Life insurance is a financial tool that can be used to provide for your loved ones after you pass away. It is a contract between you and an insurance company, where the company agrees to pay a specified amount, also known as a death benefit, to your chosen beneficiaries after your death, as long as the premiums are paid. The premiums are usually paid monthly and can start from as little as £5 per month. The cost of your premium will depend on the level of cover you choose and your personal circumstances, such as your age, gender, and health. Affordability is an important consideration when deciding on life insurance, as you need to ensure that you can continue paying the premiums to maintain coverage.

| Characteristics | Values |

|---|---|

| Purpose | Provide financial protection for your loved ones in the event of your death |

| Who needs it? | Those with people depending on them for financial support, e.g., married couples, common-law partners, parents |

| Who might not need it? | Those without dependents, beneficiaries, or large debts |

| Factors to consider | Income, debts, mortgage, education expenses, age, health, policy length, number of dependents, etc. |

| Calculating coverage | Multiplying income by 10-15, DIME method (Debt, Income, Mortgage, Education), adding financial obligations and assets |

| Affordability | Depends on monthly budget; shorter terms or lower coverage can reduce costs |

What You'll Learn

How much life insurance do I need?

When deciding how much life insurance you need, it's important to consider your financial obligations and resources. You want to ensure that your loved ones will have enough financial support to maintain their standard of living if something happens to you. Here are some factors to help you determine the appropriate amount of life insurance coverage:

Financial Obligations:

- Income replacement: Consider the number of years you want to replace your income and multiply it by your annual salary.

- Mortgage balance: Include the remaining amount on your mortgage to ensure your family can stay in their home.

- Future needs: Consider college fees for your children and funeral costs.

- Stay-at-home parent: Calculate the cost of replacing services provided by a stay-at-home parent, such as childcare.

Subtract Liquid Assets:

- Savings: Deduct your savings and investments from the total amount of financial obligations.

- Existing college funds: If you have already saved for your children's education, subtract that amount.

- Current life insurance policies: Take into account any existing life insurance coverage you may have.

Use a Life Insurance Calculator:

You can use an online life insurance calculator to get a more accurate estimate of your coverage needs. These calculators consider various factors, including your income, debts, and future expenses.

Consider Different Methods:

- Multiply your income by 10: This rule of thumb suggests purchasing life insurance worth 10 times your annual income. However, it may not provide a comprehensive assessment of your family's needs and doesn't account for your savings or existing policies.

- DIME method: This method considers Debt, Income, Mortgage, and Education. It provides a more detailed analysis of your financial situation but may not factor in your existing resources adequately.

Remember, the amount of life insurance you need depends on your unique circumstances, including your age, family situation, debts, and financial goals. It's essential to review your coverage periodically as your life changes to ensure your loved ones are adequately protected.

Life Insurance Benefits: Taxable Income or Not?

You may want to see also

What is life insurance used for?

Life insurance is used to provide financial security for your loved ones in the event of your death. It can help your family maintain their standard of living, pay off any debts you may have, and cover living expenses. It can also provide peace of mind, knowing that your loved ones will be taken care of financially.

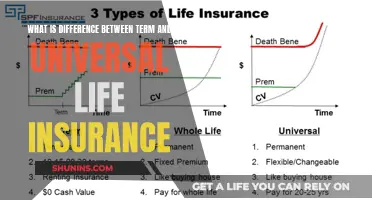

There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance covers you for a set number of years, while permanent life insurance covers you for your whole life. The cost of life insurance depends on various factors, including the level of coverage selected and your personal circumstances.

When choosing a life insurance policy, it is important to consider your budget and how much coverage you need. You may also want to think about any additional features or coverage you may want through life insurance riders.

Life insurance can be used to replace lost income, especially if you are the primary breadwinner in your family. It can help your loved ones cover expenses such as childcare, health care, and education costs. Additionally, life insurance can be used to pay off any debts or mortgages you may have, ensuring that your family is not burdened with these financial obligations.

Another use of life insurance is to provide a legacy or inheritance for your loved ones. This can be in the form of a lump-sum payment or ongoing financial support. Life insurance can also be used to cover final expenses, such as funeral and burial costs, ensuring that your family does not have to bear these expenses.

Coronavirus: Life Insurance Impact and Your Coverage

You may want to see also

How much is life insurance going to cost me?

The cost of life insurance depends on several factors, including your age, gender, health, coverage amount, and policy length. The younger and healthier you are, the less you will pay for premiums.

Term life insurance is the most popular and affordable option for most individuals. It provides financial coverage for your beneficiaries over a specific period, such as until your mortgage is paid off. The coverage amount can range from $20,000 to $10 million, with the average life insurance protection per household in Canada being $442,000.

- $21.39/month for a woman

- $30.13/month for a man

Permanent life insurance, on the other hand, covers you for your entire life, so the premiums are higher.

When deciding on the amount of coverage, it is important to consider your overall financial plan, income, and assets. You should also think about your family's current and future expenses, such as mortgage payments, debts, education costs, and daily living expenses.

There are several methods to calculate the appropriate amount of life insurance coverage:

- Multiply your income by 10 to 15: This is a simple rule of thumb that doesn't take into account your family's financial requirements or current assets.

- Use the DIME method (Debt, Income, Mortgage, and Education expenses): This method provides a more accurate calculation by adding up your total debt, income, mortgage, and education expenses. However, it may result in more insurance than you need as it doesn't consider existing financial resources.

- Add up your financial obligations and assets: This comprehensive method involves calculating your current financial obligations, such as income replacement, mortgage balance, and other large debts, and subtracting your existing liquid assets, such as savings and your spouse's income.

