Term life insurance is a valuable financial tool that provides coverage for a specific period, offering peace of mind and financial security to individuals and their loved ones. However, there may be instances when you consider canceling your term life insurance policy. Before making a decision, it's crucial to carefully evaluate several factors. Firstly, assess your current financial situation and determine if maintaining the policy is still beneficial. Consider your remaining term and whether you have other forms of coverage that could fill the gap. Additionally, review the policy's terms and conditions to understand any potential penalties or fees associated with cancellation. It's essential to weigh the reasons for cancellation against the long-term benefits of the policy, ensuring that you make an informed decision that aligns with your financial goals and circumstances.

| Characteristics | Values |

|---|---|

| Financial Needs | Assess your current and future financial obligations. Consider if you have dependents or a spouse who relies on your income. Ensure you have other financial resources in place to cover these expenses if you cancel the policy. |

| Health and Lifestyle | Evaluate your health and any recent changes in lifestyle. Term life insurance rates may be affected by your medical history, smoking status, occupation, and hobbies. If your health has improved or your lifestyle has changed, it might be worth reviewing the policy. |

| Alternative Coverage | Research and compare other insurance options that might better suit your needs. For example, permanent life insurance or universal life insurance could provide long-term coverage and potential investment benefits. |

| Policy Terms | Understand the terms of your current policy, including the duration of the term and any conversion options. Consider if extending the term or converting to a permanent policy is a better option. |

| Premiums and Costs | Calculate the total cost of the policy over its term, including any potential increases in premiums. Compare this to the cost of maintaining the policy versus the benefits you receive. |

| Tax Implications | Be aware of any tax consequences related to life insurance. In some cases, canceling a policy may result in a taxable event, especially if you have a cash value component. Consult a tax advisor for personalized advice. |

| Alternative Uses | Explore other financial instruments or savings plans that could serve similar purposes, such as building an emergency fund or investing in stocks/bonds. |

| Future Plans | Consider your long-term goals and plans. If you have a significant life event, such as getting married, having children, or buying a home, your insurance needs may change, and canceling the policy might not be the best decision. |

| Professional Advice | Consult a financial advisor or insurance specialist who can provide tailored advice based on your specific circumstances. They can help you navigate the complexities and make an informed decision. |

What You'll Learn

- Financial Impact: Understand the financial consequences of canceling your policy, including any penalties or loss of coverage

- Alternative Options: Explore alternative insurance plans that might better suit your current needs and financial situation

- Health Changes: Consider recent health changes that may affect your eligibility for other insurance types

- Family Needs: Evaluate how canceling insurance would impact your family's financial security and coverage needs

- Long-Term Goals: Assess how canceling insurance aligns with your long-term financial goals and retirement planning

Financial Impact: Understand the financial consequences of canceling your policy, including any penalties or loss of coverage

Canceling a term life insurance policy can have significant financial implications, and it's crucial to understand these consequences before making a decision. One of the primary financial considerations is the potential loss of coverage. Term life insurance provides a specified death benefit, which is a lump sum amount paid to your beneficiaries upon your passing. If you cancel the policy, you risk losing this coverage entirely, leaving your loved ones without the financial support they may have relied on. This is especially critical if you have dependents or financial obligations that the policy was designed to secure.

In addition to the loss of coverage, canceling a life insurance policy may result in penalties or fees. Insurance companies often charge a surrender charge or a penalty fee when a policy is canceled within a certain period, typically the first few years of the policy's term. These charges can vary depending on the insurance provider and the type of policy, but they can be substantial. For instance, some policies may have a surrender charge of 10% of the initial premium paid, or even higher, during the first few years. These fees are designed to compensate the insurance company for the potential loss of future premiums and the administrative costs associated with issuing the policy.

Another financial impact to consider is the potential opportunity cost of canceling the policy. Term life insurance is generally a low-cost form of coverage, especially for younger individuals with good health. By canceling the policy, you might be forgoing the potential long-term savings that could have been accumulated through the accumulation or investment components of certain life insurance policies. Over time, the cash value of a policy can grow, providing a tax-free source of funds that can be borrowed against or withdrawn. Canceling the policy means losing out on this potential financial benefit.

Furthermore, canceling a term life insurance policy may also affect your overall financial planning and risk management strategy. Life insurance is a critical component of financial planning, providing a safety net for your loved ones and helping to manage financial risks. If you cancel the policy, you might need to reconsider your overall insurance needs and potentially seek alternative coverage, which could be more expensive or less comprehensive. It's essential to evaluate your financial situation and goals to determine if canceling the policy aligns with your long-term financial plans.

