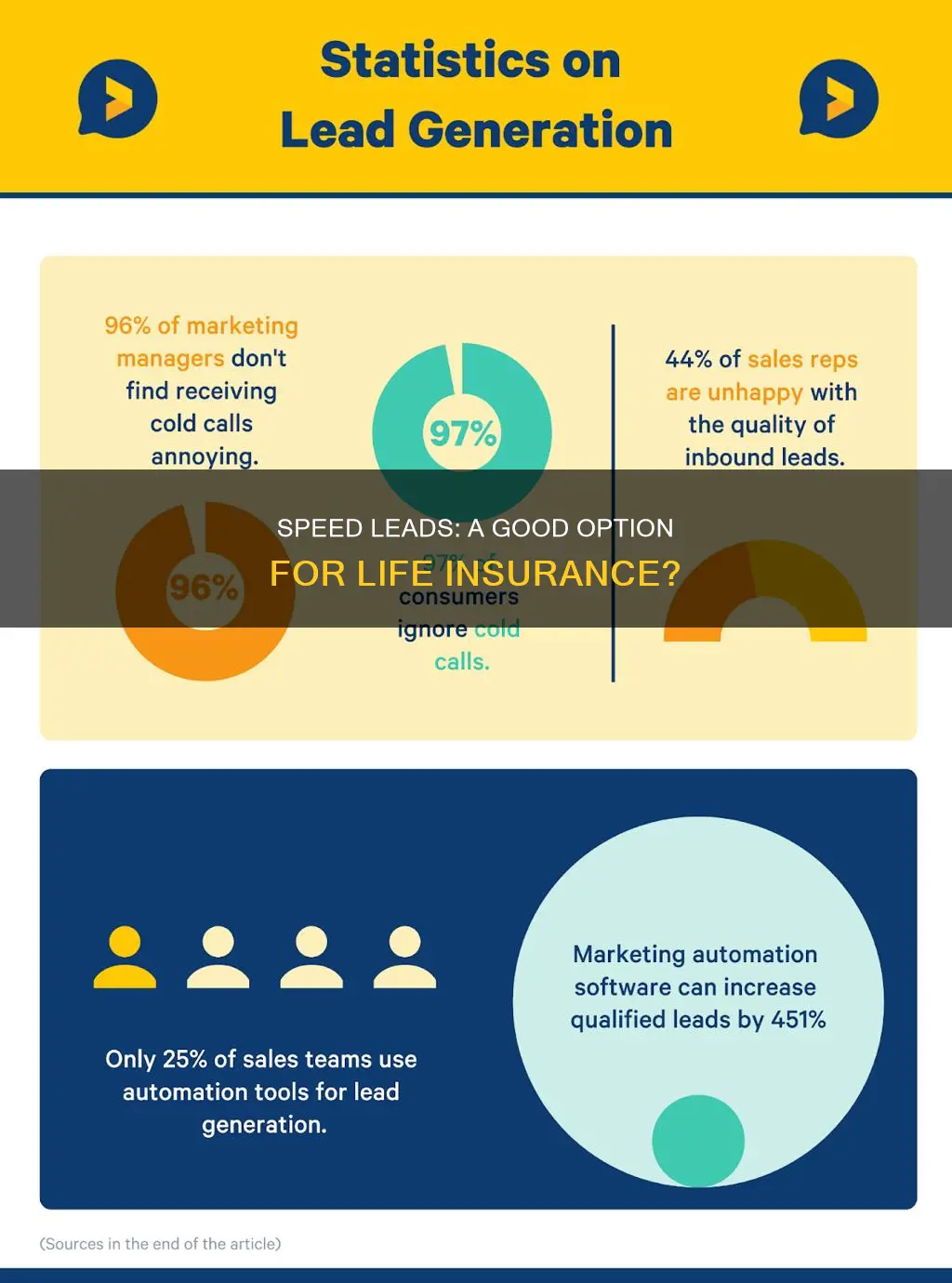

Life insurance speed leads can be a great way to get your business off the ground, but they are not all created equal. The best life insurance leads are those that are exclusive and high-intent, while the worst are those that are shared, old, or obtained through unethical means such as bait-and-switch scams.

There are two main ways to get life insurance leads: through your company or through a third-party lead generation company. Company-provided leads are often the fastest and simplest way to get started, but they may not be exclusive and you will have to pay for them through lower commissions. Third-party leads can be more expensive, but you will face less competition and have more control over the quality.

