When it comes to finding the best-rated life insurance for seniors, it's important to consider their unique needs and circumstances. As individuals age, their health and financial situations may change, making it crucial to choose a policy that offers adequate coverage and peace of mind. In this article, we will explore the various factors to consider when selecting life insurance for seniors, including the different types of policies available, the role of health and medical history, and the benefits of consulting with a financial advisor. By understanding these aspects, seniors can make informed decisions and find the right life insurance plan to protect their loved ones and ensure financial security in their later years.

What You'll Learn

- Affordable Options: Compare rates for seniors with pre-existing conditions

- Term vs. Permanent: Understand the differences and benefits for older adults

- Health Considerations: Explore how health impacts senior life insurance choices

- Financial Planning: Learn how life insurance fits into retirement planning for seniors

- Customer Reviews: Read reviews to find the most highly-rated policies for seniors

Affordable Options: Compare rates for seniors with pre-existing conditions

When it comes to finding affordable life insurance options for seniors, especially those with pre-existing conditions, it's essential to approach the process with a strategic mindset. The key is to understand that while age and health history can impact premiums, there are still ways to secure coverage at a reasonable cost. Here's a guide to help you navigate this journey:

Research and Compare Rates: Start by researching various life insurance providers who specialize in senior coverage. Many companies offer tailored policies for older adults, recognizing the unique needs of this demographic. Obtain quotes from multiple insurers to gain a comprehensive understanding of the market. Websites and online tools can be invaluable resources for comparing rates, allowing you to quickly identify the most competitive prices. Look for companies that have a good reputation for customer service and claim processing to ensure a smooth experience.

Emphasize Longevity and Wellness: Insurance companies often consider factors beyond just age and health history. They may take into account your lifestyle choices, such as smoking status, exercise habits, and overall wellness. Providing accurate information about these aspects can lead to more favorable rates. For instance, non-smokers or individuals with a history of regular exercise may be offered lower premiums. It's also beneficial to disclose any pre-existing conditions accurately, as this transparency can result in more precise quotes.

Consider Term Life Insurance: Term life insurance is a popular choice for seniors due to its affordability and simplicity. This type of policy provides coverage for a specified term, such as 10, 20, or 30 years, and typically offers lower premiums compared to permanent life insurance. If you have pre-existing conditions, term life insurance can still provide valuable coverage during the years when you need it the most. After the term ends, you can decide whether to renew the policy or explore other options.

Review and Understand Policy Details: When comparing quotes, pay close attention to the policy details. Different insurers may offer varying levels of coverage, benefits, and exclusions. Understand what is covered and what is not to ensure you make an informed decision. Additionally, consider the flexibility of the policy. Some insurers allow policyholders to increase or decrease coverage as their needs change, providing a sense of security for the future.

Seek Professional Advice: Navigating the world of life insurance can be complex, especially when dealing with pre-existing conditions. Consider consulting a licensed insurance agent or broker who specializes in senior coverage. They can provide personalized recommendations, explain policy nuances, and help you find the best fit within your budget. A professional advisor can also assist in understanding the fine print of policies and ensure you are not missing out on any essential benefits.

Stranger-Originated Life Insurance: What You Need to Know

You may want to see also

Term vs. Permanent: Understand the differences and benefits for older adults

When considering life insurance for seniors, it's essential to understand the differences between term and permanent life insurance policies, as each type offers unique advantages and considerations for older adults.

Term Life Insurance:

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. For seniors, this type of policy can be an excellent option for several reasons. Firstly, term life insurance is generally more affordable than permanent policies, making it financially accessible for older individuals who may have limited budgets. The coverage period aligns with the need for insurance during this time, ensuring that beneficiaries are protected without the long-term financial burden. Additionally, term life insurance offers a straightforward and transparent approach, allowing seniors to plan and budget effectively. This policy is ideal for those who want a simple, short-term solution to secure their family's financial future.