Before making a decision, it's advisable to carefully review your policy documents and consult with a financial advisor or insurance professional. They can provide personalized advice based on your specific circumstances, helping you understand the financial implications and explore alternative options if canceling the policy is still deemed necessary. Understanding the financial consequences is a critical step in making an informed decision about your term life insurance.

Life Insurance Options for Pre-Existing Conditions: Finding Affordable Coverage

You may want to see also

Alternative Options: Explore alternative insurance plans that might better suit your current needs and financial situation

When considering whether to cancel your term life insurance, it's crucial to explore alternative options that might better align with your current needs and financial situation. Term life insurance provides a specific level of coverage for a defined period, and while it can be a valuable financial tool, it may not always be the best fit for every individual. Here are some alternative insurance plans to consider:

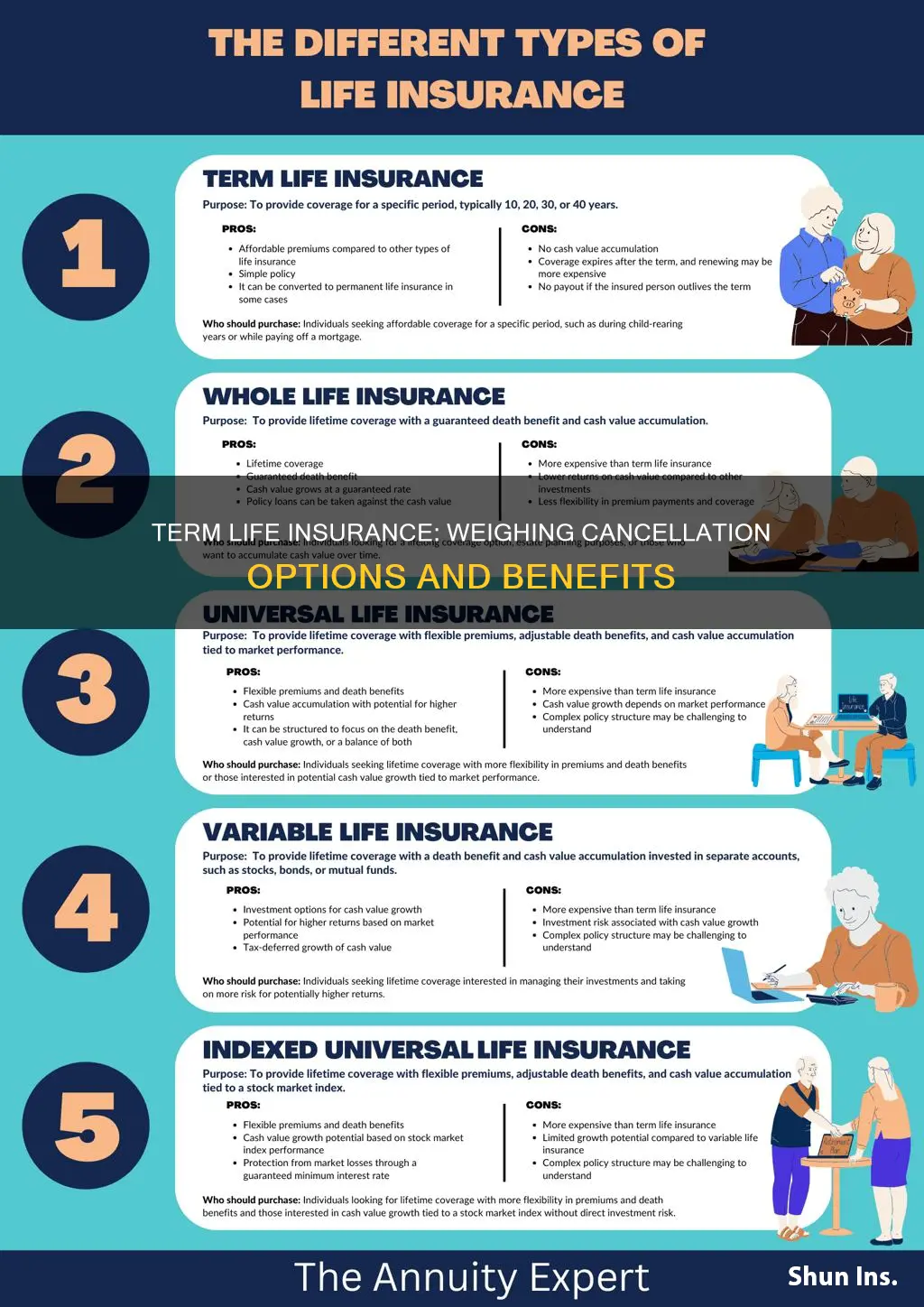

- Permanent Life Insurance: This type of insurance offers lifelong coverage and provides a cash value component that can accumulate over time. Unlike term life, permanent life insurance remains in force as long as premiums are paid. It offers flexibility in terms of coverage and can be tailored to your specific needs. With permanent life insurance, you have the option to build cash value, which can be borrowed against or withdrawn, providing financial security and potential tax advantages. This option is ideal for those seeking long-term financial protection and a more permanent solution.

