Life insurance rates are primarily determined by three factors: lifestyle, health, and age. The younger and healthier you are, the cheaper your premiums will be. Insurers typically classify applicants as super preferred, preferred, or standard, with premiums calculated based on risk class. While the specific evaluation process may vary, they generally assess age, gender, smoking status, health, family medical history, driving record, occupation, and lifestyle. The type of life insurance chosen also affects the cost, with term life insurance being the least expensive and permanent life insurance offering longer coverage with a cash value component, resulting in higher premiums. Additionally, life insurance rates can be influenced by inflation and changes in the economic landscape.

| Characteristics | Values |

|---|---|

| Average cost of life insurance | $26 a month |

| Factors determining life insurance rates | Age, gender, smoking status, health, family medical history, driving record, occupation, lifestyle |

| Factors not impacting life insurance rates | Ethnicity, race, sexual orientation, credit score, marital status, number of policies, number of beneficiaries |

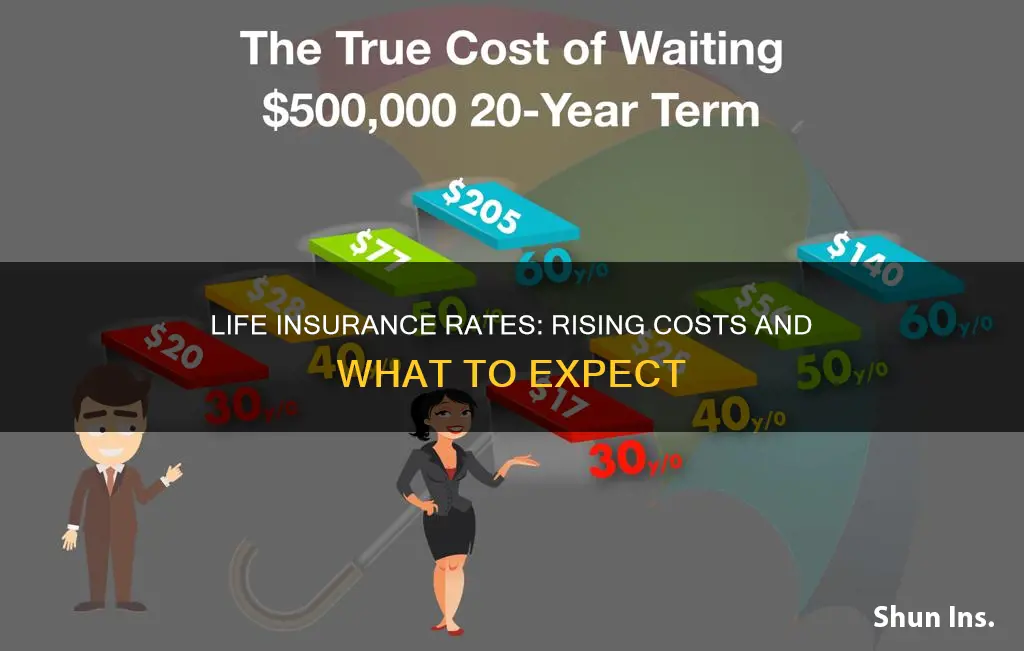

| Average cost of term life insurance by age | $500,000, 20-year term life insurance policy for preferred applicants in good health: $20-$30 for 20-year-old men, $15-$20 for 20-year-old women; $30-$40 for 30-year-old men, $20-$30 for 30-year-old women; $40-$50 for 40-year-old men, $30-$40 for 40-year-old women; $100-$150 for 50-year-old men, $70-$100 for 50-year-old women; $300-$400 for 60-year-old men, $200-$300 for 60-year-old women |

| Average cost of whole life insurance by age | $500,000 policy for preferred applicants in good health: $100-$150 for 30-year-old men, $70-$100 for 30-year-old women; $150-$200 for 40-year-old men, $100-$150 for 40-year-old women; $300-$400 for 50-year-old men, $200-$300 for 50-year-old women; $700-$900 for 60-year-old men, $500-$700 for 60-year-old women |

| Average cost of term life insurance by risk class | $500,000, 20-year term life policy: $20-$30 for nonsmoking 40-year-old men, $10-$20 for nonsmoking 40-year-old women; $300-$400 for smoking 40-year-old men, $200-$300 for smoking 40-year-old women |

| Average cost of life insurance by term length | $500,000 term life policy for a nonsmoking 40-year-old applicant in good health: $20-$30 for 10-year term, $30-$40 for 20-year term, $50-$60 for 30-year term |

What You'll Learn

Life insurance rates are based on life expectancy

In addition to age, other factors influencing life insurance rates include gender, smoking status, health, family medical history, driving record, occupation, and lifestyle choices. Women generally have lower rates than men due to their longer life expectancy. Smokers and individuals with pre-existing health conditions are also typically offered higher rates.

The type of life insurance policy chosen also affects the cost, with term life insurance being less expensive than permanent life insurance due to its shorter coverage period and lack of a cash value component. Riders added to a policy, such as a child rider, can further increase the premium.

While life insurance rates are influenced by various factors, it is important to shop around and compare quotes from multiple insurers as they may weigh these factors differently in their evaluation processes.

Crohn's Impact: Life Insurance and Your Health

You may want to see also

The younger and healthier you are, the cheaper your premiums

Life insurance premiums are based primarily on life expectancy. The younger and healthier you are, the cheaper your premiums tend to be. Insurers typically classify applicants using terms like "super preferred", "preferred", and "standard", with "super preferred" being the healthiest category. They then calculate premiums based on your risk class.