It is important to note that life insurance costs can vary based on individual health history, and it is recommended to regularly review your coverage to ensure it aligns with your changing circumstances.

Using Life Insurance: Your Options and Benefits Now

You may want to see also

How to calculate how much life insurance you need

There are several methods to calculate how much life insurance you need. However, it's important to note that not all methods are optimal and may not provide a full financial picture. Here are some ways to estimate your life insurance needs:

Manual Calculation:

You can manually calculate your life insurance needs by using the basic equation:

Financial Obligations - Existing Assets = Life Insurance Need

Financial Obligations:

- Income Replacement: Multiply the salary you want to replace by the number of years. This should cover current and future expenses.

- Mortgage: Include the mortgage balance if you want your family to be able to stay in their home.

- Other Large Debts: Consider any other large debts that your family would struggle to pay off.

- Children's College Tuition: Add tuition costs to ensure your children can go to college.

- Funeral Expenses: Consider whether you want life insurance to cover funeral and final expenses.

Existing Assets:

- Existing Life Insurance: Include any other life insurance policies you already have.

- Savings: Include retirement savings such as a 401(k) plan, unless your beneficiaries want to preserve this money for retirement.

- College 529 Savings: If you have a 529 account for your children, you can subtract it from your life insurance needs.

Life Insurance Calculator:

Another option is to use a life insurance calculator. These calculators take into account various factors, such as your annual income, the number of income-earning years you want to replace, net income of your survivors, investments, savings, number of children, and any one-time expenses like college tuition or charitable donations. While these calculators provide estimates, they don't show the cost of life insurance and may not cover all your unique circumstances.

Multiplying Income by 10:

This rule of thumb suggests multiplying your income by 10 to get an estimate of your life insurance needs. However, this method doesn't consider your family's specific needs, savings, or existing life insurance policies.

DIME Formula:

The DIME formula stands for Debt, Income, Mortgage, and Education. This method provides a more detailed look at your finances:

- Debt and Final Expenses: Calculate your debts, excluding your mortgage, and estimate funeral expenses.

- Income: Multiply your income by the number of years your family would need financial support.

- Mortgage: Calculate the amount needed to pay off your mortgage.

- Education: Estimate the cost of sending your children to school and college.

Replace Income with a Cushion:

With this method, you buy enough coverage so that your beneficiaries can replace your income without spending the payout. They can invest the lump sum and use the income generated to cover expenses. For example, if your income is $50,000 and you estimate a 5% rate of return, you would need a $1 million life insurance policy.

When deciding on the right amount of life insurance, it's essential to consider your overall financial plan, future expenses, and the growth of your income and assets. It's better to have a cushion to ensure your family can maintain their lifestyle. Additionally, consider working with a licensed agent or financial planner to ensure the coverage level fits your unique needs.

Understanding Split-Dollar Life Insurance: How Does It Work?

You may want to see also

Do I need life insurance?

Life insurance is a financial tool that can help you protect your loved ones in the event of your death. It is not a one-size-fits-all product, and the amount of coverage you need depends on various factors, including your financial goals, family situation, and existing assets. Here are some key points to consider when deciding if you need life insurance and how much coverage you may require:

If you have people who rely on you financially, such as a spouse, children, aging parents, or other loved ones, then you should strongly consider purchasing life insurance. The coverage will help them cover day-to-day expenses, pay off any debts, and maintain their standard of living if something happens to you.

Consider your income, debts, mortgage, education expenses, and any other financial obligations when deciding on life insurance. Calculate your current financial obligations and subtract any existing assets, such as savings, investments, or additional income that your dependents could use to cover expenses. The remaining amount will give you an idea of the coverage you need.

Think about your family's current and future expenses and how life insurance fits into your overall financial strategy. If you are young and healthy, purchasing coverage early can lock in a low monthly rate for the entire term of the policy.

Affordability is crucial when considering life insurance. You need to find a policy that fits within your monthly budget to ensure you can continue paying the premiums. While permanent life insurance offers coverage for your entire life, it tends to have higher premiums. Term life insurance, which covers a specific period, is generally more affordable.

The cost of life insurance also depends on your age and health. The younger and healthier you are, the lower your premiums are likely to be. However, older individuals can still obtain life insurance, although it may be more expensive.

In summary, life insurance is essential if you have financial dependents or significant debts that outweigh your assets. By considering your financial situation, budget, and health, you can determine the amount of coverage you need to protect your loved ones adequately.

Get Licensed: Health and Life Insurance Basics

You may want to see also

Frequently asked questions

This depends on your financial goals and needs. You should consider your family's current and future expenses, your income, and your assets. You should also think about unpaid contributions, such as childcare and housework provided by a stay-at-home parent. A general rule of thumb is to get coverage worth 10 times your annual income.

The cost of your monthly premium depends on your age, gender, health, coverage amount, and policy length. For example, a 30-year-old non-smoking woman may pay $21.39 per month for $500,000 in coverage over 20 years, while a 30-year-old non-smoking man may pay $30.13 for the same coverage.

If you're getting life insurance purely to cover debts and have no dependents, you could consider self-insuring by setting aside a pool of money to cover unexpected losses. Another option is to simply not buy life insurance if you're single, have beneficiaries for your significant assets, and your estate can cover your debts and final expenses.

There are two main types of life insurance: permanent and term. Permanent life insurance policies do not expire and often have an investment component, while term life insurance only covers you for a set number of years and does not accumulate cash value. Term life insurance is generally more affordable and suitable for those who want coverage for a specific period, such as until their mortgage is paid off.