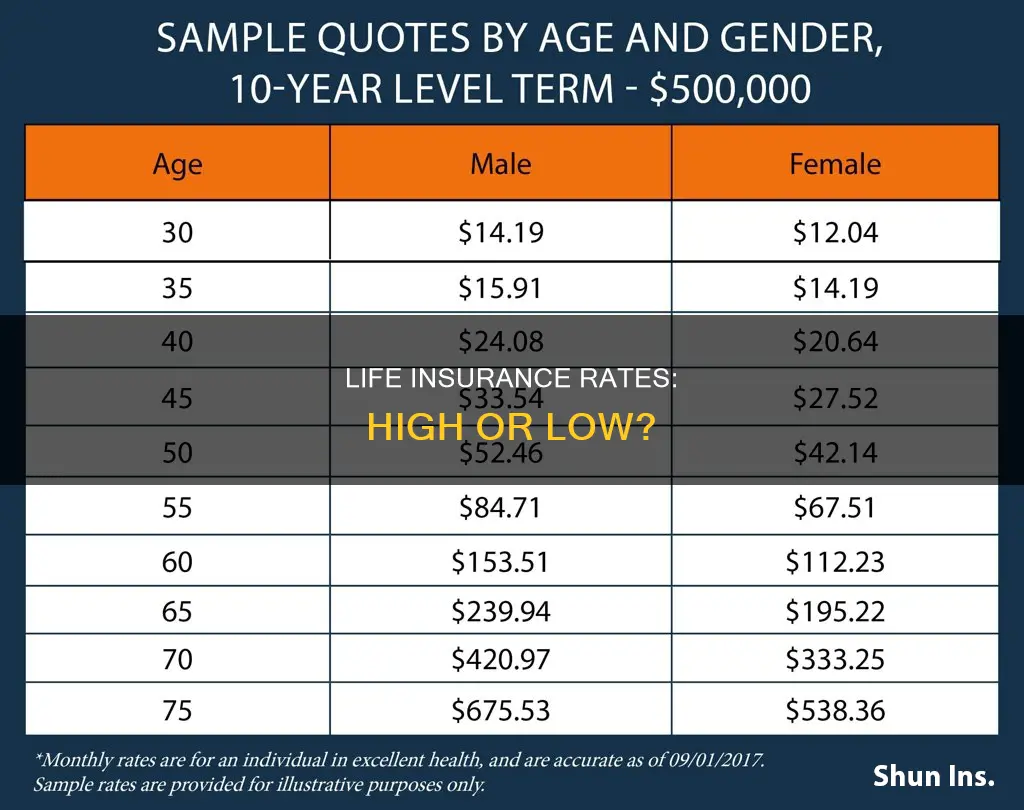

Life insurance rates are determined by a variety of factors, including age, gender, health, lifestyle, and the type of policy chosen. While rates can vary, the average cost of life insurance is $26 a month for a 40-year-old with a 20-year, $500,000 term policy. Life insurance rates tend to increase with age, with older individuals paying higher premiums due to a decrease in life expectancy and a higher risk of health issues. On the other hand, younger people typically pay lower rates as they are less likely to have health problems and have a longer life expectancy.

In addition to age, other factors such as gender, health status, and lifestyle choices can also impact life insurance rates. Men tend to pay higher rates than women due to shorter life expectancies and riskier jobs or lifestyles. Individuals with pre-existing health conditions or risky hobbies may also be subject to higher premiums.

The type of policy chosen also affects rates, with term life insurance being more affordable than whole life insurance or universal life insurance. Overall, while life insurance rates can vary, they are influenced by a combination of personal and policy-related factors, with age being a significant determinant.

| Characteristics | Values |

|---|---|

| Average cost of life insurance | $26 a month |

| Average cost of a 20-year term life insurance policy | $50 a month for a 40-year-old with $500,000 in coverage |

| Average cost of life insurance at age 25 | $31 a month |

| Average cost of life insurance at age 65 | $593 a month |

| Average monthly rate for life insurance for a 30-year-old | $22 |

| Average monthly rate for life insurance for a 40-year-old | $32 |

| Average monthly rate for life insurance for a 50-year-old | $80 |

| Average life insurance rate per month for men | $16.10 |

| Average life insurance rate per month for women | $14.79 |

| Average cost of life insurance for a healthy 20-40 year old | $24-$29 a month |

What You'll Learn

Life insurance rates for men vs women

Life insurance rates are determined by a variety of factors, including age, gender, health, and lifestyle choices. While age is a primary factor, with younger people generally paying lower premiums than older people, gender also plays a significant role in the cost of life insurance.

Men typically pay higher life insurance rates than women due to differences in life expectancy and health risks. According to data from the Centers for Disease Control and Prevention, the average life expectancy for women in the United States is 79.3 years, while for men, it is 73.5 years. This difference in life expectancy means that women are expected to live longer and pose a lower risk to insurers, resulting in lower premiums.

