Personal term life insurance can be a valuable financial tool, but understanding its tax implications is crucial for effective planning. When considering the tax status of term life insurance, it's important to note that the premiums paid for this type of insurance are generally not taxable income. However, there are specific circumstances where the proceeds of a term life insurance policy may be taxable. This guide will explore the conditions under which term life insurance benefits could be subject to taxation, helping individuals make informed decisions about their insurance and financial strategies.

What You'll Learn

- Tax Treatment: Personal term life insurance proceeds are generally tax-free, but exceptions exist

- Excess Proceeds: If the death benefit exceeds the policy's cash value, it may be taxable

- State Variations: Tax rules vary by state; some may exempt life insurance benefits

- Policy Type: Different types of life insurance have distinct tax implications

- Income Tax Implications: The tax treatment depends on the recipient's income and other factors

Tax Treatment: Personal term life insurance proceeds are generally tax-free, but exceptions exist

Personal term life insurance is a popular financial product that provides coverage for a specific period, typically one to ten years. When an insured individual passes away during this term, the beneficiary receives a death benefit, which is generally tax-free. This tax-free status is a significant advantage of personal term life insurance, offering financial security to the designated recipient without the burden of income tax.

The tax treatment of personal term life insurance proceeds is based on the principle of insurance benefits being exempt from taxation. The rationale behind this is that the death benefit is intended to replace lost income and cover expenses, and it is considered a form of financial assistance rather than income. As such, the proceeds are typically not subject to income tax, providing a valuable tax-free benefit to the policyholder's beneficiaries.

However, it is important to note that there are exceptions to this general rule. In some cases, the tax treatment of personal term life insurance proceeds may vary. For instance, if the policy is considered a modified endowment contract (MEC) in the United States, the death benefit may be taxable. MECs are subject to a 10% penalty tax if the insured individual dies within a certain period, typically five years from the date of issuance. This exception applies to high-value policies with long terms, and the tax treatment can be complex, requiring careful consideration of the policy's characteristics.

Additionally, if the insured individual is a high-income earner or has a substantial estate, the tax implications can become more intricate. In such cases, the tax authorities may recharacterize the death benefit as income, subjecting it to taxation. This recharacterization can occur if the policy is deemed to have a significant value or if the insured individual's estate exceeds a certain threshold. It is crucial for individuals in these situations to consult with tax professionals to ensure compliance with tax laws and to understand the potential tax consequences.

In summary, personal term life insurance proceeds are generally tax-free, providing a valuable financial safety net for beneficiaries. However, exceptions exist, particularly for high-value policies or those with specific characteristics. Understanding these exceptions and seeking professional advice when necessary can help individuals navigate the tax implications of personal term life insurance effectively.

Insurable Interest: Can You Insure Your Own Life?

You may want to see also

Excess Proceeds: If the death benefit exceeds the policy's cash value, it may be taxable

When it comes to personal term life insurance, understanding the tax implications is crucial, especially in cases where the death benefit exceeds the policy's cash value. This scenario, known as "excess proceeds," can have significant tax consequences for the beneficiary.

In the event of the insured individual's passing, the life insurance policy typically pays out a death benefit to the designated beneficiary. However, if the death benefit surpasses the policy's cash value, it may be subject to taxation. The excess amount, which is the difference between the death benefit and the cash value, could be considered a taxable event. This is because the insurance company may view this excess as a form of income or a distribution of assets, which could trigger tax liabilities for the beneficiary.

The tax treatment of excess proceeds can vary depending on the jurisdiction and the specific insurance policy. In some cases, the excess amount may be taxable as ordinary income for the beneficiary. This means the beneficiary would need to report the excess proceeds as income on their tax return and pay taxes accordingly. The tax rate applied would depend on the beneficiary's overall income for the year.

To avoid potential tax issues, it is essential to carefully review the insurance policy and seek professional advice. Some insurance companies may offer options to reduce or eliminate excess proceeds, such as taking out loans against the policy's cash value or making additional premium payments. These strategies can help minimize the taxable event and ensure that the death benefit aligns with the policy's value.

In summary, when the death benefit of a personal term life insurance policy exceeds its cash value, it can result in excess proceeds that may be taxable. Beneficiaries should be aware of these potential tax implications and consider consulting tax professionals to navigate this complex area of insurance and taxation. Proper planning and understanding of the policy's terms can help mitigate any unexpected tax burdens.

