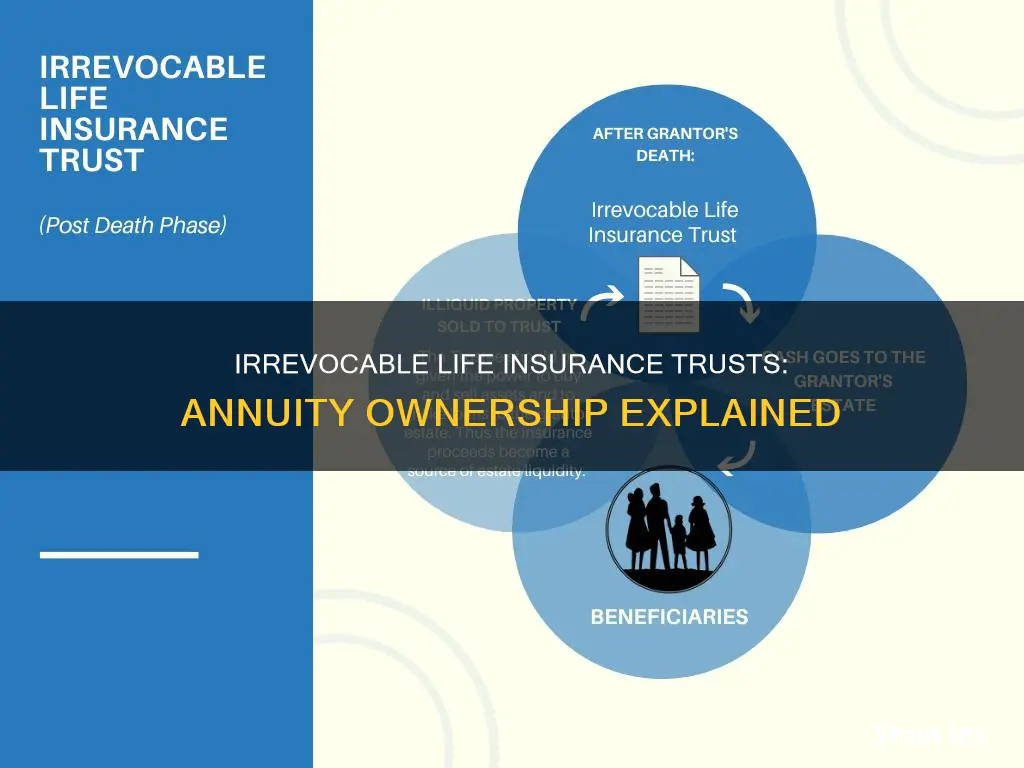

An irrevocable life insurance trust (ILIT) is a legal entity that owns and controls a life insurance policy. It is created during the insured's lifetime and can manage and distribute the proceeds to beneficiaries upon the insured's death. An ILIT can provide several benefits, such as minimizing estate taxes, avoiding gift taxes, and protecting government benefits. While it offers these advantages, it is important to note that an ILIT is irreversible and cannot be altered or undone once established. In the context of annuities, a trust can own an annuity, typically to assist the beneficiary financially. However, naming a trust as the owner of an annuity can have tax implications, and it is crucial to understand the potential complexities.

What You'll Learn

An irrevocable life insurance trust (ILIT) can be used to minimise estate taxes

An irrevocable life insurance trust (ILIT) is a powerful tool for minimising estate taxes. It is a legal entity that can hold assets, with its own tax ID number. It is created during the insured's lifetime and owns and controls a term or permanent life insurance policy.

The main benefit of an ILIT is that it reduces the value of an individual's estate, thereby reducing the estate tax paid on the life insurance benefits passed from the grantor to the beneficiary. This is achieved by transferring assets from the grantor to the trust, which then uses a life insurance policy to distribute the proceeds when the grantor passes away. The proceeds from the life insurance policy are not part of the insured's gross estate and are therefore not subject to estate taxation.

