Life insurance proceeds are typically not taxable as income, but there are certain situations in which they may be taxed. For example, if the beneficiary is anyone other than your spouse, the payout will be added to the value of your estate for tax purposes. If the total value of your estate exceeds the exemption threshold, any amount over the exemption will be subject to estate and inheritance taxes. In the case of New Jersey, this means that estates with a total value of more than $675,000 are subject to the state's estate tax when inherited by anyone other than the deceased person's spouse.

What You'll Learn

- Life insurance proceeds are income tax-free for beneficiaries

- Life insurance proceeds are included in the taxable estate if the policy is individually owned by the insured

- New Jersey charges an inheritance tax on estates worth more than $25,000 for certain heirs

- Beneficiaries may have to pay federal estate taxes if the estate is over $12.06 million

- Creating an irrevocable life insurance trust (ILIT) can help avoid life insurance payouts being taxed as part of the estate

Life insurance proceeds are income tax-free for beneficiaries

Life insurance proceeds are typically not taxable as income, but can be taxed as part of your estate if the amount being passed to your heirs exceeds federal and state exemptions. Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person are not includable in gross income and you don't have to report them. This is true whether you receive the payout in a lump sum or in installments. However, if your beneficiary receives the life insurance payment as a series of installments, the insurer will typically pay interest on the outstanding death benefit, and your beneficiary would have to pay income tax on the interest.

If you are the beneficiary of a life insurance policy, the proceeds are income tax-free. However, if the policy is individually owned by the insured, the death benefit is included in the taxable estate and is subject to both federal and state estate taxes, but only when the estate is worth more than the current exemption limits. For example, the federal estate and gift tax exemption for 2016 was $5.45 million, meaning an individual could leave $5.45 million to heirs and pay no federal estate or gift tax. The exemption amount for 2022 is above $12.06 million for individuals and $12.92 million for 2023, while maintaining a top tax rate of 40%.

There are ways to reduce the taxes on your estate and ensure that your beneficiaries receive as much as possible. One way is to transfer ownership of the life insurance policy, usually to an irrevocable life insurance trust (ILIT). By transferring ownership of the policy to the ILIT and not being the trustee, you can keep the death benefit out of your taxable estate. However, if you pass away within three years of transferring the policy, the full amount of the proceeds will be included in your estate and taxed accordingly. Additionally, if the cash value of the policy is greater than the gift tax exemption, you may need to pay a gift tax when transferring ownership.

MetLife's Drug Testing Policy for Life Insurance Applicants

You may want to see also

Life insurance proceeds are included in the taxable estate if the policy is individually owned by the insured

Life insurance proceeds are typically not taxable as income but can be taxed as part of your estate if the amount being passed to your heirs exceeds federal and state exemptions. If the policy is individually owned by the insured, the death benefit is included in your taxable estate and is subject to both federal and state estate taxes, but only when your estate is worth more than the current exemption limits.

In the United States, the federal estate tax exemption is $12.06 million for 2022 ($12.92 million for 2023), while the top tax rate is 40%. However, not all estates are subject to taxes. Each state has its own estate tax exemption and tax rates, which range from $1 million to $7 million, with tax rates as high as 20%.

In New Jersey, the estate tax exemption is $675,000, and the tax rate starts at 11% and rises to 16% depending on the amount inherited. It's important to note that New Jersey is one of the few states that charge both an estate tax and an inheritance tax. The inheritance tax is determined by the relationship between the deceased and the beneficiary. Spouses, children, grandchildren, and parents of the deceased are exempt from the inheritance tax, regardless of the size of the estate. For other beneficiaries, the tax rate ranges from 11% to 16% for transfers exceeding $25,000.

To avoid including life insurance proceeds in your taxable estate, you can transfer ownership of the policy to another person or entity. This involves choosing a competent adult or entity as the new owner, obtaining the proper forms from the insurance company, and ensuring that the new owner pays the premiums. Alternatively, you can set up an irrevocable life insurance trust (ILIT) and transfer ownership of the policy to the trust. This option allows you to maintain some legal control over the policy and ensures that all premiums are paid promptly. However, it's important to consult with a financial planner and an estate attorney to determine the best course of action for your specific situation.

