In Washington State, it is illegal to drive a car without liability insurance or another way to assume financial responsibility for damages. If you drive a vehicle that is registered in Washington State, you must have motor vehicle insurance with liability limits of at least $25,000 of bodily injury or death of one person in any one accident, $50,000 of bodily injury or death of any two people in any one accident, and $10,000 of injury to or destruction of property of others in any one accident. You will receive an identification card from your auto insurance company when you buy a policy, and it is important to keep this with you whenever you drive so that you can show proof of insurance to law enforcement if requested.

What You'll Learn

Logging into your account

Once you have your login details, you can sign in to your account. From here, you can access a range of features, including viewing your policy documents, paying bills, and downloading your proof of insurance. You can also obtain a temporary proof of insurance if needed for a newly acquired vehicle. All of these features are available through the insurance company's website or mobile app, which you can download from the App Store or Google Play.

If you don't already have an account, you can sign up for online access on the insurance company's website or through their mobile app. This will give you the ability to manage your insurance information conveniently from your device.

Remember, online access provides a simple and efficient way to manage your auto insurance, so be sure to take advantage of these digital tools offered by your insurance provider.

U.S.A.A. vs Geico: Competitive Auto Insurance Rates

You may want to see also

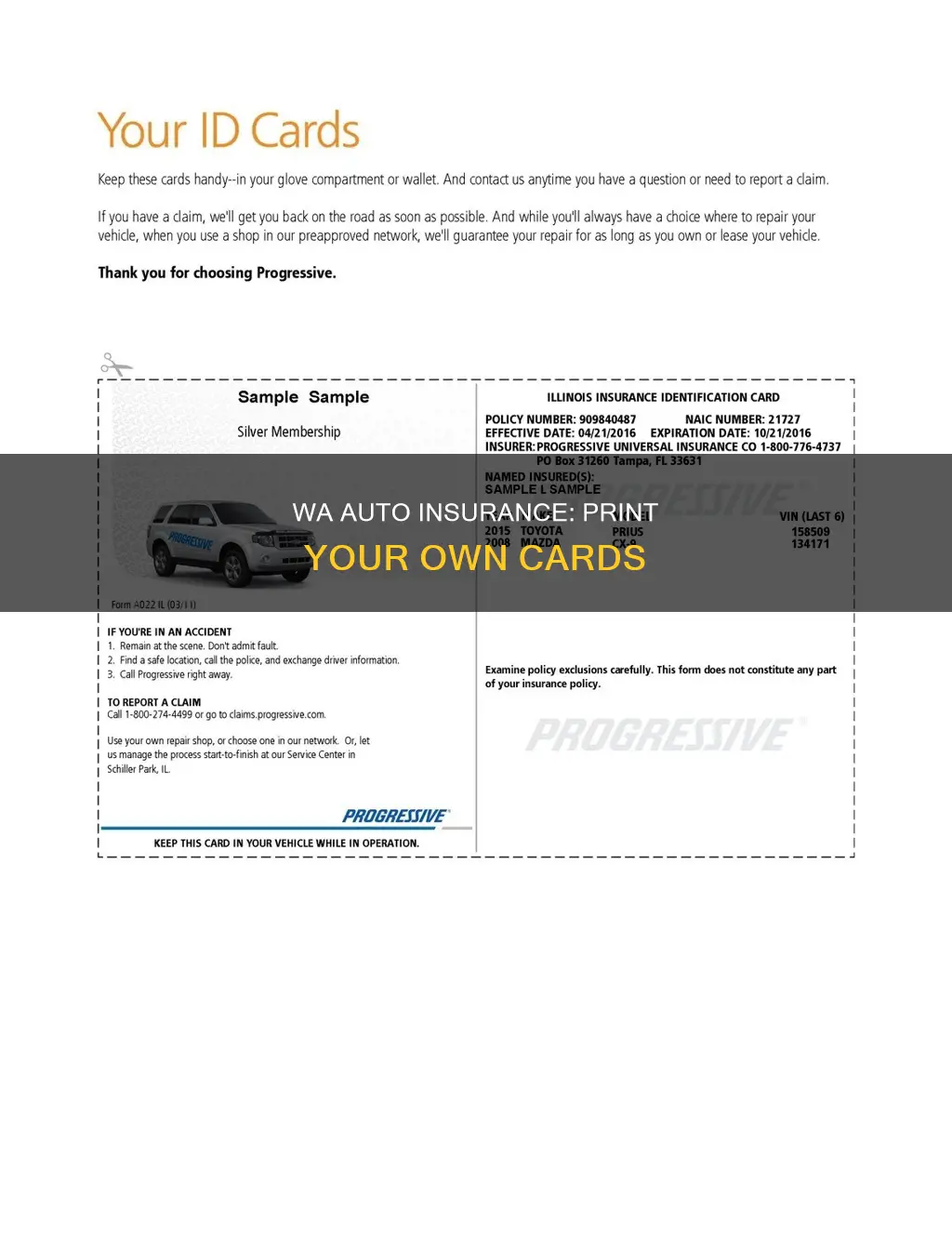

Required information on the insurance card

In Washington State, it is illegal to drive a car without having liability insurance or another way to assume financial responsibility for damages. If you drive a vehicle that is registered in Washington State, you must have motor vehicle insurance with certain minimum coverage. The insurance policy must have liability limits of at least:

- $25,000 of bodily injury or death of 1 person in any 1 accident

- $50,000 of bodily injury or death of any 2 people in any 1 accident

- $10,000 of injury to or destruction of property of others in any 1 accident

In addition to purchasing the required insurance, you must also be able to provide proof of this insurance to law enforcement if requested. Any time you drive in Washington, you must be prepared to show your auto insurance ID card, which you will receive from your auto insurance company when you buy a policy.

