Can Auto Insurance Companies Use Your Age to Determine Rates?

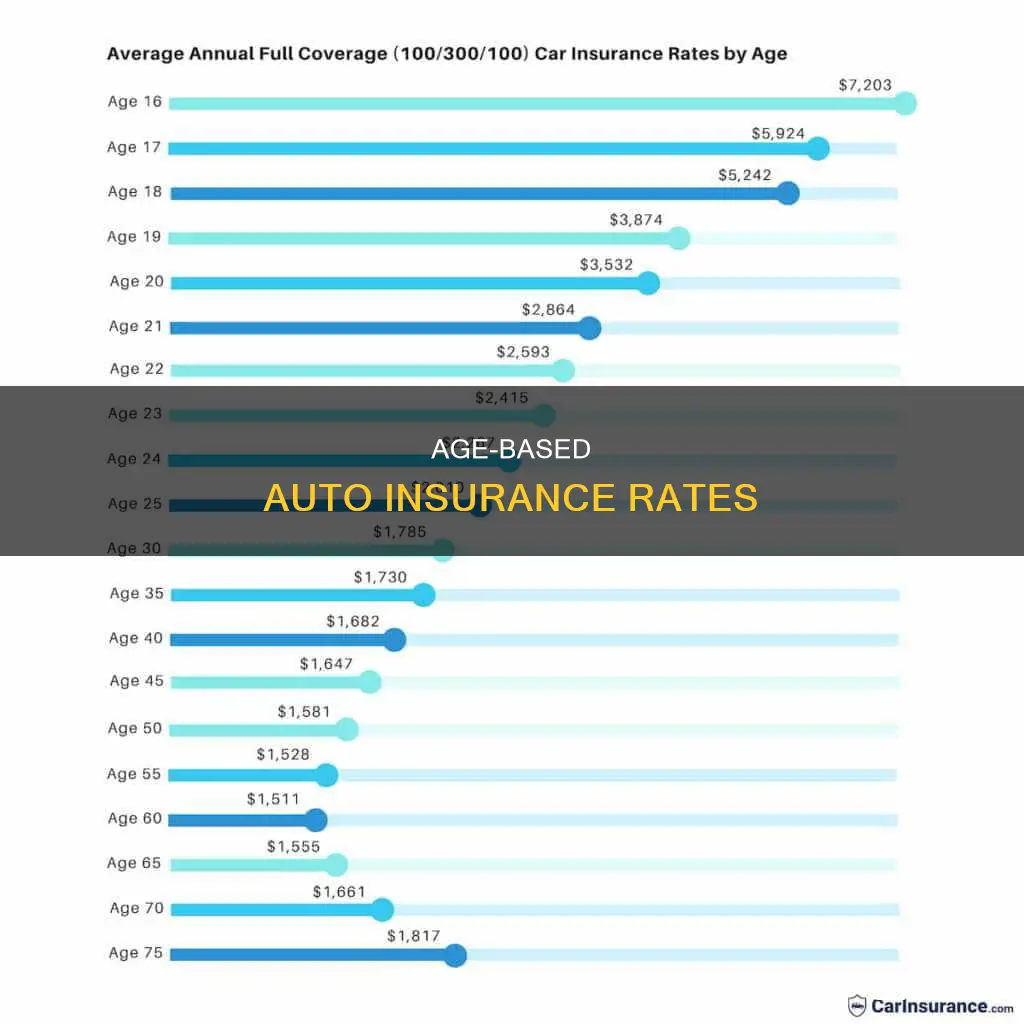

When requesting an auto insurance quote, your age is one of the main factors that insurance companies use to set a coverage rate. Younger drivers are considered a higher risk for accidents and tend to pay more for insurance. This is due to their lack of driving experience, as well as statistical evidence that shows younger drivers are more likely to be involved in accidents.

However, it's important to note that age is not the only factor influencing insurance rates. Other factors such as driving history, vehicle type, location, and gender can also impact the cost of auto insurance.

What You'll Learn

Young drivers pay more

Young drivers are considered a high risk to insure due to their lack of experience on the road. They are more likely to be involved in accidents, which results in higher claim rates. This is supported by statistics, which show that young drivers have a claim rate that is 27% higher than drivers over 25. Additionally, one in five young drivers will have an accident within six months of passing their test.

The increased risk of accidents among young drivers is attributed to factors such as poor hazard assessment, prevalent risk-taking behaviour, and biological and behavioural characteristics of youth. These factors contribute to higher insurance premiums for young drivers, as insurers aim to offset the potential costs of claims.

