Life insurance is a crucial financial product for people of all ages, but it can be especially important for those over 50. As people age and their financial responsibilities evolve, life insurance can provide peace of mind and ensure loved ones are taken care of. While it's generally more expensive to purchase life insurance later in life, there are still options available to meet the unique needs of older individuals. This article will explore the benefits of life insurance for people over 50 and provide insights into selecting the most suitable coverage.

| Characteristics | Values |

|---|---|

| Purpose | To secure the financial future of loved ones in the event of an untimely death |

| Age | People over 50 can still apply for life insurance to protect their loved ones |

| Family | Life insurance can help provide for lost income and protect your family from losing your home |

| Dependents | Life insurance can help cover outstanding debts and provide ongoing support for dependents |

| Retirement | Life insurance can help fulfil post-retirement financial needs and goals |

| Tax Benefits | Life insurance provides tax benefits under sections of the Income Tax Act |

| Riders | Additional benefits can be added to a life insurance policy, such as accidental death or disability riders |

| Health | Different insurance policies offer varying coverage for medical or health issues |

| Tenure | When buying life insurance in your 50s, the tenure period is usually shorter |

| Premium | The premium for life insurance is higher for older age groups |

What You'll Learn

Life insurance for senior citizens

Life insurance is a crucial financial tool for senior citizens to secure their family's future and protect their loved ones from financial hardship in the event of their untimely demise. While it is recommended to purchase a term plan at a young age to avail of low premiums, senior citizens can also buy term insurance plans to ensure the financial protection of their families.

Senior citizens may need life insurance for a variety of reasons, including:

- Income replacement: Life insurance can provide a consistent income for senior citizens, enabling them to be financially independent after retirement. It acts as a channel for savings and an income source at the end of the policy term.

- Debt repayment: The policy payout can be used to pay off any outstanding debts, such as loans, credit card bills, or medical expenses.

- Inheritance: Life insurance can ensure that the policyholder's children receive a significant inheritance.

- Spouse support: In the absence of the policyholder, life insurance can provide financial benefits to the surviving spouse, especially if they are unable to care for themselves.

- Property taxes and legal expenses: The insurance payout can cover property taxes or other legal expenses incurred by the policyholder's family.

Types of Life Insurance Plans for Senior Citizens

There are two main types of life insurance plans for senior citizens:

- Term life insurance: Offers coverage for a predetermined period. It is more flexible and affordable than whole life insurance. Seniors can choose the duration, sum assured, and payment frequency. Certain policies allow for coverage extensions.

- Whole life insurance: Provides coverage for the entire life of the policyholder. It includes a savings component, making it more expensive than term insurance. Whole life insurance offers steady premium payments, tax benefits, increasing cash value, and everlasting protection.

Benefits of Life Insurance for Senior Citizens

- Financial security: Life insurance provides financial protection for the policyholder's family, helping them fulfil their financial goals and objectives.

- Tax advantages: Senior citizens can avail of tax benefits under sections 80C, 80D, and 10(10D) of the Income Tax Act, 1961.

- Peace of mind: Life insurance gives senior citizens peace of mind, knowing that their loved ones will be taken care of financially.

- Enhanced legacy: Life insurance can help senior citizens create a legacy for their family and future generations.

- Riders: Life insurance plans for senior citizens often offer additional coverage through riders, such as critical illness, accidental death, and disability benefits.

Factors to Consider When Choosing Life Insurance for Senior Citizens

When selecting a life insurance plan, senior citizens should consider the following:

- Age and health: The premium rates and coverage options may vary depending on the age and health condition of the senior citizen. It is generally recommended to purchase life insurance early to secure a larger life cover at affordable premiums.

- Claim settlement ratio: Opt for a plan from a company with a high claim settlement ratio to ensure timely and efficient settlement of claims.

- Riders: Evaluate the different riders offered by insurers and choose the ones that best suit your needs to enhance the base coverage of the policy.

- Payout options: Consider the payout options offered by the plan. Some plans offer flexible payout options, allowing you to choose between a lump sum or regular income.

