Variable life insurance is a type of permanent life insurance that includes a death benefit and a cash value component. The cash value component is invested in securities, often mutual funds, and the policyholder can choose how the money is invested. This means that the cash value can rise or fall in value, so these policies carry more risk than other life insurance policies. Variable life insurance policies are considered more volatile than standard life insurance policies.

| Characteristics | Values |

|---|---|

| Type of Insurance | Permanent life insurance |

| Investment Options | Mutual funds, index funds, equities, bonds, money market funds, fixed interest investment |

| Death Benefit | Paid to beneficiaries upon death |

| Cash Value | Determined by premiums paid, policy fees, expenses, and performance of investment options |

| Risk | Higher risk compared to other life insurance policies |

| Tax Implications | Returns on variable policies are tax-free |

| Fees | Sales fees, surrender charges, mortality and expense risk fees, cost of insurance, administration fees, loan interest, transaction fees |

| Lapse | Policy may lapse if cash value is insufficient to cover fees and expenses |

What You'll Learn

- Variable life insurance offers a cash value account with investment options

- The cash value of a variable life insurance policy can be invested in mutual funds

- The cash value of a variable life insurance policy can be used to increase the death benefit

- The cash value of a variable life insurance policy can be withdrawn as cash

- The cash value of a variable life insurance policy can be used as collateral for a loan

Variable life insurance offers a cash value account with investment options

Variable life insurance is a permanent life insurance policy with an investment component. It offers a cash-value account with investment options, which is invested in assets like mutual funds. The cash value component of variable life insurance can be invested in asset options, mainly mutual funds, but also index funds, equities, bonds or money market funds. The value of the account will depend on the premiums paid, the performance of the investments and the associated fees and expenses.

Variable life insurance is a contract between the policyholder and the insurance company. It is intended to meet certain insurance needs, investment goals and tax planning objectives. It pays a specified amount to the policyholder's beneficiaries upon their death. The cash value varies according to the amount of the premiums paid, the policy's fees and expenses, and the performance of the investment options.

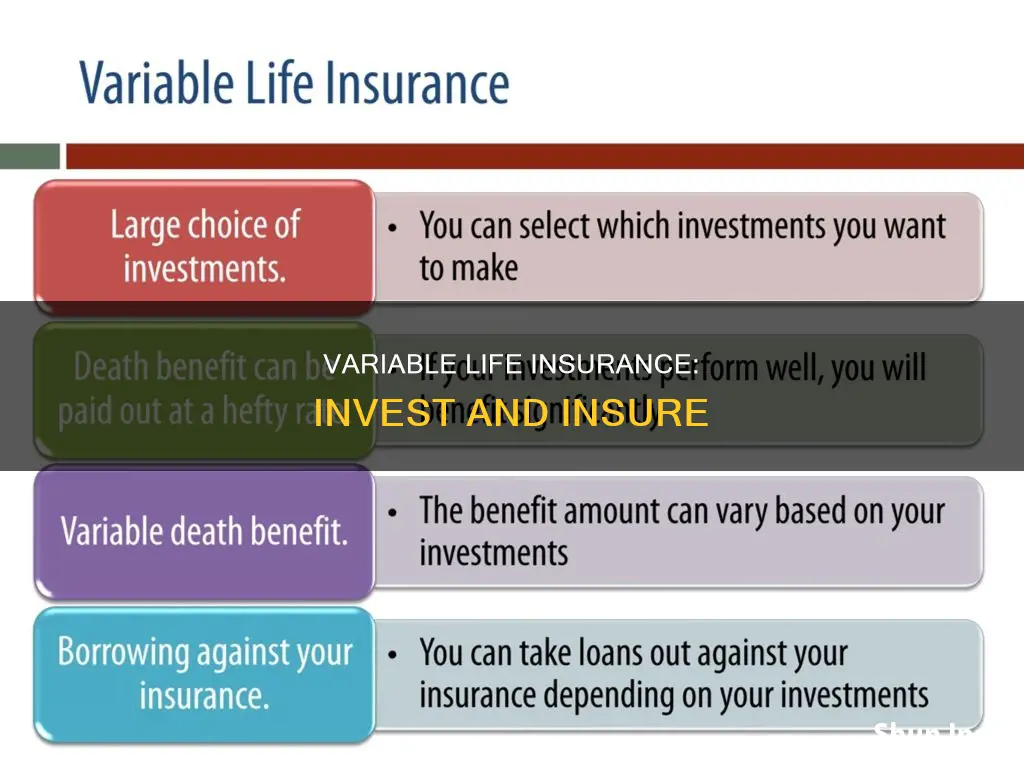

Variable life insurance is a flexible option, allowing policyholders to choose from several funds when deciding where to invest their money. It also offers the opportunity to make money with tax advantages. The investment portion receives favourable tax treatment, and money can be drawn from these accounts later on, through loans using the account as collateral, with tax-free income.

Variable life insurance policies are considered more volatile than standard life insurance policies, and they carry more risk. The cash value component is invested in assets that may rise or fall in value. However, policyholders can often allocate a portion of their premium to a fixed account, which guarantees a rate of return to reduce the overall risk.

New York Life: Exploring No-Underwriting Insurance Options

You may want to see also

The cash value of a variable life insurance policy can be invested in mutual funds

Variable life insurance is a permanent life insurance policy that includes an investment component. This means that the policy has a cash-value account that is typically invested in mutual funds.

The unique feature of variable life insurance is that its cash component can be invested in asset options, mainly mutual funds. The value of the policy will depend on the premiums paid, the performance of the investments, and the associated fees and expenses. The more money that is paid in premiums, the lower some of the policy's fees and expenses may be. This is because the net amount of risk determines some policy fees and expenses. The net amount of risk is the difference between the policy's face amount and cash value, so it decreases as the amount of money in the account increases.

