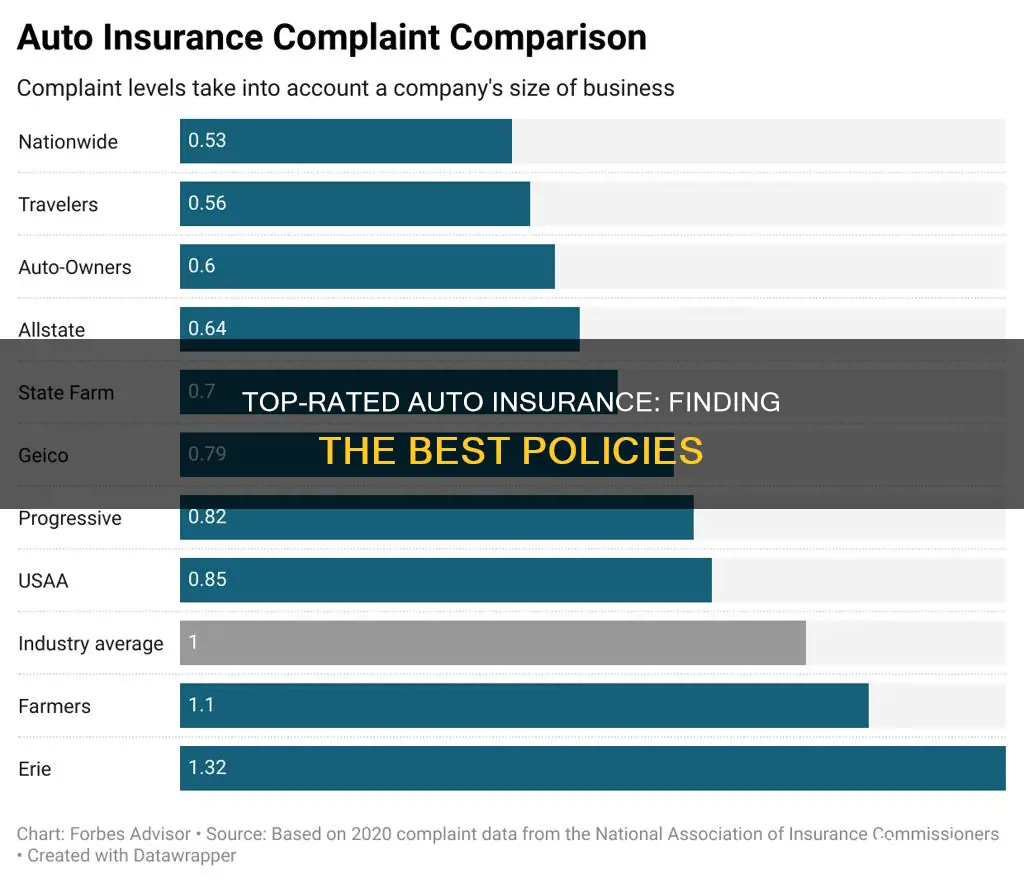

There are many auto insurance companies to choose from, and the best one for you will depend on your personal needs and circumstances. Some of the best-rated auto insurance companies include:

- USAA

- Auto-Owners

- Nationwide

- State Farm

- Geico

- Erie

- Progressive

- American Family

- Travelers

- NJM

- Amica

| Characteristics | Values |

|---|---|

| Company | USAA, Auto-Owners, Nationwide, State Farm, Geico, American Family, Progressive, Erie, Allstate, Travelers, NJM, Amica, Farmers, Liberty Mutual, North Carolina Farm Bureau |

| Availability | All 50 states and Washington, D.C. |

| Annual Premium | $1,335 - $3,374 |

| Customer Satisfaction | High |

| Claims Handling | High |

| Discounts | Yes |

Discounts

Driver History Discounts

If you have a clean driving record, free of any accidents or traffic violations, you may qualify for a "good driver" discount. Most insurance companies offer this discount if you have had no incidents in the past three to five years. Defensive driving course completion can also earn you a discount.

Affiliation Discounts

Your job, school, or club memberships can sometimes get you a discount. For example, being an alumni of certain universities or a member of professional organizations may qualify you for a discount. Military personnel, veterans, and their families often receive discounts as well.

Vehicle-Related Features Discounts

Insuring a new car, a car with safety features, or an environmentally friendly vehicle may qualify you for a discount. Anti-theft devices, anti-lock brakes, airbags, and daytime running lights are all safety features that can help lower your insurance rates.

Personal Traits Discounts

Full-time students with good grades may be eligible for a discount, usually requiring a B average or higher. Homeowners may also receive a discount, even if they don't buy homeowners insurance from their auto insurance provider.

Customer Loyalty Discounts

Insurers often reward loyal customers with discounts. This could include customers who have multiple policies or vehicles insured with the same company or those who have been with the company for a long time.

Policy-Related Discounts

You can also get discounts based on how you buy and pay for your policy. Switching to automatic payments, paying your premium in full upfront, or choosing electronic billing can all result in savings. Shopping for insurance early, before your current policy expires, may also earn you a discount.

Usaa: Commercial Auto Insurance Coverage

You may want to see also

Customer satisfaction

USAA

USAA is a highly rated insurance company in terms of customer satisfaction. It is the only company to receive five stars out of five from NerdWallet, and it also ranks highly in other sources. USAA is available only to current and former military members and their families, however.

Auto-Owners

Auto-Owners Insurance is available in 26 states and receives high ratings for customer satisfaction from multiple sources. It also ranks highly for financial strength and has a low number of customer complaints.

