Life insurance and investments are two essential financial tools that often go hand in hand. While life insurance provides financial protection and peace of mind by ensuring that your loved ones are taken care of in the event of your passing, investments offer the potential for wealth creation and growth. The correlation between these two financial instruments is significant because life insurance can be a valuable investment tool. It allows individuals to secure their financial future, build a substantial cash value over time, and provide a financial safety net for their beneficiaries. Understanding the relationship between life insurance and investments is crucial for anyone looking to create a comprehensive financial plan, ensuring both protection and growth in their financial portfolio.

What You'll Learn

- Life Insurance Basics: Understanding coverage, benefits, and policy types

- Investment Options: Exploring various investment vehicles within life insurance policies

- Tax Advantages: How life insurance can offer tax benefits for investments

- Long-Term Financial Planning: Using life insurance to secure financial goals

- Risk Management: Life insurance as a tool to manage investment risks

Life Insurance Basics: Understanding coverage, benefits, and policy types

Life insurance is a financial tool that provides a safety net for individuals and their families, offering a range of benefits and coverage options. It is a contract between an individual (the policyholder) and an insurance company, where the insurer promises to pay a designated beneficiary a sum of money upon the death of the policyholder. This fundamental concept of life insurance is crucial for managing financial risks and ensuring the well-being of loved ones.

Coverage and Benefits:

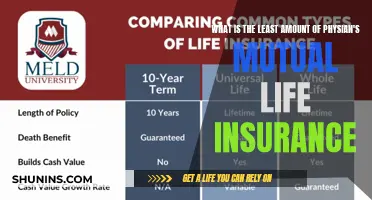

Life insurance policies offer various types of coverage, each with its own set of advantages. The two primary types are Term Life Insurance and Permanent (or Whole Life) Insurance. Term life insurance provides coverage for a specified period, such as 10, 20, or 30 years. During this term, the insurer guarantees a death benefit if the policyholder passes away. This type of policy is often more affordable and offers a straightforward way to secure financial protection for a defined period. On the other hand, permanent life insurance provides lifelong coverage, offering both a death benefit and a cash value component. The cash value grows over time and can be borrowed against or withdrawn, making it a more complex but potentially valuable investment vehicle.

Policy Types and Customization:

Life insurance policies can be tailored to meet specific needs and preferences. One common type is a Whole Life Insurance policy, which offers level premiums and a guaranteed death benefit. This policy type is ideal for those seeking long-term financial security and a consistent premium payment schedule. Additionally, there are Universal Life Insurance policies, which provide flexible premiums and potential investment options. These policies allow policyholders to adjust their coverage and investment strategies over time, making them adaptable to changing financial goals.

Understanding the different policy types and their features is essential for making informed decisions. For instance, some policies may offer additional riders or optional benefits, such as accelerated death benefits, which allow policyholders to access a portion of the death benefit if they are diagnosed with a critical illness. These customization options ensure that life insurance can be tailored to individual circumstances and financial objectives.

In summary, life insurance serves as a vital tool for managing financial risks and providing financial security. By comprehending the various coverage options, policy types, and benefits, individuals can make informed choices to protect their loved ones and achieve their long-term financial goals. It is a powerful instrument that, when properly understood and utilized, can offer peace of mind and a safety net for the future.

Brain Hemorrhage: Is Life Insurance Coverage Guaranteed?

You may want to see also

Investment Options: Exploring various investment vehicles within life insurance policies

The correlation between life insurance and investments is an important aspect of financial planning, especially for those seeking to maximize their wealth and secure their loved ones' financial future. Life insurance, traditionally seen as a safety net for families, has evolved to offer investment opportunities that can help grow your money over time. This integration of insurance and investment products allows individuals to achieve multiple financial goals simultaneously.