Popular Life Insurance Plans for Senior Citizens in India

- Reliance Life Super Golden Years Term 10 Senior Citizen Plan: A systematic investment plan offering flexible investment fund options and tax-free commutation.

- Kotak Lifetime Income Plan: A non-linked, non-participating immediate annuity plan providing a steady income throughout life, with various annuity options to choose from.

- Max Life Guaranteed Lifetime Income Plan: Offers guaranteed income for the lifetime of the insured, with options for single or joint life annuity.

- Aegon Life iTerm Prime Plan: Provides flexible premium payment options and the option to add riders for accidental death and critical illness coverage.

- SBI Life's Poorna Suraksha Plan: A non-linked, non-participating plan with built-in critical illness cover, offering tax benefits and automatic premium waivers in the event of a critical illness diagnosis.

Life Insurance: Haven Life and MassMutual Compared

You may want to see also

Term insurance for over 50s

Term insurance is a great way to secure your family's future and ensure they are well protected, even in your absence. Here are some key points to consider when exploring term insurance options for those over 50:

Reasons to Get Term Insurance in Your 50s

- Family Protection: Many people in their 50s still have financial dependents, such as a spouse or children. Term insurance can help provide for lost income, protect your family from losing their home, and cover children's education costs.

- Coverage for Final Expenses: These policies are designed to cover funeral and death-related costs, which can be substantial. A term insurance policy can ensure your loved ones don't have to bear this financial burden during a difficult time.

- Debt Protection: If you have outstanding loans, credit card debt, or other financial commitments, term insurance can help ensure these are covered in the event of your untimely death.

- Retirement Planning: Some term insurance plans offer a survival benefit, which can help build a corpus for your post-retirement years and provide financial security.

- Income Tax Benefits: In some countries, purchasing term insurance can provide tax benefits, allowing you to save on income tax.

- Additional Riders: Insurance providers often offer the option to add riders for an extra layer of protection, such as disability, critical illness, or accident cover.

Factors to Consider

- Health Status: If you are in good health, you may qualify for higher coverage at more affordable premiums, even in your 50s.

- Debts and Liabilities: Calculate your debts to ensure that your chosen coverage is sufficient to cover these liabilities in the event of your death.

- Riders: Choose riders based on your specific needs, such as critical illness or accident cover.

- Claim Settlement Ratio: Check the claim settlement ratio of the insurance provider to ensure they have a good track record of honouring claims.

- Retirement Plans: If your insurance provider offers a survival benefit, you can use term insurance as part of your retirement planning.

Choosing the Right Policy

When selecting a term insurance policy, it's important to evaluate your specific needs, budget, and health. Here are some key considerations:

- Needs: Identify why you need term insurance, whether it's to provide for loved ones, cover final expenses, or leave a legacy. This will guide you in choosing the right type of policy and coverage amount.

- Budget: Longer-term policies and permanent coverage options are typically more expensive. Consider your budget and how long you will need coverage to determine the best option for you.

- Health: If you have health concerns, look for policies with flexible underwriting, such as simplified or guaranteed issue options. However, these options may come with higher premiums or limited coverage amounts.

Term Insurance Providers for Over 50s

When considering term insurance providers, it's worth comparing quotes from various companies, as each evaluates risk differently. Here are some providers that offer term insurance for over 50s:

- Corebridge Financial: Offers flexible term lengths and permanent options, as well as final expense insurance products with added benefits.

- Mutual of Omaha: Provides both term and whole life insurance policies for individuals aged 50 and above, with high customer satisfaction ratings.

- New York Life: In partnership with AARP, offering exclusive pricing and policy features for members, including no health exam requirements.

- Transamerica: Offers final expense policies, as well as term, whole, and universal life insurance plans.

Additional Considerations

When choosing a term insurance policy, it's important to also consider the following:

- Death Benefit: Select a death benefit amount that will sufficiently provide for your loved ones and cover any immediate expenses, such as funeral costs. Higher death benefits typically come with higher premiums.

- Riders: Consider adding riders, such as a long-term care rider, disability waiver of premium rider, accelerated death benefit rider, or chronic illness rider, to enhance your coverage.

