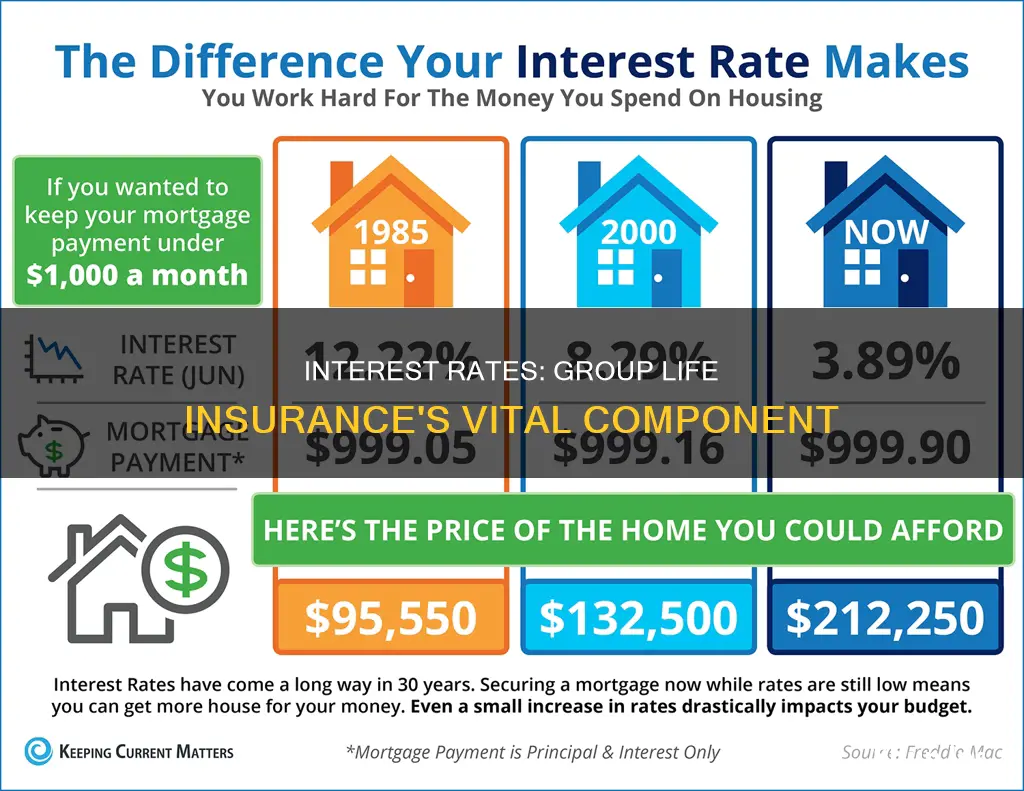

Interest rates are important in group life insurance as they directly impact insurance companies, their products, and policies. Life insurance companies are large purchasers of bonds and mortgages, which are repackaged into annuities and life insurance products. Therefore, interest rates affect the yields of these underlying investments. Low-interest rates can decrease the attractiveness of interest-rate-sensitive products, reducing sales growth and premium income. Conversely, rising interest rates may not lead to lower pricing for fully guaranteed life insurance products as insurers are cautious about increasing long-term assumptions for bond yields. Understanding interest rate risk is crucial for life insurers to manage their company's value effectively.

What You'll Learn

The impact of low interest rates on life insurance

Interest rates have a significant impact on the insurance industry, especially life insurance. Prolonged periods of low interest rates can negatively affect the financial performance of life insurance companies in multiple ways.

Life insurance companies are some of the largest purchasers of bonds and mortgages in the United States. These investments are repackaged into annuities and life insurance products that reflect the yields of the underlying investments. Therefore, interest rates have a direct impact on insurance companies, their products, and their policies.

Low interest rates can lead to a decrease in investment earnings on bonds for life insurance companies. As a result, some insurers may shift their funds to riskier but potentially higher-earning assets, such as asset-backed securities, derivatives, and real estate. This strategy, however, comes with its own set of risks and challenges.

Life insurance products, such as annuities and cash value life insurance policies, are directly affected by low-interest rates as their earnings depend on the spread between what insurers earn in interest and what they credit to the customer. When market interest rates are low, the spread is compressed, resulting in lower earnings for the insurers.

Additionally, low-interest rates can create a misperception of superior investment expertise and access for carriers, leading to higher yield expectations from policyholders. Carriers, in turn, may be forced to make difficult decisions, including dividend and credit reductions, cost of insurance increases, and workforce layoffs.

