Life insurance is a crucial financial product that provides peace of mind and security for individuals and their loved ones. However, it's essential to understand the tax implications associated with life insurance benefits to make informed decisions. In Virginia, as in most states, the tax treatment of life insurance benefits can vary depending on several factors, including the type of policy, the payout structure, and the relationship between the policy owner, the insured person, and the beneficiary. While life insurance proceeds are generally exempt from federal taxation under IRC § 101, certain scenarios may trigger tax liabilities. Understanding these nuances is essential for effective financial planning and ensuring compliance with tax regulations in Virginia.

| Characteristics | Values |

|---|---|

| Are life insurance benefits taxable in Virginia? | In most cases, life insurance benefits are not taxable in Virginia. However, there may be specific circumstances where the beneficiary is taxed, such as when the cash value of the policy exceeds a certain amount or when the beneficiary is a third party. |

| Life insurance and taxes | Life insurance benefits are generally not considered taxable income, but there are certain instances when the payout may be taxable. |

| Estate Tax | Life insurance proceeds may be subject to estate tax if the estate's value exceeds the maximum threshold. |

| Inheritance Tax | The inheritance tax is imposed on the recipient for inherited cash payouts, properties, and other assets. This tax is currently enforced in Iowa, Kentucky, Nebraska, New Jersey, Maryland, and Pennsylvania. |

| Generation-Skipping Tax | Similar to the estate tax, the generation-skipping tax is applied to assets that skip a generation and exceed the same threshold. |

| Virginia-specific regulations | In Virginia, if the beneficiary is not named in the life insurance policy, the benefits will go into a taxable estate. The first $11.7 million is exempt from federal taxes, but amounts above this threshold are subject to taxation. State regulations may have different exemption rules and vary by location. |

What You'll Learn

Life insurance proceeds are generally not taxable

However, there are certain instances when life insurance proceeds may be subject to taxation. For example, if you receive interest on the life insurance payout, that interest is typically taxable, and you should report it on your tax return. Additionally, if the policy was transferred to you in exchange for cash or other valuable consideration, the exclusion for the proceeds may be limited, and you may need to report a taxable amount.

In Virginia specifically, the state's tax code conforms to federal law, which exempts life insurance benefit payments from federal taxation under IRC § 101. This exemption also applies to Virginia taxation, meaning that life insurance benefits are generally not taxable in the state.

It's important to note that there are other types of taxes and situations that may result in taxation on life insurance proceeds. For example, if the cash value of the policy exceeds a certain amount, you may encounter estate taxes or generation-skipping taxes. Additionally, if you live in a state that imposes an inheritance tax, you may be taxed on the life insurance payout. Each state has its own set of guidelines and regulations regarding taxes on life insurance policies, so it's always a good idea to consult with a tax professional to ensure you understand your specific situation.

Furthermore, the taxation of life insurance proceeds can depend on the relationship between the policy owner, the insured person, and the beneficiary. Typically, if the policy owner and the insured person are the same individual, the policy is not taxable. However, if a third person is involved, the beneficiary may be taxed on the life insurance proceeds.

Check Your Texas Life Insurance License Status

You may want to see also

Interest on life insurance proceeds is taxable

In most cases, life insurance proceeds are not taxable. However, interest accrued on life insurance proceeds is taxable.

According to the Internal Revenue Service (IRS), life insurance proceeds received as a beneficiary due to the death of the insured person are generally not taxable and do not need to be reported as income. Nevertheless, any interest earned on these proceeds is taxable and should be reported. This means that if you receive a life insurance payout and it generates interest, you must pay taxes on the interest portion.

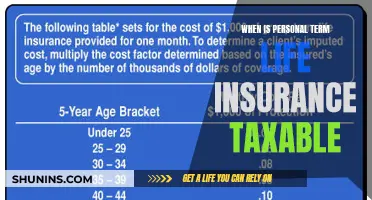

For example, if you invest in a cash value life insurance policy, you can take out a loan or make a partial withdrawal against the cash value. If you opt for a loan, you may be subject to interest payments, which are taxable. If you choose a partial withdrawal, you may have to surrender the policy to access the funds freely, and this amount will be deducted from your final life insurance payout.

Additionally, if you sell your life insurance policy, the profits could be subject to income tax if they exceed the amount you have paid into the policy. Similarly, if you surrender a life insurance policy, you may have to pay taxes on the cash value, as it can be considered income.

It is important to note that each state has its own regulations regarding taxes on life insurance policies, and there may be specific rules in Virginia that you need to consider. Consulting a tax professional or referring to Virginia's tax laws can provide more detailed and localized information.

Understanding Bonus Calculation Methods in Life Insurance Policies

You may want to see also

Life insurance cash value may be taxable

In most cases, life insurance proceeds are not taxable. However, there are certain instances where the cash value of life insurance may be taxable.

Estate Tax

An estate tax is a tax on your right to transfer property upon your death. If your estate is worth more than the maximum threshold allowed, which is $11.7 million at the federal level, your life insurance proceeds may be taxable.