When considering investment options within life insurance policies, it's essential to understand the various vehicles available. These investment components are designed to provide policyholders with a means to potentially increase their money's value while also ensuring the insurance coverage remains intact. Here's a breakdown of some common investment options:

Investment Accounts within Life Insurance Policies: Some life insurance companies offer investment accounts directly linked to the policy. These accounts allow policyholders to allocate a portion of their premium payments into various investment options. Common investment vehicles include stocks, bonds, and mutual funds. By investing in these accounts, policyholders can benefit from potential capital growth and income generation. For instance, investing in stocks may offer higher returns but also carries more risk, while bonds provide a more conservative approach with regular interest payments.

Policy Loans and Riders: Life insurance policies often include the option to take out a loan against the policy's cash value. This loan can be used for various purposes, such as funding education, starting a business, or any other significant financial need. Additionally, riders, or optional riders, can be added to the policy to enhance its investment features. For example, a "rider" might allow policyholders to increase their death benefit or provide additional coverage for critical illness or accidental death. These riders can be valuable tools for those seeking to customize their life insurance policy to align with their investment goals.

Universal Life Insurance with Investment Components: Universal life insurance policies offer flexibility in premium payments and death benefits. They often include investment components that allow policyholders to direct their premiums into various investment options. This feature enables individuals to potentially grow their money faster than with traditional term life insurance. Universal life policies may offer a combination of fixed and variable components, allowing investors to choose their risk tolerance and potential returns.

Annuities and Fixed Accounts: Some life insurance companies offer annuity products, which provide a steady income stream for policyholders. Annuities can be a valuable investment option for those seeking regular payments, especially during retirement. Additionally, fixed accounts within life insurance policies offer a more conservative investment approach, ensuring a guaranteed rate of return. These options are ideal for risk-averse investors who prefer a more stable and predictable investment strategy.

Exploring these investment options within life insurance policies can be a strategic move for individuals seeking to diversify their portfolios and secure their financial future. It allows them to combine the safety net of life insurance with the potential growth and income generation of various investment vehicles. When considering these options, it's crucial to review the policy details, understand the associated risks and benefits, and consult with financial advisors to make informed decisions tailored to one's unique financial circumstances.

Adjustable Life Insurance: Permanent or Temporary Solution?

You may want to see also

Tax Advantages: How life insurance can offer tax benefits for investments

Life insurance and investments are often discussed in the context of financial planning and wealth management, and they can indeed be correlated in several ways. One of the most significant advantages of life insurance is its potential to provide tax benefits, especially when it comes to certain types of investments. Here's an overview of how life insurance can offer tax advantages for your investment portfolio:

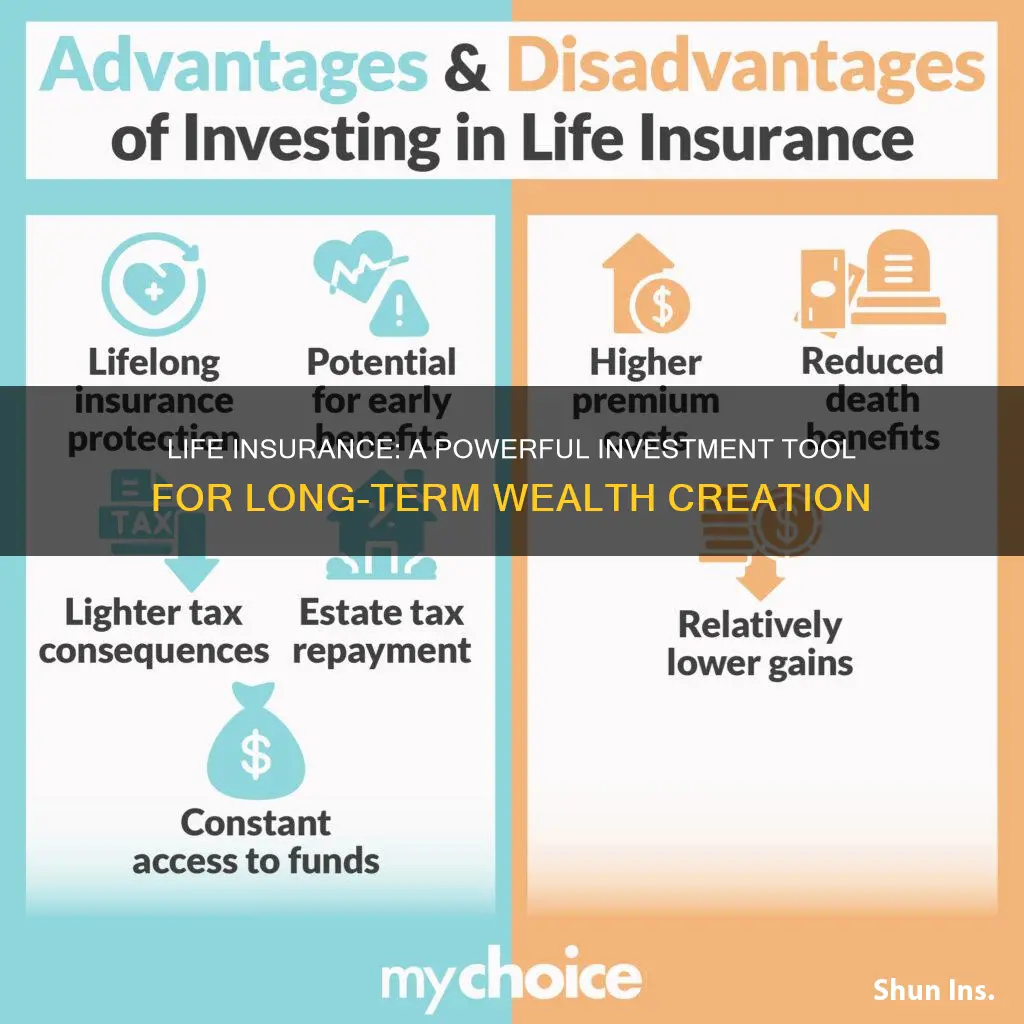

Tax-Deferred Growth: One of the primary tax benefits of life insurance is the ability to grow your investments tax-deferred. When you invest in certain types of life insurance policies, such as permanent life insurance, a portion of your premium payments goes into an investment account. This investment account can offer tax-deferred growth, meaning the earnings and interest accrued within this account are not taxed annually. As a result, your investments can compound over time without incurring regular tax liabilities, allowing your money to grow faster.

Tax-Free Withdrawals: Some life insurance policies, particularly those with cash value accumulation, provide the option to withdraw funds without paying taxes. These withdrawals can be used to fund various financial goals, such as paying for college tuition, starting a business, or covering unexpected expenses. By accessing the cash value in this manner, you can avoid capital gains taxes that might be applicable if you were to sell other investments.

Tax-Efficient Legacy Planning: Life insurance can also be a powerful tool for tax-efficient legacy planning. When you pass away, the death benefit of your life insurance policy is typically paid out tax-free to your beneficiaries. This means that your loved ones receive a substantial sum without incurring any tax liabilities on the proceeds. This aspect of life insurance can be particularly valuable for passing on wealth to heirs, ensuring that more of your estate remains intact for future generations.

Tax Deductions: In certain jurisdictions, life insurance premiums may be tax-deductible, especially for business owners or high-income individuals. This deduction can provide a significant tax benefit, as it reduces your taxable income. It's important to consult with a tax professional to understand the specific rules and limitations regarding tax deductions for life insurance premiums in your region.

Long-Term Investment Strategy: Life insurance can be a long-term investment strategy that aligns with your overall financial plan. By incorporating life insurance into your investment portfolio, you can diversify your assets and potentially benefit from the tax advantages mentioned above. This approach allows you to manage risk and optimize your tax situation while also providing a safety net for your loved ones.

