there are situations where taxes come into play, especially regarding the cash value component of permanent life insurance policies. This paragraph will delve into the topic of taxability on increases in life insurance cash value for corporations, exploring the complexities and providing valuable insights for policyholders and financial advisors alike.

| Characteristics | Values |

|---|---|

| Are increases in life insurance cash value taxable to a corporation? | It depends on the unique situation. |

| Cash value life insurance taxable? | Generally not taxable as it grows within the policy. |

| Taxable when withdrawn? | Yes, if the withdrawal exceeds the total premium payments made. |

| Taxable when cashed out? | Yes, if withdrawn on any gains, such as dividends. |

| Taxable when loaned? | Yes, if the policy terminates before the loan is repaid. |

What You'll Learn

Tax-free cash value accumulation

Cash value life insurance is generally not taxable as it grows within the policy. This means that the cash value of life insurance grows tax-free. However, taxes may apply in some instances.

When life insurance cash value could be taxable

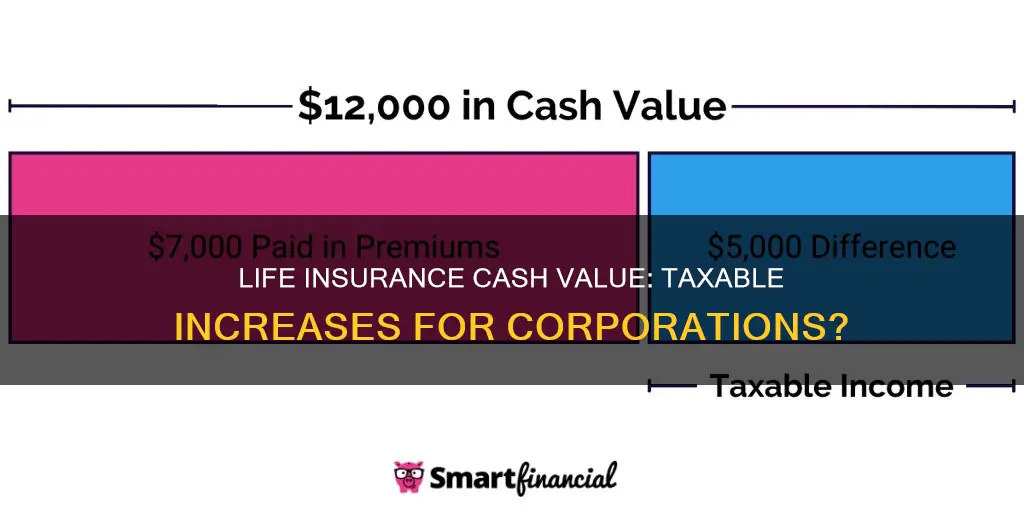

If you withdraw money from your cash value, you can generally take out an amount equal to your total premium payments without owing taxes. But once your withdrawals exceed the amount you've contributed to your policy, you will generally owe income tax on those withdrawals.

Policy loans

If you take out a loan from your life insurance plan, the loan won't be taxable. However, if the policy terminates before you've repaid the loan, you might get hit with a tax bill.

Cashing out your policy

You can withdraw up to the amount of the total premiums you've paid into the policy without paying taxes. But if you withdraw any gains, such as dividends, you can expect them to be taxed as ordinary income.

In general, a life insurance benefit isn't subject to taxes. But there are a few exceptions to this rule. The type of policy you have, the size of your estate, and the way the benefit gets paid out to you will dictate if your life insurance benefits will get taxed. If you opt for monthly installments rather than a lump sum, the funds that have yet to be distributed will accrue taxable interest. Also, if you plan to name your estate as a beneficiary, you may owe taxes as well.

Global Life Insurance: A Good Investment?

You may want to see also

Taxable cash value withdrawals

Withdrawals from a cash value life insurance policy are generally tax-free up to the total premiums paid into the policy. This is because you have already paid income tax on those dollars once, so they won't be taxed again when you withdraw them. However, if you withdraw more than your basis in the policy, you will have to pay income tax on the excess amount. The basis is the amount of premiums you have paid into the policy, minus any prior dividends paid or previous withdrawals.

For example, if you have a cash value life insurance policy with a cash value of $18,000 and a basis of $12,000, you can withdraw up to $12,000 without incurring any income tax consequences. However, if you withdraw $15,000, you will have to pay income tax on the remaining $3,000. It's important to note that withdrawals could cause your policy to lapse, resulting in a loss of coverage.

When it comes to policy loans, the amount you borrow is generally not treated as taxable income as long as you repay the loan. However, you will have to pay interest on the loan, which is not tax-deductible. In the case of a modified endowment contract (MEC), withdrawals and policy loans are taxable to the extent of gain and are subject to a 10% tax penalty if the policyowner is under 59 and a half years old.

If you surrender or cash out your policy, you may also incur taxes on any withdrawals that exceed your total premium payments. This is because the cash value of your policy may include accrued interest, which is generally taxable.