The impact of low-interest rates can also vary across different insurance product structures and their subsets, with different risks and recovery options. For example, universal life policies, where the premiums become part of the cash value that grows tax-deferred based on the carrier's investment return, can be affected by declining yields. Carriers may reduce the amounts credited to policies to maintain their targeted spreads, but if they are unable to do so due to guaranteed minimum crediting levels, they may have to increase the costs of insurance.

The Impact of Rising Interest Rates

While rising interest rates may seem beneficial, they can also have a complex impact on the life insurance industry. Life insurance companies need to consider the duration of the bonds in their portfolios, which can range from 7 to 12 years, and slowly incorporate higher-yield bonds as existing bonds mature. Additionally, the cost of statutory reserving requirements may increase with rising interest rates, impacting the pricing of guaranteed life insurance products.

Furthermore, rising interest rates can increase the cost of capital for life insurance companies, affecting their overall profitability. It is crucial for insurers to employ hedging techniques, such as matching asset and liability durations, to mitigate the impact of changing interest rates on their firm value.

In summary, interest rates play a crucial role in the life insurance industry, and both low and rising interest rates can have significant implications for insurance companies and their policyholders.

Understanding Group Life Insurance: Base Coverage Determination

You may want to see also

Interest rates and insurance company valuations

Interest rates have a significant impact on the insurance industry, especially life insurance. Life insurance companies are some of the largest purchasers of bonds and mortgages, which are repackaged into annuities and life insurance products that reflect the yields of the underlying investments. Therefore, interest rates have a direct impact on insurance companies, their products, and policies.

The degree of exposure of net worth to changes in interest rates is known as interest rate risk. By understanding their company's interest rate risk profile, managers can gain greater insight into ways to better manage the volatility of their company's value.

The simple formula below can be used as a framework for considering the relevant issues in analyzing the relationship between interest rates and a firm's equity value:

Equity Value = Asset Value – Liability Value

Life insurance assets are primarily financial in nature and are composed mainly of bonds and stocks. On the other hand, life insurance liabilities consist of obligations relating to the policies sold to individuals. Life insurers incur liabilities by "borrowing" premiums from policy owners and investing in stocks and bonds to generate returns through investment income and capital gains.

Equity value is the residual claim of the owners in the assets of the company after the deduction of the company's liabilities. Generally, the value of a company's equity value is driven by its growth prospects, risk profile, and expected profitability. All else being equal, companies with higher growth, greater profitability, and lower risk will have higher valuations.

One metric that captures these elements and is used by insurance industry analysts to assess equity valuations is the price-to-earnings (P/E) multiple. By analyzing trends in valuation multiples, analysts can gain a better understanding of the market's assessment of a company's growth prospects and risk profile, both of which could be affected by the interest rate environment.

The impact of interest rates on the value of a firm's assets and liabilities is essential to understanding a company's exposure to interest rate risk. In the case of life insurers, the sensitivity of investment assets and policyholders' claims (liabilities) to interest rate changes could significantly impact equity value.

Low-interest rate environments can result in depressed crediting rates, potentially decreasing the insurer's future obligation on the policy (liability). However, lower crediting rates can also reduce the attractiveness of interest-rate-sensitive products, leading to a decline in sales growth and premium income for the insurer. The net impact on equity value will depend on how sensitive the growth prospects of the assets are relative to those of the liabilities to changes in interest rates.

Interest rates also influence a company's risk profile, notably through exposure to interest rate risk. Managers in the life insurance industry face the challenge of structuring their investment portfolios to meet future obligations on policies. One risk factor is disintermediation risk, which refers to the potential that policyholders may relinquish policies due to rising interest rates. If interest rates rise too rapidly, policyholders may surrender policies faster than expected, resulting in cash flow obligations that exceed returns on investment assets.

Alternatively, during persistent periods of low-interest rates, when policy surrender rates tend to decrease, insurers face the risk that investment returns will decline to the point that they are unable to service ongoing liabilities. In either scenario, the sensitivity of investment income and policy obligations to interest rate changes could considerably impact equity value.

By influencing a company's perceived growth prospects, risk, and profitability, interest rates have the potential to influence equity valuations. Life insurers can employ hedging techniques, such as matching asset and liability durations, to help insulate firm value from changes in interest rates.