Understanding the tax implications of life insurance and its correlation with investments is crucial for making informed financial decisions. By utilizing the tax advantages offered by life insurance, you can potentially enhance the growth and efficiency of your investment portfolio while also ensuring financial security for your beneficiaries.

Universal Life Insurance: What's the Real Deal?

You may want to see also

Long-Term Financial Planning: Using life insurance to secure financial goals

Life insurance and investments are two interconnected financial tools that play a crucial role in long-term financial planning. While they serve different purposes, they can be strategically combined to secure and grow your financial goals. Understanding the correlation between these two instruments can help individuals make informed decisions to ensure their financial well-being and the security of their loved ones.

Life insurance is primarily designed to provide financial protection and peace of mind. It offers a safety net for your beneficiaries in the event of your untimely death. The death benefit from a life insurance policy can be used to cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or even provide a lump sum for immediate financial needs. This aspect of life insurance is essential for long-term financial planning as it ensures that your family's financial obligations are met, even if you are no longer around. For example, if you have a young family and a mortgage, term life insurance can provide the necessary coverage to protect your loved ones from the financial burden of repaying the mortgage or covering other essential expenses.

On the other hand, investments are a means to grow your wealth over time. This can include various financial products such as stocks, bonds, mutual funds, real estate, or retirement plans. Investments are typically aimed at accumulating wealth, generating income, or achieving specific financial goals, such as retirement, education funding, or wealth creation. While investments focus on growth, they also carry risks, and the value of these assets can fluctuate.

The correlation between life insurance and investments lies in their complementary nature. Life insurance provides a stable and guaranteed financial resource, ensuring that your beneficiaries receive a predetermined amount at a specific time. This can be particularly useful when investing in long-term financial goals, as it offers a safety net to cover potential shortfalls or unexpected events. For instance, if you are investing in a retirement plan, life insurance can provide the necessary funds to ensure your retirement goals are met, even if your investment returns are lower than expected.

Additionally, life insurance can be a valuable investment tool itself. Permanent life insurance policies, such as whole life or universal life, offer a combination of insurance coverage and an investment component. The cash value of these policies grows over time and can be borrowed against or withdrawn, providing a source of funds for various financial needs. This feature allows individuals to utilize life insurance as a long-term investment strategy, especially when considering the potential for tax-deferred growth and the ability to build equity.

In long-term financial planning, it is essential to strike a balance between insurance coverage and investment strategies. By combining life insurance with a well-diversified investment portfolio, individuals can ensure that their financial goals are both protected and grown. For example, a person might purchase a term life insurance policy to cover immediate financial obligations and then invest the remaining funds in a mix of stocks, bonds, and real estate to build long-term wealth. This approach allows for risk management while also pursuing growth opportunities.

In summary, life insurance and investments are powerful tools for long-term financial planning. Life insurance provides financial protection and security, ensuring that your loved ones are taken care of, while investments focus on growing wealth and achieving specific financial goals. By understanding the correlation and complementary nature of these instruments, individuals can make informed decisions to secure their financial future and that of their beneficiaries.

Life Insurance and Hospital Bills: What's Covered?

You may want to see also

Risk Management: Life insurance as a tool to manage investment risks

Life insurance and investments are two financial tools that are often considered together, as they both play a crucial role in managing personal finances and can be interconnected in various ways. While life insurance primarily provides financial protection and peace of mind, it can also be utilized as a strategic tool to manage investment risks. Here's how life insurance can be an effective risk management strategy in the context of investments:

Risk Mitigation and Security: One of the primary functions of life insurance is to provide financial security to the policyholder's beneficiaries in the event of the insured's death. This aspect of life insurance can be particularly useful for investors who have made significant financial commitments or have substantial assets. By having a life insurance policy, investors can ensure that their loved ones are financially protected, even if they are no longer around to provide for them. This security can be especially valuable when individuals have made substantial investments, such as in real estate, businesses, or other high-value assets. In the event of the investor's untimely death, the life insurance payout can help cover any outstanding debts, taxes, or expenses related to these investments, thus mitigating potential financial risks for the beneficiaries.