In addition to minimising estate taxes, an ILIT can also help with asset protection. Each state has different rules regarding how much of an insurance policy's cash value or death benefit is protected from creditors. However, when the policy is held in an ILIT, any excess value above those limits is generally protected from the creditors of both the grantor and the beneficiary.

An ILIT can also be useful for government benefit protection. For example, if a family member with special needs is set to inherit assets, an ILIT can help ensure that they do not inadvertently lose eligibility for government benefits. The trustee can carefully control how distributions from the trust are used, maintaining the beneficiary's eligibility for benefits.

It is important to note that an ILIT is irrevocable and cannot be amended or cancelled once established. This means that the grantor relinquishes control over the assets placed in the trust and cannot access or use them. As such, it is important to carefully consider the potential benefits and drawbacks of an ILIT before setting one up.

Life Insurance and Acts of War: What's Covered?

You may want to see also

An ILIT can help avoid gift taxes

An Irrevocable Life Insurance Trust (ILIT) is a powerful tool for wealth management and estate planning. It can be used to avoid gift taxes in several ways. Firstly, contributions made by the grantor to the trust are considered gifts to the beneficiaries, and therefore, avoid gift tax consequences. Secondly, to further ensure gift taxes are avoided, the trustee must notify the beneficiaries of their right to withdraw contributions within a 30-day period using a Crummey letter. This qualifies the transfer for the annual gift tax exclusion by making it a present rather than a future interest, thus avoiding the need to file a gift tax return in most cases.

The annual gift tax exclusion amount for 2024 is $18,000 per individual, or $36,000 for a married couple filing jointly. In 2025, these amounts will increase to $19,000 and $38,000, respectively. It is important to note that you only need to report gifts to the IRS if they exceed the lifetime gift exemption amount, which is $13.99 million for 2025.

By using an ILIT, individuals can also reduce the size of their estate, thereby reducing or eliminating estate taxes. This is because the proceeds from the death benefit of a life insurance policy owned by an ILIT are not considered part of the insured's gross estate and are therefore not subject to estate taxation.

Additionally, an ILIT can protect the eligibility of family members who are receiving government benefits, such as Social Security disability income or Medicaid. The trustee can carefully manage distributions to ensure that they do not interfere with the beneficiary's eligibility for government assistance.

Grandparents' Guide to Life Insurance for Grandchildren

You may want to see also

An ILIT can protect government benefits

An irrevocable life insurance trust (ILIT) is a powerful tool for protecting government benefits for beneficiaries who are receiving government aid, such as Social Security disability income or Medicaid. Here are four to six paragraphs explaining how an ILIT can achieve this:

Firstly, an ILIT allows for careful control and management of distributions to beneficiaries. The trustee of the ILIT has the discretion to determine when and how beneficiaries receive proceeds from the policy. This means that distributions can be structured in a way that does not interfere with the beneficiary's eligibility for government benefits. For example, if a lump-sum death benefit payment would cause the beneficiary to lose their government assistance, the trustee can instead distribute the proceeds over time or as needed.

Secondly, an ILIT can help mitigate the impact of estate taxes. When a policyholder passes away, the death benefit amount becomes part of their estate value, which can increase the overall value of the estate and trigger higher estate taxes. By placing the life insurance policy into an ILIT, the death benefit is separated from the policyholder's estate value, reducing the potential tax burden. This, in turn, helps preserve more of the estate's value, which can then be used to provide ongoing care for the beneficiary without reducing their government benefits.

Thirdly, an ILIT can be particularly beneficial for families with special needs members who require long-term care. By setting up an ILIT, families can ensure that inherited assets do not inadvertently interfere with the beneficiary's eligibility for government assistance programs. The trustee can carefully manage the distributions to maintain the beneficiary's continued eligibility for benefits while also providing additional financial support for their care.

Additionally, an ILIT can be used to mitigate the generation-skipping transfer tax. Typically, the IRS can impose a tax of up to 40% on gifts to individuals who are more than 37.5 years younger than the donor. However, by using an ILIT, grantors can transfer assets to grandchildren or other younger generations without triggering this tax. This allows for more efficient wealth transfer to future generations while also protecting their government benefits.