Variable life insurance policies are considered more volatile than standard life insurance policies because of the investment component. The cash value of a variable life insurance policy is invested in assets, and the return on these investments is not guaranteed. This means that there is a risk of losing money, including the initial investment. However, investors who can assume additional risk may prefer variable life policies for their tax advantages. Returns on variable policies can provide tax-free income.

Life Insurance: DSHS Resource or Not?

You may want to see also

The cash value of a variable life insurance policy can be used to increase the death benefit

Variable life insurance is a type of permanent life insurance policy that includes a death benefit and a cash-value component. The death benefit is the amount of money that the insurance company pays to the policyholder's beneficiaries upon their death. The cash value is a savings component that the policyholder can access during their lifetime. This cash value can be used in several ways, including increasing the death benefit, withdrawing it as cash, or using it as collateral for a loan.

The cash value of a variable life insurance policy is invested, typically in mutual funds, and its performance may cause it to rise or fall in value. This creates an opportunity for higher returns compared to other life insurance policies but also carries more risk. The policyholder can choose how the cash value is invested, and some insurance companies offer a fixed interest investment option as well.

When you purchase a variable life insurance policy, you will receive a prospectus outlining all your investing options. If your cash value investments perform well, you have the option to use those gains to increase the death benefit. This can provide a larger payout for your beneficiaries when you pass away. However, it is important to note that taking out cash value during your lifetime will reduce the future death benefit for your heirs.

While variable life insurance offers the potential for higher returns, it also comes with higher premiums and management fees for the investments. Additionally, the returns on the cash value investments are typically capped, and there may be limited investment options available. Policyholders should carefully consider their preferences, financial situation, and investment goals when deciding if variable life insurance is right for them.

Sun Life Insurance: CPAP Machine Coverage Explained

You may want to see also

The cash value of a variable life insurance policy can be withdrawn as cash

Variable life insurance is a permanent life insurance policy with an investment component. It is intended to meet certain insurance needs, investment goals, and tax planning objectives. It is a policy that pays a specified amount to your beneficiaries upon your death. It also has a cash value that varies according to the amount of premium you pay, the policy's fees and expenses, and the performance of a menu of investment options offered under the policy.

- Withdrawals: You can usually withdraw up to a set limit, which is typically the amount you have put into the policy. Withdrawals are generally not considered taxable income if they are within the policy basis (the premiums you have already paid). However, withdrawals may reduce your death benefit and may not be an option within the first two years of the policy.

- Loans: You can take out a loan from your insurance provider, using your policy as collateral. Loan rates are usually lower than personal or home equity loans, and there is no loan application or credit check required. However, loans may incur interest charges, and any unpaid balance will reduce your benefits.

- Surrender: You can surrender your insurance policy, cancelling it and receiving the surrender cash value payment, which may be a lump sum or paid over time. While this allows you to access a large portion of your cash value, your policy will terminate, and your beneficiaries will not receive a death benefit. Surrender fees and taxes could also reduce the amount you receive.

- Sale: You can sell your policy to a life settlement company, which typically buys policies on behalf of financial institutions and investors. You will receive a lump sum payment, and you will no longer owe premiums on the policy. However, your heirs will not receive a death benefit, and you may owe taxes on the sale.

It is important to carefully consider the potential consequences of withdrawing cash from a variable life insurance policy, as it can impact the amount available to you, your death benefit, and the growth of your account. Consulting a financial advisor can help you understand the potential implications and make an informed decision.

Life Insurance: A Warm Welcome or Cold Comfort?

You may want to see also

The cash value of a variable life insurance policy can be used as collateral for a loan

Variable life insurance is a permanent life insurance policy with an investment component. It is intended to meet insurance needs, investment goals, and tax planning objectives. The policy has a cash-value account with money that is typically invested in mutual funds. The cash value of a variable life insurance policy can be used as collateral for a loan.

Variable life insurance policies are considered more volatile than standard life insurance policies. They carry more risk because the cash value component is invested in assets like mutual funds, which rise and fall in value. However, investors who can assume additional risk may prefer variable policies for their tax advantages. Returns on variable policies can provide tax-free income.

To use the cash value of a variable life insurance policy as collateral for a loan, the lender will usually be appointed as the primary beneficiary of the policy's death benefit. This means that if you default on the loan, the lender can claim the death benefit to recoup their losses. It is important to understand the risks involved in using the cash value of a variable life insurance policy as collateral for a loan. If you default on the loan, not only will your death benefit be reduced, but your premiums may also increase if you were using the invested returns of the policy's cash value to offset your premium costs.

In summary, the cash value of a variable life insurance policy can be used as collateral for a loan through a collateral assignment. This can provide benefits such as tax advantages and the ability to access funds for business or personal needs. However, it is important to carefully consider the risks involved, such as the potential reduction in the death benefit and the possibility of increased premiums if the invested returns of the cash value are used to offset premium costs.

Life Insurance and Sunsuper: What's the Deal?

You may want to see also

Frequently asked questions

Variable life insurance is a type of permanent life insurance policy. It has a higher potential for earning cash compared to traditional policies because it includes a cash value account that you get to decide how to invest.

Variable life insurance includes two components: a life insurance death benefit and a cash value account that is invested in various funds, usually mutual funds. The money from your insurance premium is used for account maintenance, fees, the death benefit, and the policy's cash value.

Variable life insurance policies may offer significant benefits, including financial protection for your family, a potentially increased death benefit, and flexibility and choice. However, potential downsides include high premiums, capped returns, and limited investment options.