Erie Insurance

Erie Insurance is available in 12 states and Washington, D.C. It is rated the best auto insurance company for customer satisfaction by The Motley Fool and is also rated highly by NerdWallet and Insure.com.

State Farm

State Farm is a large national insurer that is available in every state except Massachusetts and Rhode Island. It is rated highly for customer satisfaction by The Motley Fool, NerdWallet, and Insure.com.

Amica

Amica is available in all states except Hawaii. It is rated highly for customer satisfaction by The Motley Fool, Bankrate, and Insure.com.

The Hartford

The Hartford is rated highly for customer satisfaction by The Motley Fool. Its auto insurance policies are available only to drivers over 50, and members of AARP.

Other Mentions

Other companies that are rated highly for customer satisfaction by at least one source include:

- Wawanesa

- Farm Bureau Insurance

- NJM

- American Family

- Geico

- Nationwide

- Progressive

- Allstate

- Farmers

- Mercury Insurance

- CSAA Insurance Group

- Auto Club of Southern California

Auto Insurance: NV vs GA, Who's More Expensive?

You may want to see also

Claims satisfaction

Amica

Amica is highly rated for its claims handling, earning the highest rating in the J.D. Power 2023 U.S. Auto Claims Satisfaction Study. Amica also received high marks for customer satisfaction and has a robust online claim centre. It is available in all states except Hawaii.

State Farm

State Farm received a high score in the J.D. Power 2023 U.S. Auto Claims Satisfaction Study and offers an Easy Claims Centre, allowing customers to file and track accident claims entirely online. State Farm has a large network of local agents for in-person support and is available in all states except Massachusetts and Rhode Island.

NJM

NJM Insurance received the third-best rating in the J.D. Power 2023 U.S. Auto Claims Satisfaction Study and has excellent reviews on Trustpilot. However, its availability is limited to only five states: Connecticut, Maryland, New Jersey, Ohio, and Pennsylvania.

Erie Auto Insurance

Erie Insurance came in second place in the J.D. Power 2023 U.S. Auto Claims Satisfaction Study, with reviewers praising the company's fast claims process and professionalism. Erie also offers up to $500 per pet for veterinary care, making it an excellent choice for pet owners. Erie is available in 12 states and Washington, D.C.

Country Financial

Country Financial ranked fourth in the J.D. Power 2023 Auto Claims Satisfaction Study and is known for its great customer service. However, it is only available in 19 states.

Unraveling the Complexities of Auto Insurance Settlements

You may want to see also

Financial strength

- USAA: USAA has impressive financial strength ratings from Moody's, AM Best and S&P.

- State Farm: State Farm has a superior AM Best financial strength rating.

- Geico: Geico has a strong AM Best financial strength rating.

- Progressive: Progressive has a strong AM Best financial strength rating.

- Auto-Owners: Auto-Owners has a strong AM Best financial strength rating.

- Amica: Amica offers the option to buy a dividend-paying policy, which can save money in the long run.

- Nationwide: Nationwide has a strong AM Best financial strength rating.

- Travelers: Travelers has a superior AM Best financial strength rating.

- American Family: American Family has a wide range of insurance discounts and receives fewer consumer complaints than expected for a company of its size.

- Safeco: Safeco has a lower AM Best rating compared to other major carriers.

- Liberty Mutual: Liberty Mutual has a strong AM Best financial strength rating.

Farm Bureau's Gap Insurance: What You Need to Know

You may want to see also

Affordability

- Cost-Effective Options: When assessing affordability, it's essential to consider the cost-effectiveness of the insurance plan. This involves evaluating the coverage provided and the associated price. The best-rated auto insurance options should offer a balance between comprehensive coverage and reasonable pricing.

- Discounts and Promotions: Many auto insurance companies provide discounts and promotional offers to make their plans more affordable. These can include discounts for safe driving, bundling policies, insuring multiple vehicles, or being a loyal customer. When considering affordability, it's important to factor in any applicable discounts that can reduce the overall cost of the insurance plan.

- Comparison Shopping: To determine the most affordable option, it's recommended to compare quotes from multiple insurance providers. By obtaining quotes from different companies, individuals can assess the coverage and price differences, helping them identify the most cost-effective option for their needs.

- Customizable Coverage: Some insurance companies allow customers to customize their coverage. This flexibility can make auto insurance more affordable by enabling individuals to select only the coverage they need. For example, if an individual doesn't require rental car coverage or roadside assistance, they can opt-out of those add-ons to lower their premium.

- Customer Satisfaction: While affordability is crucial, it's also important to consider customer satisfaction. The best-rated auto insurance companies should strive to provide value for money by offering competitive rates, reliable coverage, and excellent customer service. Customer reviews and ratings can provide insights into how satisfied customers are with the affordability and overall experience of a particular insurance provider.

Capital One: Gap Insurance Coverage

You may want to see also

Frequently asked questions

The best-rated auto insurance companies include USAA, Auto-Owners, Geico, Erie, Progressive, American Family, and State Farm.

To find the best auto insurance for you, consider your top priorities, whether it's low cost, superior customer service, or something else. Shop around for the best policy to suit your needs.

The cost of car insurance is influenced by factors such as your age, location, vehicle, driving history, and the insurance company you choose.

There are several types of car insurance, including liability coverage, collision coverage, comprehensive coverage, personal injury protection, and uninsured motorist coverage.

The amount of car insurance you need depends on your state's minimum requirements, your lender or lessor requirements, and your personal needs.