Medical mileage reimbursement is a crucial aspect of auto insurance, providing financial relief to individuals who have incurred transportation costs due to medical appointments, hospital visits, or accident-related injuries. This reimbursement covers travel expenses, including mileage, gas, parking fees, and even taxi or ride-sharing fares if an individual is unable to drive due to their injuries. It is worth noting that the reimbursement rate varies annually and is determined by organisations like the IRS in the US. For example, the IRS medical mileage rate for 2023 was 22 cents per mile. It is important to maintain detailed records of mileage and transportation expenses to support any claims for reimbursement.

| Characteristics | Values |

|---|---|

| What is medical mileage? | A benefit provided to car accident victims to reimburse transportation costs and expenses incurred from travelling to and from doctors' appointments. |

| What does it cover? | Number of miles travelled, bus, taxi or rideshare fares, parking fees, gas, oil and tolls. |

| Who is eligible? | Car accident victims in Michigan are eligible under Michigan's No-Fault law. |

| How much coverage is there for these travel expenses? | Coverage depends on the No-Fault PIP benefits coverage level in the auto insurance policy. |

| How to claim | File a No-Fault application with the applicable auto insurance within one year from the date of the car accident. |

| Who pays? | If the claimant has their own auto insurance policy in which they are the "named insured", then their own auto insurer will pay. Otherwise, the No-Fault law's "priority" rules will determine what insurer is responsible. |

| When is the reimbursement paid? | The auto insurance company is supposed to pay within 30 days of receiving "reasonable proof" of what is owed. |

| What if the reimbursement is unpaid? | The claimant can sue their auto insurance company for unpaid travel expenses, but the lawsuit must be filed within one year from the date that the number of miles were travelled. |

| How to calculate miles travelled | Use applications such as Google Maps to calculate the number of miles travelled. |

| How to keep track of mileage | Keep an accurate journal or log of the date and time of the medical visit, the mileage accrued, and the locations travelled to and from. |

| How to claim reimbursement from the IRS | The IRS sets the medical mileage rate per mile each year. The rate for 2023 is 22 cents per mile. |

What You'll Learn

The No-Fault medical mileage reimbursement in Michigan

The No-Fault medical mileage reimbursement is one of the PIP benefits that car accident victims are entitled to under Michigan's No-Fault law. It covers transportation costs for travelling to and from accident-related appointments, hospitals, and rehabilitation and therapy clinics. This includes mileage, parking fees, tolls, gas, oil, or bus and taxi fares.

There is no fixed Michigan medical mileage rate. Car accident victims often argue that the rate should be based on the IRS standard mileage rates, which were $57 per mile in 2020. After July 1, 2021, the rate may depend on the No-Fault law's Medicare-based fee schedule. Reimbursement rates vary by carrier and may be as high as 55 cents a mile.

To claim No-Fault medical mileage reimbursement, victims must file a No-Fault application with the applicable auto insurance within one year from the date of their car accident. They should keep a detailed record of their mileage and transportation expenses, including dates, total mileage travelled round-trip, and the name of the doctor and treatment facility visited. This information should be submitted to their No-Fault insurance company along with their other accident-related treatment bills.

If a car accident victim has their own auto insurance policy in which they are the "named insured", their own auto insurer will pay their No-Fault medical mileage. Otherwise, the No-Fault law's "priority" rules will determine what insurer is responsible. Generally, if the victim doesn't have a policy, the applicable insurance company that will pay their reimbursement will be their spouse's insurer or the insurer for a family member they live with.

Gap Insurance vs. Conditional Gap Waivers

You may want to see also

Tracking and documenting mileage for reimbursement

Tracking and documenting your mileage is essential for reimbursement, and there are several methods to do so accurately. Firstly, it is important to note that reimbursement is provided for medical treatments related to injuries sustained in a car accident. The No-Fault medical mileage reimbursement is a PIP benefit provided to car accident victims through their No-Fault personal protection insurance coverage.