Lastly, an ILIT provides privacy and avoids the public probate process. Unlike other estate settlements, trusts do not require court approval, which means that distributions can be made discreetly and efficiently. This added layer of privacy can be beneficial for beneficiaries who wish to maintain their financial situation confidential while still receiving the financial support they need.

In summary, an ILIT is a valuable tool for protecting government benefits for beneficiaries. Through careful management of distributions, mitigation of taxes, support for special needs individuals, and privacy, an ILIT can help ensure that beneficiaries receive the financial support they need without sacrificing their eligibility for crucial government assistance programs.

Life Insurance Exams: What Medical Tests Are Required?

You may want to see also

An ILIT can be used to protect assets from creditors

An Irrevocable Life Insurance Trust (ILIT) is a powerful tool for protecting assets from creditors. Once an ILIT is established, the grantor can’t amend or cancel it. This is a critical feature of an ILIT, as it ensures that the life insurance proceeds are protected from creditors and kept out of the grantor's taxable estate.

The assets within an ILIT are generally safe from creditors' claims and civil lawsuits or bankruptcy. This includes the cash value and death benefits of the life insurance policy. By placing the life insurance policy inside the trust, it is removed from the grantor's personal assets. As a result, if the grantor passes away and the life insurance policy makes a substantial payout, the payout goes to the trust, excluding it from the grantor's estate. This can lead to significant tax savings when passing on assets to heirs.

In addition to protecting assets from creditors, an ILIT offers several other benefits. It can help minimize estate taxes, avoid gift taxes, and preserve eligibility for government benefits. An ILIT can also provide liquidity to pay estate taxes and other expenses, such as by purchasing assets from the grantor's estate or through a loan. Lifetime gifts can also help reduce the taxable estate by transferring assets into the ILIT.

The trustee of an ILIT plays a crucial role in managing the trust and ensuring that the assets are protected. They are responsible for paying premiums, handling tax filings, investing trust assets, sending required notices, and distributing proceeds to beneficiaries. It is important to choose an independent and competent trustee who can carry out these duties effectively.

While an ILIT offers strong asset protection, it is important to consider the potential drawbacks. Once an asset is placed in an ILIT, the grantor loses control over it and cannot make changes to the trust. This inflexibility means that the grantor needs to be confident about their goals and plans before establishing an ILIT. Additionally, there may be complex tax implications and higher tax rates associated with irrevocable trusts.

Denied Life Insurance? What You Need to Know

You may want to see also

An ILIT can be used to manage and distribute proceeds

An Irrevocable Life Insurance Trust (ILIT) is a trust created by an individual, known as the grantor, to purchase life insurance on their own life. The grantor creates and funds the trust, and the trustee manages it. The beneficiaries are chosen by the grantor and receive distributions.

In addition, an ILIT can provide liquidity to the grantor's estate upon their death. The trust can provide a loan to the estate to cover any estate taxes due, ensuring that the estate's assets do not have to be sold to pay a tax bill.

It is important to note that an ILIT cannot be altered or undone once it is created, so careful planning is essential.

Understanding Post-Mortem Dividends: Form 706 and Life Insurance

You may want to see also

Frequently asked questions

An irrevocable life insurance trust (ILIT) is a legal arrangement that seeks to minimise your current tax burden as well as the impact taxes will have on your estate. It does this by transferring assets from you to the trust and uses a life insurance policy to distribute the proceeds when you pass away.

ILITs are powerful planning tools that serve as an important wealth transfer mechanism in many well-crafted estate plans. They offer tax benefits, estate planning benefits, and legacy benefits.

The only major downside is that ILITs are irrevocable. A revocable trust can be easily modified or terminated because the assets remain your property, but you relinquish control over assets when you gift them to an irrevocable trust.

Yes, an irrevocable life insurance trust can own an annuity. However, there are some situations where naming a trust as the owner of an annuity could complicate your finances. For example, if the trust is named as the annuity owner rather than the beneficiary, the annuity loses its tax-deferred benefit.