Many car enthusiasts often wonder about the insurance coverage for their prized possessions, such as the iconic Honda S2000. While insuring a daily driver is common, insuring a rare or collectible car like the S2000 may seem like an extra expense. However, insuring both your daily driver and the S2000 is a smart financial decision. This ensures that both your primary vehicle and your beloved sports car are protected against potential accidents, theft, or damage. In this article, we'll explore the reasons why insuring both vehicles is a wise choice and how it can provide peace of mind for car enthusiasts.

What You'll Learn

Insurance Coverage Options: Daily Driver vs. S2000

When it comes to insuring your vehicles, especially a daily driver and a high-performance car like the S2000, there are several coverage options to consider. The insurance needs for these two vehicles can vary significantly due to their distinct purposes and characteristics. Here's a breakdown of the insurance coverage options to help you make informed decisions:

Liability Coverage: This is a fundamental aspect of any car insurance policy. Liability coverage protects you in case you are at fault in an accident, covering the costs of medical treatment, property damage, and legal fees for the other party involved. It is essential to ensure that you have adequate liability coverage for both your daily driver and the S2000, especially if you are driving the S2000 on public roads. The S2000's powerful engine and potential for high-performance driving may attract more attention from other drivers, increasing the risk of accidents.

Collision Coverage: This type of coverage is designed to pay for repairs or replacement of your vehicle if it is damaged in a collision, regardless of fault. For the S2000, collision coverage is particularly important due to its higher value and the potential for more expensive repairs. Since the S2000 is a specialized car, finding a mechanic who can work on it might be more challenging, and the cost of parts and labor could be significantly higher. For your daily driver, collision coverage might be less critical unless it is a newer model or has a higher value.

Comprehensive Coverage: This coverage protects your vehicle from non-collision-related incidents, such as theft, vandalism, natural disasters, and animal collisions. For the S2000, comprehensive coverage is highly recommended due to its specialized nature and potential for theft or damage from extreme weather events. The S2000's unique features and desirability among car enthusiasts make it a target for thieves. For your daily driver, comprehensive coverage can provide peace of mind, especially if you park it in an area prone to theft or natural disasters.

Physical Damage Coverage: This includes both collision and comprehensive coverage, providing protection for your vehicle in various situations. For the S2000, this is a crucial aspect of insurance, as it ensures that you can repair or replace the car if it sustains damage. For your daily driver, physical damage coverage is essential if you have a loan or lease, as it helps protect the lender's interest in the vehicle.

Personal Injury Protection (PIP) or Medical Payments: These coverages provide financial assistance for medical expenses and lost wages if you or your passengers are injured in an accident, regardless of fault. PIP is often mandatory in certain states and can be beneficial for both vehicles, ensuring that you and your passengers are well-protected in the event of an accident.

When considering insurance for your daily driver and S2000, it's essential to assess the specific needs and risks associated with each vehicle. The S2000's high performance and specialized nature may require more specialized insurance, while your daily driver might benefit from standard coverage options. Reviewing your policy regularly and adjusting it as your circumstances change is also a good practice to ensure you have the appropriate level of protection.

Credit Scores and Auto Insurance: What's the Connection?