The insurance ID card must include the following information:

- Name of the insurance company

- Effective date of the policy

- Expiration date of the policy

- Description of the year, make, and model of the insured vehicle(s) and their VIN number(s) or the name of the insured driver(s). The word "fleet" may be used for more than 5 vehicles owned by the same person or business.

Failing to show acceptable proof of insurance is a traffic infraction. If you are unable to provide proof of insurance when requested by law enforcement, you may face a fine of $450 or more. Knowingly providing false evidence of coverage is a misdemeanour.

Michigan's Insured Vehicles: How Many?

You may want to see also

Minimum insurance coverage

In Washington state, drivers must carry a minimum amount of car insurance to legally drive and to ensure they have enough coverage in the event of an accident. This minimum coverage includes $25,000 for bodily injury liability per person, $50,000 for bodily injury liability per accident, and $10,000 for property damage liability per accident. This is often referred to as a 25/50/10 policy.

The state's minimum coverage requirements aim to ensure that all drivers have financial responsibility in the event of an accident. This coverage helps pay for the costs of injuries and damages to others caused by the at-fault driver, protecting victims from paying out of pocket for expenses not covered by the liable motorist. It is a legal requirement to maintain accountability and protect the public.

While the minimum coverage is $25,000 per person for bodily injury, this amount can be quickly reached, especially in cases of moderate to severe injuries. Similarly, the $10,000 property damage liability may not be sufficient to cover the cost of a new vehicle, leaving you financially responsible for any costs exceeding this amount. Therefore, it is recommended to consider increasing these limits or adding extra coverage for enhanced protection.

In addition to the minimum requirements, Washington drivers may also want to consider optional add-on coverages, such as uninsured motorist coverage, collision coverage, comprehensive coverage, personal injury protection (PIP), and rental reimbursement. These optional coverages provide additional financial protection in various scenarios, such as accidents with uninsured drivers, vehicle theft, or damage from natural disasters.

Complying with the minimum insurance coverage requirements in Washington state is essential for legal and financial protection. Failure to maintain at least the state-mandated minimum coverage can result in penalties, including fines, vehicle impoundment, license suspension, and even jail time if involved in an accident while uninsured.

CSL Auto Insurance: Understanding Combined Single Limit

You may want to see also

Self-insurance

In Washington state, self-insurance is an option for those with 26 or more vehicles. It is a unique program where the employer directly provides workers' compensation benefits to injured workers. Self-insurers communicate directly with injured workers and manage their industrial injury claims.

The self-insurance certificate must be printed and include the following:

- The self-insurance certificate number issued to the policyholder.

- The effective date of the certificate.

- A description of the year, make, or model of the covered vehicles, or the name of the covered driver(s).

In addition, a certificate of deposit of at least $60,000 is required. This can be made with the State Treasurer's office or in a bank account set up for the state of Washington.

The Washington Self-Insurers Association (WSIA) is the network for self-insured employers in the state. They provide training, resources, and a community for self-insured employers, as well as advocate for them in the state capital.

Auto Insurance Scores: Accessible Without SSN?

You may want to see also

Penalties for driving without insurance

Driving without insurance in Washington State is illegal and can result in serious penalties. If you are caught driving without insurance, you may be subject to a fine of up to $450 for a first offense and $550 or more for subsequent offenses. In addition, you may be convicted of a misdemeanor, and your driver's license and driving privileges may be suspended, especially if you are in an accident.

If you are unable to provide proof of insurance when asked by law enforcement, you will likely receive a ticket for a traffic infraction, which could result in community service and at least two fees totaling $15, on top of other penalties. Failing to pay the fine in full or set up a payment plan may also result in a suspended license.

If you are caught driving without insurance and are involved in an accident, you will be responsible for paying for the collision damage. If the accident resulted in more than $1,000 worth of property damage or any kind of personal injuries, your driver's license would be suspended for up to three years, and it would cost $75 to reinstate it.

To avoid license suspension after an accident, you can provide the Washington Department of Licensing with proof of insurance, a signed release from the other parties involved, a copy of a written agreement for reimbursement, proof of security deposit, or a certified copy of a civil court decision stating you were not liable.

It is important to maintain continuous auto insurance coverage in Washington State to avoid these penalties and financial risks.

Minds at Ease: Gap Insurance Explained

You may want to see also

Frequently asked questions

To print your auto insurance card in Washington state, you must first log in to your account. If you don't know your login details, you can select the "Forgot User ID/Password?" link to reset your account. Once you're logged in, select the "Print License(s)" option, check the "Select All" column that corresponds to your license type, and select "Generate License Certificate". You will then be prompted to open a PDF file, which you can save, forward via email, or print.

Your auto insurance card must include the following:

- The name of the insurance company

- The effective date of the policy

- The expiration date of the policy

- A description of the year, make, and model of the insured vehicle(s) or the name of the insured driver. If you have more than five insured vehicles, the card may simply state "fleet".

Yes, it is illegal to drive a car in Washington state without having liability insurance or another way to assume financial responsibility for damages. If you drive your car without the required insurance, you could receive a fine of $550 or more.