AARP members can get life insurance through the AARP Life Insurance Program, which is underwritten by New York Life Insurance Company. This program offers term, whole, and guaranteed life insurance without a medical exam, and is available exclusively to AARP members aged 50 and older. AARP members can get an instant quote and apply online.

| Characteristics | Values |

|---|---|

| Life Insurance Provider | New York Life Insurance Company |

| Life Insurance Program | AARP Life Insurance Program |

| Available to | AARP Members aged 50-80 and their spouses aged 45-80 |

| Types of Policies | Term, Whole, and Guaranteed Life Insurance |

| Medical Exam Required | No |

| Health Questionnaire Required | Yes |

| Coverage Amount | Up to $150,000 for Term, $50,000 for Whole, and $30,000 for Guaranteed |

| Coverage End Age | 80 years |

| Premium Increases | No |

| Waiting Period | None |

| Riders Offered | Term Rider Protect Plus, Guaranteed Exchange Option |

| Contact | (800) 607-6957 |

What You'll Learn

AARP Term Life Insurance

The application process for AARP Term Life Insurance is straightforward and can be completed online in minutes. There is no medical exam required, only health and other information are needed. Most applicants are accepted, and approval can be received via email in minutes. The rate of $11/month is for a female, aged 50, for $10,000 of coverage (this rate also applies to female, aged 50, non-smoker where applicable).

In addition to term life insurance, AARP also offers permanent life insurance and guaranteed acceptance life insurance. The permanent life insurance option provides up to $50,000 in coverage with no premium increases, while the guaranteed acceptance life insurance offers up to $30,000 in coverage with no premium increases and no medical exam or health questions.

Overall, AARP Term Life Insurance from New York Life is a trusted and reliable option for individuals seeking financial protection for their loved ones. With its easy application process, no medical exam requirement, and valuable coverage options, it provides a convenient way for AARP members to secure their financial future.

Retired Military: What Life Insurance Benefits Are Available?

You may want to see also

AARP Permanent Life Insurance

New York Life Insurance Company pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers and do not employ or endorse agents, producers, or brokers. AARP has established the AARP Life Insurance Trust to hold group life insurance policies for the benefit of its members.

Pension and Life Insurance: Taxable Proceeds?

You may want to see also

AARP Guaranteed Acceptance Life Insurance

The plan is underwritten by the New York Life Insurance Company, which has the highest ratings for financial strength awarded to any U.S. life insurer from leading independent rating services. New York Life has been in operation for over 175 years and has been working with AARP for more than 25 years.

This insurance plan can help loved ones with funeral costs, rent or mortgage payments, unpaid bills, and more. It is important to note that the full coverage amount may not be available if the individual is already insured with the program.

Sleep Apnea: Does it Affect Your Life Insurance Eligibility?

You may want to see also

AARP Life Insurance Options

AARP members between the ages of 50 and 80, and their spouses between the ages of 45 and 80, are eligible for AARP life insurance policies. The program offers term, whole, and guaranteed life insurance without a medical exam. Coverage is available in all 50 states and Washington, D.C.

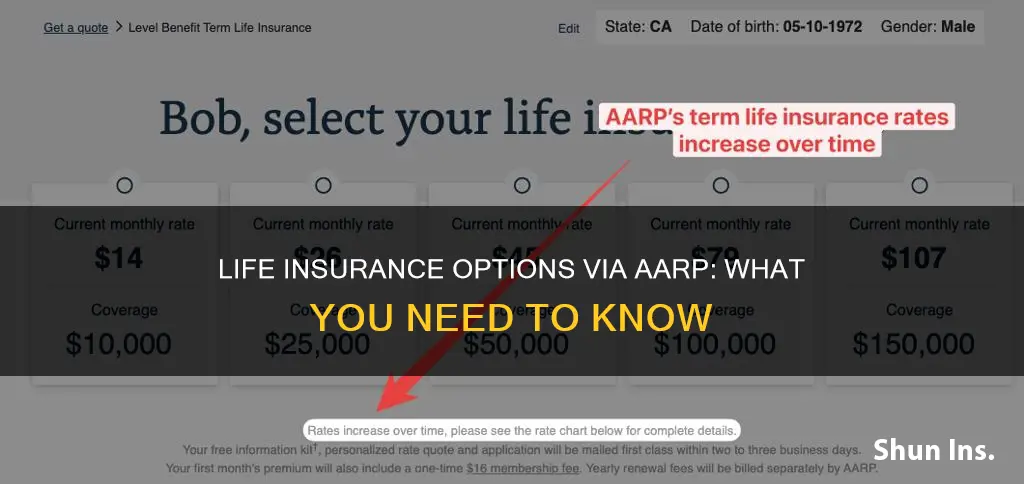

- Term Life Insurance Options: Term life insurance provides coverage for a set amount of time, typically until the policyholder turns 80. It can help beneficiaries manage expenses such as funeral costs, unpaid bills, and other financial obligations after the policyholder's passing. The coverage amount ranges from $10,000 to $150,000 for members aged 50 to 74 and their spouses aged 45 to 74. Premiums may increase over the policy term, and there is no waiting period for coverage to begin. While a medical exam is not required, a health questionnaire and access to other medical information are necessary.

- Permanent Life Insurance Options: Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the policyholder and grows in cash value over time, provided policy premiums are paid on time. The coverage amount ranges from $5,000 to $50,000 for members aged 50 to 80 and their spouses aged 45 to 80. Premiums are locked for life, and there is no medical exam required. However, a health questionnaire must be completed.

- Guaranteed Acceptance Life Insurance Options: AARP offers a second whole life policy called Guaranteed Acceptance. Coverage is guaranteed for members aged 50 to 80 and their partners aged 45 to 80, with no medical exam or health questionnaire required. The maximum death benefit is $25,000, and payouts are limited for the first two years.

In addition to these policies, AARP provides two riders: the Term Rider Protect Plus and the Guaranteed Exchange Option. The former raises coverage limits on an existing term life insurance policy, while the latter allows for exchanging term coverage for whole life insurance without proving insurability.

Life Insurance Options Post-Bypass Surgery

You may want to see also

AARP Life Insurance Plans

AARP life insurance is provided by New York Life Insurance Company, and is the only life insurance program developed exclusively for AARP members.

AARP Term Life Insurance

AARP members aged 50 to 74 and their spouses aged 45 to 74 can apply for term life insurance. The coverage can last until the insured person's 80th birthday, with coverage of up to $150,000. The annual price increases every five years, and the term life policy can be converted to permanent insurance at or before the age of 80.

AARP Permanent Life Insurance

AARP permanent life insurance offers whole life protection of up to $50,000. The annual price stays the same and coverage lasts throughout your life. Acceptance is based on health information and other details.

AARP Guaranteed Acceptance Life Insurance

The guaranteed acceptance life insurance option offers up to $30,000 in protection with limited benefits for the first two years. The rates never increase and there is no medical exam or health questions required.

AARP Life Insurance Options

Customised plans are available to supplement retirement savings.

How Life Insurance Inheritance Works for Children

You may want to see also

Frequently asked questions

The maximum coverage depends on the type of insurance. Term life insurance offers coverage of up to $150,000, permanent life insurance offers up to $50,000, and guaranteed acceptance life insurance offers up to $30,000.

No, AARP life insurance does not require a medical exam. However, you will need to provide health information and, in some cases, complete a health questionnaire.

Yes, AARP life insurance is exclusive to AARP members aged 50 and older.

You can get a quote and apply for AARP life insurance online through the AARP website or by contacting a licensed New York Life agent.