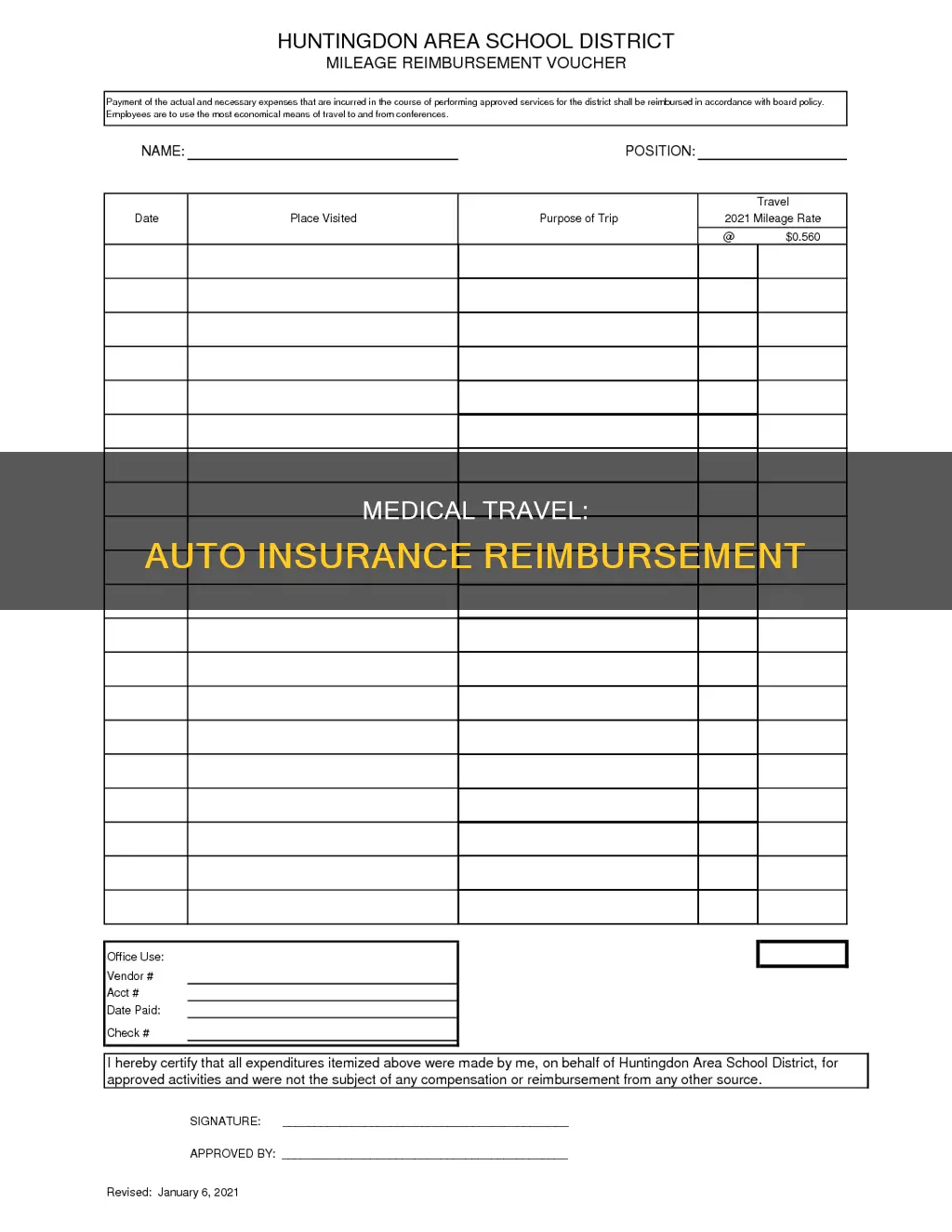

To ensure you receive proper reimbursement, it is crucial to keep a detailed record of your mileage and transportation expenses. This includes tracking the date and time of your medical visit, the total mileage travelled round trip, and the name of the doctor and treatment facility visited. Additionally, keep records of other costs such as parking fees, tolls, and gas.

There are various tools and templates available to assist you in tracking your mileage. For instance, you can use a paper logbook, a diary, or a digital spreadsheet. Some mobile applications, such as Google Maps, can help you calculate the distance travelled for each trip. Moreover, specific mileage-tracking applications, such as Driversnote, can automate the process by recording your trips in real time. These applications can save you time and ensure that your records are compliant with IRS requirements.

The IRS defines "adequate records" for mileage logs, which include the mileage for each business use, the total mileage for the year, the time and place of each trip, and the business purpose. Odometer readings at the start and end of the year are also recommended. It is important to note that your employer may have specific requirements for mileage reporting, so be sure to clarify this with them.

In summary, accurate and timely tracking and documentation of your mileage are crucial for reimbursement. Utilize the tools and templates mentioned above to create comprehensive records, ensuring you capture all the necessary details of your trips. This will help streamline the reimbursement process and provide supporting evidence for your claims.

Insuring a Vehicle: Ownership Flexibility

You may want to see also

Medical mileage deductions for tax purposes

Medical mileage deductions are a crucial aspect of tax planning, and it's important to understand what qualifies and how to claim these deductions accurately. Here is a detailed guide on medical mileage deductions for tax purposes:

Medical mileage deductions allow individuals to claim reimbursement for travel expenses incurred while seeking medical treatment. This includes the cost of transportation to and from medical appointments, such as mileage, gas, parking fees, and tolls. These deductions are intended to provide financial relief to individuals who incur significant expenses while travelling for medical reasons.

Eligibility for Medical Mileage Deductions

To be eligible for medical mileage deductions, the transportation costs must meet specific criteria. Firstly, the transportation expenses must be primarily for medical care. This means that the primary purpose of the travel should be to receive medical treatment, attend doctor's appointments, or obtain essential medications. Additionally, the medical care must be necessary for the diagnosis, cure, mitigation, treatment, or prevention of a disease that affects the body's function.

How to Calculate Medical Mileage Deductions

When calculating medical mileage deductions, individuals can choose between two methods: the standard mileage rate and actual expenses. The standard mileage rate for medical purposes in 2023 is 22 cents per mile. This rate is adjusted annually by the Internal Revenue Service (IRS) and provides a simplified way to calculate deductions. Alternatively, individuals can deduct the actual expenses incurred for medical transportation. This includes costs such as gas, parking fees, and tolls, but excludes depreciation, insurance, and vehicle maintenance expenses.

