Life insurance agents can sell fixed annuities, but they need to have the necessary credentials to sell life insurance in their state. Licensing requirements vary from state to state, but generally, they involve taking a pre-licensing course and passing a state exam. Fixed annuities are a type of annuity where the interest rate is known upfront. They are considered a lower-risk option, as they are not tied to the performance of a stock market index, and buyers can calculate their exact minimum earnings.

| Characteristics | Values |

|---|---|

| Who can sell fixed annuities? | Licensed life insurance agents |

| What is required to sell fixed annuities? | A standard life insurance license issued by the resident state |

| What is the process to obtain a license? | Pre-licensing education, a licensing exam, and a background check |

| What is the role of the National Association of Insurance Commissioners? | Provides an interactive map with state-specific qualifications |

| What are the licensing requirements? | Vary by state, but typically include pre-licensing education, an exam, and a background check |

| What is the importance of licensing? | Ensures sellers have the required knowledge, skillset, and ethics to guide clients towards financial decisions that align with their long-term goals |

What You'll Learn

Fixed annuities licensing requirements

Selling annuities is a regulated activity in the United States, and anyone wishing to sell them must obtain a license. The specific requirements to obtain a license vary from state to state, but generally, they involve taking a pre-licensing course and passing a state exam.

Every state in the U.S. licenses life insurance producers who offer fixed annuities for sale. These licenses are typically granted by each state's insurance regulatory body, often called the Department of Insurance. While the requirements differ depending on the state, they usually involve taking a pre-licensing course and passing a state exam. These courses are offered by many accredited schools, including county colleges and business schools, but they must be approved by the insurance department of the state administering the insurance license.

The National Association of Insurance Commissioners (NAIC) provides an interactive map with state-specific qualifications and contact information for each state insurance department. It is important to refer to this resource to ensure compliance with the specific requirements of the state in which you intend to sell fixed annuities.

In addition to the state license, insurance agents who want to offer equity-indexed and variable annuities must obtain additional approvals and licenses. They must become registered representatives by taking exams administered by the Financial Industry Regulatory Authority (FINRA), specifically the Series 6 and Series 7 exams.

The Series 6 license is a limited investment securities license that allows holders to sell packaged" investments like variable annuities and mutual funds. It is also a prerequisite for insurance producers offering any kind of variable annuity, as these products are mainly composed of securities. The Series 7 license, on the other hand, is a general securities representative license that permits agents to offer a wide range of securities, excluding real estate, life insurance, and commodities futures.

To summarise, selling fixed annuities in the United States requires a state insurance license, which can be obtained by completing pre-licensing education and passing a state exam. Additionally, for those interested in offering variable and equity-indexed annuities, further approvals and licenses, such as the Series 6 and Series 7 licenses from FINRA, are necessary.

Life Insurance Value: Does Term Insurance Decrease Over Time?

You may want to see also

Variable annuities licensing requirements

Variable annuities are more complex than fixed annuities, and as a result, the licensing requirements to sell them are more stringent. Variable annuities are regulated by both the Securities and Exchange Commission (SEC) and state insurance commissions. This is because variable annuities are considered securities products, and the principal amount can either lose or grow in value based on the investment choices made by the company.

To sell variable annuities, insurance agents must obtain a Series 6 or Series 7 license from the Financial Industry Regulatory Authority (FINRA). The Series 6 license is a limited investment securities license that allows licensees to sell packaged investments like variable annuities and mutual funds. The Series 7 license is a general securities representative license that permits agents to sell almost any kind of security, except real estate, life insurance, and commodities futures.

To obtain a Series 6 license, individuals must be sponsored by a FINRA-registered broker-dealer firm and pass the Securities Industry Essentials (SIE) and Series 6 exams. The Series 6 exam covers topics such as investment product characteristics, regulatory standards, and ethical considerations. The SIE exam provides a broad overview of the securities industry, while the Series 6 exam focuses on investment companies and variable contract products.

