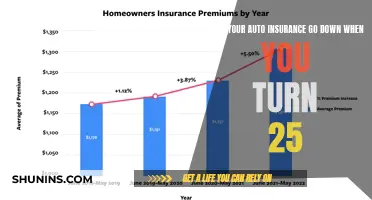

Toronto has some of the highest car insurance rates in the province. The average cost of car insurance in Toronto for 2023 is $2,325 per year or about $193 per month. This is a 19% jump from the 2021 premium of $1,953.

There are several ways to get cheap car insurance in Toronto. One way is to compare quotes from different insurance providers and choose the one that offers the lowest rate. Another way is to increase your deductible, which is the amount you pay out of pocket before your insurance company covers the rest. You can also bundle your home and auto insurance policies or take a defensive driving course to get a discount on your premium.

What You'll Learn

Compare quotes from different providers

Comparing quotes from different providers is the best way to save money on car insurance in Toronto. Here are some tips on how to compare quotes and get the cheapest car insurance:

Use Online Tools

Use online tools such as Ratehub.ca or RATESDOTCA to compare quotes from different providers. These websites allow you to input your information, such as your vehicle and driving history, and instantly see quotes from top Canadian providers. This makes it easy to find the lowest rate without having to contact each provider individually.

Direct Writers vs. Insurance Brokers vs. Quote Comparison Websites

There are three main ways to buy insurance: through a classic insurance company, a direct writer, or an insurance broker. Classic insurance companies rely on dedicated agents to sell their products, while direct writers allow you to purchase policies online directly from the insurance company. Insurance brokers, on the other hand, offer quotes from multiple companies but do not sell insurance themselves; they refer you to an insurance company to complete the sale. Quote comparison websites, such as RATESDOTCA, aggregate quotes from multiple brokers and insurance companies, allowing you to easily compare prices and policies.

Factors Affecting Your Insurance Rate

When comparing quotes, it's important to consider the various factors that can affect your insurance rate. These include your neighbourhood, vehicle type, daily commute, driving history, coverage options, and policy limits. For example, driving a luxury car or having a history of speeding tickets will result in a higher insurance rate. Additionally, bundling your home and auto insurance or increasing your deductible can help lower your rate.

Shop Around Regularly

Don't wait until your policy is up for renewal to shop around for a new one. Insurance rates can change frequently, so it's a good idea to compare quotes from different providers at least once a year. This way, you can take advantage of any new discounts or lower rates that may be available.

Ask About Discounts

Many insurance providers offer discounts for things like employee or alumni status, safety features, or low mileage. Be sure to ask about any potential discounts when comparing quotes to get the cheapest rate possible.

Contractors: Auto Insurance Necessity?

You may want to see also

Bundle home and auto insurance

Bundling home and auto insurance is a great way to save money on your insurance premiums. By combining your home and auto insurance with the same provider, you can save up to 20% on your insurance costs. This is because insurance companies value loyal customers and offer discounts when you purchase multiple types of insurance from them.

There are several benefits to bundling your home and auto insurance:

- Discounted Premiums: The biggest advantage of bundling is the significant discount you receive. You can save up to 20% on your auto insurance and up to 50% on your home insurance by bundling them together.

- Simplified Payments and Management: With bundling, you only have to deal with one insurance company, which means you'll have one payment and one renewal date for all your insurance needs. This simplifies your insurance management and makes it easier to stay on top of your bills.

- Single Deductible: In some cases, if both your home and car are damaged in the same incident (e.g., a storm), you may only need to pay one deductible instead of dealing with multiple policies and deductibles.

- Reduced Risk of Being Dropped: Having multiple insurance policies with one provider can reduce the likelihood of losing your coverage. For example, if you make frequent auto insurance claims, bundling your home and auto insurance may make it less likely for the insurer to drop you as a customer.

When considering bundling your home and auto insurance, it's important to shop around and compare quotes from different providers. Each insurance company offers different discounts and rates, so it's essential to find the one that best meets your coverage needs at the lowest possible rate. Additionally, review your coverage annually to ensure it aligns with your changing needs and to take advantage of any new discounts you may qualify for.

Michigan's Unique Auto Insurance System: Understanding the Basics

You may want to see also

Increase your deductible

The deductible is the amount you pay out-of-pocket before your insurance provider covers the rest. Typically, the higher the deductible, the lower your insurance premium will be, as you are taking on more financial responsibility in the event of a claim.

For example, increasing your deductible from $200 to $500 could reduce your collision and comprehensive coverage costs by 15% to 30%. Moving to a $1,000 deductible could save you 40% or more.

However, it's important to ensure you have enough money set aside to pay the deductible if needed. Additionally, other factors such as the vehicle's value, driving record, miles driven, location, and claims frequency can also impact your insurance premium, so it's essential to consider all variables before making a decision.

In Toronto, car insurance is mandatory, and the average cost is $2,325 per year or about $193 per month. Toronto operates under a no-fault insurance system, and insurance providers are regulated by the Financial Services Regulatory Authority of Ontario (FSRA).

When looking for cheap auto insurance in Toronto, it's recommended to compare quotes from multiple providers, as rates can vary significantly. Other ways to lower insurance costs include bundling home and auto insurance, increasing your deductible, paying annually instead of monthly, and maintaining a good driving record.

Auto Insurance Pricing Secrets: Are Companies Sharing Data?

You may want to see also

Pay annually

Paying your insurance premium annually is a great way to save money on your car insurance in Toronto. While paying monthly premiums is a more convenient option for many, it adds to your insurer's administrative costs. Therefore, paying your premium annually can lower your car insurance rate. Some insurance companies even offer a discount on the payment of annual premiums upfront.

Deer-Related Crashes: Understanding New York State's Unique Approach to Auto Insurance Reimbursement

You may want to see also

Drive less

One of the best ways to save money on car insurance in Toronto is to drive less. The more time you spend on the road, the more likely you are to get into an accident and file a claim. If you can reduce your daily commute, you can lower your insurance premium.

If you can switch from driving to using public transportation, that will also help lower your insurance costs. In Toronto, 61% of commuters travel by car, while 26.2% use public transit. If you can be part of the latter group, you can save money on insurance.

Another way to drive less is to carpool. If you can be a passenger in someone else's vehicle, rather than the driver, you can save on insurance.

Books to Help You Become an Auto Insurance Adjuster

You may want to see also

Frequently asked questions

As a Toronto driver, you must follow laws set by the province of Ontario for mandatory minimum insurance coverage. There are four main types of coverage included in your policy: third-party liability insurance, statutory accident benefits insurance, direct compensation property damage insurance, and uninsured vehicle insurance.

It’s important to compare car insurance quotes frequently to get cheap rates in Toronto. You should shop around every year.

Auto insurance in Toronto is expensive compared to other cities in the province due to lots of vehicles and traffic volume, more accidents, more tickets and violations, an increased occurrence of auto theft, and insurance fraud.

Compare car insurance rates in Toronto with a comparison site, or visit our main car insurance page to learn other ways of getting cheap car insurance quotes.

Yes. All drivers across the province must have auto insurance to drive. The fines for driving without insurance are steep. They start at $5,000 and can go up to $25,000 for first-time offenders.