Indexed universal life insurance is a type of permanent life insurance policy that combines the features of traditional universal life insurance with the potential for cash value growth linked to the performance of a stock market index, such as the S&P 500. It offers both a death benefit and a cash account linked to stock market gains. When the insured passes away, the policy pays out a death benefit to the beneficiaries. The cash value of an IUL policy grows based on the performance of an index, providing the potential for higher returns compared to traditional life insurance policies.

What You'll Learn

Permanent life insurance with a savings component

Universal index life insurance is a type of permanent life insurance that includes a savings component. Permanent life insurance is designed to provide coverage for an individual's entire life, rather than for a set number of years. It typically includes a death benefit and a cash value feature, which grows over time and can be accessed while the individual is still alive.

The cash value component of permanent life insurance functions as a living benefit for the policyholder, who may access the funds for various purposes. The policyholder can borrow against the accumulated cash value, which comes from regular premium payments plus any interest and dividends credited to the policy. The policyholder can also withdraw cash from the policy, but this will reduce the death benefit. Additionally, if the policyholder withdraws more than the amount they have paid into the cash value, that portion will be taxed as ordinary income.

The cash value of permanent life insurance earns interest, and taxes on the accumulated earnings are deferred. While premiums are paid and interest accrues, the cash value builds over time. As the life insurance cash value increases, the insurance company's risk decreases, as the accumulated cash value offsets part of the insurer's liability.

Indexed universal life insurance is a type of permanent life insurance that provides a cash value component along with a death benefit. The money in the policyholder's cash value account can earn interest by tracking a stock market index selected by the insurer, such as the Nasdaq-100 or the Standard & Poor's 500. The interest rate derived from the equity index account can fluctuate, but the policy offers an interest rate guarantee, which limits losses. It may also cap any gains.

Indexed universal life insurance allows the policyholder to decide how much cash value to assign to an equity-indexed account and to a fixed-rate account, if available. The policyholder can choose how much they want to allocate to each account. The cash value in an indexed universal life insurance policy can be borrowed against, but if the loans are not repaid, they are deducted from the death benefit.

Compared to other types of permanent life insurance, indexed universal life insurance offers more flexibility in terms of premium payments and death benefits. It also provides the potential for higher returns on the cash value component, although there may be additional fees. However, the returns on the cash value are dependent on the performance of the underlying index, so there is a risk of lower returns if the index performs poorly.

Overall, universal index life insurance is a type of permanent life insurance that offers a savings component, flexible premiums, and the potential for higher returns on the cash value. It is important to consider the risks and fees associated with this type of policy before purchasing.

Metropolitan Life Insurance: What's the Deal with NYSRLS?

You may want to see also

Cash value growth through an equity index account

Indexed universal life (IUL) insurance is a type of permanent life insurance that provides a cash value component and a death benefit. IUL insurance policies allow for cash value growth through an equity index account, which is not possible with other universal policies that only grow cash value through non-equity earned rates.

IUL policies allow policyholders to grow their cash value by putting a portion of it toward an equity index account that tracks the performance of a market index, like the S&P 500 or NASDAQ. When the selected index gains value, so does the policy's cash value. The cash value will also have a minimum interest rate guarantee that it will always earn, regardless of market performance. However, there may be a cap on the maximum interest rate.

Policyholders can decide how much cash value to assign to an equity-indexed account and to a fixed-rate account, if available. The value of the selected index is typically recorded at the beginning of the month and compared with the value at the end of the month. If the index increases during this period, interest is added to the cash value. If the index decreases, no interest is credited to the cash value for that month.

The interest rate derived from the equity index account can fluctuate, but IUL policies offer an interest rate guarantee, which limits losses. These policies are more volatile than fixed universal life policies but are less risky than variable universal life insurance policies because they do not invest directly in equity positions.

IUL insurance offers permanent, lifelong coverage when premiums are kept up-to-date, along with flexible premiums and a flexible death benefit. The accumulated cash value can be used to lower or cover premiums without reducing the death benefit. Policyholders can also choose to allocate part of the cash value to a fixed-interest option.