Renewing Life and Health Insurance: Quick License Guide

You may want to see also

New Jersey charges an inheritance tax on estates worth more than $25,000 for certain heirs

Life insurance proceeds are typically not taxable as income, but they can be taxed as part of your estate if the amount being passed to your heirs exceeds federal and state exemptions. If the beneficiary is your spouse, the life insurance payout is not taxed and will be passed on to them fully, along with the rest of your estate. Spouses typically have an unlimited exemption with regards to estate taxes.

If the beneficiary is anyone other than your spouse, such as a child or parent, your life insurance payout will be added to the value of your estate. If your total estate has a greater value than is exempted, any amount over the exemption is subject to estate and inheritance taxes.

Federal estate taxes apply when the value of your estate exceeds $12.06 million per individual and is subject to a tax rate of up to 40%.

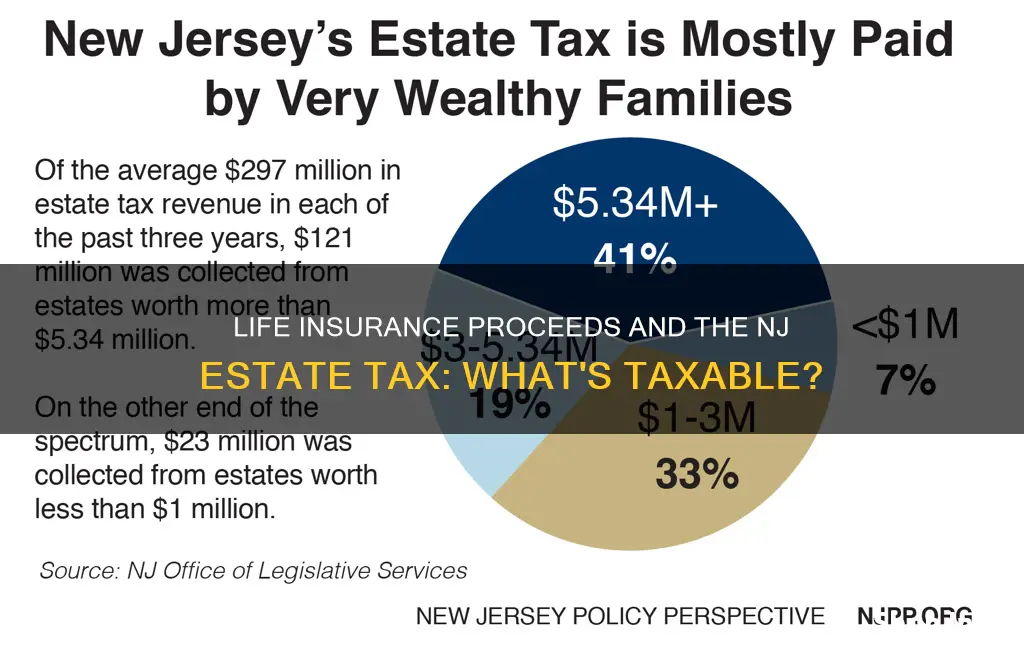

New Jersey is one of only two states that charge both an estate tax and an inheritance tax. Estates with a total value of more than $675,000 are subject to the New Jersey estate tax when inherited by anyone other than the deceased person's spouse.

New Jersey charges an inheritance tax on estates worth more than $25,000, but only to certain heirs, not all. Beneficiaries who are the surviving spouse, children, grandchildren, and parents of the deceased are entirely exempt and will not pay any state inheritance tax, regardless of the size of the estate. Other relatives, such as siblings and the spouses or partners of deceased children, are taxed on estates over $25,000. The rate starts at 11% and rises to 16% depending on the amount inherited.

One way to avoid this is to create an irrevocable trust that owns the life insurance policy, thereby removing it from your taxable estate.

Huntington Bank: Life Insurance Options and Benefits

You may want to see also

Beneficiaries may have to pay federal estate taxes if the estate is over $12.06 million

Life insurance proceeds are typically not taxable as income, but they can be taxed as part of your estate if the amount being passed to your beneficiaries, along with the rest of your estate, exceeds certain thresholds.

In the United States, if your estate is worth more than $12.06 million, it will be subject to federal estate taxes. The exact percentage depends on the taxable amount of the estate, but the rate can be as high as 40%.

