Life insurance is a financial product that provides a lump-sum payout to beneficiaries in the event of the policyholder's death. While the proceeds of life insurance policies are generally not taxable, there are certain situations where taxes may be incurred. For instance, if the beneficiary chooses to receive the payout in installments, any interest accrued during that time may be subject to taxation. Similarly, if the policyholder delays the benefit payout, resulting in interest accumulation, the beneficiary may need to pay taxes on that interest. Additionally, if the policy is left to an estate rather than an individual, estate taxes may apply if the value exceeds the exemption threshold. It's important to understand these nuances to effectively plan and avoid unexpected tax liabilities.

| Characteristics | Values |

|---|---|

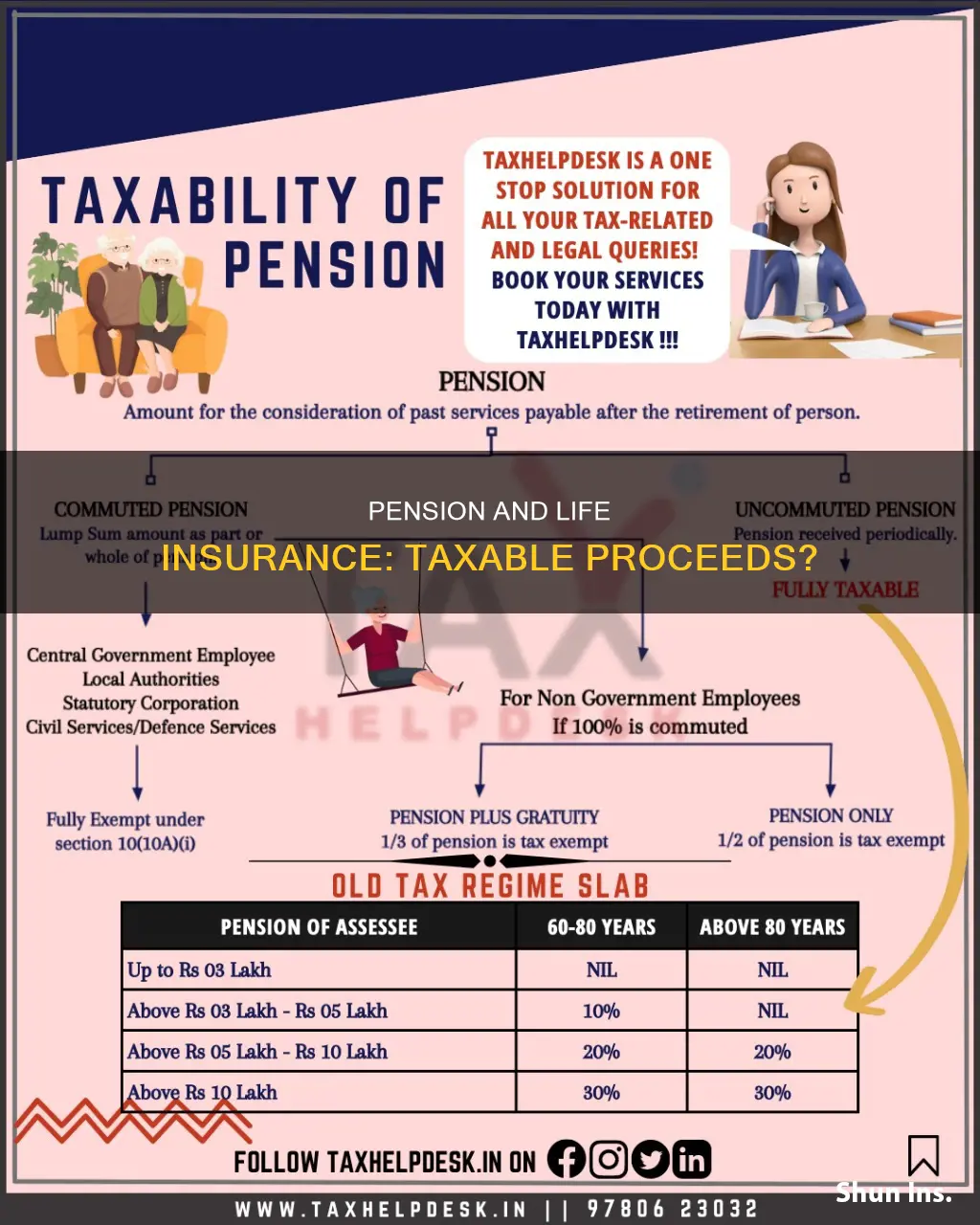

| Are pension life insurance proceeds taxable? | Generally, life insurance proceeds received as a beneficiary due to the death of the insured person are not taxable income and do not need to be reported to the IRS. |

| Are there any exceptions? | Yes, there are some exceptions. For example, if the beneficiary receives the payout in installments, any interest that builds up on those payments is considered taxable income. If the policyholder names their estate as the beneficiary rather than an individual, the person(s) inheriting the estate may have to pay estate taxes. |

| Are life insurance premiums tax-deductible? | Life insurance premiums are not usually tax-deductible. However, there are a few exceptions, such as if you gift a life insurance policy to a charity and continue to pay the premiums, or if you own a business and provide life insurance for your employees. |