IUL policies are a good option for those seeking permanent life insurance with a cash component that earns interest, as well as a death benefit. However, it is important to note that IUL insurance is more expensive than term life insurance and may have higher fees and premiums than other types of life insurance.

Edward Jones: Life Insurance Offering and Details

You may want to see also

Interest calculated on indexed universal life insurance

Indexed universal life insurance policies typically pay interest based on the movement of underlying stock and bond indexes. The cash value in an IUL policy can be invested in a fixed-rate account or an equity-indexed account, or a combination of both.

The fixed-rate account option offers a guaranteed minimum interest rate, usually around 0%, and is not subject to the volatility of the market. The equity-indexed account option is more complex. The cash value is placed in sub-accounts that mirror the performance of a chosen stock index, such as the S&P 500 or NASDAQ. The index's gains are then credited back to the policy, either monthly or annually.

The interest earned on the equity-indexed account is subject to "floors" and "caps" to minimise large swings in interest payments. The floor is the lowest the account rate can go and is usually guaranteed for the life of the policy. The cap is the highest interest rate the account can earn. For example, if the cap is 10% and the index rises by 12%, only 10% will be earned.

There is also a participation rate that dictates whether the cash value tied to a market index can fully "participate" in the gains of that index. A participation rate below 100% will limit the interest earned. For example, if the index gain is 12%, the cap is 10%, and the participation rate is 80%, only 8% will be earned.

Several methods are used to calculate gains in indexed universal life policies, such as the Daily Average, Monthly Point-to-Point, and Annual Point-to-Point methods. These methods vary among policies and insurers, so it is important to carefully review the information and consult with an agent to understand the specifics of a particular policy.

Life Insurance for Incarcerated: Is It Possible?