You may want to see also

Cost Comparison: Insuring Sports Cars

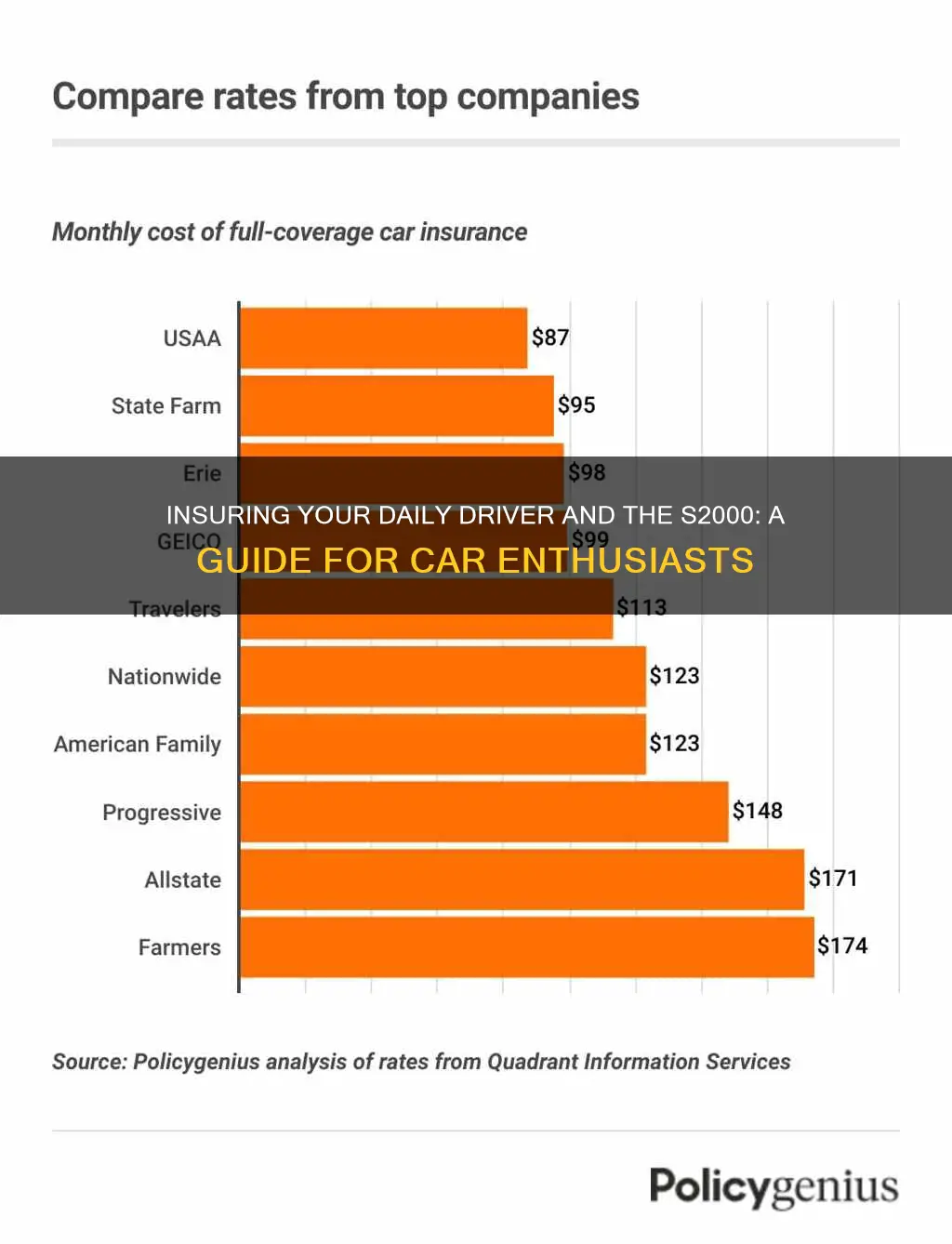

When it comes to insuring sports cars, especially high-performance models like the S2000, many enthusiasts often wonder about the cost implications of insuring both their daily driver and this prized possession. The insurance landscape for sports cars can be complex, and understanding the factors that influence premiums is crucial for car owners.

The cost of insuring a sports car, such as the S2000, is generally higher compared to a standard daily driver due to several factors. Firstly, sports cars are often more expensive to purchase, and their value can depreciate quickly. This higher initial cost and rapid depreciation make them riskier for insurers, leading to more expensive insurance premiums. Additionally, the performance and power of these vehicles can attract attention from thieves, increasing the likelihood of theft and, consequently, the insurance cost.

Several key factors contribute to the varying insurance costs for sports cars. Age and model of the car play a significant role; newer and more modern sports cars tend to have lower insurance rates due to improved safety features and technology. The insurance company's assessment of the car's value and its market demand also influences premiums. For instance, a limited-edition S2000 will likely have a higher insurance rate due to its rarity and desirability among collectors.

Another critical factor is the driver's profile. Insurance companies consider the driver's age, driving experience, and driving record. Younger, less experienced drivers often face higher insurance rates for sports cars due to the perceived higher risk. Additionally, the location where the car is primarily driven can impact costs, as certain areas may have higher accident rates or more frequent thefts.

