Gap insurance is an optional type of insurance that covers the difference between the actual cash value of your car and the remaining balance on your car loan if your car is stolen or damaged beyond repair. The cost of gap insurance depends on various factors, including the provider, the vehicle, your age, and your location. In California, gap insurance costs an average of $2 to $30 per month, while in Texas, it can range from a few dollars per month to $500 or more. The maximum cost of gap insurance in Texas is limited to 5% of the loan amount. When purchasing gap insurance, it is recommended to compare quotes from multiple providers to find the best rate.

| Characteristics | Values |

|---|---|

| Average cost per year | $2,238 |

| Average cost per month | $2-$30 |

| Average cost per year (from an insurer) | $20 |

| Average cost (standalone from an insurer) | $200-$300 |

| Average cost (added to an auto loan) | $500-$700 |

| Cheapest provider in California | Progressive |

| Cheapest provider in California (average annual rate) | $1,492 |

| Most expensive city in California | Los Angeles |

| Least expensive city in California | Portola |

| Average annual rate in Los Angeles | $2,755 |

| Average annual rate in Portola | $1,805 |

| Average annual rate for a 20-year-old driver | $3,978 |

| Average annual rate for a 30-year-old driver | $2,382 |

What You'll Learn

- Gap insurance costs $20 per year when purchased from a regular auto insurer

- The cost of gap insurance is $500 to $700 when added to an auto loan

- Standalone gap insurance costs a one-time fee of $200 to $300

- In California, gap insurance costs an average of $2 to $30 per month

- Gap insurance is not required in Texas

Gap insurance costs $20 per year when purchased from a regular auto insurer

Gap insurance is an optional form of financial protection for vehicle owners. It covers the difference between the current value of your car and the amount you still owe on it if your car is considered a total loss. This could be due to a major accident, fire, or theft. It is important to note that gap insurance does not cover repair costs.

When purchased through a regular auto insurer, gap insurance is typically added to your comprehensive and collision coverage. This means that, in the event of an accident, your insurer will pay the actual cash value (ACV) of your car, taking into account depreciation, and your gap insurance will cover the remaining loan balance.

While not a legal requirement, gap insurance is often considered a smart choice for those financing a new or nearly new vehicle, especially if they have a small down payment, a long-term loan, or a lease. It is also beneficial if you have a new car that depreciates in value quickly.

Before purchasing gap insurance, it is recommended to compare quotes from multiple providers, including your current car insurance provider and other insurance companies or financial institutions. It is worth noting that not all insurers offer gap insurance, and the cost can vary depending on factors such as your car's age and your claims history.

Uninsured Motorist Driving Insured Vehicle: What Now?

You may want to see also

The cost of gap insurance is $500 to $700 when added to an auto loan

The Cost of Gap Insurance

Gap insurance is an optional form of financial protection for automobile owners. It covers the difference between the amount owed on a car loan or lease and the vehicle's actual cash value in the event of theft or damage. This type of insurance is particularly useful for those who have made a small down payment on their vehicle, have a long-term loan, or own a car that depreciates quickly.