You may want to see also

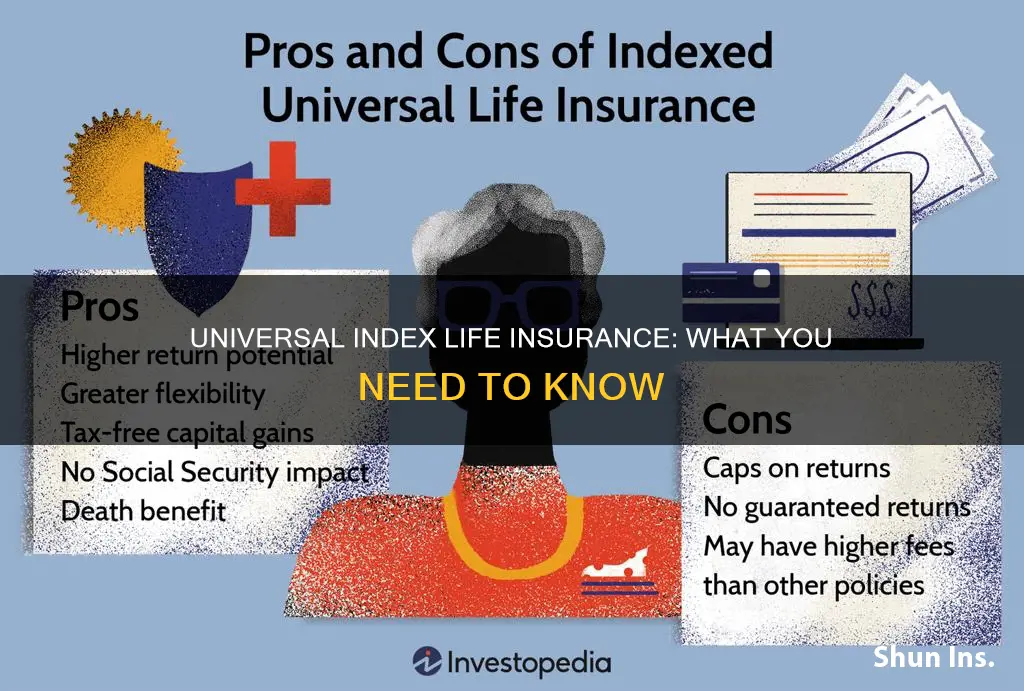

Pros and cons of indexed universal life insurance

Pros of Indexed Universal Life Insurance

- Potential for higher returns than other life insurance policies

- Tax-free capital gains

- Does not reduce Social Security benefits

- Can be designed around your risk appetite

- Flexible premiums

- High contribution limits

- Locked loan rates

- Tax-deferred growth and tax-exempt income

- Controlled growth strategies

- Continuous compounding on cash value

- Additional protection benefits

Cons of Indexed Universal Life Insurance

- Returns are capped at a certain level

- No guaranteed returns

- May have higher fees than other policies

- Complexity requires ongoing understanding

- No guarantees inside the rising cost structure

- Gains are taxed instantly if the policy lapses

Exide Life Insurance: IRDA-Accredited and Reliable

You may want to see also

Alternatives to indexed universal life insurance

While indexed universal life insurance offers a unique blend of death benefit protection and lifetime value through the policy's cash value growth potential, tax advantages, and loan facilities, there are several alternatives to this type of insurance that you can consider. Here are some options:

- Term life insurance: This is a temporary form of life insurance designed to provide coverage for a specific period, typically 10, 15, 20, or 30 years. Term life insurance policies do not offer cash value accumulation or investment options, making them a more affordable and straightforward choice. They are generally recommended for individuals who are young, in good health, and have dependents, as the coverage is usually sufficient to replace lost income and cover expenses in the event of the policyholder's death.

- Whole life insurance: Whole life insurance is a permanent policy that can offer coverage for an individual's entire life. It is typically more straightforward than indexed universal life insurance, with fixed premiums and a cash value component that grows tax-deferred at a fixed rate. Whole life insurance provides a higher level of financial security and predictability but tends to have higher premiums than indexed universal life insurance.

- Final expense insurance: This is a small permanent life policy that can help loved ones cover end-of-life expenses, such as funeral and burial costs. It has a lower death benefit and typically does not require a medical exam.

- Adjustable Life (AL): AL combines elements of traditional, fixed-premium ordinary life insurance with the ability to alter the policy plan, premium payments, and the face amount within certain limits. It can be thought of as IUL without the current assumption and equity-indexed interest crediting features.

- Variable Life (VL) and Variable Universal Life (VUL): VL and VUL policies allow policyowners to select a portfolio of investments within their policies. If the chosen portfolio is similar to the equity index used in an IUL equity-indexed interest crediting formula, the investment performance and cash value accumulations can be expected to be at least as great as, and generally greater than, that of the IUL policy when equity markets are performing well. However, due to the guaranteed minimum interest crediting rates of IUL policies, they generally outperform VL and VUL in down markets. Over the long term, VL and VUL should outperform IUL, but this is not guaranteed.

- Current-Assumption Whole Life (CAWL): CAWL, also known as interest-sensitive whole life, is essentially IUL without the adjustability features or equity-indexed interest crediting rate. CAWL uses current interest rates to determine additions to cash values, similar to the IUL's equity-indexed interest crediting formula. However, CAWL generally offers the policyowner little flexibility in changing premium payments or death benefits.

These alternatives may be suitable options depending on your specific needs, financial goals, and risk tolerance. It is always recommended to consult with a qualified financial advisor or insurance agent to determine the best type of life insurance for your unique circumstances.

Life Insurance and Subrogation: What's the Verdict?

You may want to see also

Frequently asked questions

Universal index life insurance, or Indexed Universal Life (IUL) insurance, is a type of permanent life insurance that provides a cash value component along with a death benefit.

The money in a policyholder's cash value account can earn interest by tracking a stock market index, such as the Nasdaq-100 or the Standard & Poor's 500, selected by the insurer. The interest rate derived from the equity index account can fluctuate, but the policy offers an interest rate guarantee, which limits losses and may cap gains.

Universal index life insurance offers permanent coverage, flexible premiums, and the potential for cash value growth through an equity index account. It also provides the option to allocate part of the cash value to a fixed-interest option.

Universal index life insurance is more expensive than term life insurance and has higher fees and premiums than other types of life insurance, such as whole life or term life insurance. It also has caps on accumulation percentages, so there may be a limit on the maximum amount you can earn.