In addition to life expectancy, health and lifestyle factors also contribute to the gender gap in life insurance rates. Men are generally more prone to certain health conditions, such as heart disease and hypertension, which can increase their mortality risk. They are also more likely to engage in risky behaviours, such as smoking, heavy alcohol consumption, and extreme sports, which can impact their health and life expectancy.

Occupational hazards are another factor influencing insurance rates. Men are statistically more likely to work in high-risk fields, such as construction, mining, or logging, which increases the likelihood of accidents and fatalities.

While gender plays a role in determining life insurance rates, it is important to note that other factors, such as medical history, family medical history, driving record, and occupation, can also have a significant impact on the cost of coverage.

To illustrate the difference in rates, let's compare the annual premiums for a $500,000, 20-year term life insurance policy for a healthy 30-year-old male and female:

- The average annual premium for a male non-smoker in the Preferred health classification is $375.

- In contrast, the average annual premium for a female non-smoker in the same health classification is $290.

These examples demonstrate how gender can influence life insurance rates, with women generally paying lower premiums than men due to their longer life expectancy and lower overall risk assessment.

Allergy Sufferers: Life Insurance and You

You may want to see also

How health impacts life insurance rates

Life insurance rates are calculated based on several factors, and health is one of the most significant ones. Here's how health impacts life insurance rates:

Health Classification

Insurers typically classify applicants into different health categories, such as super preferred, preferred, and standard. The healthiest category is usually super preferred, and the premiums are calculated based on the applicant's risk class. Each insurer has its own evaluation process, known as life insurance underwriting, and they may weigh factors differently. Therefore, it is advisable to compare quotes from multiple insurers.

Overall Health

When assessing your overall health, insurers consider various factors, including pre-existing conditions, blood pressure, cholesterol levels, height, and weight. They may also look into your medical history, past and current treatments, and prescription medications. Addressing controllable health conditions can help manage premiums.

Smoking Status

Smokers are considered high-risk due to the increased likelihood of developing health issues such as respiratory disease. Life insurance rates for smokers tend to be significantly higher than for non-smokers. However, if you quit smoking after purchasing a plan, you may become eligible for non-smoker rates from your provider.

Family Medical History

Insurers may inquire about your family's medical history, particularly regarding serious health conditions such as heart disease, cancer, or diabetes. A strong family history of certain diseases can impact your premiums.

Lifestyle and Occupation

High-risk jobs, such as those in law enforcement or racing, can result in higher premiums. Additionally, participating in risky activities like skydiving or scuba diving may also increase your insurance rates.

Health Assessment

As part of the life insurance application process, you may be required to undergo a health assessment, which could include a medical exam and a review of your medical records. The information obtained during this assessment can influence your premiums, especially if certain health conditions are identified.

In summary, health plays a crucial role in determining life insurance rates. Insurers assess various aspects of your health to gauge the likelihood of a payout during the policy's term. By understanding these factors, individuals can take steps to improve their health and, consequently, manage their life insurance premiums.

Life Insurance Options Post-Heart Attack: What You Need to Know

You may want to see also

Life insurance rates for smokers

When applying for life insurance, individuals will typically be asked if they smoke, and a medical exam may be required to test for nicotine or cotinine, a metabolite of nicotine, in the system. Life insurance companies classify smokers into different categories, such as "preferred smoker" or "smoker (standard)", and these categories determine the premium rates. The frequency and type of tobacco use also affect the cost of coverage, with some companies offering cheaper rates for occasional smokers or those who use pipes or chewing tobacco.

Smokers can qualify for various types of life insurance policies, including term life insurance, whole life insurance, and guaranteed issue insurance. Term life insurance is the simplest and cheapest option, providing coverage for a specific term, usually between 10 and 30 years. Whole life insurance is permanent coverage that remains in force as long as premiums are paid and includes a cash value component. Guaranteed issue insurance does not require a medical exam or health screening and is available to individuals between the ages of 50 and 80, but it has limited coverage and higher premiums.

It is important for smokers to compare life insurance quotes from multiple companies, as rates and policies can vary significantly. Some companies offer incentives for smokers who want to quit, and re-evaluation of rates may be possible after a period of abstinence from smoking. However, it is never a good idea to lie on a life insurance application, as this could lead to denial of coverage or withholding of the death benefit.

Kratom Users: Life Insurance Testing and You

You may want to see also

How age impacts life insurance rates

Age is one of the most important factors that determines life insurance premium rates, whether for a term or permanent policy. The older you are when you buy a policy, the more expensive the premiums will be. This is because the cost of life insurance is based on actuarial life tables that assign a likelihood of dying while the policy is in force. The older you are, the more likely you are to die while under coverage.