Long-Term Financial Planning: Life insurance policies often offer long-term financial planning benefits. Term life insurance, for instance, provides coverage for a specific period, allowing individuals to secure their family's financial future during the years when they are most dependent on their income. This long-term perspective can be aligned with investment strategies, especially those involving long-term financial goals. For example, an investor planning for retirement might consider a life insurance policy as a safety net, ensuring that their retirement savings and investments are protected. In the event of unexpected death, the life insurance proceeds can provide a financial cushion, allowing the retiree to maintain their standard of living and potentially even support their family.

Investment Diversification: Life insurance can also contribute to a well-diversified investment portfolio. Certain types of life insurance policies, such as universal life insurance, offer investment components that can be tailored to the investor's risk tolerance and financial goals. These investment options within life insurance policies can provide an additional layer of diversification, reducing the overall risk of the investment portfolio. By allocating a portion of their investments to life insurance, individuals can balance their risk exposure and potentially benefit from the long-term growth potential of these financial instruments.

Income Generation and Liquidity: Some life insurance policies, particularly whole life insurance, offer a cash value component that grows over time. This cash value can be borrowed against or withdrawn, providing a source of liquidity for investors. This liquidity can be advantageous in various investment scenarios, such as when an investor needs to access funds for business opportunities, education expenses, or other financial needs. By utilizing the cash value of a life insurance policy, individuals can access funds without selling their investments, thus maintaining their investment strategy while also managing short-term financial risks.

In summary, life insurance can be a powerful tool for managing investment risks by providing financial security, long-term planning benefits, diversification, and liquidity. By integrating life insurance into their financial strategy, investors can ensure that their investments are protected and that their loved ones are cared for, even in the face of unexpected events. It is essential to carefully consider the various types of life insurance policies and their investment components to find the best fit for one's specific financial goals and risk management needs.

Understanding Life Insurance: Surrender Value Explained

You may want to see also

Frequently asked questions

Life insurance and investments are two distinct financial tools that can work together to achieve specific financial goals. Life insurance provides a safety net for your loved ones in the event of your passing, ensuring they have financial security. Investments, on the other hand, are strategies to grow your wealth over time. While they serve different purposes, they can be complementary. For example, the proceeds from a life insurance policy can be used to fund investments, allowing your beneficiaries to benefit from the investment returns while still having a financial safety net.

Life insurance can be considered an investment in the sense that it offers potential financial growth. Term life insurance, in particular, provides a fixed premium and death benefit over a specified term. While the primary purpose is to provide coverage, the cash value of certain types of life insurance policies (like whole life) can accumulate over time, allowing policyholders to borrow against or withdraw funds, providing an investment element. Additionally, some life insurance policies offer investment-linked products, where a portion of the premium is invested in various assets, offering the potential for growth.

Yes, life insurance can be a tool to build wealth, especially when combined with investment-oriented policies. Whole life insurance, for instance, has an investment component where a portion of the premium goes into an investment account. This account can grow tax-deferred, and policyholders can access the cash value, which can be borrowed against or withdrawn. Over time, this can accumulate significant value, providing a financial asset. Additionally, some life insurance companies offer investment-linked policies that offer various investment options, allowing policyholders to potentially grow their money while also having insurance coverage.

Yes, there can be tax benefits associated with using life insurance for investments. The cash value of certain life insurance policies grows tax-deferred, meaning no taxes are paid on the investment gains until the money is withdrawn. Additionally, the death benefit paid to beneficiaries is generally tax-free. This can be advantageous for those looking to build a tax-efficient investment portfolio. However, it's important to consult with a financial advisor to understand the specific tax implications and ensure compliance with relevant regulations.