- Universal Life Insurance: Universal life insurance combines the coverage of permanent life insurance with the flexibility of adjustable premiums. It allows you to customize your coverage and adjust the death benefit and premium payments according to your changing financial circumstances. The cash value component of universal life insurance can grow tax-deferred, providing a valuable asset that can be used for various financial goals. This plan is suitable for individuals who want a more adaptable and personalized insurance solution.

- Whole Life Insurance: Similar to permanent life insurance, whole life insurance provides lifelong coverage with a fixed premium. The primary difference is that the death benefit and premiums remain constant throughout the policy's term. Whole life insurance also builds cash value, which can be borrowed against or withdrawn. This option offers stability and predictability, ensuring that your loved ones will receive the intended financial benefit. It is a good choice for those seeking long-term financial security and a consistent insurance plan.

- Critical Illness Insurance: If your primary concern is the financial impact of a critical illness, this type of insurance can provide a lump-sum payment upon diagnosis. It complements your existing life insurance by offering additional financial support during a challenging time. Critical illness insurance can be tailored to your specific needs and may be more affordable for individuals with specific health concerns. This option ensures that you have dedicated funds to cover medical expenses and other related costs, providing peace of mind.

Exploring these alternative insurance plans can help you make an informed decision about your life insurance coverage. It's essential to assess your financial goals, risk tolerance, and long-term plans to determine the most suitable insurance option. Consulting with a financial advisor or insurance professional can provide valuable guidance in navigating these alternatives and ensuring you make the best choice for your unique circumstances.

Life Insurance Cash Redemptions: Michigan's Tax Implications Explained

You may want to see also

Health Changes: Consider recent health changes that may affect your eligibility for other insurance types

When contemplating the cancellation of your term life insurance, it's crucial to consider how recent health changes might impact your future insurance needs and options. Term life insurance is a valuable financial tool that provides coverage for a specified period, and understanding the implications of any health-related developments is essential before making a decision.

One significant health consideration is the occurrence of any new medical conditions or diagnoses. If you have recently been diagnosed with a chronic illness or a serious health issue, it could affect your eligibility for future insurance policies. Insurance companies often assess the risk associated with an individual's health history, and a new medical condition might lead to higher premiums or even denial of coverage. For instance, if you've developed a heart condition, diabetes, or a severe allergy, these could impact your ability to secure comprehensive health insurance or life insurance in the future.

Additionally, changes in your overall health and lifestyle can play a role. Have you recently undergone a significant weight loss or gain? Have you made substantial changes to your diet or exercise routine? These factors can influence your health status and, consequently, your insurance prospects. For example, a dramatic weight loss might indicate a successful health transformation, which could be viewed favorably by insurers. Conversely, a sudden weight gain or significant lifestyle changes might raise concerns about potential health risks.

Furthermore, it's important to consider the timing of these health changes. If you've recently experienced a health scare or a minor medical issue, it might be wise to reassess your insurance needs before making any hasty decisions. Insurance companies often require a waiting period before they can adjust premiums or deny coverage based on new health information. During this time, you can monitor your health and make informed choices.

In summary, when evaluating the impact of health changes on your decision to cancel term life insurance, it's crucial to consider recent diagnoses, overall health transformations, and the timing of these changes. Being proactive in understanding how these factors might influence your insurance eligibility can help you make a well-informed decision regarding your long-term financial security.

Canada's Top Life Insurance: Find the Best Fit for You

You may want to see also

Family Needs: Evaluate how canceling insurance would impact your family's financial security and coverage needs

When considering the cancellation of your term life insurance, it is crucial to evaluate its impact on your family's financial security and coverage needs. Term life insurance provides a safety net for your loved ones, ensuring they are financially protected in the event of your untimely passing. Here's a detailed breakdown of how to approach this evaluation:

Assess Family Financial Situation: Begin by understanding your family's current financial landscape. Calculate your family's total monthly expenses, including housing, utilities, groceries, transportation, and any other regular outgoings. Also, consider one-time expenses, such as education fees or medical bills, that may arise in the future. This comprehensive view will help you determine the potential financial strain if your insurance coverage were to lapse.