Life insurance rates typically increase by about 8% to 10% for every year of age. This can be as low as 5% annually if you're in your 40s and as high as 12% annually if you're over 50. With term life insurance, your premium is established when you buy a policy and remains the same every year. With some permanent life insurance policies, the premium rises annually.

Age also affects whether a person will qualify for life insurance coverage at all, with qualifying medical exams becoming more stringent as you get older. Most carriers only offer 20-year term policies to those aged 18 to 70. After that, you can't get a term that long. Older applicants may also be required to undergo more extensive health-related testing.

Life insurance premiums will increase on a policy if you buy it when you are older. Whole life policies can be issued to people as old as 80 or 85, but term policies may have restrictions for those who are much younger, such as age 65 or 70.

Young adults are often in good health and may only need a minimum amount of coverage, which can translate to lower rates. Many individuals and families opt for term life insurance because it's more affordable. For example, a 35-year-old couple with a child might consider purchasing term life insurance policies with $500,000 in coverage over a 30-year term. This can help provide a financial cushion for the surviving spouse and child if one policyholder passes away.

As people get older, they often benefit from a term life insurance policy that lasts until they retire. For instance, instead of purchasing a 30-year policy, a middle-aged adult might buy a 10-year policy if they're only a decade away from retiring.

Older adults might have a harder time purchasing life insurance. Many insurers stop issuing new life insurance policies to seniors over a certain age, usually around 80. Life insurance for seniors can be cost-prohibitive, depending on their health and the type of coverage they qualify for. A guaranteed life insurance policy might be one of the only options available to seniors, but these policies can be expensive and usually have a low death benefit cap.

Kroger Life Insurance: What You Need to Know

You may want to see also

How to get affordable life insurance

Life insurance rates are determined by a number of factors, including age, gender, health, and lifestyle. Generally, the younger and healthier you are, the lower your premiums will be.

- Choose term life insurance: Term life insurance is the simplest and cheapest type of policy. It covers you for a set number of years and is designed to protect you while you have financial dependents or obligations, such as paying off a mortgage or raising children. Permanent life insurance, on the other hand, is significantly more expensive as it offers coverage for your entire life and includes a cash value component.

- Opt for a medical exam: If you are relatively healthy, choose a policy that requires a medical exam. The insurer will use this information to set your premiums. Without these details, insurers have to take on the risk of the unknown, which tends to result in higher premiums.

- Buy a policy early: Life insurance companies offer their best rates to young, healthy applicants. As you age, your risk of health issues increases and your life expectancy decreases, leading to higher premiums. Buying early locks in lower rates.

- Avoid tobacco and nicotine products: Smoking is linked to various health issues and is the leading cause of preventable death in the US. Smokers almost always pay more for life insurance. If you are in the process of quitting, you can still apply for a policy at smoker rates and then request a review of your rates once you have been smoke-free for a certain period.

- Buy only as much coverage as you can afford: Calculate how much life insurance you need and get quotes for that amount. Then choose a policy that fits your budget, or reduce your coverage to what you can afford. It is better to have some life insurance than none, and you can always purchase more coverage later when you are in a better financial position.

- Improve your health: Insurers assess your Body Mass Index (BMI) and interpret high BMIs as linked to chronic health conditions. Lowering your BMI can help you access more affordable rates. Maintaining a healthy cholesterol level and blood pressure can also help you land in a better rate class.

- Manage pre-existing medical conditions: If you can prove that you are managing your condition by going to regular check-ups and following your doctor's orders, you may be able to score standard or preferred rates.

- Skip unnecessary riders: Riders are extra features that can be added to your policy to bridge any gaps in your coverage. While some are free, others will increase your premium. For example, adding a return-of-premium rider, which reimburses you for the premiums you paid if you outlive the term, can make your policy much more expensive.

- Ask about discounts for annual payments: Some insurers charge an additional service fee for frequent payments. Paying your premium annually can save you up to 5%.

- Compare quotes from multiple insurers: With over 800 life insurance companies in the US, it is important to compare quotes to find the most affordable policy for your needs.

Life Insurance for Dependents: Who and What is Covered?

You may want to see also

Frequently asked questions

Life insurance rates are primarily determined by age and health status, but insurers also factor in job, weight, smoking status, family health history, gender, and risky hobbies.

Yes, life insurance rates increase with age as health issues become more frequent and life expectancy decreases. The likelihood of an insurance company having to pay out a claim rises as the policyholder gets older, so the premiums are higher to offset this risk.

Rates depend on many factors, including age, gender, type of coverage, health class, lifestyle, and coverage amount. On average, a healthy 20-40-year-old can expect to pay between $24 and $29 per month for a 10-year, $250,000 term life insurance policy.

Maintaining a healthy lifestyle can help lower your life insurance rate. This includes keeping a healthy weight, managing any medical conditions, avoiding smoking, and refraining from high-risk hobbies. Additionally, purchasing life insurance at a younger age can result in lower premiums.