Inheritance Tax

The inheritance tax is levied on the recipient for any inherited cash payouts, properties, and other assets. Only Iowa, Kentucky, Nebraska, New Jersey, Maryland, and Pennsylvania enforce this tax.

Income Tax

Typically, life insurance proceeds are not considered taxable income. However, if you withdraw money from a cash value life insurance policy, you may be taxed if the cash value exceeds a certain amount. This could be in the form of a loan or a partial withdrawal. If you take out a loan against the cash value, you may be subject to interest payments, and your benefits may shrink over time. If you opt for a partial withdrawal, you may have to surrender the policy to use the money freely, and that amount will be subtracted from your final life insurance payout.

Generation-Skipping Tax

Similar to the estate tax, the generation-skipping tax is imposed on any assets that skip a generation and are only enforced when they exceed the same threshold.

When There Are More Than Two Parties Involved

If a third person is involved, the beneficiary on the life insurance policy may be taxed. For example, if a mother buys her daughter a life insurance policy but names the father the beneficiary, the father would be taxed.

When You Sell a Life Insurance Policy

If you sell your life insurance policy for cash, the profits may be worth more than what you have paid so far, and this life insurance payout can qualify for income tax.

When You Surrender a Life Insurance Policy

When surrendering a life insurance policy, you may have to pay taxes on the life insurance cash value because it now falls under the qualifications to be income-taxed.

When Your Life Insurance Policy Goes into a Taxable Estate

If the beneficiary isn't named in your policy, your life insurance benefits will go into a taxable estate. While the first $11.7 million is not taxed at the federal level, anything above this amount is subject to taxation. State regulations have a lower chance of exemption and vary depending on location.

Life Insurance: Expensive or Affordable?

You may want to see also

Life insurance payout can be taxable income

In most cases, life insurance payouts are not taxable. However, there are certain instances where the beneficiary can be taxed.

Estate Tax

If your estate is worth more than the maximum threshold allowed, your life insurance proceeds may be taxable. The first $11.7 million is not taxed at a federal level – this is the threshold. Anything above this amount is subject to being taxed.

Inheritance Tax

The inheritance tax is levied on the recipient for any inherited cash payouts, properties, and other assets. Iowa, Kentucky, Nebraska, New Jersey, Maryland, and Pennsylvania are currently the only states that enforce this tax.

Income Tax

Typically, life insurance proceeds are not considered taxable income. However, if you receive interest from the life insurance payout, it is taxable, and you should report it as interest received. If the policy was transferred to you for cash or other valuable consideration, the exclusion for the proceeds is limited to the sum of the consideration you paid, additional premiums you paid, and certain other amounts.

Generation-Skipping Tax

Similar to the estate tax, the generation-skipping tax is imposed on any assets that skip a generation. They are only enforced when they exceed the same threshold.

When There Are More Than Two Parties Involved

If a third person is involved, the beneficiary on the life insurance policy may be taxed. For example, if a mother buys her daughter a life insurance policy but names the father the beneficiary, the father would be taxed.

When You Withdraw Money from a Cash Value Life Insurance Policy

If you invest in a cash value life insurance policy, you can take out a loan or make a partial withdrawal. If you take out a loan against the cash value, you may be subject to interest payments, and your benefits may shrink over time. If you opt for a partial withdrawal, you may have to surrender the policy to use the money freely. If not, that amount will be subtracted from your final life insurance payout.

When You Sell a Life Insurance Policy

You can sell your life insurance policy for cash, but the broker that facilitates this sale usually takes a portion of the selling price. If the profits are worth more than what you have paid so far, this life insurance payout can qualify for income tax. Viatical Settlements for the terminally ill can escape this tax.

When You Surrender a Life Insurance Policy

When surrendering a life insurance policy, you may face surrender fees and taxes on the life insurance cash value because it now falls under the qualifications to be income taxed.

When Your Life Insurance Policy Goes into a Taxable Estate

If the beneficiary isn't named in your policy, your life insurance benefits will go into a taxable estate. State regulations have a lower chance of exemption and vary depending on location.

Understanding Tax Implications of Life Insurance Cash Surrender

You may want to see also

Life insurance premiums are not tax-deductible

Life insurance premiums are generally not tax-deductible. This is because the IRS considers them to be personal expenses. However, there are some exceptions to this rule. For example, if you are a business owner offering life insurance to your employees, you can write off those premiums as a business expense.

Other instances where life insurance premiums can be tax-deductible include alimony agreements that went into effect before 2019, donating your policy to a charity, and certain business-related expenses.

It's important to note that while life insurance premiums themselves may not be tax-deductible, there are other tax benefits associated with life insurance. For example, the death benefit paid out to beneficiaries is generally tax-free, and the cash value of permanent life insurance is not taxed while it remains within the policy.

In the context of Virginia, it's worth noting that the state conforms to federal law regarding the taxation of life insurance benefits. Specifically, life insurance benefit payments received by the beneficiary due to the death of the insured are exempt from federal and Virginia taxation. However, a portion of the death benefits from an annuity, including life insurance contracts, may be taxable.

Life Insurance Benefits: Taxable in Massachusetts?

You may want to see also