Yes, you can cancel your Travelers auto and home insurance policy at any time. However, there are a few things you should know before you do. First, you will need to secure a new insurance policy before cancelling your existing Travelers coverage. This is to ensure that you don't have a lapse in coverage, which can result in higher future insurance rates and legal troubles if you are pulled over by an officer. Second, Travelers may charge a cancellation fee, depending on the state you live in and when you cancel. Early cancellations may result in a fee of $20 to $50. Finally, if you have prepaid your Travelers policy, you may be entitled to a refund for the unused portion of your premium. To cancel your policy, you can call their customer service line, send a letter, or visit a local agent in person.

| Characteristics | Values |

|---|---|

| Can I cancel my Travelers auto and home insurance anytime? | Yes |

| Ways to cancel | By phone, email, online, or in person |

| Phone number | 866-336-2077 or 1-800-842-5075 |

| Address | Travelers, P.O. Box 5600, Hartford, CT 06102 |

| Cancellation fee | Yes, $20 to $50 |

| Refund | Yes, for the unused portion of the premium |

What You'll Learn

- Travelers auto insurance can be cancelled by phone, email, online or in person

- You can cancel anytime but may be charged a fee if it's before your renewal date

- Before cancelling, it's important to secure a new insurance plan to avoid a lapse in coverage

- Cancellation fees may apply depending on your state and policy

- You may be eligible for a refund for the unused portion of your premium

Travelers auto insurance can be cancelled by phone, email, online or in person

Yes, you can cancel your Travelers auto insurance policy at any time. There are four ways to do this: by phone, email, online, or in person.

By Phone

To cancel your policy over the phone, call the Travelers customer service number at 866-336-2077. A customer service representative will guide you through the cancellation process.

