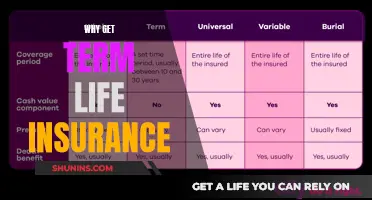

Life insurance is a useful safety net that can help cover debts, pay off mortgages, and provide financial support for families after the policyholder's death. However, for those with a cancer diagnosis, the process of obtaining life insurance can be challenging and is dependent on various factors. While a pre-existing policy usually remains valid after a cancer diagnosis, applying for a new policy during or after cancer treatment is a different story.

| Characteristics | Values |

|---|---|

| Cancer diagnosis before or after getting life insurance | If you are diagnosed with cancer after getting life insurance, your coverage won't be affected as long as you continue to pay the premiums. However, if you are diagnosed before getting life insurance, it can be challenging to qualify for a new traditional policy. |

| Cancer insurance | Some companies offer cancer insurance, which provides cash benefits for medical bills and other expenses related to a cancer diagnosis. |

| Life insurance options for cancer patients | Cancer patients may be eligible for simplified issue or guaranteed issue life insurance, also known as no-medical exam life insurance. They may also qualify for final expense insurance, but the premiums may be nearly equal to the death benefit. |

| Factors affecting life insurance eligibility | The type and stage of cancer, treatment and medical history, time since diagnosis or remission, age and other health factors, family's cancer history, lifestyle habits, and other health issues. |

| Life insurance riders | Some life insurance policies include riders that allow cancer patients to access their death benefit while still alive to help with treatment or other costs. These include accelerated death benefit riders and chronic or critical illness riders. |

What You'll Learn

Life insurance for cancer patients in remission

If you are a cancer patient in remission, you may be able to obtain life insurance. Insurance companies typically require a period of remission before offering coverage, with most sources stating that this period is usually between one and five years. The length of the remission period depends on the insurance company, the type of cancer, and other factors.

Factors Affecting Life Insurance for Cancer Patients in Remission

When applying for life insurance, cancer patients in remission will need to provide detailed medical records and reports to the insurer, showcasing their remission period and oncologist's assessments. The longer a patient has been in remission, the better their chances of securing affordable coverage.

The type of cancer is also a significant factor. Cancers with a higher survival rate or a lower chance of returning once remission is achieved will result in improved odds of being approved for a policy and qualifying for an affordable premium.

Types of Life Insurance for Cancer Patients in Remission

Cancer patients in remission may be able to qualify for traditional term and whole life insurance policies, depending on the length of their remission and other factors. However, it is important to note that these policies may be prohibitively expensive, and patients may be limited to no-medical-exam policies, such as simplified issue and guaranteed issue life insurance. These policies typically have lower coverage amounts and higher premiums.

Another option for cancer patients in remission is final expense life insurance, which is designed to cover end-of-life expenses such as funeral costs and medical bills. This type of insurance is easier to qualify for and may be a good option for those with pre-existing conditions.

Tips for Obtaining Life Insurance for Cancer Patients in Remission

It is recommended to work with an experienced independent life insurance agent who can help navigate the different options and find the best coverage for specific health issues. Improving overall health, avoiding risky hobbies, and working in a low-risk profession may also help to increase the chances of obtaining life insurance and keep premiums lower.

Whole Life Insurance: Longevity Risk's Ultimate Hedge?

You may want to see also

Life insurance with pre-existing cancer

If you are currently undergoing treatment for cancer or have a pre-existing cancer diagnosis, obtaining life insurance can be challenging. However, it is not impossible. Here are some things to keep in mind when considering life insurance with pre-existing cancer:

Types of Life Insurance Policies

There are several types of life insurance policies available, and the options may vary depending on your situation. Here are some common types:

- Traditional term and whole life insurance policies: These policies are typically designed for individuals in good health. If you have an active cancer diagnosis, these policies may be extremely expensive or even inaccessible. Once your cancer has been in remission for a certain period, usually between one and five years, insurers may reconsider and offer you coverage.

- No-exam life insurance: This type of policy does not require a medical examination and may be suitable for individuals with pre-existing conditions. However, these policies often come with lower coverage amounts and potentially higher premiums.