Life Insurance: Income Protection and Its Coverage

You may want to see also

State Variations: Tax rules vary by state; some may exempt life insurance benefits

When it comes to personal term life insurance, the tax implications can vary significantly depending on the state you reside in. This is primarily because tax laws are often tailored to the specific needs and economies of each state, leading to diverse interpretations of what constitutes taxable income. One of the most notable variations is the treatment of life insurance benefits.

In some states, life insurance proceeds are entirely exempt from taxation. This means that if you pass away while having a valid life insurance policy, the beneficiaries will receive the payout without any tax consequences. For instance, in states like New York, life insurance benefits are generally not taxable, providing a significant financial benefit to the policyholders' families. Conversely, other states may impose taxes on these benefits, treating them as ordinary income. This can result in a substantial tax liability for the beneficiaries, especially if the policy had a high death benefit.

The difference in state laws can be attributed to the varying levels of economic development and the unique financial situations of each state. States with a higher cost of living or those that have traditionally favored personal savings over state-provided benefits may be more likely to tax life insurance proceeds. For example, California, known for its high cost of living, taxes life insurance benefits as income, which can significantly impact the financial planning of residents.

Understanding the tax rules in your state is crucial for effective financial planning. It can help individuals make informed decisions about their life insurance policies and ensure that their beneficiaries are aware of any potential tax obligations. Consulting with a tax professional or insurance advisor who is familiar with state-specific regulations can provide valuable guidance in navigating these complex rules.

Additionally, some states offer specific exemptions or deductions for life insurance premiums, which can further complicate the tax picture. These variations in tax treatment highlight the importance of considering both federal and state tax laws when structuring your life insurance policy. Being aware of these state-by-state differences can help you make more informed decisions and potentially save on taxes.

Freedom Life Insurance: Marketplace Approved?

You may want to see also

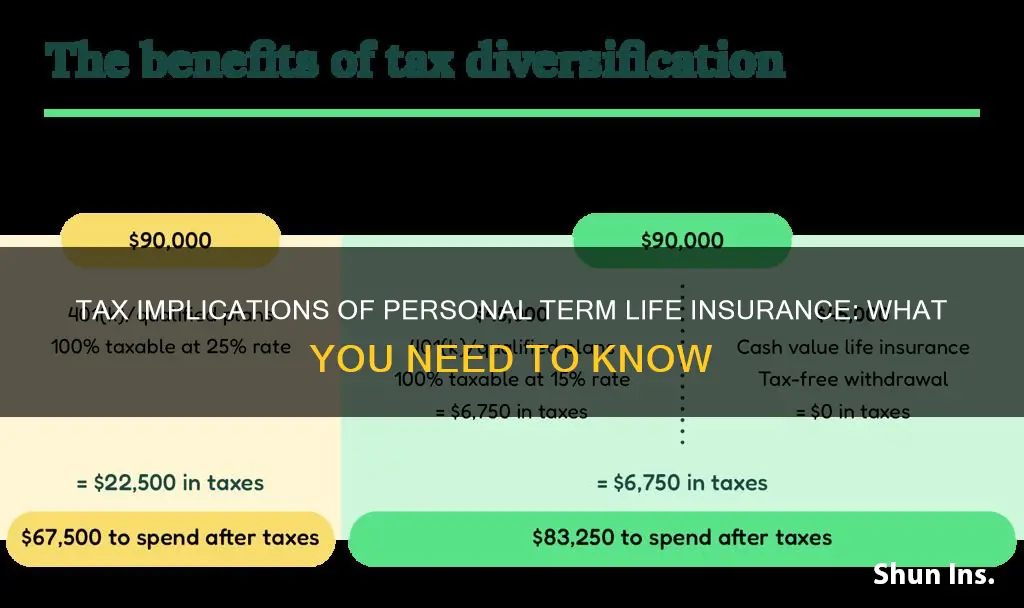

Policy Type: Different types of life insurance have distinct tax implications

When it comes to life insurance, understanding the tax implications of different policy types is crucial for making informed financial decisions. The tax treatment of life insurance policies can vary significantly depending on the type of policy you have. Here's an overview of how different types of life insurance policies are taxed:

Term Life Insurance: This is a pure insurance policy where the primary purpose is to provide coverage for a specified term, typically 10, 20, or 30 years. During the term, if the insured individual dies, the death benefit is paid out tax-free to the beneficiary. However, term life insurance is generally not taxable to the policyholder. The premiums paid are typically considered a form of savings or an investment, and the policyholder can deduct the cost of these premiums from their taxable income, especially if the policy is part of a group plan. After the term ends, the policy may continue as a permanent life insurance policy, and the tax treatment may change accordingly.