- Customer Service: Research the insurance company's customer service reviews and satisfaction ratings to ensure they have a good reputation for taking care of their customers.

- Financial Strength: Check the financial strength rating of the insurance company (e.g., through AM Best) to ensure they have the financial viability to pay out claims in the future.

In conclusion, while term insurance premiums may be higher for individuals over 50, it is still a valuable option to consider for financial planning and protecting your loved ones. By evaluating your specific needs, budget, and health, you can choose the right term insurance policy to provide peace of mind and security for you and your family.

Life Insurance: Can You Cover Your Ex?

You may want to see also

Permanent life insurance

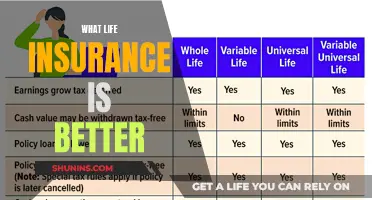

Because it lasts your entire life, a permanent life insurance policy can also be used as a tax-advantaged estate-planning tool. There are two primary types of permanent coverage: whole life insurance and universal life insurance.

Whole life insurance provides guaranteed death benefit protection for as long as you live, while earning cash value. A whole life insurance policy doesn't expire as long as regular premiums are paid. The cash value grows at a guaranteed rate, and the premiums never increase. Policies from a mutual life insurance company may also provide dividends, which can help cash value grow faster.

Universal life insurance also provides permanent protection and can earn additional cash value. However, it gives you added flexibility. You can adjust your monthly payments within a specific range to help deal with changing work circumstances. That variability also means that cash value growth and the death benefit can fluctuate with universal life insurance or even lapse if cash value and premiums drop below a certain level.

Marijuana Industry and Life Insurance: Who's Eligible?

You may want to see also

Whole life insurance

State Farm is ranked as the best provider of whole life insurance for people over 50 by USNews. Their whole-life policies include the benefit of cash value accumulation, which can be borrowed against or withdrawn for various financial needs. Their potential for dividend payments with participating whole-life policies is another potential financial advantage.

When choosing a whole life insurance policy, it's important to consider your specific needs, budget, and health. Understanding these factors can help you determine which type of policy aligns with your goals. For example, if you need coverage to last throughout your lifetime and can afford higher premiums, a whole life insurance policy might be suitable.

Convertable Life Insurance: Cash Value and Benefits Explained

You may want to see also

Universal life insurance

One of the key advantages of universal life insurance is its flexibility. Policyholders can choose the amount of their death benefit and how much they pay in premiums, as well as when they pay them. This flexibility can be helpful for those with fluctuating cash flow or variable income, such as self-employed individuals or business owners. Additionally, universal life insurance provides the opportunity to accumulate a cash value that can be used for various purposes, such as emergencies, home repairs, college tuition, or business investments.

The cash value in a universal life insurance policy earns interest, which can lead to potential cash value growth over time. Policyholders can borrow against this cash value or use it as collateral for a loan from a bank. However, it's important to note that unpaid loans will reduce the death benefit by the outstanding amount. While universal life insurance offers flexible premiums, there is a risk of large payment requirements or policy lapse if the cash value drops too low.

Another key difference between universal life and whole life insurance is that the former does not guarantee a fixed interest rate. The interest rate for universal life insurance is set by the insurer and can change frequently, whereas whole life insurance offers a guaranteed interest rate. Additionally, universal life insurance may require policyholders to undergo a medical exam to increase the size of their death benefit.

Overall, universal life insurance provides a flexible option for individuals seeking lifelong protection and the opportunity to build a cash value that can be utilised for various purposes. However, it's important to carefully manage the policy to avoid potential risks associated with large payments or policy lapse.

Northwestern Mutual: Max-Funded Life Insurance Options

You may want to see also

Frequently asked questions

Yes, life insurance is important for senior citizens to secure their family's future financially. It can also help fulfil their children's educational and career goals and ensure their spouse's financial independence.

Term insurance for senior citizens offers flexible payout options, tax benefits, and enhanced coverage with optional riders. It also provides financial support for children and spouses.

The main factors include the family's medical history, existing health conditions, term plan sum assured, and smoking/lifestyle habits.