Yes, you can sell your term life insurance policy for cash through a process called a life settlement. Life settlement companies purchase policies from policyholders, providing a lump-sum cash payment in exchange for ownership and beneficiary rights. While the option to sell is available, there are a few things to consider before doing so.

| Characteristics | Values |

|---|---|

| Can you sell it? | Yes, you can sell a term life insurance policy. |

| How to sell it? | You can sell it through a life settlement or viatical settlement. You can use a broker or go directly to a life settlement provider. |

| Who buys it? | Life settlement companies, such as Coventry or Abacus Life Settlements, buy life insurance policies from policyholders on behalf of investors and financial institutions. |

| Who sells it? | The policy's owner and the insured person must cooperate in the sale. In most cases, this is the same person. |

| How much will you get? | The amount you get depends on your life expectancy, the life insurance face amount, and how much the buyer expects to pay in premiums while you're alive. |

| How long does it take? | The sale process can take anywhere from a few weeks to several months. |

| Are there tax implications? | The proceeds from the sale may be subject to income tax. |

| Are there alternatives? | Alternatives include surrendering your policy, taking out a loan against your policy, withdrawing funds from the cash value, or reducing the death benefit. |

What You'll Learn

- Life settlement companies must be licensed

- You can sell a term life insurance policy for cash through a process called a life settlement

- Life settlement companies are mainly interested in buying high-value policies from older policyholders

- You will lose access to the cash value of your policy, and your family will not receive the death benefit when you die

- Selling a life insurance policy requires the cooperation of the policy owner and the insured person

Life settlement companies must be licensed

In Texas, for example, life settlement companies must be licensed with the Texas Department of Insurance. You can check a company's license by calling 800-252-3439. Other states with licensing requirements include California, Delaware, Florida, Georgia, Minnesota, New York, Ohio, Pennsylvania, and Tennessee.

A growing number of states regulate life settlement companies and brokers, and it is important to research the purchasers of life settlements to see if they are licensed and regulated. Only FINRA-registered financial professionals are permitted to transact in variable life settlements, as these are securities transactions subject to federal securities laws and applicable FINRA rules.

It is recommended to only work with reputable life settlement companies or brokers that are licensed in your state.

Who Can Sell Their Life Insurance?

You may want to see also

You can sell a term life insurance policy for cash through a process called a life settlement

There are several reasons why people choose to sell their term life insurance policies. One reason is that they may no longer need the policy, perhaps because their children are grown up and no longer financially dependent on them. Another reason could be that they can no longer afford the premiums. By selling the policy, they can avoid letting the policy lapse and be cancelled, which may result in a smaller cash surrender value or none at all. A third reason could be that they need cash for emergencies, such as the death or illness of a family member.

When selling a term life insurance policy, it is important to keep a few things in mind. Firstly, not all life settlement transactions are regulated, so it is important to research the purchasers of life settlements to see if they are licensed and regulated. Secondly, the amount of money received from the sale will depend on factors such as the policyholder's age, health, policy value, and market conditions. It is advisable to consult with a life settlement provider to get an estimate of the potential cash payout. Thirdly, the proceeds from the sale may be subject to income tax, and it is important to consult a tax advisor for guidance. Finally, selling a term life insurance policy will result in the policy's ownership and beneficiary rights being transferred to the buyer, and the seller's beneficiaries will no longer receive the death benefit from that policy.

Term Life Insurance: Can It Outlast 30 Years?

You may want to see also

Life settlement companies are mainly interested in buying high-value policies from older policyholders