Trends in Valuation Multiples

Analyzing the historical trend in valuation multiples for life insurers provides insights into the current relationship between value and interest rates in the industry. For instance, during the period from January 1, 2010, to July 1, 2011, which was characterized by low-interest rates, the trend in interest rates closely tracked the average P/E multiples. During this time, life insurance companies potentially faced the risk of falling investment returns and reduced cash flows. As interest rates began to rise around October 2010, the market's concern for the financial stability of life insurers diminished.

With some analysts indicating that interest rates are unlikely to increase significantly anytime soon, disintermediation could remain a risk for life insurance companies, potentially impacting equity valuations. Therefore, understanding how both the assets and liabilities of a business can be affected by various interest rate environments is crucial for properly assessing and managing interest rate risk.

Crate Carriers: Life Insurance Provision and Employee Benefits

You may want to see also

The effect of rising interest rates on insurance premiums

Interest rates have a significant impact on the insurance industry, especially life insurance. While rising interest rates generally improve the financial performance of life insurers, the impact is not immediate. Life insurance policies and retirement savings products are often in force for many years, and life insurers typically hold their bonds to maturity to match the duration of their assets with their liabilities. As a result, it may take a significant amount of time for higher-interest-earning bonds to replace the lower-yielding bonds obtained during periods of low-interest rates.

The opportunity cost of holding bonds over a long period increases when interest rates rise, as the cost of missing out on better investments grows. However, insurance companies constantly receive premiums and invest new money, allowing them to hold onto existing bonds and collect payments while purchasing new, higher-yielding bonds. This raises the average yield of their holdings and increases their interest income, leading to rising profits for insurers.

Rising interest rates can also affect the liabilities of insurance companies. Lower interest rates can decrease an insurance company's future obligations to policyholders, but they can also make their products less attractive, resulting in lower sales and premium income. The net impact on profitability depends on whether the decrease in liabilities is greater than any reduction in assets. Additionally, lower interest rates can negatively impact an insurance company's risk profile as an equity investment if analysts believe the company may struggle to meet future financial obligations.

For life and retirement providers, higher interest rates reduce reinvestment risk and make rate guarantees less expensive. However, a sharp rise in interest rates can introduce disintermediation risk, negatively impacting balance sheets. In contrast, a gradual increase in interest rates will mitigate these risks but require carriers to reset rate guarantees and pricing more frequently to respond to market pressure.

Rising interest rates can also affect the liquidity of life insurers. Liquidity management is critical, and life companies strive to match asset cash flows with cash outflows to avoid asset-liability mismatches and interest rate risks. During periods of rising interest rates, cash flows from assets and liabilities can become mismatched, exposing insurers to potential losses from pressured asset sales to meet current obligations. If a significant volume of policies lapse and annuities are withdrawn due to rising yields, liquidity demands will increase further.

In summary, rising interest rates generally improve the financial performance of life insurers, but the impact is not immediate due to the long-duration nature of their assets and liabilities. The opportunity cost of holding bonds increases, but insurance companies can benefit from investing new money in higher-yielding assets. The impact on liabilities and liquidity should also be carefully considered, as lower interest rates can decrease future obligations but also make products less attractive, and rising interest rates can create cash flow mismatches and increase liquidity demands.

Crohn's Impact: Life Insurance Underwriting

You may want to see also

Interest rates and insurance hedging strategies

Interest rates have a significant impact on the insurance industry, especially life insurance. Prolonged periods of low interest rates can negatively affect the financial performance of life insurance companies. Conversely, higher interest rates can improve their financial performance.

Life insurance companies are among the largest purchasers of bonds and mortgages in the United States. They repackage these investments into annuities and life insurance products that reflect the yields of the underlying investments. As a result, interest rates have a direct impact on insurance companies, influencing their new products, existing policies, and investment strategies.

When interest rates are low, life insurance companies may struggle to maintain their targeted interest rate spreads due to guaranteed minimum crediting rates. This can lead to tough decisions, such as reducing dividends and increasing insurance costs. Additionally, policyholders may seek higher yields elsewhere, impacting the companies' earnings.

Hedging strategies are essential for managing interest rate risk. These strategies allow businesses to fix interest rates for a period, providing certainty and reducing future volatility in cash flows. Here are some common hedging strategies:

- Matching and smoothing: This approach involves dividing loans or deposits into fixed-rate and variable-rate portions. By doing so, businesses can mitigate the impact of interest rate increases, as only the variable-rate portions will be affected.