When buying third-party leads, there are a few things to keep in mind. First, always buy exclusive leads whenever possible, as shared leads are often sold to multiple agents and can result in the prospect being bombarded with calls. Second, be wary of aged leads, as these may come with compliance risks and low conversion rates. Finally, make sure to establish a clear line of communication with your lead generator and have a backup plan in case of delivery issues.

In addition to buying leads, there are also several ways to generate your own life insurance leads. Social media, websites and SEO, referrals, and cold calling are all effective strategies for finding potential clients. However, these methods can be time-consuming and may not always result in high-quality leads.

Ultimately, the best way to find life insurance leads is to diversify your lead sources and constantly refine your lead generation strategies. By doing so, you can ensure a steady flow of high-quality prospects and maximise your chances of success in the competitive life insurance industry.

| Characteristics | Values |

|---|---|

| Lead type | Cold, warm, hot |

| Lead generation challenges | People tend to buy what brings them immediate benefits, which is not the case with life insurance services; most clients find insurance policies challenging to understand; the life insurance seekers' demographics are broad, which makes targeting more difficult |

| Lead generation strategies | Create engaging content; strengthen your social media presence; optimise your website and CTA; launch contextual advertising; contact the lead right away; familiarise yourself with the lead's information; start a genuine conversation; follow up through email; speak in a cheerful yet professional tone; answer questions efficiently; make yourself available; diversify your lead strategy; designate a budget and track crucial metrics |

| Worst life insurance leads | Bait-and-switch leads; overseas call transfers; telemarketed leads; aged or reworked leads; pre-booked appointment leads; direct mail leads |

| Best life insurance leads | Self-generated leads; calendar appointment leads; inbound TV leads; SEO or search engine leads; centre of influence or referral leads |

What You'll Learn

Company-provided life insurance leads

The biggest benefit of using company leads is that you don't have to spend money to access them. This saves you a lot of time, which you can then spend contacting prospective clients and selling life insurance. However, you do pay for these leads in the form of lower commissions. These leads are also not exclusive and may have been contacted by other agents.

Company leads are generated by insurance agencies using their internal data sources, which can include demographic data, purchase history, and online marketing campaigns. While they can save you time and money, it's important to remember that they may not be the freshest leads and could have already been worked on by several other agents.

If you're just starting and don't want to risk spending money on leads that might not convert, company-provided leads can be a good option. They also give you more time to focus on selling and building relationships with clients. However, if you're a good salesperson, you may find that the lower commissions aren't worth the convenience of having pre-generated leads.

Selling Life Insurance: An Uphill Battle?

You may want to see also

Third-party life insurance leads

There are several reasons why someone would choose to become a third-party owner. One of the primary reasons is to provide financial protection for dependents. For example, a parent may choose to be the third-party owner of their child's life insurance policy to ensure financial security in the event of their untimely death. Another reason is business continuity. If the insured individual is a key employee or business owner, a third-party owner can help ensure continuity by providing funds to sustain operations or facilitate a smooth transition. Third-party ownership can also serve as a means of protecting assets and enhancing estate planning.

When it comes to buying third-party life insurance leads, there are a few things to keep in mind. Firstly, it is essential to understand the different types of leads, such as cold, warm, and hot leads, which require different nurturing approaches. Cold leads are at the beginning of the sales cycle and require careful nurturing, while hot leads are almost ready to purchase a policy. Secondly, lead generation is crucial, and there are various strategies to attract qualified life insurance leads, such as creating engaging content, strengthening your social media presence, and optimising your website and call-to-action (CTA).

Another important consideration is the cost of life insurance leads. Real-time, exclusive life insurance leads can be expensive, ranging from $20 to $50 per lead. However, purchasing high-quality, pre-validated aged leads in bulk can be a more cost-effective option, with prices as low as $0.25 per lead for older leads. Additionally, buying shared leads, which are shared with multiple sources, can also reduce costs, although it may result in the prospect being inundated with calls.

When buying third-party life insurance leads, it is crucial to do your research and compare different lead generation agencies or marketplaces. Aged Lead Store, for example, offers affordable, pre-validated aged leads with instant download and custom orders available. Profitise is another option, providing a platform to trade life insurance leads by setting your target demographics, price per lead, and type of leads.

ADHD and Life Insurance: What You Need to Know

You may want to see also

Social media leads

Social media platforms such as Facebook, Instagram, LinkedIn, and Twitter offer immense opportunities to connect with potential customers and generate life insurance leads. Here are some strategies to leverage social media effectively for lead generation:

- Identify the Right Platforms: Determine the social media platforms that are most relevant to your target market. For example, Facebook caters to a wide range of demographics, while LinkedIn is ideal for B2B lead generation. Focus your efforts on platforms where your target audience is most active.