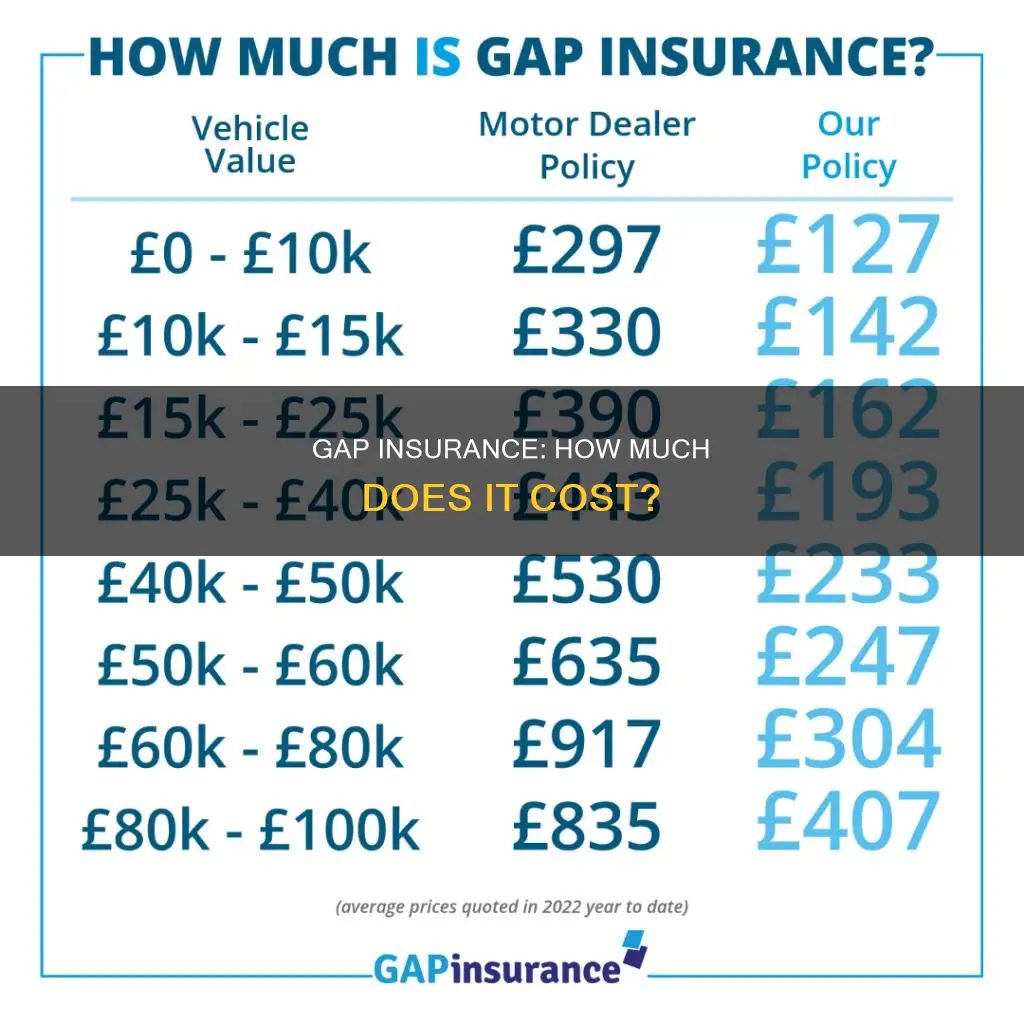

The cost of gap insurance varies depending on the provider and the vehicle being covered. Dealerships and lenders typically charge a flat rate for gap insurance, which can range from $500 to $700. This cost is usually added to the auto loan, resulting in additional interest charges over the life of the loan.

Advantages of Buying Gap Insurance from an Insurer

Insurance companies, on the other hand, often offer gap insurance at a lower cost when it is added to an existing insurance policy. In this case, the cost of gap insurance ranges from $20 to $40 per year, increasing the overall cost of comprehensive and collision insurance by only about 5-6%.

Factors Affecting the Cost of Gap Insurance

Several factors influence the cost of gap insurance, including the vehicle's actual cash value, the provider, location, and the driver's age. It is recommended to compare quotes from multiple providers before purchasing gap insurance to ensure the best deal.

When to Consider Gap Insurance

Gap insurance is worth considering when an individual finances a car with a low down payment, has a long-term auto loan, or leases a vehicle. It is an affordable way to protect against the financial risk of a car being stolen or totaled.

Alternatives to Gap Insurance

There are alternative coverage options available besides gap insurance, such as new-car replacement insurance and better-car replacement coverage, which may be more suitable depending on individual needs.

Ally's Prorated Gap Insurance: How It Works

You may want to see also

Standalone gap insurance costs a one-time fee of $200 to $300

Gap insurance, or guaranteed asset protection, is an optional form of insurance that covers the difference between the amount still owed on a loan or lease for a vehicle and the vehicle's actual cash value in the event of theft or a total loss. While gap insurance is not mandatory, it can be a valuable form of protection for drivers with new vehicles, especially if they have only made a small down payment on the loan.

Standalone Gap Insurance

Standalone gap insurance is a separate coverage option offered by some auto insurers. When purchased as a standalone policy, gap insurance typically costs a one-time fee of $200 to $300. This is a relatively affordable option for those seeking added protection for their vehicle.

