Life insurance is a contract between an insurance company and a policyholder, where the insurer agrees to pay a sum of money to the policy's beneficiaries upon the death of the insured person. In exchange, the policyholder pays premiums to the insurer during their lifetime. There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance covers the insured for a set period, such as 10 or 20 years, while permanent life insurance lasts the entire life of the policyholder, provided they continue paying premiums. Life insurance provides financial security for loved ones, helping to cover funeral costs, pay off debts, or maintain their standard of living. When choosing a life insurance policy, it is essential to consider factors such as affordability, coverage amount, and the financial strength of the insurance company.

| Characteristics | Values |

|---|---|

| Who do they represent? | Financial advisors represent the consumer and help them get the best-suited insurance policies from multiple insurance providers. Insurance agents represent a single insurance company and help sell policies from that provider. |

| Services | Financial advisors analyse the financial planning needs of a person relating to insurance and recommend appropriate insurance products. Insurance agents provide customer service, help manage policies, update details, and adjust coverage. |

| Expertise | Financial advisors have expertise in financial planning. Insurance agents have in-depth knowledge of insurance products offered by the company they represent. |

| Recommendations | Financial advisors provide unbiased advice and recommendations. Insurance agents provide personalized recommendations based on a client's specific needs, financial goals, and risk tolerance. |

| Sales | Financial advisors do not have a sales quota. Insurance agents act as salespeople. |

| Fees | Financial advisors may charge a fee for their services. Insurance agents are paid on commission. |

What You'll Learn

Term vs. Permanent Life Insurance

Life insurance is a contract between an insurance company and a policy owner in which the insurer guarantees to pay a sum of money to one or more named beneficiaries when the insured person dies. There are two main types of life insurance: term and permanent.

Term Life Insurance

Term life insurance is temporary and lasts for a specific amount of time, typically between one and 30 years, or until a particular age. It is a simple and relatively inexpensive way to get life insurance coverage. Term life insurance policies do not carry any cash value, meaning they don't accrue savings over time that can be accessed by the policyholder. In general, term life premiums are level, meaning they will not change while the policy is in effect. However, prices do rise with age.

Permanent Life Insurance

Permanent life insurance, on the other hand, lasts for as long as you live. Unlike term coverage, this type of life insurance does not expire, provided you keep making the premium payments. Permanent life insurance carries a savings or investment component, also called its cash value, which grows tax-deferred and may be withdrawn or borrowed against while you're still alive. Permanent life insurance is generally more expensive than term life insurance.

When choosing between term and permanent life insurance, consider your assets, the needs of your loved ones, and your budget. If you need short-term coverage or have a limited budget, term life insurance may be a good option. On the other hand, if you need long-term financial protection, want to create an inheritance for your heirs, or prefer stable premiums, permanent life insurance may be more suitable.

Great-West Life Insurance: Orthotics Coverage and Your Benefits

You may want to see also

Whole Life Insurance

- Lifetime coverage

- Cash value that can be used for loans, withdrawals, or premium payments

- A guaranteed death benefit amount

- Predictable premium payments

- Tax-free loans

However, there are also some disadvantages to consider:

- More expensive than term life insurance

- Cash value may grow slower than with other policies

- No flexibility to adjust the premium

- Limited ability to adjust the death benefit

The cost of whole life insurance varies based on factors such as age, occupation, and health history. It is generally more expensive than term life insurance due to the additional benefits it provides.

Understanding MEC: Life Insurance's Essential Clause

You may want to see also

Universal Life Insurance

Flexibility

Cash Value

Permanent Coverage

Comparison with Whole Life Insurance

Both universal life and whole life insurance are types of permanent life insurance and offer lifelong coverage. They also build cash value over time, which can be used for various purposes. However, there are some key differences between the two. Whole life insurance has guaranteed death benefits and set premiums, while universal life insurance offers flexible death benefits and premiums. Whole life insurance can also earn dividends, which universal life insurance does not offer. The choice between the two depends on your specific goals and preferences for flexibility in premiums and benefits.

Potential Drawbacks

While universal life insurance offers flexibility and lifelong coverage, there are some potential drawbacks to consider. The cash value of a universal life insurance policy can be affected by underperformance or insufficient funds, leading to increased premiums or policy lapse. Additionally, some withdrawals from the cash value may be subject to taxes. It's important to carefully monitor the cash value and understand the tax implications to avoid unexpected costs.

Free Life Insurance: A Military Benefit?

You may want to see also

Variable Universal Life Insurance

Variable Universal Life (VUL) Insurance is a type of permanent life insurance policy that combines a death benefit with a savings component, called cash value. This coverage can last an entire lifetime as long as the insured continues to pay for the insurance costs.

A VUL allows the policyholder to adjust how much they pay into the policy each year, similar to traditional universal life insurance. However, the policyholder must pay enough each year to cover the ongoing insurance costs of their policy. The insurer will deduct this amount from the premiums, and the remainder of the premiums will go towards the policy's cash value.

The cash value in a VUL can be invested and grown through subaccounts that operate like mutual funds, exposing the policyholder to market fluctuations. While this can generate high returns, it may also result in substantial losses. The growth of the cash value is tax-deferred, and policyholders may access their cash value by taking a withdrawal or borrowing funds.

VUL insurance policies provide policy customisation, allowing policyholders to add optional features for an additional charge, such as the Long-Term Care Rider. However, it is important to carefully assess the risks before purchasing a VUL, as the return on the cash component is not guaranteed, and there is a possibility of losing money.

Cigar Smokers: Haven Life Insurance Exclusion Policy Explained

You may want to see also

Final Expense Insurance

When considering final expense insurance, it is important to review the specific features and benefits offered by different insurance companies, as they can vary. Some policies may include additional features such as child riders, accidental death and dismemberment coverage, or support benefits for surviving loved ones, such as funeral price shopping. It is also crucial to be honest when answering health questions on the application, as withholding information could lead to the denial of a claim. Final expense insurance is an excellent option for individuals over 40 who want to ensure their loved ones are financially protected during a challenging time.

Life Insurance Proceeds: Taxable or Not?

You may want to see also

Frequently asked questions

A life insurance policy is a contract between you and an insurance company. In exchange for regular payments, called premiums, the insurer pays out money after you die to your chosen beneficiaries.

A life insurance policy can act as a safety net for your loved ones if they depend on you financially. For example, if you are a parent, a homeowner, or someone with co-signed debt, you may need life insurance coverage.

There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance covers you for a set period, e.g., 10 or 20 years, while permanent life insurance typically lasts your entire life and includes a cash value component.

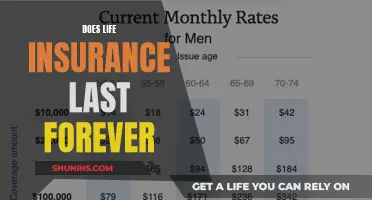

The cost of life insurance depends on the type of policy and your personal circumstances, such as age and health. Term life insurance is generally cheaper than permanent life insurance. The average life insurance rate is $26 per month for a $500,000, 20-year term policy for a healthy, non-smoking 40-year-old.

You can buy life insurance online, through an agent or broker, or directly from an insurer. When buying life insurance, compare quotes from multiple companies to find the best coverage and price for your needs.