- Create a Compelling Profile: Optimize your social media profiles to effectively represent your brand. Use high-quality visuals, include a clear description of your services, and provide a link to your website. Display any relevant certifications or accolades prominently.

- Share Engaging Content: Regularly share valuable and relevant content on your social media platforms. This can include blog posts, articles, videos, infographics, or industry updates. Focus on providing insights and addressing the pain points and questions of your target audience.

- Run Targeted Ads: Take advantage of the targeting options on social media platforms to reach your desired audience. Design compelling ads that highlight the benefits of life insurance and incentivize users to take action. Use eye-catching visuals and concise, persuasive copy to drive clicks and conversions.

- Engage with Your Audience: Actively engage with your audience by responding to comments, messages, and inquiries in a timely manner. Personalize your interactions and provide helpful information or solutions. Building genuine relationships and demonstrating your expertise can increase trust and improve the likelihood of converting leads into customers.

- Leverage Groups and Communities: Join relevant groups and online communities in your industry. Participate in discussions, offer valuable insights, and establish yourself as an authority in the field. This can lead to natural and organic lead generation as you build relationships and gain visibility within these communities.

- Host Webinars or Live Q&A Sessions: Utilize live video features on social media platforms to engage with your audience in real-time. Host webinars or Q&A sessions to address common concerns, provide educational content, and answer questions about life insurance. This interactive approach can generate interest and help establish credibility.

- Foster User-Generated Content (UGC): Encourage your audience to share their experiences with your brand or specific life insurance products. User-generated content, such as testimonials or reviews, can serve as powerful social proof and inspire trust in potential leads.

- Analyze and Adapt: Regularly analyze the performance of your social media efforts using analytics tools provided by the platforms or third-party software. Track metrics such as engagement, reach, click-through rates, and lead conversion to identify successful strategies and make necessary adjustments.

Remember, social media is not just about self-promotion, but about building connections and providing value. By consistently sharing engaging content, engaging with your audience, and leveraging the targeting capabilities of social media platforms, you can effectively generate leads and grow your life insurance business.

Life, Accident, and Health Insurance: Do Licenses Expire?

You may want to see also

Website and search engine optimisation (SEO) leads

The life insurance market is growing rapidly, with agents in fierce competition to reach an audience that demands immediate answers and information. With all this competition, websites of excellent and customer-oriented insurance providers can get pushed further and further down in search results.

Almost 70% of people click on one of the first five websites listed on a search engine results page (SERP). If you're not there, your potential for success is being constrained by competitors leveraging search engine optimisation (SEO).

Search engines use complex algorithms to sort and organise the vast resource directory so that when a user conducts a search, they're directed to the best possible results.

At its core, SEO is about using relevant search terms and phrases on your website to help this process along. It's unlikely that most people search for your business by name, so the trick is to consider what they do type into a search bar. When Google sees that your website matches those queries, the algorithm indexes your business as relevant.

When a search engine's bots crawl the web, they're looking for more than just keywords. SEO algorithms are built around three main pillars:

- Relevance: How well a webpage matches a user's search intent.

- Authority: How trustworthy and reputable a webpage is.

- Trustworthiness: How safe and secure a webpage is.

15 ways to implement good SEO for insurance agents

#### 1. Do keyword research

Keywords are the words and phrases your audience uses when looking for answers online. Developing your keyword list can uncover what questions you should target and what topics are most popular among your prospective leads.

#### 2. Develop your on-page SEO

Best practices for using keywords for on-page SEO include:

- Including targeted keywords in title tags of each page, limiting titles to about 60 characters.

- Working keywords into H1 Headings, but only using these headings once per page.

- Putting keywords into URLs where possible, but keeping them short.

- Adding alt text to images, invisible to the average user but critical for search engines.

- Linking internally to other pages on your website.

#### 3. Leverage your off-page SEO

Working on off-page SEO involves building your website's domain authority through backlinks. When another reputable and high-traffic source publishes a link to your website, these backlinks inform search engines that you're relevant and trustworthy.

#### 4. Use Google Business Profile

Google Business Profile (GBP) is embedded right into Google's search engine — where more than 90% of searches occur — making it one of the most effective ways to rank high in local search results.

#### 5. Build social proof

Social proof is the idea that if others endorse something, we're more likely to choose it ourselves. Reach out to your current and past clients to request a review on your Google Business Profile or Yelp profiles. Most people will be happy to oblige — research shows that 70% of people will take the time to leave a review when asked.