Other Options for Purchasing Gap Insurance

There are two other primary ways to purchase gap insurance: through your regular auto insurer or by adding it to your auto loan.

Regular Auto Insurer

When purchased through your regular auto insurer, gap insurance is typically very affordable, costing just $20 per year on average. This is a cost-effective option, but not all insurers offer gap insurance, so it is important to check with your provider.

Added to an Auto Loan

Many lenders offer the option to add gap insurance to your loan agreement. This route usually involves paying a one-time flat rate rather than making regular payments. The average cost of gap insurance when added to an auto loan ranges from $500 to $700. However, it is important to note that this option can be more expensive in the long run, as you will pay interest on the cost of the gap insurance over the life of the loan.

Factors Affecting Gap Insurance Cost

The cost of gap insurance can vary depending on several factors, including the provider, the vehicle's value, location, and the driver's age. Dealerships and lenders typically charge higher prices for gap insurance than insurance companies. It is always a good idea to compare quotes from multiple providers before making a purchase.

Autonomous Cars: Motor Insurance's Future

You may want to see also

In California, gap insurance costs an average of $2 to $30 per month

Gap insurance covers the difference between a totaled vehicle's actual cash value and the amount still owed on a loan or lease. It is designed to protect automobile owners if their car is totaled or stolen. It is worth noting that gap insurance is not cheap and is only needed for one to three years, or until your vehicle is worth more than you still owe.

In California, gap insurance is not required by state law, and it cannot be mandated as a condition of getting an auto loan or lease. However, lenders and lessors often require it for financed vehicles. It is typically only available for brand-new vehicles or models less than three years old.

The cost of gap insurance in California depends on factors such as the value of your car, the insurance company, your location, and your age. Progressive, Allstate, and Nationwide are some of the insurance companies offering gap insurance in the state.

Additionally, a new California law that took effect in 2023 adds oversight and regulation to the sale of gap insurance, addressing concerns about unreasonable financial burdens on consumers and predatory practices. This law includes requirements such as clear and bold disclosures that gap insurance is optional and cannot be mandated, as well as restrictions on selling gap insurance that covers less than 70% of the vehicle's value.

Vehicle Symbols: Insurance Decoded

You may want to see also

Gap insurance is not required in Texas

Gap insurance, also known as a debt cancellation agreement or gap waiver, is not a legal requirement in Texas. It is entirely optional for vehicle owners to purchase this type of insurance. In fact, the state prohibits a gap waiver from being a mandatory condition of a car lease or loan agreement.

While not required, gap insurance can be a valuable form of coverage for certain drivers. If your car is stolen or deemed a total loss after an accident, gap insurance will cover the difference between the amount you still owe on your loan or lease, and the actual cash value of the vehicle. This is especially useful for drivers of new vehicles, as cars depreciate quickly in value in the first few years after purchase. Gap insurance can also be beneficial if you have a long loan term, a small down payment, or a high-interest rate, as these factors can contribute to a situation where you owe more on your car than it is worth.

Where Can I Buy Gap Insurance in Texas?

You can purchase gap insurance in Texas from an insurance company or through your car dealership as a standalone policy. Not all insurers are authorised to offer gap insurance in the state, so it is recommended to first get quotes from your auto insurance provider. Coverage directly from an insurer is often the cheaper option, at around a few dollars per month, especially if added to an existing policy.

The cost of gap insurance in Texas can vary, with prices ranging from around $500 to over $1,000. The maximum cost of gap insurance under Texas law is 5% of the loan's value. For example, the cost of coverage for a $30,000 car can be as high as $1,500.

Leasing a Vehicle: Insurance Impact

You may want to see also

Frequently asked questions

The average cost of gap insurance in California is $2,238 per year, according to a 2023 rate analysis by Insurance.com. However, gap insurance in California can cost as little as $2 to $30 per month, depending on the provider.

The cost of gap insurance in Texas depends on where you buy it. Dealership gap insurance in Texas may range from $500 to over $1,000. The maximum amount a dealership can charge for gap insurance is 5% of the loan value. Gap insurance from an insurance company is often cheaper, costing several dollars per month.

Gap insurance typically costs $20 per year when purchased from an insurance company as an add-on to an existing policy.