Life insurance payouts are generally not taxable, but there are some exceptions. For instance, if the cash value of the policy exceeds a certain amount, you may have to pay estate tax or generation-skipping tax. If you live in Iowa, Kentucky, Nebraska, New Jersey, Maryland, or Pennsylvania, you may also have to pay inheritance tax. If you withdraw money from a cash-value life insurance policy or surrender your policy, you may also be taxed. Additionally, if you receive proceeds from an employer-paid life insurance policy, any death benefit beyond $50,000 is taxed as income.

| Characteristics | Values |

|---|---|

| Are life insurance proceeds taxable? | Generally, life insurance proceeds are not taxable. |

| Are there exceptions to the rule? | Yes, there are some exceptions. |

| When is life insurance taxed? | When withdrawing money from cash value, surrendering the policy, when it's an employer-paid group life insurance, when the beneficiary is an estate, and when payment is in installments. |

| What is an estate tax? | A tax on your right to transfer property upon your death. |

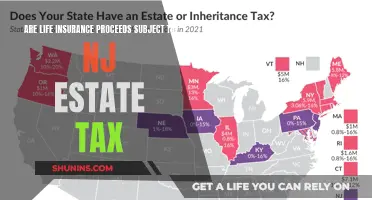

| What is an inheritance tax? | A tax placed upon the recipient for any inherited cash payouts, properties, and other assets. |

| Which states enforce the inheritance tax? | Iowa, Kentucky, Nebraska, New Jersey, Maryland, and Pennsylvania. |

| What is a generation-skipping tax? | A tax imposed on any assets that skip a generation. |

| When is the beneficiary taxed? | When a third person is involved. |

| When is the beneficiary not taxed? | When the policy owner and the insured person are one and the same. |

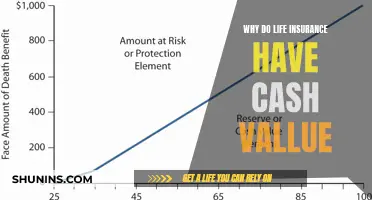

| When is the cash value of life insurance taxable? | When it exceeds a certain amount, you may encounter the estate tax or the generation-skipping tax. |

| When is the inheritance tax applicable? | If you live in one of the six states that enforce this measure. |

| When is the interest on life insurance taxable? | When the beneficiary receives the proceeds in installments. |

| When is the interest on the proceeds not taxable? | When the beneficiary receives the proceeds in a lump sum. |

What You'll Learn

Taxation on cash withdrawals from life insurance policies

Cash withdrawals from life insurance policies are generally tax-free up to the total premiums paid, unless the policy is a modified endowment contract (MEC). In the case of an MEC, you would need to pay taxes on your earnings first. Withdrawing more than the total premiums paid is considered a withdrawal of earnings and is therefore taxable.

If you take a withdrawal during the first 15 years of the policy, and this withdrawal causes a reduction in the policy's death benefit, the withdrawn cash could be subject to taxation. Withdrawals are treated as taxable to the extent that they exceed your basis in the policy.

If you take out a loan against the cash value of your life insurance policy, you may be subject to interest payments, but you won't have to pay taxes on the borrowed amount. However, if the loan is still outstanding when the policy lapses or is surrendered, the borrowed amount becomes taxable if the cash value (without reduction for the outstanding loan balance) exceeds your basis in the contract.

Understanding PA's Tax on Life Insurance Proceeds

You may want to see also

Surrendering a life insurance policy

There are a few things to keep in mind when considering surrendering a life insurance policy. Firstly, check if your policy has any surrender fees, as these can be quite high, especially in the early years of the policy. Secondly, the cash you receive from surrendering the policy will be treated as income and will be subject to income tax. Finally, by surrendering your policy, you will lose your coverage, so consider whether you need to replace it with a new policy.

Compared to surrendering a policy, selling a life insurance policy is generally considered a better option as it can result in a higher payout. With a life settlement, you sell your policy to a third-party buyer in exchange for a lump sum of cash. The buyer then becomes the new owner of the policy and will be responsible for paying the premiums. However, it's important to note that selling a life insurance policy also has its own set of considerations, such as potential fees and the loss of control over the death benefit.

Understanding MEC: Life Insurance's Essential Clause

You may want to see also

Taxation on employer-paid group life insurance

According to the Internal Revenue Code (IRC) Section 79, the first $50,000 of group-term life insurance coverage provided by an employer is excluded from taxable income. This means that if the total amount of coverage does not exceed $50,000, there are no tax consequences for the employee. However, if the employer-paid coverage exceeds $50,000, the excess amount is considered taxable income for the employee and must be included in their gross income for federal income tax purposes. This is often referred to as "phantom income."

A policy is considered carried directly or indirectly by the employer if the employer pays any cost of the life insurance or if the employer arranges for the premium payments, and the premiums paid by at least one employee subsidize those paid by another employee (the "straddle" rule). In such cases, a taxable fringe benefit arises, and the employee is responsible for federal, state, and local taxes on the excess coverage amount, as well as associated Social Security and Medicare taxes.