Another factor that contributes to higher insurance rates for young drivers is their lack of a proven driving record. Insurance companies rely on driving records to assess an individual's driving behaviour and determine their risk level. Without a substantial driving history, insurers cannot accurately judge the driving behaviour of young drivers, which further reinforces their perception of young drivers as high-risk.

Furthermore, young drivers tend to have lower credit scores, which is also considered when determining insurance rates. Lower credit scores are associated with a higher likelihood of filing insurance claims. However, it is important to note that some states, such as California, Hawaii, Maryland, and Massachusetts, have made it illegal to use credit scores as a factor in determining insurance rates.

While it may seem unfair for young drivers to pay more for car insurance, it is important to understand that insurance companies base their rates on statistical data and risk assessment. Young drivers can take steps to mitigate these costs by maintaining a clean driving record, taking advantage of good student discounts, and comparing quotes from different insurance providers.

Auto Insurance: Family and Friends Covered?

You may want to see also

Older drivers pay less

Age is one of the most important factors that insurance companies consider when determining car insurance rates. While younger drivers tend to pay more for car insurance, older drivers are seen as less of a risk and, therefore, pay less.

Drivers under the age of 25 tend to pay the highest car insurance rates. This is because younger drivers have less experience and are more likely to cause accidents. According to the Insurance Institute for Highway Safety, drivers aged 16 to 19 are four times more likely to be involved in car accidents than older drivers. As a result, insurance companies view teens as a higher risk and charge higher premiums to offset the potential costs of claims.

However, as drivers gain more experience and enter their mid-30s to late 50s, their insurance rates typically decrease. Insurance companies consider drivers in this age range to be safer due to their increased practice and road maturity.

While rates generally continue to decrease as drivers age, there is a point where they begin to rise again. This typically occurs after the age of 60 or 65. This is because older drivers are seen as riskier to insure due to age-related changes in health, such as hearing or vision loss, slower reflexes, and overall health concerns. Statistics show that seniors are more accident-prone than younger and middle-aged drivers, resulting in larger insurance claims.

It's important to note that insurance rates for older drivers can also vary based on other factors, such as driving record, location, and the type of car they drive. Additionally, some states offer discounts for senior drivers who take approved defensive driving courses or have a good driving record.

Overall, while younger drivers pay more for car insurance, older drivers benefit from lower rates due to their experience and safer driving records.

Auto Insurance: Why the Spike?

You may want to see also

Gender affects rates

In most states, gender is used as a factor when determining car insurance premiums. Generally, men are statistically more likely to engage in risky driving behaviour, but this does not automatically mean that men pay more than women for coverage. While the general trend of premiums shows that men pay more than women, this depends on numerous factors.

State

Your location can determine whether your gender will affect your car insurance premium. Currently, seven states do not allow gender to be used as a rating factor: California, Hawaii, Massachusetts, Michigan, Montana, North Carolina and Pennsylvania. In these states, rates for men and women should be roughly equal if all the other rating factors—like vehicle type, driving history, etc.—are the same.

Credit score

In many states, your credit-based insurance score will impact your car insurance premium. So, for example, a male driver with poor credit will probably pay more for car insurance than a male with good credit. On the other hand, a female driver with poor credit could pay more for car insurance than a male driver with great credit. However, this also depends on location. Insurance companies in California, Hawaii, Massachusetts and Michigan are restricted from using credit-based insurance scores as rating factors.

Driving record

Another factor that affects car insurance premiums is driving record. Drivers with a history of accidents, speeding tickets or other traffic violations typically pay the highest rates. For example, a female driver with a DUI or other serious violation will likely pay a higher rate than a male with a clean driving record. Maintaining a good driving record is one of the best ways to get a low rate for both males and females.

Statistics

Statistics show that crash and claims histories differ by gender. Young and older males tend to have more accidents and thus pay higher rates. Men are also more likely to drive a car that’s more costly to insure.

Insurance company

Some insurers don’t recognise gender differences and offer the same rates regardless of gender but vary them based on age. Other insurers, like State Farm, have rate differences by gender only for some ages.

Age

Male drivers often pay more for car insurance in comparison to female drivers, but there are exceptions. Rates fluctuate based on age, as well as the insurance company. Female drivers from age 16 to 24 pay, on average, between $500 and $800 a year less for car insurance compared to their male counterparts. That rate data shows that around age 30, males and females even out, with males even paying a few dollars less at age 40, on average. After age 50, females start again to pay less, but less than $50 annually.