- Simplified issue life insurance: This is a type of term or permanent life insurance with fewer requirements to qualify. There is no medical exam, and the application process typically involves answering a few health questions. Simplified issue policies have lower maximum death benefits than fully underwritten policies, but they can still provide coverage up to a certain limit.

- Guaranteed acceptance life insurance: These policies offer lifetime coverage regardless of your health status and do not require a medical examination or answers to health questions. They are ideal for individuals with severe pre-existing conditions. However, the death benefits are generally limited, and the policies are more expensive.

- Final expense life insurance: Also known as burial insurance, this type of whole life insurance covers end-of-life expenses, such as funeral and medical bills. It is easier to qualify for this type of insurance, making it an option for those with pre-existing conditions.

Factors Affecting Your Options and Premiums

Several factors will influence your eligibility and the cost of premiums when applying for life insurance with pre-existing cancer:

- Type and stage of cancer: Different types of cancer carry varying risks and will be assessed accordingly by insurance providers. Cancers with a higher survival rate or a lower chance of recurrence will improve your chances of approval and more affordable premiums.

- Treatment and medical history: Insurance providers will want to know about your treatment plan, response to treatment, and overall medical history. They may request detailed medical records and reports from your oncologist.

- Time since diagnosis: Insurers often require a certain period of remission before offering coverage. This period can range from one to five years, as they want to ensure that your cancer has not returned and that your health is stable.

- Age and other health factors: Your age and any other health conditions you may have will also impact your options and premiums.

Steps to Take When Applying for Life Insurance with Pre-Existing Cancer

When applying for life insurance with pre-existing cancer, consider the following steps:

- Get quotes from multiple insurers: Different insurance companies have their own underwriting guidelines, so it's important to compare rates and coverage options.

- Be honest about your health: It is crucial to be completely transparent about your health status when applying for life insurance. Misrepresenting your health on the application could lead to the insurer rejecting a claim or denying the death benefit to your beneficiaries.

- Work with an independent life insurance agent: Consider working with an agent who has experience with impaired risk cases. They can help you navigate the complex underwriting processes and find the best coverage and rates for your specific situation.

- Compare options and shop around: Each life insurance company has its own criteria for coverage. By comparing options, you can find the most suitable policy for your needs.

In summary, while obtaining life insurance with pre-existing cancer can be challenging, there are options available. It is important to be honest about your health, compare quotes from multiple insurers, and seek the assistance of a knowledgeable agent to find the best coverage for your unique circumstances.

Life Insurance Proceeds: Separate Property or Not?

You may want to see also

Life insurance riders for cancer patients

If you already have life insurance and are then diagnosed with cancer, your coverage will not be affected. Your existing policy will remain in effect as long as you continue to pay the premiums. However, if you are looking to buy a new life insurance policy after a cancer diagnosis, you will likely face some obstacles and higher premiums.

If you already have life insurance, you may want to check if you have a rider that can help with cancer-related expenses. Here are some life insurance riders that can be useful for cancer patients:

Critical Illness Riders

Critical illness riders are a specific type of accelerated death benefit. They allow you to access your death benefit if you meet certain requirements related to chronic or critical illnesses, as defined in your policy. The funds you use will be deducted from your death benefit.

Accelerated Death Benefit (ADB) Riders

Also called terminal illness riders, ADB riders allow you to receive a portion of the death benefit while you are still alive if you are diagnosed with a qualifying terminal illness. There may be a cap on the amount you can access, and the funds you use will be deducted from the death benefit when you pass away.

Chronic Illness Riders

Chronic illness riders are another type of accelerated death benefit. They allow you to access your death benefit if you meet certain requirements related to chronic illnesses, as defined in your policy. The funds you use will be deducted from your death benefit.

Final Expense Life Insurance

Final expense insurance, also known as burial insurance, is a type of whole life insurance designed to cover end-of-life expenses, such as funeral costs and medical bills. It is easier to qualify for this type of insurance, making it an option for those with pre-existing conditions like cancer.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance plans can work for those currently in cancer treatment or following a diagnosis because they don't require a medical exam or usually ask any health questions. You generally cannot be rejected for these types of life insurance as long as you fall within the eligible age range. However, coverage amounts can be low, and guaranteed issue plans usually have graded death benefits.