By Email

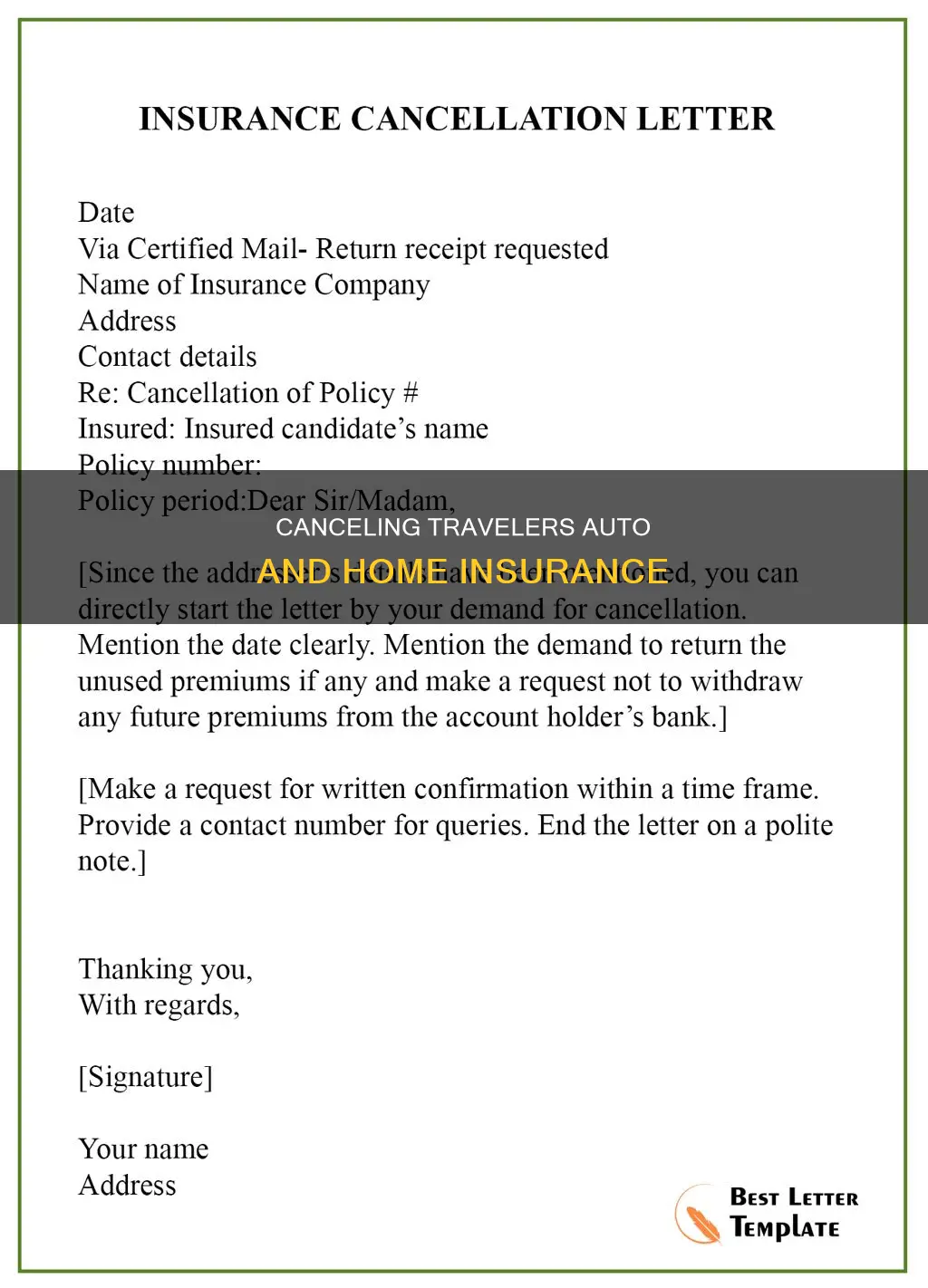

You can also cancel your policy by writing a letter with your cancellation request to the following address:

> Travelers P.O. BOX 5600 Hartford, CT 06102

Be sure to include your name, policy number, and the date you want your policy to end in your letter. If you are starting a new policy elsewhere, make sure that your new policy starts before your Travelers policy ends to avoid any lapse in coverage.

Online

To cancel your policy online, go to the Travelers insurance website and email them via an online form. You will need your Travelers auto insurance login information to sign in.

In Person

You can also cancel your policy in person by visiting your local Travelers agent.

Insurers: Self-Serve Commission Claims

You may want to see also

You can cancel anytime but may be charged a fee if it's before your renewal date

Yes, you can cancel your Travelers auto and home insurance policy at any time. However, it's important to note that if you cancel before your renewal date, you may be charged a fee. This fee can vary depending on your state and policy, ranging from $20 to $50 for early cancellations.

To cancel your Travelers insurance policy, you can do so over the phone by calling their customer service line at 1-800-842-5075, by mail, or in person at a local office. When cancelling, it's important to have certain information ready, such as your policy number, name, address, and the effective date of cancellation. You may also be asked for details of your new replacement policy if you have one.

If you cancel your Travelers insurance policy before the end of the policy term, you may be eligible for a refund of the unused portion of your premium. However, any applicable cancellation fees or administrative charges may be deducted from the refund amount. It's recommended to contact Travelers directly to understand the specific cancellation fees and refund details applicable to your policy.

Additionally, it's important to secure a new insurance policy before cancelling your current one to avoid a lapse in coverage. Driving without insurance is illegal in most states and can result in serious financial consequences in the event of an accident.

Jeep Leases: Gap Insurance Included?

You may want to see also

Before cancelling, it's important to secure a new insurance plan to avoid a lapse in coverage

Yes, you can cancel your Travelers auto and home insurance policy at any time. However, before you do so, it is important to secure a new insurance plan to avoid a lapse in coverage. Driving without insurance is illegal in most states and can result in fines from the Department of Motor Vehicles (DMV). Having a lapse in coverage may also increase your future insurance rates.