It's important to note that the cost of coverage must be determined using the IRS Premium Table, even if the employer's actual cost is lower. This can result in older employees being attributed a higher amount of taxable phantom income than the premium they would pay for comparable coverage under an individual term policy.

To determine if the tax cost of employer-provided group term life insurance is too high, employees can check Box 12 of their Form W-2. If a specific dollar amount appears with the code "C", that amount represents the employer's cost of providing group term life insurance coverage in excess of $50,000, less any amount the employee paid for the coverage. This amount is already included in the total "Wages, tips, and other compensation" in Box 1 of the W-2, which is reported on the employee's tax return.

If employees find the tax cost of this benefit too high, they can explore alternative options, such as requesting that their employer implement a ""carve-out" plan, which allows the employer to provide $50,000 of group term insurance (tax-free) and then offer an individual policy or a cash bonus for the employee to purchase their own coverage.

Holding Life Insurance in an IRA: Is It Possible?

You may want to see also

Taxation on life insurance payouts to beneficiaries who are estates

Firstly, if the beneficiary is an estate rather than an individual, the person(s) inheriting the estate may be subject to estate taxes. This is because the value of the life insurance proceeds can be included in the gross estate if payable to the estate, either directly or indirectly. According to Section 2042 of the Internal Revenue Code, this also applies if the proceeds are payable to named beneficiaries and the deceased had any "incidents of ownership" in the policy at the time of death.

Secondly, if the policyholder chooses to delay the benefit payout, resulting in the life insurance company holding the money for a period of time, the beneficiary may be taxed on the interest generated during that period. This is because income earned in the form of interest is typically taxable, and life insurance is no exception. Therefore, the beneficiary must pay taxes on the interest accrued, rather than the entire benefit.

To avoid taxation on life insurance payouts to estates, it is recommended to transfer ownership of the policy to another person or entity. This can be done by choosing a competent adult or entity as the new owner and obtaining the necessary forms from the insurance company. It is important to note that the new owner will be responsible for paying the premiums, and the original owner will give up all rights to make changes to the policy. Another option is to create an irrevocable life insurance trust (ILIT), which removes the policy from the taxable estate. However, the original owner cannot be the trustee of the trust and must not retain any rights to revoke it.

Challenging Life Insurance Beneficiaries: Your Legal Options Explained

You may want to see also

Taxation on life insurance payouts in installments

Taxation on life insurance is a complex topic, and while in most cases there is no tax on life insurance payouts, there are some instances where beneficiaries may be taxed.

Estate Tax: This is a tax on your right to transfer property upon your death. Life insurance proceeds may be taxable if your estate is worth more than the maximum threshold allowed. In 2024, the federal estate tax ranges from 18% to 40% for amounts over $13.61 million.

Inheritance Tax: This is a tax placed on the recipient for any inherited cash payouts, properties, and other assets. Only Iowa, Kentucky, Nebraska, New Jersey, Maryland, and Pennsylvania currently enforce this tax.

Income Tax: Income tax is collected by the government for any money earned by citizens throughout the year. Typically, life insurance proceeds are not considered taxable income, but there are exceptions. If you receive a policy payout in installments, any interest that accrues is taxable. The principal death benefit is still not taxed.

Generation-Skipping Tax: Similar to the estate tax, this is imposed on any assets that skip a generation and are only enforced when they exceed the same threshold.

If you are the beneficiary of a life insurance policy, the payout is typically tax-free, but there are some exceptions. For example, if you withdraw money from the cash value of a whole life or universal life insurance policy, and the withdrawal is more than the total amount of premiums you've paid, the excess can be taxed.

Additionally, if you cancel a whole life or universal life insurance policy, you will typically receive the cash surrender value, which is the policy's cash value minus any fees. You don't have to pay taxes on the principal, but any cash value the policy has accrued will be taxed as income.

If you are receiving proceeds from an employer-paid life insurance policy, any death benefit beyond $50,000 is taxed as income, according to the IRS.

Finally, if the beneficiary of your life insurance policy is your estate, the death benefit may be subject to estate taxes.

Progressive's Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Life insurance proceeds are generally not taxable. However, if the proceeds have accumulated interest, taxes are usually due on the interest amount.

There are several instances where life insurance proceeds may be taxable. These include:

- When the policy is transferred for cash or other valuable consideration.

- When the beneficiary is an estate.

- When the insured and the policy owner are different individuals.

- When the beneficiary receives the payout in installments.

- When the beneficiary withdraws or takes out a loan against the policy's cash value.

- When the beneficiary surrenders the policy.

- When the beneficiary sells the policy.

There are a few strategies that can help avoid paying taxes on a life insurance payout, such as:

- Choosing a person as the beneficiary instead of an estate.

- Creating an irrevocable life insurance trust (ILIT) to own the policy.

- Using an ownership transfer to another person or entity.