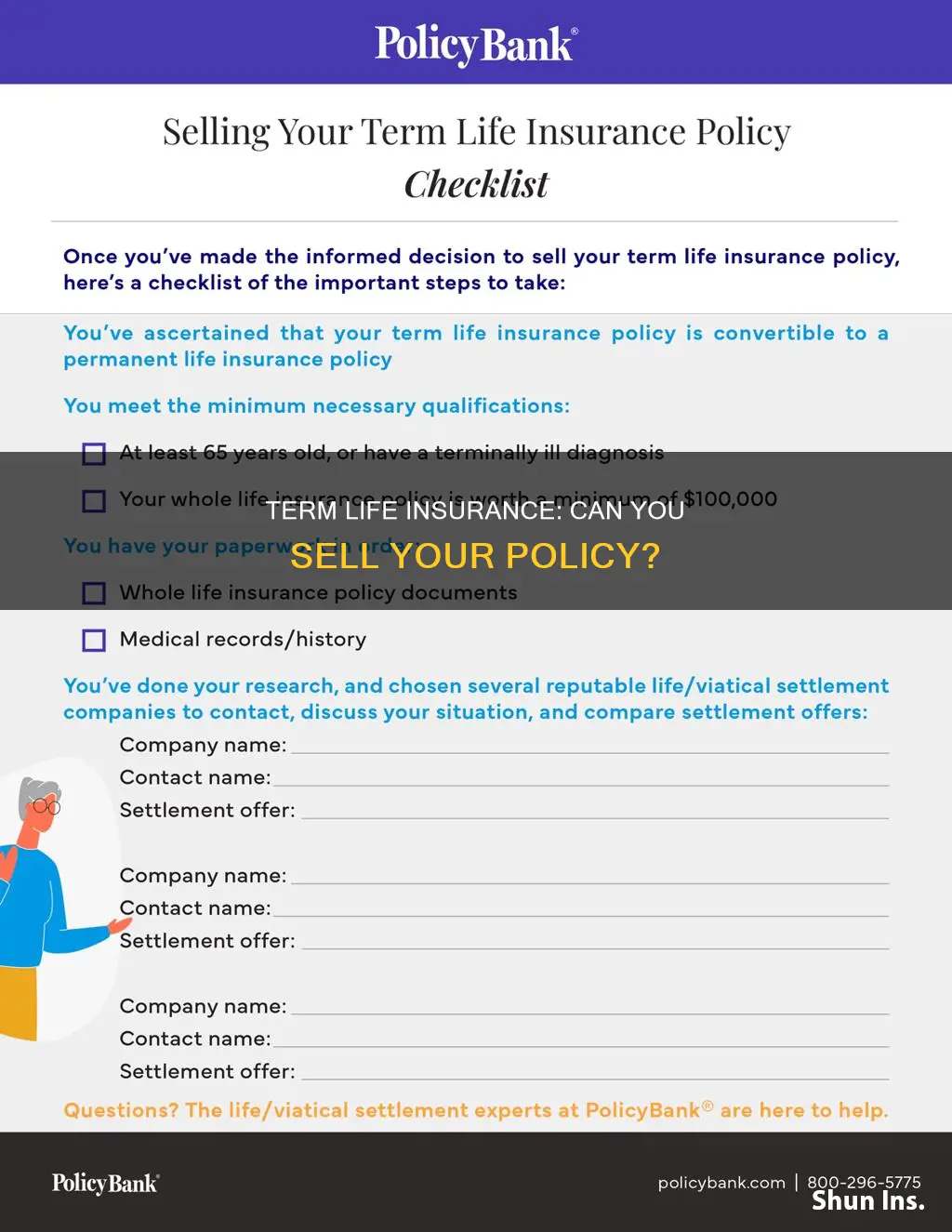

Life settlement companies are primarily interested in purchasing high-value life insurance policies from older policyholders. This is because the value of a life insurance policy in a life settlement is influenced by the policyholder's age and health status, among other factors. Typically, policyholders need to be over the age of 65 and have a policy worth at least $100,000 to sell their policy.

Life settlement companies are particularly attracted to policies held by older individuals because their age increases the likelihood of a shorter life expectancy, which is a key factor in determining the value of a life insurance policy. The older the policyholder, the higher the settlement payout is likely to be. Additionally, if the policyholder has a health condition that reduces their life expectancy, life settlement companies will often pay more for the policy.

The process of selling a life insurance policy to a life settlement company is known as a life insurance settlement or a senior settlement. It involves selling an existing policy to a third-party entity other than the company that issued the policy. In exchange for the policy, the policyholder receives a lump-sum payment, which is generally more than the policy's cash surrender value but less than the net death benefit.