The requirements for the Series 7 license are similar, but this license involves a more comprehensive examination that covers a wider range of security-specific areas. The Series 7 exam is a six-hour exam that is considered the most challenging of the securities tests.

In addition to obtaining a license from FINRA, individuals who want to sell variable annuities must also comply with state-specific insurance licensing requirements. These requirements vary by state but typically include pre-licensing education, a licensing exam, and a background check. Some states also require agents to pass the Uniform Securities Agent State Law Exam (Series 63), which covers state securities regulations.

Overall, the licensing requirements for selling variable annuities are extensive and ensure that individuals are knowledgeable and qualified to sell these complex financial products.

Life Insurance Duration: Understanding Your Policy's Lifespan

You may want to see also

Indexed annuities

The rate on an indexed annuity is calculated based on the year-over-year gain in the index or its average monthly gain over a 12-month period. In years when the stock index declines, the insurance company will credit the account with a minimum rate of return, typically around 2% but sometimes as low as 0% or as high as 3%.

While indexed annuities offer the opportunity for higher yields than fixed annuities when the financial markets perform well, they also usually provide some protection against market declines. However, certain provisions in these contracts can limit the potential upside to only a portion of the market's rise. For example, participation rates and rate caps may limit the amount credited to the accumulation account, reducing your potential gains.

Life Insurance Agents: Financial Consultants or Not?

You may want to see also

State-specific requirements

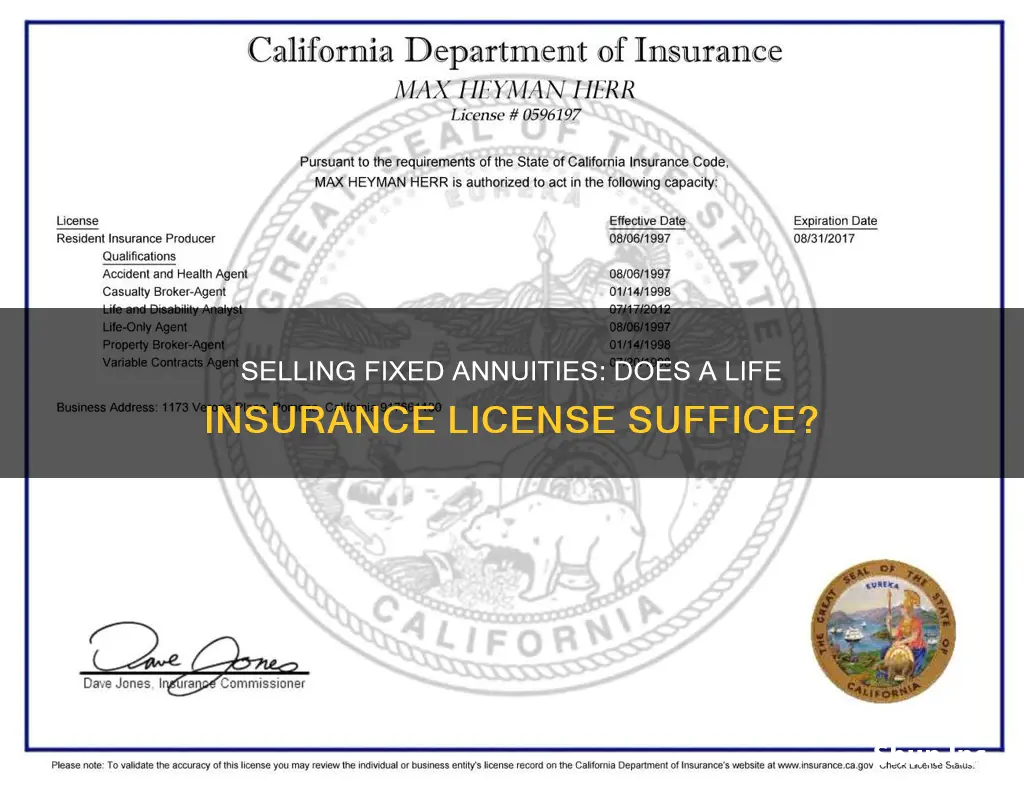

In most states, you must obtain a separate license to sell annuities, in addition to a life insurance license. This is because selling annuities is considered a separate line of authority (LOA) from life insurance. However, some states do allow life insurance producers to sell certain types of annuities with their existing license, as long as they have completed the necessary training and meet the residency requirements of that state.