Permanent Life Insurance:

Permanent life insurance, on the other hand, provides lifelong coverage and offers several benefits for older adults. This policy builds cash value over time, which can be borrowed against or withdrawn, providing financial flexibility. For seniors, permanent life insurance can be a valuable asset, especially if they wish to leave a legacy or have long-term financial goals. The cash value accumulation can be a significant advantage, allowing policyholders to access funds for various purposes, such as retirement planning or paying for long-term care. Moreover, permanent life insurance ensures that the coverage never expires, providing peace of mind and security for the rest of one's life.

Choosing the Right Option:

For older adults, the decision between term and permanent life insurance depends on individual circumstances and financial goals. Term life insurance is suitable for those seeking affordable, short-term coverage, while permanent life insurance caters to those who want lifelong protection and the potential for long-term financial benefits. It is crucial to assess one's financial situation, future plans, and the level of coverage required before making a decision. Consulting with a financial advisor can provide valuable insights and help seniors choose the best insurance option to meet their needs.

In summary, understanding the differences between term and permanent life insurance is vital for seniors to make informed decisions. Term life insurance offers affordability and simplicity, while permanent life insurance provides lifelong coverage and potential financial advantages. By evaluating their unique circumstances, older adults can select the most appropriate policy to secure their loved ones' futures and achieve their financial objectives.

Life Insurance for Husbands: A Necessary Safety Net?

You may want to see also

Health Considerations: Explore how health impacts senior life insurance choices

When considering life insurance for seniors, health is a critical factor that significantly influences the options available and the overall cost. As individuals age, their health status becomes a primary determinant of insurance eligibility and rates. Insurers often use health assessments to evaluate the risk associated with providing coverage to older adults. This process involves reviewing medical history, current health conditions, and lifestyle factors to determine the likelihood of future claims.

For seniors, pre-existing health conditions can play a pivotal role in shaping their life insurance journey. Chronic illnesses such as heart disease, diabetes, or cancer may lead to higher premiums or even denial of coverage. Insurers might require additional medical information or a comprehensive health evaluation to assess the severity of these conditions and their potential impact on longevity. It is essential for seniors to be transparent about their health history to ensure they receive accurate quotes and suitable coverage options.

Age itself is a significant health consideration. Older individuals generally face higher risks of developing health issues, which can affect their insurance rates. As people age, the likelihood of requiring medical interventions or facing critical illnesses increases. Insurers often use age-based tables to determine the cost of life insurance, with older individuals typically paying more due to the higher statistical risk. However, it's important to note that age is just one factor, and many seniors can still find affordable and comprehensive coverage by maintaining good health and managing pre-existing conditions effectively.

Lifestyle choices also come into play when assessing the health of seniors. Smoking, excessive alcohol consumption, and a sedentary lifestyle can negatively impact health and, consequently, life insurance rates. Insurers may offer discounts or better rates to non-smokers and individuals with healthy habits, as these factors contribute to reduced risk. Encouraging seniors to adopt a healthier lifestyle can not only improve their overall well-being but also make them more attractive candidates for life insurance.

In summary, health considerations are vital when exploring life insurance options for seniors. Understanding how health conditions, age, and lifestyle choices influence insurance rates and eligibility is essential for making informed decisions. By being proactive about health management and disclosing relevant medical information, seniors can navigate the process more effectively and secure suitable life insurance coverage tailored to their needs.

Federal Life Insurance: Permanent or Term?

You may want to see also

Financial Planning: Learn how life insurance fits into retirement planning for seniors