Documentation and Record-Keeping

It is essential to maintain accurate records and documentation when claiming medical mileage deductions. Individuals should keep track of the date and time of medical visits, the mileage accrued, and the locations travelled to and from. Additionally, recording the vehicle used for travel can be beneficial. This documentation will support the claim for reimbursement and ensure compliance with tax regulations.

Claiming Medical Mileage Deductions

To claim medical mileage deductions, individuals should gather their records and calculate the total mileage and expenses incurred for the tax year. They can then complete and submit the required tax forms, such as Schedule A (Form 1040), to claim the deductions. It is important to note that medical mileage deductions are subject to certain limitations and may be reduced by any reimbursements received from insurance or other sources.

Deadlines and Timeframes

It is crucial to be mindful of deadlines when claiming medical mileage deductions. Individuals typically have a timeframe within which they must file their tax returns and claim these deductions. Any delays beyond the specified deadlines may result in the loss of eligibility for the deductions. Therefore, staying organised and timely with tax filings is essential.

Aflac Auto Insurance: Does It Exist?

You may want to see also

Reimbursement for travel expenses

If you are using your personal vehicle for work, your employer should compensate you for the costs incurred. This includes not just the obvious expenses like gas, oil changes, and maintenance, but also the costs of vehicle ownership like insurance, taxes, and registration.

In the case of medical mileage reimbursement, car accident victims are entitled to compensation for their transportation costs for travelling to and from accident-related doctor appointments, hospitals, and rehabilitation and therapy clinics. This includes the number of miles travelled, bus, taxi, or ride-share fares, parking fees, gas, oil, and tolls.

The Internal Revenue Service (IRS) in the United States sets the medical mileage rate per mile each year. This rate is the amount you can deduct from your taxes for the miles you drive for medical purposes. For 2023, the IRS medical mileage rate is 22 cents per mile, and for 2024, it is 21 cents per mile.

To claim reimbursement for travel expenses, it is important to keep an accurate log of the date and time of your medical visits, the mileage accrued, and the locations travelled to and from. Additionally, recording the vehicle used for travel can be helpful. This information can be used to create a spreadsheet to support your claim for compensation.

If you have not been keeping a record of your mileage, you can estimate your travel by using medical bills and records to calculate the distance travelled from your home or work. You can also use applications like Google Maps to calculate the mileage retroactively. Remember to include the return mileage as well.

Auto Insurance: Medical Bills Covered?

You may want to see also

Medical mileage reimbursement for car accident victims

Car accident victims often spend a lot of time and money on travel to and from medical appointments. This text will explain when and how accident victims can claim reimbursement for these travel expenses.

Medical mileage is a benefit provided to car accident victims through their No-Fault Personal Protection Insurance Coverage. It reimburses victims for the transportation costs they incur while travelling to and from doctors' appointments as they recover from accident-related injuries.

Medical mileage reimbursement covers a car accident victim's healthcare-related transportation costs, including the number of miles travelled, bus, taxi or rideshare fares if the victim is unable to drive, parking fees, gas, oil and tolls.

How to Claim Medical Mileage Reimbursement

To claim reimbursement for healthcare mileage expenses after a car accident, you must file a No-Fault application with the applicable auto insurance within one year from the date of the accident. It is important to keep a detailed record of mileage and transportation expenses (including dates, total mileage travelled round trip, and the name of the doctor and treatment facility visited) and submit that information to the insurance company.

The Internal Revenue Service (IRS) sets the medical mileage rate per mile each year. The rate for 2023 is 22 cents per mile. This rate can be used to calculate the total reimbursement amount.

Requirements for Claiming Medical Mileage as a Tax Deduction

To claim medical mileage as a tax deduction, the miles driven must be primarily for medical purposes, and your expenses must exceed 7.5% of your adjusted gross income (AGI). Additionally, you cannot claim mileage for trips that are reimbursed by your employer or insurance company.

Auto Insurance in Georgia: Costs Explained

You may want to see also

Frequently asked questions

Medical mileage is a benefit provided to car accident victims that reimburses them for the transportation costs and expenses they incur travelling to and from doctors' appointments as they recover from accident-related injuries.

Medical mileage reimbursement covers healthcare-related transportation costs, including the number of miles travelled, bus, taxi or rideshare fares, parking fees, gas, oil and tolls.

To collect benefits for your healthcare mileage expenses after a car accident, you must file a No-Fault application with the applicable auto insurance within one year from the date of the accident.

If you have your own auto insurance policy in which you are the "named insured", then your own auto insurer will pay your No-Fault medical mileage. If you don't have a policy, then the applicable insurance company will be your spouse's insurer or the insurer for a family member who lives with you.

Your auto insurance company is supposed to pay your accident-related medical mileage within 30 days of receiving "reasonable proof" of what is owed. If your auto insurance does not pay, then the unpaid expenses are deemed to be "overdue".