#### 6. Consider paid advertising

While organic SEO techniques take time to grow, pay-per-click (PPC) ads can help your website appear at the top of search results with some strategic keyword bidding.

#### 7. Lean on content creation

To fully optimise your website's SEO, give search engines more content to work with.

Your keyword research helps identify topics popular among your niche audience. Think about the intent behind these searches and what answers they are after — then use your blog to provide the solutions.

#### 8. Optimise for mobile

More than 60% of Google searches happen on a mobile device. Websites that aren't mobile-responsive get distorted on smartphone or tablet screens, making it difficult to navigate and interact with the content.

#### 9. Ensure fast loading times

The majority of people abandon a website when it takes more than 3 seconds to load. A slow-loading website isn't just bad at keeping customers' interest; search engine bots are clued into this behaviour and prioritise faster pages.

#### 10. Build trust with HTTPS security

In 2014, Google announced that website security had been added as an official ranking factor for their algorithm. Installing a secure sockets layer (SSL) on your server ensures any information and data collected by your website is encrypted, a standard expected by your insurance clients.

#### 11. Create an organised website structure

A good website structure depends on how well content is organised, linked, and presented to online visitors. It's an important feature for user experience, offering clear navigation so that new leads can find the answers they're after.

#### 12. Check your robots.txt

Your page's robots.txt file includes code that tells Google where to go — and if certain files are unintentionally blocked, the bots can't get the full picture.

#### 13. Add structured data

Also known as schema markup, structured data is how you describe your content to search engines. This text is invisible to website visitors but gives bots key details, like hours and areas of operation, and services and products offered.

#### 14. Customise 404 pages

A 404 page is what people see if a URL they visit doesn't exist. Customising your 404 pages helps ensure smooth website navigation for your users while boosting its SEO.

#### 15. Clean up your sitemap

Your sitemap is the blueprint search engines use to understand your website. Optimising yours puts your website's best foot forward so that bots discover your best content.

Next steps

Search engine algorithms are constantly changing, so your strategy must evolve, too. You can use free tools like Google Analytics to measure your SEO implementation's impacts and audit your efforts.

These SEO findings can enhance all of your marketing efforts — from social media to direct email, content marketing to web design. Incorporate your SEO strategy across all the tools and platforms at your disposal to bring in more and more valuable insurance leads to your business.

Life Insurance: Suicide and Family's Benefits

You may want to see also

Referral leads

They're Free to Acquire

You Gain Borrowed Trust

Referrals come with an inherent level of trust already established. When someone is referred to you by a friend, family member, or another trusted source, they are more likely to do business with you because of that existing relationship. This trust is a valuable currency in sales, and it can make the sales process easier and faster, as the prospect is more receptive to what you have to offer.

Trust Leads to More Trust

When you receive a referral, you not only gain a potential new client but also the opportunity to gain even more referrals. Satisfied customers are often happy to refer their friends and family, especially if they've had a positive experience. This creates a network of trust and can lead to exponential growth for your business. Don't forget to ask your clients for referrals and make it easy for them to do so.

You Can Focus on Building Relationships

With referral leads, you can focus on cultivating genuine connections and offering personalised recommendations. Since the initial trust is already there, you can concentrate on understanding your client's needs and providing valuable guidance. This approach will help you establish yourself as a trusted advisor rather than just a salesperson.

They're More Likely to Convert

In conclusion, referral leads are a powerful tool for life insurance agents. They provide an opportunity to build a network of trusted relationships, which can lead to more business and higher conversion rates. By focusing on providing excellent service and maintaining strong connections, you can leverage referral leads to grow your business successfully.

Term Life Insurance: Outliving and Navigating the Next Steps

You may want to see also

Frequently asked questions

Life insurance leads are potential clients who may be interested in purchasing the life insurance policies that you’re selling. They can be categorised into three types: cold leads, warm leads, and hot leads.

A sales career in life insurance provides opportunities to earn a high income with strong growth potential. Life insurance agents and brokers earn commission-based incomes that are among the highest in the entire insurance industry.

Many life insurance sales professionals work long hours and are under constant pressure to meet different targets and quotas. This creates a work environment that’s conducive to stress and burnout, especially for new agents.

There are two main ways to access life insurance leads: company-provided leads and third-party leads. Company-provided leads are generated by insurance agencies using their internal data sources, while third-party leads are sourced from lead generation companies.

Apart from company-provided and third-party leads, you can also find life insurance leads through social media, websites and search engine optimisation (SEO), referrals, lead aggregators, and cold calling.