- Asset and liability management: This strategy focuses on matching the periods or durations of loans (liabilities) and deposits (assets). For example, a company should align the loan period for a new property with the expected lease period to benefit from lower interest rates.

- Forward rate agreements (FRAs): FRAs allow businesses to borrow or deposit funds at a fixed rate for a specific period, providing protection against interest rate fluctuations.

- Interest rate derivatives: These include interest rate futures, options, caps, floors, collars, and swaps. Interest rate futures give the right to earn or pay interest at a given rate. Options protect against adverse interest rate movements while allowing businesses to benefit from favourable movements. Caps set a maximum interest rate for borrowers, while floors set a minimum rate for investors. Collars combine a cap and a floor to confine the interest rate within a predetermined range. Swaps involve exchanging interest payments between counterparties, allowing them to obtain better borrowing rates.

By employing these hedging strategies, insurance companies can manage their exposure to interest rate risk and make more informed decisions about their financial strategies.

Does the FBI Offer Life Insurance Policies to Agents?

You may want to see also

Interest rates and insurance company liabilities

Interest rates have a direct impact on insurance companies, their products and policies. Life insurance companies are some of the largest purchasers of bonds and mortgages. These investments are repackaged into annuities and life insurance products that reflect the yields of the underlying investments. As a result, interest rates impact insurance companies, their new products and their existing policies.

Life insurance assets are primarily financial in nature and are composed primarily of bonds and stocks. On the other hand, life insurance liabilities mostly consist of obligations relating to the policies sold to various individuals. Life insurers effectively incur liabilities by "borrowing" premiums from policy owners and investing in stocks and bonds to generate returns through investment income and capital gains.

The degree of exposure of net worth to changes in interest rates is known as interest rate risk. By understanding their company's interest rate risk profile, managers can gain greater insight into ways to better manage the volatility of their company's value.

In a low-interest rate environment, insurers face the risk of declining investment returns and reduced cash flows. This can lead to a decrease in the insurer's future obligation on the policy (i.e., the liability). However, lower crediting rates can also reduce the attractiveness of interest rate-sensitive products, resulting in slower sales growth and lower premium income for the insurer. The net impact on equity value will depend on how sensitive the growth prospects of the assets are relative to those of the liabilities.

During periods of rising interest rates, life insurers may experience an increase in policy surrenders as policyholders seek to take advantage of higher yields elsewhere. This can result in cash flow obligations that exceed returns on investment assets. Additionally, rising interest rates can affect the liquidity of life insurers, as cash flows from assets and liabilities can become mismatched, exposing insurers to potential losses from pressured asset sales to meet current obligations.

To mitigate the impact of interest rate changes, life insurers can employ a variety of hedging techniques, such as matching the durations of their assets and liabilities. This "immunization" strategy aims to reduce the risk of loss in a changing interest rate environment. However, in practice, it can be challenging to attain a perfect hedge against interest rates, and equity values for life insurers tend to be subject to some level of interest rate risk.

Employee Life Insurance: Voluntary Benefits Worth the Cost?

You may want to see also

Frequently asked questions

Interest rates have a significant impact on the life insurance industry. Life insurance companies are large purchasers of bonds and mortgages, and their investments are repackaged into annuities and life insurance products. Therefore, interest rates have a direct impact on insurance companies, their new products, and their existing policies.

Low interest rates negatively affect the financial performance of life insurance companies. As large purchasers of bonds, lower interest rates mean lower investment earnings on those bonds. This can lead to life insurance companies shifting funds to riskier but potentially higher-earning assets.

Low interest rates can decrease crediting rates and reduce the attractiveness of interest-rate-sensitive products. This can lead to a decline in sales growth and lower premium income for insurers, impacting their asset growth.

Rising interest rates can increase the cost of statutory reserving requirements for life insurance companies. As interest rates rise, the cost of capital tied up in reserves for products also rises. Additionally, policyholders may surrender policies faster than expected in response to rising interest rates, creating potential cash flow obligations that exceed returns on investment assets.

Rising interest rates may not immediately lead to lower pricing for fully guaranteed life insurance products. Life insurance companies need to consider if long-term interest rates will remain higher than the current rates. The slow incorporation of higher-yield bonds into their portfolios and the cautious approach taken by insurers regarding long-term assumptions for bond yields can influence pricing decisions.