Identify Dependents and Their Needs: Make a list of all family members who depend on your income. This includes children, spouse, or any other relatives who rely on your financial support. Consider their short-term and long-term needs. For instance, if your children have upcoming college expenses or if your spouse is a stay-at-home parent, these factors will influence the decision-making process.

Evaluate the Impact of Loss: Think about the potential consequences of canceling the insurance. If you were to pass away, how would your family's financial situation change? Could they afford their living expenses? Would they be able to maintain their standard of living? It's essential to consider the emotional and financial burden that your family might face without the insurance payout.

Explore Alternative Sources of Income: Research and explore alternative sources of income that could potentially replace the insurance coverage. This might include savings, investments, or other financial assets. However, be cautious and realistic in your assessment, as relying solely on these alternatives may not provide the same level of financial security as the insurance policy.

Consider Long-Term Goals: Reflect on your family's long-term goals and aspirations. Are there any significant milestones or plans that the insurance policy helps secure? For example, funding your child's education or ensuring a comfortable retirement for your spouse. By understanding these goals, you can make an informed decision about whether canceling the insurance would hinder or support your family's future prospects.

In summary, evaluating the impact of canceling term life insurance on your family's financial security and coverage needs is a critical step in the decision-making process. It requires a thorough understanding of your family's financial situation, the needs of your dependents, and the potential consequences of a loss. By carefully considering these factors, you can make an informed choice that best serves the well-being of your loved ones.

Therapy and Life Insurance: What's the Connection?

You may want to see also

Long-Term Goals: Assess how canceling insurance aligns with your long-term financial goals and retirement planning

When contemplating the cancellation of your term life insurance, it's crucial to consider its long-term implications, especially in the context of your financial goals and retirement planning. Term life insurance provides a safety net for your loved ones in the event of your untimely demise, ensuring financial security during their most vulnerable years. Before making a decision, it's essential to evaluate how this insurance fits into your broader financial strategy.

One key aspect to consider is the role of life insurance in your retirement planning. As you age, the value of life insurance may diminish, and other forms of coverage might become more suitable. For instance, if you've reached a stage in life where your children are financially independent and your mortgage is paid off, the need for a substantial death benefit may decrease. In such cases, canceling the policy could result in significant savings, which could be redirected towards other financial goals, like investing for retirement or funding a comfortable retirement lifestyle.

Additionally, assess your long-term financial objectives. If you're planning to retire early or pursue a significant financial goal, such as purchasing a second home or starting a business, the funds saved from canceling insurance could be allocated to these endeavors. However, it's important to weigh the potential benefits against the loss of the insurance's financial security. Consider consulting a financial advisor to explore alternative investment options that could provide similar long-term benefits.

Furthermore, evaluate your current financial situation and future projections. If you've recently experienced a significant life event, such as a job change or a major purchase, it might be worth reassessing your insurance needs. For instance, if you've taken on more personal debt or have a growing family, the insurance might still be essential. Conversely, if your financial situation has improved, and you've built a substantial emergency fund, canceling the insurance could be a strategic move.

In summary, when deciding whether to cancel your term life insurance, it's imperative to align your decision with your long-term financial goals and retirement plans. Consider the potential impact on your retirement savings, the financial security of your loved ones, and the availability of alternative financial instruments that can provide similar benefits. A comprehensive evaluation of your personal circumstances will help you make an informed decision that best serves your future financial well-being.

Understanding Life Insurance: The Role of Settlement Options

You may want to see also

Frequently asked questions

Term life insurance provides a financial safety net for your loved ones in the event of your death. Cancelling the policy means you won't have this coverage anymore, and you'll lose the potential financial benefits. It's important to consider if you have any dependents or financial obligations that the policy was designed to cover. If you cancel, you might need to explore other options to ensure your family's financial security.

Yes, insurance companies often have cancellation policies in place. When you cancel a term life insurance policy, you may be subject to penalties or fees, especially if you do so during the initial period of the policy. These fees can vary depending on the insurance provider and the type of policy. It's crucial to review the terms and conditions of your specific policy to understand any potential costs associated with cancellation.

Before making a final decision, it's advisable to explore other options. You could consider converting your term life insurance to a permanent policy, which provides lifelong coverage. Alternatively, you might want to review your coverage needs and adjust the policy accordingly, such as increasing or decreasing the death benefit. Additionally, you can look into other insurance products like universal life insurance or whole life insurance, which offer more flexibility and potential long-term benefits.