Can You Take Oregon Auto Insurance From California?

Oregon and California have different auto insurance requirements, and it is essential to understand the implications of moving between these two states. Oregon has higher auto insurance coverage requirements than California and other neighbouring states, which contributes to higher insurance costs for Oregon drivers.

| Characteristics | Values |

|---|---|

| Cheapest car insurance in Oregon | CIG |

| Cheapest car insurance in California | Progressive |

| Average monthly insurance cost in Oregon | $154 |

| Average monthly insurance cost in California | $109 |

| Average monthly insurance cost in Washington | $110 |

| Minimum insurance requirements in Oregon | Bodily injury liability, property damage liability, personal injury protection, and uninsured motorist coverage |

| Minimum insurance requirements in California | N/A |

What You'll Learn

Oregon's mandatory car insurance rules

In Oregon, car insurance is mandatory, and drivers must maintain certain types and amounts of insurance coverage in case they cause a car accident. Oregon follows a traditional "fault"-based system, which means that the person at fault for causing the car accident is also responsible for any resulting harm. This includes injuries, lost income, and vehicle damage.

The required minimum amounts of car insurance in Oregon are:

- $25,000 liability coverage for bodily injury or death of one person in an accident caused by the owner/driver of the insured vehicle.

- $50,000 liability coverage for total bodily injury or death liability in an accident caused by the owner/driver.

- $20,000 liability coverage for property damage per accident caused by the owner/driver.

- $15,000 in personal injury protection coverage per person.

- Uninsured motorist coverage of $25,000 per person and $50,000 total per accident.

Liability car insurance covers the medical bills, property damage bills, and other losses of drivers, passengers, and pedestrians injured or whose vehicles are damaged in an accident caused by the policyholder, up to the coverage limits. Personal injury protection coverage (or PIP) covers the policyholder and passengers in the policyholder's vehicle, unless they have their own coverage. PIP benefits in Oregon include the claimant's reasonable and necessary accident-related medical expenses incurred within two years of the crash, up to $15,000, and, if the claimant is employed and unable to work due to their injuries, 70% of their lost income, up to $3,000 per month. Finally, uninsured motorist (UIM) coverage protects you and your passengers if the at-fault driver has no insurance or if you're injured in a hit-and-run accident.

If you are caught driving without insurance in Oregon, you could be fined, lose your driving privileges, or have your vehicle towed. If convicted, you will have to file proof of insurance with the state's Driver & Motor Vehicle Services (DMV) for three years, and your driving privileges will likely be suspended for one year if you are in an accident and are uninsured.

Gap Insurance: How Much Does It Cost?

You may want to see also

Driving without insurance in Oregon

If you're caught driving without insurance in Oregon, you could face a range of penalties, including costly fines, suspension of your driving privileges, and towing and storage fees if your car is impounded. The minimum financial penalty for driving uninsured in Oregon is $135, but fines can increase to a maximum of $1,000 depending on the situation. For example, if you were cited for reckless driving or caused a crash while violating the insurance requirement, you may be subject to a higher fine. Additionally, if you're caught driving uninsured and are involved in an accident, your driving privileges will be suspended for one year, and you'll be required to purchase insurance coverage to reinstate your license.

If convicted of driving without insurance in Oregon, you'll also be required to file proof of insurance with the state's Driver & Motor Vehicle Services (DMV) for three years. This means submitting your insurance receipt showing you've paid for car insurance coverage. During this three-year period, Oregon's Department of Transportation (ODOT) will also monitor your insurance coverage on a monthly basis.