For example, in California, life insurance agents can sell fixed annuities and some indexed annuities with their life license, but they must complete a one-time, four-hour training course on the topic and apply for a Life-Only (including Annuities and Life Insurance) license. On the other hand, states like Texas and Florida require separate licenses for selling annuities, even if you have a life insurance license. Texas may require a Life, Accident, Health, and HMO license, while Florida might offer a specific Life Line of Authority (including Variable Contracts) license.

In New York, the requirements are more stringent. Here, you need to obtain a Life Insurance and Annuities Agent license, which allows you to sell both life insurance and annuities, but you must also complete pre-licensing education and pass the state licensing exam. Additionally, New York may have specific residency requirements.

Some states have more relaxed requirements. For instance, in Ohio, you can sell annuities with a life insurance license as long as you have completed the necessary training and are appointed by an insurer that offers annuities. No additional license is required. Similarly, in Pennsylvania, a life insurance license may be sufficient to sell fixed annuities, but agents must complete annuity training and register with the state.

It's important to note that these requirements can change over time, so it's always best to check with your state's insurance department for the most up-to-date information. Each state's insurance department website will have detailed information on the specific requirements, including any necessary forms, fees, and continuing education needed to maintain your license.

Life Insurance for Couples: A Joint Policy Advantage

You may want to see also

Exam and education requirements

Selling fixed annuities requires a life insurance license, issued by the seller's state of residence. This is because fixed annuities are categorised as a life insurance product.

Each state has its own department of insurance, and its own specific requirements for obtaining a license. However, there are some general requirements that apply across the US.

Firstly, you must be at least 18 years old to earn a life insurance license. Secondly, you must complete any pre-licensing education required by the state. The number of hours of education required varies by state, typically ranging from 20 to 40 hours. This education covers foundational knowledge about insurance principles, ethics, and state-specific laws and regulations. After completing the required pre-licensing education, you must pass the state's insurance licensing exam. This comprehensive test assesses the applicant's understanding of insurance laws, ethics, and various types of insurance, including annuities.

In addition to passing the exam, most states also require applicants to pass a background check and submit fingerprints. This ensures that the applicant has a clean criminal record and is suitable for a position of trust.

Once these requirements have been met, applicants can submit their license application to the state's insurance department. After approval, the department will issue the insurance license.

It is important to note that maintaining a license requires ongoing education. Licensees must fulfill continuing education requirements and periodically renew their license according to state regulations. This ensures that insurance professionals stay up-to-date with industry changes and ethical standards.

Pacific Life: Diabetic Life Insurance Options

You may want to see also

Frequently asked questions

A fixed annuity is a type of annuity where the interest rate is known upfront and guaranteed. Fixed annuities are often considered a lower financial risk option as they are not tied to the performance of a stock market index.

Yes, a standard life insurance license issued by your resident state is sufficient to sell fixed annuities. However, licensing requirements may vary by state, so it is important to check the specific requirements for your state.

The requirements for obtaining a license to sell fixed annuities typically include pre-licensing education, passing a state licensing exam, and undergoing a background check. Most states require a specific number of hours of pre-licensing education, ranging from 20 to 40 hours.

Yes, obtaining additional certifications such as the Certified Financial Planner (CFP), Chartered Financial Consultant (ChFC), or Chartered Life Underwriter (CLU) can enhance a financial advisor's credibility and expertise when selling fixed annuities. These designations demonstrate specialized knowledge and adherence to ethical standards.