- Life Expectancy: As you age, your life expectancy decreases, and the likelihood of your insurer having to pay out your policy increases. Therefore, the longer you wait to purchase life insurance, the more your rates will increase based on age alone.

- Health Status: Insurers assess your health status, including any pre-existing conditions, as well as your blood pressure and cholesterol levels. They may also consider your height and weight. The healthier you are, the lower your risk of developing health issues, which translates to lower premiums.

- Smoking Status: Smokers are at a higher risk of developing health issues such as respiratory disease. Therefore, life insurance for smokers tends to be more expensive.

- Driving Record: If you have a history of DUIs, DWIs, or major traffic violations, your insurer may consider you a high-risk applicant and charge higher rates.

- Occupation and Lifestyle: If you have a hazardous or high-risk job, or participate in risky activities, you may be charged a higher premium.

By purchasing life insurance at a younger age and maintaining a healthy lifestyle, you can take advantage of lower premiums and ensure that your loved ones are financially protected in the event of your premature death.

Life Insurance Proceeds: Taxable or Not?

You may want to see also

Life insurance rates are higher for smokers

In the US, cigarette smoking is the leading cause of preventable disease, disability, and death. It accounts for 480,000 deaths per year, or 1 in 5 deaths. As a result, smokers can expect to pay nearly four times more for life insurance than non-smokers. For example, a healthy 40-year-old male of average weight and height would pay $397 per year for a 20-year $500,000 term life insurance policy. However, if he smoked, this would increase to $1,531 per year for the same coverage.

The definition of a "smoker" varies between insurance companies. Some consider vaping, nicotine gum, and marijuana use as smoking, while others do not. It is important to be honest about your smoking habits when applying for life insurance, as lying can result in your policy being cancelled or your beneficiary's claim being denied.

If you are a smoker, you can still get life insurance, but you will pay higher premiums. The best strategy is to compare quotes from multiple insurance companies and work with an independent agent who can help you find competitive rates.

Life Insurance: Asset or Liability?

You may want to see also

Life insurance rates are higher for men

Life insurance rates are influenced by a variety of factors, including age, gender, health, and lifestyle choices. While it may seem counterintuitive, gender plays a significant role in determining the cost of life insurance, with men typically paying higher premiums than women. This is primarily due to statistical differences in life expectancy and the risk of developing certain health conditions.

On average, women live longer than men. In the United States, the life expectancy for women is approximately 80 years, while for men, it is around 74.5 years. This difference in life expectancy directly impacts life insurance rates, as insurers base their premiums on potential risk. Since women are expected to live longer, they are generally seen as a lower risk to insure and are offered lower premiums.

In addition to life expectancy, men also face higher risks of certain health conditions that can impact their life insurance rates. For example, men are more prone to heart disease, hypertension, and certain types of cancer. These conditions increase the likelihood of an early death, which is a key factor in determining life insurance premiums.

Lifestyle choices and occupational hazards also play a role in the gender disparity in life insurance rates. Men are statistically more likely to engage in risky behaviours, such as smoking, heavy alcohol consumption, and drug use. They are also more likely to participate in extreme sports and work in high-risk industries such as construction, mining, or logging. These factors further contribute to the perception of men as a higher insurance risk.

While it may seem unfair, life insurance companies base their rates on extensive data and statistical analysis. By considering factors such as life expectancy, health risks, and lifestyle choices, they can assess the likelihood of having to pay out a claim. Ultimately, this allows them to set premiums that reflect the potential risk of insuring each individual.

Uninsurable for Life Insurance: What Are the Reasons?

You may want to see also

Life insurance rates are based on your occupation and lifestyle

Life insurance rates are based on a variety of factors, including your occupation and lifestyle. If you have a hazardous or high-risk job, such as a police officer or a race car driver, you will likely pay more for life insurance than someone with a desk job. Similarly, participating in risky activities like skydiving or scuba diving can also increase your premium.

Life insurance companies assess your risk level based on your occupation and lifestyle choices. They consider the likelihood of your insurer having to pay out your policy, which is higher if you engage in dangerous work or activities. By evaluating these factors, insurers determine your risk class and set your premium accordingly.

It's important to note that each insurer has its own evaluation process and may weigh factors differently. Therefore, it is recommended to compare quotes from multiple insurers to find the best rate for your specific occupation and lifestyle.

In addition to occupation and lifestyle, other factors that influence life insurance rates include age, gender, smoking status, health, family medical history, and driving record. Generally, younger people pay less for life insurance, and women typically pay less than men due to longer life expectancies. Smokers also tend to pay more for life insurance because of the higher risk of developing health issues.

FEMA: Flood Insurance and Life-of-Loan Monitoring Explained

You may want to see also

Frequently asked questions

Life insurance rates are primarily determined by your age, gender, health, smoking status, family medical history, driving record, occupation, and lifestyle choices.

The average cost of life insurance is $26 per month, based on a 40-year-old purchasing a 20-year, $500,000 term life policy. However, rates can vary depending on individual factors and the type of policy chosen.

Yes, life insurance rates generally increase as you age, as your life expectancy decreases and the likelihood of a payout increases. It is advisable to purchase life insurance as early as possible to lock in lower rates.

Yes, women typically pay lower rates than men of the same age and health due to their longer life expectancy.

Insurers consider your overall health, including pre-existing conditions, blood pressure, cholesterol levels, height, and weight when determining your rate. The healthier you are, the lower your premiums are likely to be.