Whole Life Insurance: This type of policy is a permanent life insurance contract that provides coverage for the entire lifetime of the insured individual. It has a cash value component, which grows over time. The death benefit is generally tax-free when paid out. Additionally, the cash value can be borrowed or withdrawn, providing a tax-free loan. However, the premiums paid for whole life insurance are generally not tax-deductible for the policyholder. The policy's cash value can also be used to pay for future premiums, reducing the overall cost.

Universal Life Insurance: This is a type of permanent life insurance that offers flexibility in premium payments and death benefit amounts. Policyholders can adjust their premiums and death benefits over time. The cash value in universal life insurance policies grows tax-deferred, similar to a tax-advantaged savings account. When the insured dies, the death benefit is generally tax-free. Universal life policies provide a degree of control and flexibility, allowing policyholders to customize their coverage.

Variable Universal Life Insurance: This policy combines the features of universal life with an investment component. Policyholders can allocate a portion of their premiums to various investment options, which can offer higher potential returns. The death benefit is tax-free when paid out. The investment aspect of this policy means that the cash value can fluctuate, and any gains or losses may be taxable. Policyholders should carefully consider the investment options and their tax implications.

Understanding the tax implications of these policy types is essential for maximizing the benefits of your life insurance. Consulting with a financial advisor or tax professional can provide personalized guidance based on your specific circumstances and insurance needs.

VFW Life Insurance: What You Need to Know

You may want to see also

Income Tax Implications: The tax treatment depends on the recipient's income and other factors

The tax implications of personal term life insurance can vary depending on the recipient's income and other factors. When an individual receives a death benefit from a personal term life insurance policy, it is generally considered taxable income. The tax treatment of this income is crucial for the recipient to understand, as it can impact their overall tax liability.

The taxability of the death benefit is based on the recipient's income level and the specific tax laws in their jurisdiction. In many countries, life insurance proceeds are treated as ordinary income and are subject to income tax. This means that the recipient will have to pay taxes on the full amount of the death benefit received. For example, if an individual receives a $100,000 death benefit and their annual income is $50,000, they may be required to pay taxes on the entire $100,000.

However, there are certain circumstances where the tax treatment might differ. If the recipient's income is below a certain threshold, they may be exempt from paying taxes on the death benefit. Tax authorities often set a standard deduction or exemption amount to ensure that individuals with lower incomes are not heavily taxed on unexpected income sources. Additionally, if the policyholder designated the recipient as a dependent, it could potentially affect the tax treatment.

Furthermore, the tax laws regarding life insurance proceeds can be complex and may vary by region. Some jurisdictions offer tax advantages or exclusions for life insurance death benefits, especially if the policy was owned by a spouse or a dependent. These exclusions or deductions can significantly reduce the tax burden for the recipient. It is essential to consult the relevant tax regulations and seek professional advice to understand the specific tax implications based on the recipient's individual circumstances.

In summary, the tax treatment of personal term life insurance depends on the recipient's income and other factors. Understanding the tax laws and seeking appropriate guidance can help individuals navigate the potential tax implications and make informed financial decisions regarding life insurance policies.

Maximizing ROI on Equity-Indexed Life Insurance Policies

You may want to see also

Frequently asked questions

No, personal term life insurance death benefits are generally not taxable. The proceeds from a term life insurance policy are typically paid out tax-free to the designated beneficiaries upon the insured individual's death. This is because term life insurance is designed to provide financial protection and coverage for a specific period, and the death benefit is intended to replace lost income or cover expenses, not as a form of investment or savings.

With a whole life insurance policy, the situation is a bit different. While the death benefit is generally tax-free, the cash value of the policy, which grows over time, may be subject to taxation. If you take out loans against the cash value or surrender the policy for its cash value, you may have to pay taxes on the accumulated earnings. Additionally, if you invest a portion of your premium payments in an investment account offered by the insurance company, any gains or withdrawals from those investments could be taxable.

Yes, there are a few exceptions and special cases to keep in mind. For instance, if you receive a death benefit that is considered a form of compensation for services rendered, it may be taxable. This could include situations where the insurance policy was purchased as part of a compensation package for employment. Additionally, if you are a high-income earner and the death benefit exceeds a certain threshold, it might be subject to a tax on excess earnings. It's important to consult with a tax professional or financial advisor to understand the specific tax implications in your jurisdiction.