- Purchase a new policy before cancelling: This will protect you from experiencing a lapse in coverage. You can usually switch insurance companies at any time, but it is recommended to secure a new policy at least six to eight weeks before your current policy expires. This will ensure that there is no overlap in coverage and that you are not left without insurance at any time.

- Contact your current insurance provider: Inform your current insurance provider of your decision to cancel and inquire about any specific cancellation terms and conditions, fees, and potential refunds. For example, Travelers may charge a fee for cancelling your auto insurance policy, so it is important to consult with an agent to understand the specific cancellation fees applicable to your policy.

- Confirm the renewal date of your current policy: This is based on when your auto insurance went into effect and your policy term. Most policies renew every six or 12 months. You can find this information on your insurance ID card, policy declaration page, or by logging into your online account or contacting an agent.

- Compare car insurance quotes from multiple insurers: Shop around for a new policy by comparing coverage options, deductibles, discounts, and premiums from different insurance companies. Car insurance comparison websites can be a helpful tool for finding real-time quotes from multiple insurers.

- Secure a new policy: Lock in a new policy with a different insurance company before cancelling your current Travelers policy. Make sure the start date of your new policy matches the intended cancellation date of your old policy to avoid a lapse in coverage.

By following these steps, you can avoid the risks and consequences associated with a lapse in insurance coverage and ensure a smooth transition to your new insurance plan.

Auto Auction Insurance: How It Works

You may want to see also

Cancellation fees may apply depending on your state and policy

You can cancel your Travelers auto insurance policy at any time. However, depending on your state and policy, cancellation fees may apply.

If you cancel your policy very early in the term, Travelers may charge you a cancellation fee. The fee amount and terms can vary based on your policy and state regulations. It is recommended that you consult your insurance agent to understand the cancellation fees applicable to your policy.

If you have prepaid your policy in full, you may be eligible for a refund of the unused portion of your premium. However, any applicable cancellation fees or administrative charges may be deducted from the refund amount. To understand the potential refund amount, it is important to discuss the details with your insurance agent.

To avoid a lapse in coverage, it is important to secure a new car insurance plan before leaving Travelers. You can then cancel your Travelers policy by phone, email, online, or in person.

College Kids: Vehicle Insurance Dependants?

You may want to see also

You may be eligible for a refund for the unused portion of your premium

If you cancel your Travelers auto insurance policy before the end of the policy term, you may be eligible for a refund for the unused portion of your premium. However, it's important to note that any applicable cancellation fees or administrative charges may be deducted from the refund amount.

To determine your eligibility for a refund and understand the potential amount you may receive, it is recommended to discuss the details with a Travelers insurance agent. They can provide specific information about your policy and state regulations.

When requesting a cancellation, you can contact Travelers through multiple methods, including phone, email, online, or in person. It is important to provide necessary details such as your name, policy number, and the desired end date of your policy.

By understanding your eligibility and the potential refund amount, you can make an informed decision about cancelling your Travelers auto insurance policy.

It is worth noting that cancellation fees may vary based on your location and the timing of your cancellation. Some states have reported fees ranging from $20 to $50 for early cancellations.

Farm Vehicle Insurance: Qualifying Usage

You may want to see also

Frequently asked questions

Yes, you can cancel your Travelers auto and home insurance anytime. However, certain policies may have specific cancellation terms and conditions. It is recommended to review your policy documents or consult your insurance agent to understand any potential limitations or fees associated with canceling.

You can cancel your Travelers auto and home insurance by calling their customer service line, sending a letter, or visiting a local office. It is important to have certain information ready, such as your policy number and the effective date of cancellation.

Yes, Travelers may charge a fee for canceling your auto and home insurance policy, depending on the state you live in and the specific terms of your policy. It is recommended to consult your insurance agent to understand the cancellation fees applicable to your policy.

If you cancel your Travelers auto and home insurance policy before the policy term ends, you may be eligible for a refund of the unused portion of your premium. However, any applicable cancellation fees or administrative charges may be deducted from the refund amount. It is important to discuss the refund details with your insurance agent to understand the potential amount you may receive.