Group Life Insurance

Some employers offer group life insurance plans that require minimal or no contribution from employees toward the premium. However, these plans usually offer limited coverage amounts, often based on your salary, and you cannot keep your coverage if you leave your job.

Life Insurance: Understanding the Basics and Varied Types

You may want to see also

Cancer insurance

The cost of cancer insurance varies, but it is generally affordable, with some policies available for around $18 to $19 per month. The benefits provided by cancer insurance can be significant, with maximum benefit amounts ranging from $5,000 to $100,000. This financial support can be crucial for individuals and families facing the high costs of cancer treatment.

When considering cancer insurance, it is essential to carefully review the policy details and understand what is covered. Different insurance providers may offer varying levels of coverage and benefits. Additionally, individuals should be aware that cancer insurance is not a substitute for comprehensive health insurance but rather a supplemental form of coverage.

How to Get Life Insurance for Your Dad

You may want to see also

Life insurance for stage 4 cancer patients

If you have stage 4 cancer, obtaining traditional life insurance will be extremely difficult. You may be limited to small guaranteed-issue policies like final expense insurance, and your premiums may be nearly equal to the death benefit.

Life insurance is useful for two main reasons:

- If you die, it can pay off debts, such as a mortgage.

- It can pay out money for your family after you die.

Some life insurance policies include terminal illness cover. This means that if you are diagnosed with a terminal illness and have less than 12 months to live, you can make a claim. The insurer will pay out the money straight away, and you can keep the payout even if you live longer.

If you already have life insurance and are diagnosed with cancer

If you already have a life insurance policy and are diagnosed with cancer, your coverage won't be affected. Your existing policy will remain in effect as long as premiums are paid, so it's crucial to stay on top of your payments.

Getting life insurance after a cancer diagnosis

If you don't have life insurance and are diagnosed with cancer, it can be challenging to qualify for a new traditional life insurance policy. You may need to apply for guaranteed issue life insurance, a more expensive policy that doesn't require a medical exam. Your policy will have a higher rate and a lower death benefit than a traditional policy, but you won't have to take a medical exam.

Life insurance for cancer patients in remission

If you're a cancer survivor in remission, you can typically find more life insurance options. Insurance companies often require a certain period of remission, usually ranging from one to five years, before they consider offering you coverage. They want to see that your cancer has not returned and that your overall health is stable.

Factors that affect the cost of life insurance for cancer patients

When determining the cost of life insurance for cancer patients, life insurance companies consider several factors that directly impact the monthly premium and eligibility for coverage. These include:

- Type and stage of cancer

- Treatment and medical history

- Time since diagnosis

- Age and other health factors

What to do with your life insurance policy after receiving a cancer diagnosis

If you already have lifetime coverage, such as a whole life or universal life insurance policy, a cancer diagnosis will likely not affect your policy. If you pass away from cancer while your coverage is in force, your loved ones will receive your full death benefit.

However, if you have a term life insurance policy, you may be able to convert to a permanent plan without a medical exam as long as you are within the policy's specified conversion period. Your premium costs will likely increase because permanent coverage is typically more expensive than term coverage.

Selling Life Insurance Over the Phone: Script for Success

You may want to see also

Frequently asked questions

Yes, it is possible to get life insurance if you have cancer, but your options may be limited, and your premiums are likely to be higher. You may need to apply for a guaranteed issue life insurance policy, which does not require a medical exam but is more expensive.

No, if you already have a life insurance policy in place, it cannot be cancelled if you get cancer, as long as you continue to pay the premiums.

It may be difficult to increase the value of your policy if you have cancer, but it is important to keep up with your existing policy rather than starting a new one. You may be able to increase your cover using a 'special event option', which can be triggered by certain life events such as the birth of a child or moving house.

Insurance companies will consider the type and stage of cancer, your treatment plan and medical history, the time since your diagnosis, your age and other health factors, and your family's cancer history.

If you are ineligible for traditional life insurance, you can consider simplified issue or guaranteed issue life insurance, also known as no-exam life insurance. These policies do not require a medical exam and will not deny coverage based on pre-existing conditions, but they typically have higher premiums and lower death benefits. Group life insurance through your employer is another option, as it often comes in the form of guaranteed issue.