To manage insurance costs effectively, car owners can take several steps. Firstly, comprehensive research on different insurance providers and their policies is essential. Comparing quotes and understanding the coverage options available can help in making an informed decision. Additionally, considering the car's usage and purpose can guide the choice of insurance type. For instance, a daily driver might benefit from comprehensive coverage, while an occasional weekend car could be insured with a more basic policy.

How Red Light Tickets Affect Your Auto Insurance

You may want to see also

Customization and Modifications: Impact on Insurance Rates

The decision to insure both a daily driver and a high-performance car like the S2000 involves considering various factors, including customization and modifications. These factors can significantly impact insurance rates, as insurers often view modified vehicles as higher-risk. Here's an overview of how customization and modifications can influence your insurance costs:

Understanding Customization and Modifications: Customization and modifications refer to any changes made to a vehicle that deviates from the manufacturer's original design. This can include engine upgrades, body kits, suspension enhancements, performance parts, or even interior modifications. While these alterations can enhance the car's aesthetics and performance, they also introduce unique risks that insurance companies need to consider.

Impact on Insurance Rates:

- Risk Assessment: Insurance companies assess risk based on the likelihood and potential severity of accidents. Modified vehicles, especially those with performance enhancements, may be perceived as more prone to accidents due to increased speed, handling, or braking capabilities. As a result, insurers might consider these cars as higher-risk, leading to higher insurance premiums.

- Claims History: If you have a history of claims for modified vehicles, it could reflect poorly on your insurance rates. Insurers may view you as a higher-risk driver, especially if previous claims were related to modifications or performance-related incidents.

- Value of the Vehicle: Customizations and modifications can increase the market value of your car. However, from an insurance perspective, the value of the vehicle is crucial. Insurers often use the vehicle's value to determine the cost of comprehensive and collision coverage. More expensive, modified cars may result in higher insurance premiums to cover potential repair costs.

- Safety Features: Some modifications can enhance safety, such as installing advanced braking systems or improved lighting. However, other modifications might compromise safety. For instance, lowering a vehicle's suspension can affect its stability and handling. Insurers may take these factors into account when calculating premiums, rewarding safer modifications with lower rates.

Managing Insurance Costs with Modifications:

- Consult Insurers: Before making significant modifications, inform your insurance provider. They can advise on potential risks and suggest modifications that are less likely to impact your premiums negatively.

- Accurate Vehicle Description: Provide a detailed list of modifications to your insurer. This transparency can help them assess the risk accurately and may even lead to discounts for safer modifications.

- Regular Vehicle Inspections: Keep your vehicle well-maintained and undergo regular inspections to ensure that modifications do not compromise safety or reliability. This can help maintain favorable insurance rates.

- Consider Usage-Based Insurance: Some insurers offer usage-based insurance, where rates are calculated based on your driving habits and vehicle usage. This can be beneficial if you primarily use the modified car for track days or racing, as it may reflect a lower risk profile.

In summary, customization and modifications can significantly influence insurance rates for both your daily driver and a high-performance car like the S2000. Being proactive in managing these factors, such as consulting insurers and maintaining accurate records of modifications, can help mitigate potential increases in insurance costs.

Mexican Auto Insurance: Why You Need It Now

You may want to see also

Driver Profiles: Young vs. Experienced for Both Cars

The insurance landscape for car owners can vary significantly depending on their age and driving experience, especially when considering two distinct vehicles like a daily driver and a high-performance car like the S2000. Young drivers, often in their teens or early twenties, typically face higher insurance premiums due to their lack of experience on the road. Insurance companies consider this age group as high-risk drivers, as statistics show that younger drivers are more prone to accidents and traffic violations. For a young driver, insuring both a daily vehicle and a sports car like the S2000 would likely result in a substantial financial burden due to the increased risk associated with these vehicles.

In contrast, experienced drivers, usually those over 30 years old, often benefit from lower insurance rates. With years of driving under their belts, they have developed a better understanding of road dynamics and have a proven track record of safe driving. Insurance providers often offer more competitive rates to experienced drivers, recognizing their reduced risk profile. For an experienced driver, insuring both a reliable daily driver and a powerful sports car like the S2000 might be more financially feasible, as the insurance premiums would likely be more manageable.