What You'll Learn

- Interest on life insurance proceeds is taxable

- Life insurance proceeds are taxable when included in your estate

- Withdrawals from permanent life insurance are taxed under certain conditions

- Employer-paid life insurance is taxable above a certain threshold

- Life insurance proceeds are taxable if transferred for value

Interest on life insurance proceeds is taxable

Life insurance proceeds are generally not taxable if you are the beneficiary receiving them due to the death of the insured person. However, interest on life insurance proceeds is taxable and must be reported as such.

If you are the beneficiary of a life insurance policy and the policyholder elects to delay the benefit payout, the money may be held by the life insurance company for a certain period, during which interest will accumulate. In such cases, the beneficiary will have to pay taxes on the interest generated, even though the death benefit itself is not taxable. This means that when a beneficiary receives life insurance proceeds after a period of interest accumulation, they must pay taxes on the interest earned during that time.

For example, if the death benefit is $500,000 but earns 10% interest for one year before being paid out, the beneficiary will owe taxes on the $50,000 growth. This interest income is considered taxable income and should be reported as such.

It is important to note that if the policy was transferred to you for cash or other valuable consideration, there may be additional tax implications. The exclusion for the proceeds in such cases is limited to the sum of the consideration paid, any additional premiums paid, and certain other amounts. Therefore, it is generally advisable to consult with a tax professional to understand the specific tax treatment of life insurance proceeds in your situation.

Understanding Level Benefit Term Life Insurance Policies

You may want to see also

Life insurance proceeds are taxable when included in your estate

Life insurance proceeds are generally not taxable, but there are some situations in which they can be. One such situation is when the proceeds are included in your estate. If the policyholder names their estate as the beneficiary instead of an individual, the person or people who inherit the estate may have to pay estate taxes. This only applies if the estate's value is large enough to trigger these taxes, which is typically the case only for high-net-worth individuals. However, some states have lower thresholds for state estate taxes, so it's important to factor that into your planning. Working with an estate planner can help minimize tax implications and ensure your loved ones receive as much of the death benefit as possible.

To avoid having life insurance proceeds included in your estate, you can transfer ownership of the policy to another person or entity. This strategy is often used to keep the proceeds out of your taxable estate and ensure that your beneficiaries receive the full benefit. It's important to note that the original owner must give up all rights to make changes to the policy, and the new owner must pay the premiums. Additionally, the transfer must occur at least three years before the policyholder's death to avoid federal estate tax.

Another way to keep life insurance proceeds out of your taxable estate is to create an irrevocable life insurance trust (ILIT). In this case, the policy is held in trust, and the proceeds are not included as part of your estate. With an ILIT, you can maintain some legal control over the policy and ensure that all premiums are paid promptly. This option is especially useful if the beneficiaries of the proceeds are minor children from a previous marriage, as it allows you to name a trusted family member as a trustee to handle the money according to the terms of the trust document.

In conclusion, while life insurance proceeds are typically not taxable, they can become taxable when included in your estate. To avoid this, you can transfer ownership of the policy or set up an ILIT. These strategies can help minimize tax implications and ensure that your beneficiaries receive the full benefit. Working with a financial advisor or estate planner can help you navigate these options and make the most suitable choice for your situation.

Combined Insurance: Life Insurance Options and More

You may want to see also

Withdrawals from permanent life insurance are taxed under certain conditions

Permanent life insurance policies, such as whole life and universal life, allow policyholders to access accumulated cash through withdrawals, policy loans, or partial or full surrenders. While withdrawals up to the amount of total premiums paid are typically not taxable, withdrawals exceeding this amount may be subject to taxation. This includes any gains or dividends accrued on the policy, which are treated as ordinary income and taxed accordingly.

It is important to note that certain types of permanent life insurance policies may not permit withdrawals at all. Additionally, withdrawals can have unintended consequences, such as reducing the death benefit, increasing premiums, or causing the policy to lapse. Withdrawals made during the initial years of the policy may also be subject to taxation if they result in a reduction of the policy's death benefit.