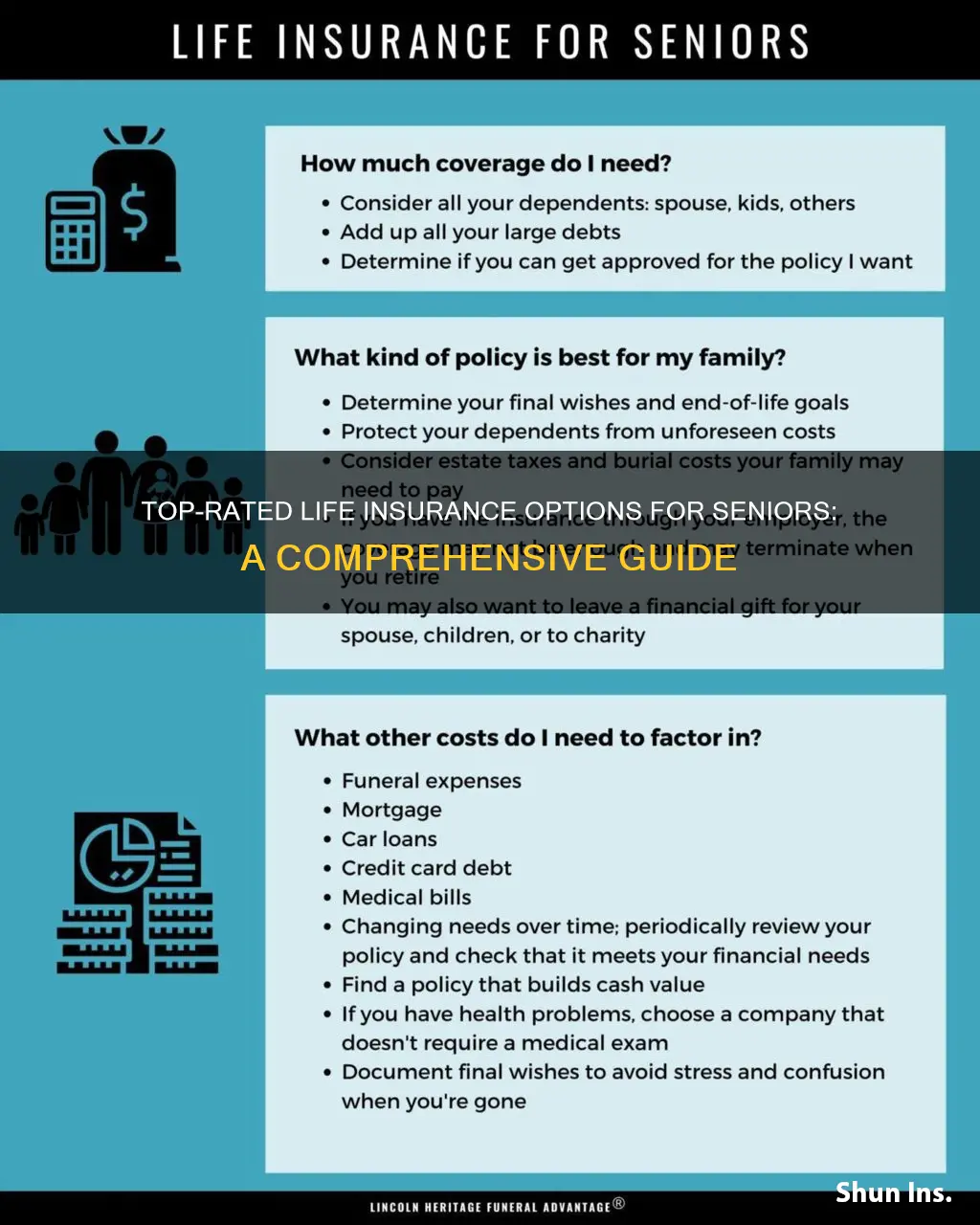

Life insurance is an essential component of financial planning, especially for seniors, as it provides a safety net and peace of mind during a critical life stage. When considering retirement planning, seniors often have unique financial goals and concerns, and life insurance can play a pivotal role in addressing these. Here's how it fits into the retirement strategy for older adults:

Income Replacement: One of the primary purposes of life insurance for seniors is to provide financial security. As individuals age, they may have reduced income sources, especially if they are no longer working. Term life insurance, which offers coverage for a specified period, can be an excellent solution. It ensures that a regular income is available to cover essential expenses, such as living costs, medical bills, or any other financial commitments, providing a safety net during retirement. This is particularly crucial for those who rely on a fixed income and want to maintain their standard of living.

Debt Management: Many seniors have accumulated debts over their working years, such as mortgages, loans, or credit card balances. Life insurance proceeds can be utilized to settle these debts, ensuring that beneficiaries are not burdened with financial obligations after the insured's passing. By doing so, life insurance can help protect the value of the estate and provide a more secure financial future for the retiree's loved ones.

