Post-traumatic stress disorder (PTSD) is a mental health condition that can affect anyone who has experienced a scary or stressful event, such as military combat, a car crash, or the death of a loved one. People with PTSD often struggle with symptoms such as flashbacks, nightmares, and negative thoughts and emotions, which can make it difficult to maintain a job or social relationships. As a result, many individuals with PTSD worry that they will be denied life insurance due to their diagnosis. While it is true that insurance companies consider mental health conditions like PTSD as a risk factor when determining coverage and premiums, it is not a disqualifier across the board. Some companies may offer coverage at higher rates, while others may provide competitive rates or specialised policies for those with PTSD, especially if the condition is mild and being managed through treatment. Ultimately, the impact of PTSD on life insurance eligibility and costs varies depending on the individual's overall health, treatment history, and the policies of the insurance company.

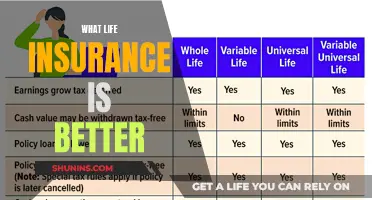

| Characteristics | Values |

|---|---|

| Can you be denied life insurance for PTSD? | Yes, but not by all insurers. |

| Is PTSD considered a high-risk condition? | Yes, by some insurers. |

| What factors affect the decision to deny life insurance for PTSD? | Severity of symptoms, date of onset, necessity of medication, need for counselling/psychotherapy, hospitalizations, suicide attempts, employment history, physical health, lifestyle, and use of alcohol or tobacco. |

| What are the consequences of being denied life insurance for PTSD? | Financial instability and exacerbation of stigma for individuals with PTSD. |

| What are the alternatives for individuals with PTSD who are denied life insurance? | Guaranteed issue life insurance, group life insurance, Veterans Group Life Insurance (VGLI), or life insurance from companies specializing in coverage for the military community. |

What You'll Learn

- PTSD sufferers can get life insurance, but may face higher premiums

- Veterans with PTSD are often denied life insurance

- PTSD is not an automatic disqualifier for life insurance

- Life insurance companies view PTSD as a high-risk condition

- People with PTSD may be denied life insurance due to related conditions

PTSD sufferers can get life insurance, but may face higher premiums

It is a common misconception that a diagnosis of Post-Traumatic Stress Disorder (PTSD) will automatically disqualify an individual from obtaining life insurance. While it is true that some insurance companies may deny coverage to applicants with PTSD, it is not a blanket rule across the industry. In fact, there are companies that specialise in providing life insurance to individuals with mental health conditions, including PTSD.

The key factor in determining whether someone with PTSD will be approved for life insurance is the severity of their condition and the overall impact it has on their life. Insurance companies will consider factors such as the date of diagnosis, the necessity of medication, the frequency of hospitalisations, and whether the applicant is undergoing counselling or psychotherapy. If an individual's PTSD is mild and well-controlled, they may even be able to obtain life insurance at standard rates. However, if the condition is more severe and requires substantial medication or frequent hospitalisations, it is likely that the applicant will be deemed an impaired risk and face higher premiums.

The application process for life insurance with PTSD can be daunting, as it often involves disclosing personal information about one's mental health. It is crucial to be honest during this process, as lying or omitting information can be considered fraud and lead to serious consequences. The more detailed the medical history and doctor's records are, the better the chances of receiving a favourable health class rating. It is also important to note that insurance companies will assess an applicant's overall health and lifestyle, including employment history, physical activity level, and substance use.

For individuals with severe PTSD who have difficulty obtaining life insurance, working with an experienced life insurance agent or broker can be beneficial. They can help navigate the complex landscape of insurance policies and find the right carrier that is more accommodating of mental health conditions. Additionally, guaranteed issue life insurance or group life insurance offered through employers can be alternative options for those who have been denied traditional life insurance coverage.

While living with PTSD can present challenges, it should not prevent individuals from seeking the financial protection that life insurance provides. By being proactive in managing their condition and shopping around for insurance providers, PTSD sufferers can increase their chances of obtaining life insurance coverage that meets their needs.

Life Insurance Cash Value: Can It Be Garnished?

You may want to see also

Veterans with PTSD are often denied life insurance

It is common for individuals with Post-Traumatic Stress Disorder (PTSD) to worry about whether they will be eligible for life insurance. While it is possible to obtain life insurance after a PTSD diagnosis, many veterans with PTSD are denied coverage. This denial can have a significant impact on both the veterans and their families, affecting their financial stability and exacerbating the stigma surrounding mental health.

The Americans with Disabilities Act (ADA) protects individuals with disabilities, including those with PTSD, in various aspects of life. However, when it comes to purchasing products from private companies, such as life insurance, the ADA offers limited protection. The decision to deny life insurance to individuals with PTSD is often justified by insurance companies as a matter of risk assessment. They argue that PTSD, especially when coupled with other physical injuries and medications, poses a higher risk.

The process of applying for life insurance can be intimidating for individuals with PTSD, as they are required to disclose personal information about their symptoms, hospitalizations, and medications. Underwriters assess this information to determine the applicant's risk level, and those with severe PTSD symptoms and frequent hospitalizations may face challenges in obtaining approval.

The impact of a denial can be devastating, not only on the veteran but also on their loved ones. It creates financial instability and further traumatizes individuals already struggling with the challenges of PTSD. Additionally, the denial of life insurance contributes to the stigma surrounding mental health, making it more difficult for those with PTSD to seek the help they need.

To address this issue, it is crucial to have an informed discussion about the use of mental illness as a basis for denying life insurance policies. While insurance companies have the legal right to deny coverage based on risk assessments, the lack of data and transparency around denial rates makes it challenging to fully understand the extent of the problem.