Furthermore, if a policy has been classified as a Modified Endowment Contract (MEC), withdrawals are generally taxed according to the rules for annuities. Withdrawals made before the policyholder reaches the age of 59½ may also be subject to an early withdrawal penalty.

To avoid taxation on life insurance proceeds, individuals can transfer ownership of the policy to another person or entity. Additionally, ensuring proper documentation and timely reporting can help minimize associated taxes on interest earned during the collection process.

MetLife Insurance: Accidental Death Coverage and Exclusions

You may want to see also

Employer-paid life insurance is taxable above a certain threshold

Life insurance is a financial product that pays out a lump sum in the event of the insured's death, providing financial support to the beneficiaries and heirs. While life insurance proceeds are typically not taxable, there are certain situations where the beneficiary may be taxed on some or all of a policy's proceeds. One such situation arises when an employer pays for life insurance as part of an employee's compensation package.

Employer-paid life insurance, also known as group life insurance, is often offered as a benefit to employees. In the United States, the Internal Revenue Service (IRS) considers this type of insurance as income to the employee, and it becomes taxable above a certain threshold. According to the IRS, if the total amount of group-term life insurance coverage provided by an employer exceeds $50,000, the excess coverage is considered a taxable fringe benefit. This means that the employee must include the imputed cost of coverage above $50,000 in their taxable income, and it is also subject to social security and Medicare taxes.

The determination of whether the coverage exceeds the $50,000 threshold is based on the IRS Premium Table rates, not the actual cost of the insurance. If the employer pays any cost of the life insurance or arranges for premium payments where the premiums paid by one employee subsidize those paid by another, it is considered a taxable fringe benefit. It is important to note that the taxable portion of the group life insurance will be labelled as 'additional income' or 'additional compensation' on the employee's W-2 tax form.

For example, let's consider a scenario where an employee named John receives $150,000 in life insurance benefits from his employer. John pays $26 per year for his portion of the premium. To calculate the taxable fringe benefit, the $50,000 coverage threshold is subtracted from the total amount. Then, the annual cost of the remaining $100,000 coverage is calculated using the imputed income table. In this case, for a 30-year-old employee like John, the yearly cost of coverage for $100,000 would be $96. By subtracting the $26 he pays, the taxable income added to his wages is $70 for the year.

It is worth mentioning that employer-paid life insurance can provide valuable financial protection for employees and their loved ones. However, it is essential to be aware of the tax implications associated with this benefit, especially when the coverage exceeds the $50,000 threshold set by the IRS.

Variable Life Insurance: Invest and Insure

You may want to see also

Life insurance proceeds are taxable if transferred for value

Generally, life insurance proceeds are not taxable. However, if a life insurance policy is transferred for cash or other valuable consideration, the exclusion for the proceeds is limited to the sum of the consideration paid, additional premiums paid, and certain other amounts. This means that if you receive a policy in exchange for cash or other assets, you can only exclude from your gross income the amount you paid for the policy, plus any additional premiums you paid, and certain other amounts.

There are some exceptions to this rule. For example, transfers to the insured or a grantor trust where the insured is the grantor for tax purposes are not treated as transfers for value. Additionally, transfers to a partner of the insured, a partnership where the insured is a partner, or a corporation where the insured is an officer or stockholder are also not considered transfers for value.

It is important to note that if a policy has been deemed a Reportable Policy Sale, the exceptions to the transfer-for-value rule do not apply. In such cases, the policy is considered "tainted" and the beneficiary will be subject to income tax on a portion of the policy's death proceeds.

To avoid taxation on life insurance proceeds, it is recommended that ownership of the policy be transferred to another person or entity. This requires choosing a competent adult or entity as the new owner, obtaining the proper forms from the insurance company, and ensuring that the new owner pays the premiums. It is also important to obtain written confirmation of the ownership change from the insurance company.

Life Insurance and Probate: What's the Connection?

You may want to see also

Frequently asked questions

Generally, life insurance proceeds paid upon the insured’s death are not included in the beneficiaries’ taxable income. However, any interest generated is taxable and should be reported.

No, life insurance premiums are not usually tax-deductible. However, there are a few exceptions. If you gift a life insurance policy to a charity and continue to pay the premiums, those payments are generally considered charitable donations and may be tax-deductible.

Life insurance proceeds you receive as a beneficiary are not included in your income and do not need to be reported to the IRS. However, life insurance proceeds are taxable when included as part of your estate and if you meet the $12.9 million filing threshold.