Long-Term Care Costs: Retirement planning often involves considering the potential costs of long-term care. As seniors age, the need for medical care and assistance may increase. Life insurance can be structured to provide a lump sum payment upon the insured's death, which can be used to cover long-term care expenses. This is especially valuable as it can help preserve assets and ensure that the retiree's savings are not depleted prematurely.

Legacy Planning: For those who wish to leave a financial legacy for their children, grandchildren, or favorite charities, life insurance can be a powerful tool. The death benefit can be designated to provide a tax-free inheritance, ensuring that the insured's hard-earned wealth is passed on according to their wishes. This aspect of life insurance is often overlooked but can be a significant part of a comprehensive retirement strategy.

Incorporating life insurance into retirement planning allows seniors to address financial concerns, protect their loved ones, and ensure a more secure future. It provides flexibility in terms of coverage duration and amount, allowing individuals to tailor the policy to their specific needs. When considering life insurance, seniors should explore various options, compare policies, and seek professional advice to make informed decisions that align with their retirement goals.

Understanding Standard Life Insurance: A Comprehensive Guide

You may want to see also

Customer Reviews: Read reviews to find the most highly-rated policies for seniors

When it comes to finding the best life insurance for seniors, customer reviews can be an invaluable resource. As we age, our health and financial situations may change, making it crucial to choose a policy that suits our specific needs. Reading reviews from other seniors can provide insights into the benefits, coverage options, and overall satisfaction with different insurance providers.

Start by searching for reputable review platforms or websites that aggregate customer feedback for life insurance companies. Look for sites that specifically cater to senior citizens or have a dedicated section for this demographic. These platforms often provide a comprehensive overview of various policies, allowing you to compare different companies and their offerings. You can find detailed reviews that highlight the pros and cons of each policy, including coverage amounts, premium costs, and the ease of the application process.

Pay close attention to the experiences shared by seniors who have already enrolled in these policies. Their insights can reveal how well the insurance company handles claims, the responsiveness of customer support, and the overall value for money. Look for patterns in the reviews; for example, multiple positive comments about a company's customer service could indicate a reliable and supportive provider. Similarly, consistent complaints about delayed payments or complicated claim processes might be a red flag.

Additionally, consider the specific needs of seniors when reading reviews. For instance, some seniors might prioritize coverage for pre-existing conditions or critical illnesses, while others may focus on the flexibility to adjust their policy as their health changes over time. By understanding these preferences, you can narrow down the options and find policies that align with the priorities of older adults.

Remember, customer reviews should be considered alongside other factors such as financial stability, medical underwriting, and policy terms. While positive reviews can guide your decision, it's essential to conduct thorough research and, if possible, consult with insurance professionals who can provide personalized advice based on your unique circumstances.

National Life Insurance: Beneficiaries Check-In Guide

You may want to see also

Frequently asked questions

For seniors, the most suitable type of life insurance is typically a guaranteed acceptance life insurance or a whole life insurance. These policies are designed for individuals who may have health issues or are considered high-risk by traditional insurers. They offer guaranteed acceptance, meaning no medical exam is required, and provide coverage regardless of the applicant's health status.

Qualification criteria for senior life insurance can vary. Typically, insurers consider factors such as age, health, smoking status, and medical history. Seniors with pre-existing conditions or those who have smoked heavily in the past may face higher premiums or limited coverage options. It's best to compare quotes from multiple insurers to find the best rates and coverage for your specific needs.

Yes, there are several benefits. Life insurance can provide financial security for your loved ones in the event of your passing. It can help cover expenses like funeral costs, outstanding debts, mortgage payments, or daily living expenses. Additionally, some policies offer a guaranteed death benefit, ensuring a fixed payout to beneficiaries.

Yes, many insurers offer medical exam waivers for seniors. This means you can qualify for coverage without undergoing a traditional medical examination. Instead, you may be asked to provide health information and answer health-related questions on an application form. This process is often quicker and more convenient for seniors who may have difficulty with a physical exam.

When comparing policies, consider factors such as the insurer's reputation, financial strength, and customer reviews. Look for policies with clear terms and conditions, and ensure you understand the coverage, exclusions, and any potential waiting periods. It's also beneficial to compare premiums, as rates can vary significantly between insurers.