It is important to note that selling a life insurance policy to a life settlement company has several implications. Firstly, the life settlement company will take over the policy and pay the premiums, meaning the policyholder's family will not receive the life insurance benefits upon the policyholder's death. Secondly, the money received from the sale may be subject to taxes and could impact the policyholder's eligibility for public assistance programs such as Medicaid. Therefore, it is crucial for policyholders to carefully consider their options and seek professional guidance before deciding to sell their life insurance policy.

Privacy Concerns: Life Insurance and Social Media

You may want to see also

You will lose access to the cash value of your policy, and your family will not receive the death benefit when you die

Term life insurance is designed to protect your loved ones financially in the event of your death. It provides a death benefit to your beneficiaries, which is a payout that they will receive if you pass away within the timeframe specified in the policy. This is typically 10, 20, or 30 years.

However, term life insurance does not have a cash value component, meaning you cannot cash it out while you are alive. This is in contrast to permanent life insurance policies such as whole life or universal life insurance, which allow you to withdraw or borrow money from the policy's cash value.

When you sell your term life insurance policy, you lose access to the potential death benefit that your beneficiaries would have received upon your death. This is because the ownership and beneficiary rights of the policy are transferred to the buyer, who will then receive the death benefit payout when you pass away. Therefore, by selling your term life insurance policy, you give up the financial protection that it would have provided to your family in the event of your death.

Additionally, selling a term life insurance policy may result in tax implications. The proceeds from the sale may be subject to income tax if they exceed the premiums you have paid into the policy. It is important to consult a tax advisor or financial professional to understand the specific tax consequences of selling your policy.

Furthermore, the money received from selling your term life insurance policy could affect your eligibility for certain public assistance programs, such as Medicaid. It is important to consider these potential consequences before deciding to sell your policy.

In summary, selling a term life insurance policy means giving up the death benefit that would have provided financial security for your family in the event of your death. It also has potential tax implications and may affect your eligibility for certain public assistance programs. It is important to carefully consider these factors and consult with professionals before making the decision to sell your term life insurance policy.

Income Protection: Life Insurance for Peace of Mind

You may want to see also

Selling a life insurance policy requires the cooperation of the policy owner and the insured person

If you want to sell your life insurance policy, you can start by familiarizing yourself with life settlement transactions and associated regulations. Check with your state's insurance authority for more information about the process, licensing requirements, and potential scams.

Application

You'll need to complete an application for each life insurance settlement from which you solicit offers. As part of the application process, you must grant the settlement company permission to obtain information about your policy and health. You may also be given disclosures and asked to provide additional information or documentation.

Documentation

Once you've submitted your application and granted the necessary permissions, the settlement company underwriters will begin gathering information. They will contact your life insurance provider to request details about your policy, including its death benefit and premiums. The underwriters will also request a copy of your medical records from your healthcare providers.

Appraisal

After reviewing the relevant information, underwriters will determine the market value of your life insurance policy. They will consider whether your policy is a good investment based on its value and the opinion of medical experts regarding your health. They will also look for signs of fraud.

Offer

If your policy is deemed suitable for purchase, the settlement company will extend an offer. You can either accept or decline the offer. It's recommended to compare offers from multiple companies before making a final decision. If you hire a broker, you may be able to negotiate a better deal.

Closing

If you accept the offer, the settlement provider will send a closing package for you to review and sign. Once you return the signed documents, your insurance provider will be notified of the transaction. Ownership of the policy will change, and you will receive the settlement funds.

From start to finish, you can expect this process to take between 60 and 120 days. The exact timing will depend on how quickly third parties—including your insurance company and healthcare providers—respond to requests for information.

It's important to carefully consider the implications of selling your life insurance policy. You will lose access to the cash value of your policy, and your family will not receive the death benefit when you die. Additionally, the money you gain from the sale may be subject to taxes and debt collection, and it could affect your eligibility for certain public assistance programs.

Get Licensed to Sell Life Insurance: A Step-by-Step Guide

You may want to see also