The age and experience of the driver play a crucial role in determining insurance costs. Young drivers often face higher premiums due to their limited driving experience and the associated risks. Conversely, experienced drivers benefit from lower rates as they have demonstrated their ability to handle various driving situations. This dynamic is particularly relevant when considering the insurance of two distinct vehicles, as the insurance company's assessment of risk is influenced by the driver's profile.

When it comes to insuring both a daily driver and a high-performance car, the insurance company's risk assessment becomes even more critical. The S2000, known for its powerful engine and aggressive styling, is often associated with a higher level of performance and, consequently, a higher risk of accidents. Young drivers, despite their enthusiasm for high-performance vehicles, might find it challenging to justify the insurance costs for both a daily driver and a sports car due to the potential financial strain.

In summary, the insurance considerations for young and experienced drivers differ significantly, especially when insuring multiple vehicles. Young drivers may face higher premiums for both cars due to their age and the perceived risk, while experienced drivers can benefit from lower rates, making it more financially viable to insure both a daily driver and a high-performance vehicle like the S2000. Understanding these driver profiles is essential for anyone seeking insurance coverage for their vehicles.

Auto Insurance 101: Understanding D&M Coverage

You may want to see also

Regional Variations: Insurance Rates by Location

The insurance landscape varies significantly across different regions, and these regional variations play a crucial role in determining the cost of insuring your vehicles. Several factors contribute to these differences, including the local economy, crime rates, population density, and the frequency of natural disasters. Understanding these regional variations is essential for anyone looking to insure their vehicles, especially when considering the insurance of a daily driver and a more specialized vehicle like an S2000.

In urban areas, insurance rates tend to be higher compared to rural regions. This is primarily due to the increased risk of accidents and theft. Cities often have higher population densities, leading to more traffic congestion and a higher likelihood of accidents. Additionally, urban areas may experience higher crime rates, which can result in more vehicle thefts and, consequently, higher insurance premiums. For instance, insuring an S2000, a vehicle often targeted by thieves, might be more expensive in metropolitan areas.

Conversely, rural areas offer lower insurance rates due to the opposite factors. The lower population density and reduced traffic congestion in rural regions contribute to fewer accidents and a lower crime rate. As a result, insurance companies may charge lower premiums for insuring vehicles in these areas. However, it's important to note that the availability of insurance providers and the types of coverage offered might differ between rural and urban settings.

Natural disasters also significantly impact insurance rates. Coastal regions, for example, often face higher premiums due to the increased risk of hurricanes, floods, or earthquakes. These events can cause extensive damage to vehicles, leading insurance companies to charge higher rates to account for the potential financial losses. Similarly, areas prone to severe weather conditions or natural disasters may see higher insurance costs for both daily drivers and specialized vehicles like the S2000.

Furthermore, the local economy and employment rates can influence insurance rates. Regions with a higher unemployment rate or economic instability might experience higher insurance premiums. This is because individuals in such areas may have fewer financial resources to cover potential insurance claims, leading to increased costs for insurance providers. Understanding these regional economic factors is essential for budgeting and making informed decisions when insuring your vehicles.

Vehicle Insurance Schedule: What's Covered?

You may want to see also

Frequently asked questions

Insuring both vehicles can provide comprehensive coverage for your entire collection, ensuring that you have protection for all your prized possessions. It also allows you to customize policies to fit the specific needs of each car, such as different usage, driving conditions, and maintenance requirements.

Yes, it is advisable to insure the S2000, even if it's not your daily driver. Classic or exotic cars like the S2000 often have unique maintenance needs and can be more susceptible to damage from accidents or theft. Insuring it provides financial protection and peace of mind, especially if you plan to participate in track days or car shows.

Start by assessing the value of each car and the level of risk associated with their usage. For your daily driver, you might opt for a comprehensive policy that covers accidents, theft, and natural disasters. For the S2000, consider a specialized classic car insurance policy that takes into account its age, rarity, and potential for depreciation. Review the insurance company's guidelines and choose coverage options that align with your specific requirements.