Veterans with PTSD face unique challenges in obtaining life insurance, and it is important to recognize the impact of these denials on their lives and the lives of their families. While there are alternative options for coverage, such as federal life insurance programs, the process of securing life insurance remains complex and often discouraging for veterans with PTSD.

Lincoln Heritage Life Insurance: Drug Testing Policy Explained

You may want to see also

PTSD is not an automatic disqualifier for life insurance

While it is true that some people with Post-Traumatic Stress Disorder (PTSD) have been denied life insurance coverage, it is not a given that you will be turned down for having this condition. In fact, many people with PTSD have successfully obtained life insurance. The key factor is the severity of your symptoms and how well your condition is managed.

When you apply for life insurance, the insurance company will consider your overall health to determine how risky you are to insure. This includes your mental health, and insurers will want to see a complete picture of your diagnosis, treatment history, and the rest of your medical history. They will also want to know if you are taking any medication, and if so, how frequently and in what dosages.

If your PTSD is mild and well-controlled with medication or counselling, you can expect to receive a Standard health class rating. This assumes that you are in good health overall and don't smoke. If your PTSD is more severe and requires substantial medication to control, you are likely to receive a Mild Sub-Standard or Sub-Standard health class rating. This means you will be considered an impaired risk to the insurance company, and your premiums will be higher.

If you have severe PTSD symptoms and frequent hospitalizations, you may find it difficult to be approved for life insurance by most companies. In this case, it is recommended that you work with an experienced life insurance agent or broker who can help you find the right carrier and navigate the application process. They can shop around on your behalf and increase your chances of finding coverage that meets your needs.

If you have been turned down for traditional life insurance, there are still other options available to you. Guaranteed issue life insurance, for example, does not require a medical exam or health questionnaire, and approval is guaranteed if you meet the age requirements (usually between 50 and 80 years old). However, the death benefits are typically capped at a lower amount, and there may be a waiting period before your beneficiaries can receive the full benefit.

Group life insurance is another option, as these policies are often inexpensive and easy to obtain through your employer. They generally do not require any medical underwriting to qualify, but the coverage only remains active while you are employed by the company.

The importance of honesty

It is important to be honest about your PTSD diagnosis when applying for life insurance. Lying or withholding information about your mental health can be considered fraud and can have serious consequences. Your application may be declined, your premiums may be higher, or your policy could be canceled. Insurance companies have access to your medical records and prescription history, so it is always best to be upfront about your health conditions.

Get Term Life Insurance: Steps to Protect Your Family

You may want to see also

Life insurance companies view PTSD as a high-risk condition

People with PTSD often experience symptoms such as flashbacks, nightmares, and negative thoughts and emotions, which can be triggered by everyday stimuli. This can make it challenging for them to hold down a job or interact with others. PTSD is also associated with an increased risk of developing other conditions, such as anxiety, depression, sleep disorders, substance abuse, and suicidal tendencies. These comorbidities further contribute to the perception of high risk by insurance companies.

The severity and duration of PTSD symptoms, as well as the effectiveness of treatment, play a crucial role in determining life insurance eligibility and premiums. Individuals with mild PTSD who are managing their condition through medication or counselling may receive more favourable ratings and premiums. However, those with severe and frequent PTSD symptoms, including hospitalizations, are likely to face higher premiums or even denial of coverage by most companies.

The impact of PTSD on an individual's overall health and functionality is a key consideration for life insurance companies. The condition's influence on physical health, such as cardiovascular risks associated with anxiety and depression, is also taken into account when determining rates.

While PTSD is viewed as a high-risk condition, it is important to note that life insurance companies do not automatically deny coverage to individuals with this diagnosis. Each application is evaluated on a case-by-case basis, taking into account the specific circumstances and treatment history of the applicant. However, the perception of PTSD as a high-risk condition can result in higher premiums or more stringent requirements for individuals seeking life insurance coverage.

Whole Life Insurance: Canceling Policy Penalties Explained

You may want to see also

People with PTSD may be denied life insurance due to related conditions

When applying for life insurance, individuals with PTSD may be assessed based on the severity of their condition, the effectiveness of their treatment, their medication usage, and their overall health. Related conditions, such as anxiety, depression, sleep disorders, substance abuse, and suicidal tendencies, can also impact the approval process and insurance rates.

In some cases, insurers may deny coverage or charge higher premiums if these related conditions are present. Additionally, inconsistent treatment records, recent hospitalizations, and health issues linked to mental health can further influence the decision.

It is crucial for individuals with PTSD to be honest about their condition and provide detailed medical records during the application process. Seeking help early and maintaining consistent treatment can improve the chances of obtaining life insurance.

Primerica's Term Life Insurance: Loan Options Explored

You may want to see also

Frequently asked questions

Yes, it is possible to be denied life insurance for PTSD. However, this is not always the case, and it depends on the insurance company and the individual's circumstances. Some companies may offer high-risk policies at exorbitant rates, while others may deny coverage altogether.

Insurance companies typically consider the severity of the condition, the date of diagnosis, the effectiveness of medications or treatments, and whether the applicant is undergoing counselling or psychotherapy. They may also look at the applicant's overall health picture, including any physical injuries or other health issues.

Yes, individuals with PTSD who have been denied commercial life insurance may consider guaranteed issue life insurance, which does not require a medical exam or health questionnaire, or group life insurance offered through their employer. These options typically have lower coverage amounts and may be more expensive.

If you are denied life insurance due to PTSD, it is essential to shop around and compare quotes from different insurance companies, as underwriting rules vary across insurers. Working with an experienced life insurance agent or broker can also increase your chances of finding coverage. Being proactive about your treatment and maintaining a consistent pattern of stability, such as steady employment, can also improve your chances of approval.