Update Your Vehicle Insurance Name

You may want to see also

Driving experience matters

In general, auto insurance rates decrease as a driver ages, provided they maintain a clean driving record. Drivers in their early 20s will notice a significant reduction in their premiums, and rates will continue to decrease as they gain more experience, provided they drive safely and avoid insurance claims. However, auto insurance rates start to increase again around age 70 due to factors such as vision or hearing loss and slowed response time, which can make seniors more prone to accidents.

The impact of driving experience on insurance rates is particularly notable for young drivers. Teenagers are considered some of the riskiest drivers to insure due to their lack of experience. Statistics show that drivers aged 16 to 19 have a much higher risk of accidents than older drivers. As a result, insurance companies charge higher rates to young drivers to offset the higher costs associated with claims from this age group.

While age is a significant factor in determining insurance rates, it is not the only consideration. Other factors, such as driving record, vehicle type, location, and credit score, also play a role in calculating insurance premiums. Additionally, some states, like Massachusetts, have rules against age-based rates, and insurers in these states must rely on other factors, such as driving experience, to set premiums.

It is worth noting that driving experience is closely linked to age, as older drivers tend to have more experience. However, it is possible for younger drivers to build up their driving experience and improve their insurance rates over time by maintaining a clean driving record and avoiding claims.

Full Coverage Auto Insurance: Florida's Definition

You may want to see also

Discounts for young drivers

Young drivers are considered high-risk, and their insurance rates can be high. However, there are ways to secure discounts for them.

Good Student Discounts

Full-time students with good grades can qualify for good student discounts. For example, Allstate offers a discount to unmarried drivers under 25 who have at least a B- average. State Farm offers up to 25% savings for students with good grades up to age 25 or their last year of school. GEICO offers a 15% discount for full-time students with a B average or who are on the dean's list.

Safe Driving Courses

At-fault accidents on a teen's record can significantly increase their insurance rates. Many insurers offer discounts to drivers who complete safe driving courses. Examples of insurers offering such discounts include GEICO, State Farm, Allstate, and Travelers.

Distant Student Discounts

If a young driver moves away for college and leaves their car at home, they may be eligible for a distant student discount. This discount is offered by insurers such as GEICO and State Farm.

Telematics Programs

Telematics devices monitor driving habits and can help young drivers secure discounts. However, poor driving habits detected by these devices may also lead to increased insurance rates. Examples of insurers offering telematics programs include Progressive, Nationwide, and GEICO.

Choosing the Right Car

The make and model of a vehicle can significantly impact insurance rates. Conventional vehicles tend to have lower insurance costs than high-performance cars. It is recommended to get separate quotes for different vehicles before making a purchase.

Increasing Deductibles

Increasing deductibles can help reduce insurance premiums. However, it is important to weigh the savings against the increased out-of-pocket expenses in the event of a claim.

Dropping Comprehensive and Collision Coverage

For older cars, dropping comprehensive and collision coverage can be considered as these only cover the current value of the car.

Defensive Driving Course Discounts

Taking a state-approved defensive driving course can help lower insurance rates by improving driving skills and reducing risk. Eligibility for these discounts depends on age and state, so it is important to check the requirements before enrolling.

Driver's Training Discounts

Insurers like GEICO and State Farm offer discounts for students who complete driver's training programs.

Bundling Policies

Bundling multiple policies, such as car insurance and home insurance, with the same insurer can often lead to discounts.

While young drivers may face higher insurance rates due to their lack of experience, taking advantage of these discounts can help mitigate the costs. It is important to compare quotes from multiple insurers and explore all available discount options to find the best rates.

Behavioral Factors: Auto Insurance Premiums

You may want to see also

Frequently asked questions

Age is one of the biggest factors in determining car insurance rates. Younger drivers are considered high-risk due to their lack of experience and increased likelihood of accidents, and so pay more for coverage. Insurance rates decrease as drivers age and gain more experience, but they begin to increase again for senior citizens, who are more likely to be involved in accidents due to factors such as deteriorating vision and reaction times.

Yes, Hawaii and Massachusetts ban the use of age as a rating factor. However, Michigan factors in years of driving experience, so younger drivers may still face higher premiums on average.

Age is a more significant factor than location, vehicle type, gender, credit score, and marital status. However, a person's driving record affects their car insurance rates more than their age does.

Young drivers can save on auto insurance by shopping for rates with different companies, signing up for a policy with a parent or experienced driver, and looking for insurers that offer discounts for good grades, driver training, and other factors.