Life, Accident, and Health Insurance: Do Licenses Expire?

You may want to see also

Taxable cash value surrenders

The cash surrender value of a life insurance policy is the amount received if the policy is surrendered to the insurer. This value is based on the policy's cash value component, which grows over time through regular premium payments. Surrendering a policy early in the term may result in a lower cash surrender value, as the cash value will be smaller and surrender charges may apply. However, surrendering the policy later can lead to a larger payout as the cash value grows.

The cash surrender value of a life insurance policy can be taxable in certain situations. Generally, any amount received over the policy's basis, or the total premiums paid, may be taxed as income. There are several scenarios that can trigger potential tax consequences when surrendering a policy:

- Receiving funds that exceed the policy's cost basis.

- Having outstanding policy loans that are higher than the policy's cost basis.

- Changes to the cost basis during the policy period, such as reducing the death benefit or adding riders.

When surrendering a policy, it is important to review the documents, speak with the insurer, fill out the necessary paperwork, and consult with tax and financial experts.

It is worth noting that there are alternatives to surrendering a policy to access its cash value. These include borrowing against the cash value, withdrawing from the cash value, or using the cash value to pay premiums. These options allow the policyholder to maintain their coverage while utilising their cash value.

In summary, while the cash surrender value of a life insurance policy can provide a significant payout, it is important to consider the potential tax implications and explore alternative options for accessing the cash value of the policy.

Contacting MetLife: Insurance Claims and Queries

You may want to see also

Taxable policy loans

Generally, the cash value of life insurance is not taxable. However, there are certain situations in which you may have to pay taxes on it. One such situation is when you take out a loan from your life insurance plan.

Policy loans are not taxable when you take them out. However, if your policy terminates and you still have an outstanding loan balance, that amount may be taxed. This is because when a policy lapses, the total policy debt (including any unpaid, accrued interest) is considered a distribution to the policyowner, resulting in taxable income.

It's important to note that interest is charged on policy loans, and this interest accumulates over time. If you are unable to repay the loan and interest through out-of-pocket payments, your policy may lapse, resulting in a tax liability. Therefore, it is crucial to evaluate the pros and cons before borrowing against your life insurance policy and to ensure you understand the tax implications.

Additionally, if you have a Modified Endowment Contract (MEC), there are specific tax considerations for policy loans. In this case, loans or collateral assignments are treated as distributions and are included in taxable income.

To avoid unexpected tax liabilities, it is recommended to consult with a tax advisor or insurance professional before taking out a policy loan or making any changes to your life insurance policy. They can help you understand the specific rules and how they apply to your unique situation.

PERS and Life Insurance: What's the Deal?

You may want to see also

Taxable death benefit

In general, the payout from a term, whole, or universal life insurance policy isn't considered part of the beneficiary's gross income. This means it isn't subject to income or estate taxes. However, there are some cases when a death benefit can be taxed.

Payout Structure

If the payout is set up to be paid in multiple payments, these payments can be taxable. For example, an annuity paid regularly over the life of the beneficiary includes proceeds and interest. These payments can be subject to taxes.

Interest Accrual

If life insurance proceeds have accumulated some interest, taxes are usually due. Fortunately, only the amount that earned interest will be taxed, rather than the entire death benefit.

Policyholder Names Estate as Beneficiary

In the event a policyholder chose their estate as a life insurance beneficiary, taxes might apply. The taxes loved ones may pay depend on the estate's value.

Policyholder and Insured are Different Individuals

The person that buys a life insurance policy is usually considered the owner and insured. But if a different person holds each role, there may be taxes involved.

Surrendering Your Policy

If you have a life insurance policy you no longer need or want, you may surrender your contract. Typically, the amount you paid into your policy (the cash basis) that you get back when surrendering your policy is considered a tax-free return of your principal. However, any funds over your policy's cash basis will be taxed as regular income.

Employer-Paid Group Life Plan

In some cases, an employer-paid plan that pays out more than $50,000 may be taxable according to the Internal Revenue Service (IRS). Otherwise, the death benefit is paid to beneficiaries tax-free.

Death Benefit and Estate Value Exceed Limits

According to the IRS, if life insurance proceeds are included as part of the deceased's estate and together, exceed the federal estate tax threshold of $12.92 million (as of 2023), estate taxes must be paid on the proceeds over the allowed limit.

Life Insurance and Taxes: What's the Deal?

You may want to see also

Frequently asked questions

The cash value of life insurance is generally not taxable as it grows within the policy. However, taxes may apply in certain situations, such as when you withdraw more than the total premium payments made.

The death benefit paid to beneficiaries is typically not taxable. However, if beneficiaries choose to receive the payout in installments, any interest earned on those payments may be taxed. Additionally, if the policyholder leaves the death benefit to their estate instead of naming a person as the beneficiary, estate taxes may apply.

Surrendering or withdrawing from a life insurance policy may result in tax liabilities if the amount withdrawn exceeds the total premiums paid. In such cases, the excess amount is typically considered taxable income.