It's important to note that this threshold and tax rate are subject to change over time. For example, the exemption amount was $12.92 million in 2023 and is projected to decrease to $5 million in 2026.

Additionally, it's worth mentioning that some states also have their own estate and inheritance tax laws. These laws vary by state, and the thresholds can range from $1 million to $7 million. So, depending on where you live, your beneficiaries may have to pay state taxes on their inheritance as well.

To avoid paying taxes on life insurance proceeds, one strategy is to set up an irrevocable life insurance trust (ILIT). By transferring ownership of the life insurance policy to the ILIT, you can remove it from your taxable estate. However, it's important to be mindful of the three-year rule, which states that if you pass away within three years of transferring the policy, it will still be included in your estate for tax purposes.

Consulting with a financial planner or estate attorney is always recommended to ensure you're making the best decisions for your specific situation.

Life Insurance Benefits: Subject to Taxation or Not?

You may want to see also

Creating an irrevocable life insurance trust (ILIT) can help avoid life insurance payouts being taxed as part of the estate

Creating an irrevocable life insurance trust (ILIT) is a powerful tool for reducing estate taxes and protecting assets. Here's how it works and why it's beneficial:

How ILITs Work

An ILIT is a trust created during the insured's lifetime that owns and controls a term or permanent life insurance policy. The grantor typically creates and funds the ILIT, choosing the trustee and beneficiaries. The trustee manages the trust and distributes the proceeds as outlined in the trust agreement. It's important that the trustee is an independent party, not connected to the grantor. The beneficiaries are the individuals chosen by the grantor to receive the money from the policy after their death.

Benefits of ILITs

Minimizing Estate Taxes

The primary benefit of an ILIT is that it keeps life insurance proceeds out of the taxable estate of the grantor. When the grantor passes away, the life insurance payout goes directly to the trust beneficiaries, bypassing the estate. This means the death benefit avoids estate taxes completely, which can be as high as 40% at the federal level.

Avoiding Gift Taxes

By gifting money to the ILIT to pay for insurance premiums, the grantor can utilize the annual gift tax exclusion, further reducing the size of their taxable estate.

Asset Protection

The assets within an ILIT are generally safe from creditors' claims and are protected in the event of divorce or bankruptcy.

Probate Avoidance

Assets in an ILIT bypass the probate process, avoiding delays and expenses associated with probate.

Preserving Government Benefits

ILITs can help beneficiaries maintain eligibility for means-tested government aid programs, ensuring they do not get disqualified due to inheritance.

Control and Flexibility

The grantor of an ILIT retains the power to change the beneficiaries, providing some level of control and flexibility.

Drawbacks of ILITs

Despite the numerous advantages, there are a few potential drawbacks to consider:

Loss of Control

Once a policy is transferred into an ILIT, the grantor loses some control over it. All decisions regarding the trust are made by the trustee, and the grantor cannot alter or revoke the trust.

Complexity

ILITs are complex instruments, and mistakes in their setup or management can negate their benefits.

Tax Administration

As a separate tax entity, the ILIT requires annual tax filings and strict adherence to tax laws and regulations.

Inflexibility

ILITs are generally permanent and cannot be changed or revoked, so it's important to be confident about your goals and plans before establishing one.

While ILITs offer significant benefits, they also come with certain trade-offs. It's essential to carefully weigh the advantages against the potential drawbacks and consult with an experienced estate planning attorney to determine if an ILIT aligns with your specific situation and goals.

Whole Life Insurance: Taxable or Not?

You may want to see also

Frequently asked questions

Life insurance proceeds are not taxable with respect to income tax as long as the proceeds are paid out entirely as a one-time payment. However, if the beneficiary is anyone besides the insured's spouse, the proceeds will be added to the value of the estate. If the total value of the estate is greater than the exemption, any amount over the exemption is subject to estate and inheritance taxes.

To avoid paying any taxes on life insurance proceeds, you will need to transfer ownership of the policy to another person or entity. Alternatively, you can set up an irrevocable life insurance trust (ILIT).

Yes, if the policyholder elects to delay the benefit payout and the money is held by the life insurance company for a given period of time, the beneficiary may have to pay taxes on the interest generated during that period.

Yes, beneficiaries who are the spouse, children, grandchildren, or parents of the deceased are exempt from the New Jersey estate tax, regardless of the size of the estate.