Gap Insurance: Lender's Letter Explained

You may want to see also

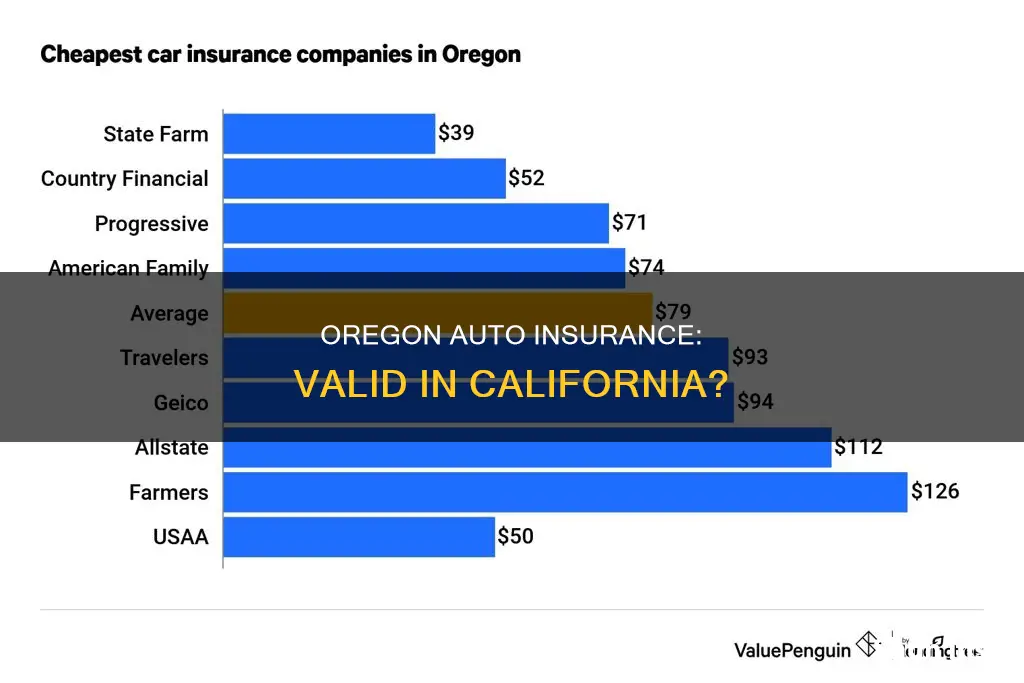

Cheapest car insurance in Oregon

When it comes to car insurance, Oregon is a "fault" state, meaning that the driver who is responsible for causing an accident is also responsible for any resulting harm. This includes injuries, lost income, and vehicle damage. As such, Oregon requires drivers to have car insurance that covers bodily injury liability, property damage liability, personal injury protection, and uninsured motorist coverage.

The cheapest car insurance in Oregon will depend on a variety of factors, including age, gender, location, vehicle type, and driving history. Here is a breakdown of the cheapest options for different driver profiles:

According to NerdWallet, the cheapest car insurance company in Oregon is QBE, with an average annual rate of $993 for full coverage. However, GEICO is also mentioned as the cheapest option for most drivers, with rates as low as $46 per month for liability-only coverage.

Country Financial offers the most affordable car insurance for teen drivers in Oregon, with average rates of $1,659 per year for female teens and $1,783 per year for male teens.

Country Financial again provides the cheapest rates for 25-year-old drivers, with average annual costs of $1,783 for males and $1,659 for females.

For 35-year-old married drivers, Country Financial has the lowest average rates, at $840 for males and $837 for females.

Country Financial also has the lowest rates for married 60-year-olds, at $768 per year for both men and women.

State Farm offers affordable rates for drivers with a clean driving history, at an average of $844 annually.

State Farm is again the cheapest option, with an average annual rate of $948 for drivers with a single speeding violation.

State Farm has the cheapest average rate for drivers with an accident on their record, at $1,115 per year.

State Farm offers the cheapest average rate for drivers with a DUI, at $948 per year.

USAA offers exclusive and affordable coverage for military members, their families, and veterans.

Country Insurance & Financial Services has the cheapest average rate for drivers with poor credit, at $1,527 per year.

Umbrella vs. Gap Insurance: What's the Difference?

You may want to see also

Car insurance requirements in Oregon

- Bodily injury liability: $25,000 per person and $50,000 total per accident.

- Property damage liability: $20,000 per accident.

- Personal injury protection: $15,000 per person.

- Uninsured motorist coverage: $25,000 per person and $50,000 total per accident.

Oregon is one of the more expensive states for car insurance, with drivers paying an average of $154 per month. This is due to the state's higher coverage requirements and higher auto theft rates.

Oregon operates a fault-based system, meaning the driver at fault for an accident (or their insurance company) is responsible for covering the costs. This includes the other driver's medical bills, property damage bills, and other losses.

If you are unable to present proof of insurance when pulled over, you may face penalties such as fines or license suspension.

Divorced Couples: Share Auto Insurance?

You may want to see also

Digital proof of car insurance in Oregon

In the state of Oregon, drivers are required to carry proof of insurance in their vehicles at all times. This can be in the form of a physical copy of the official insurance card issued by the insurance company. However, Oregon also allows digital proof of car insurance.

On May 14, Oregon Governor John Kitzhaber signed a bill into law, allowing residents to show electronic proof of car insurance on their mobile phones. This means that drivers can pull up an official, company-issued electronic version of their insurance card, policy declaration page, or other official digital documentation of their policy details. It is important to note that this law does not constitute consent for a police officer to access other contents of the electronic device.

While digital proof of insurance is convenient, it is essential to keep your phone charged to avoid any issues. Additionally, not all insurance companies may provide digital proof automatically, so it is advisable to contact your insurance provider to confirm.

Oregon takes insurance compliance seriously, and driving without insurance can result in fines, the loss of driving privileges, or even having your vehicle towed. Therefore, it is crucial to always have valid proof of insurance, whether physical or digital, when operating a motor vehicle in the state of Oregon.

Proof of Prior Car Insurance: What You Need

You may want to see also