Many drivers often wonder if it's more cost-effective to have car insurance for just one driver. This question arises from the desire to optimize insurance costs, especially for those with multiple vehicles or a family with several drivers. The answer depends on various factors, including the driver's age, driving record, the vehicle's make and model, and the insurance company's policies. In this article, we'll explore the considerations and benefits of insuring a single driver, helping you make an informed decision about your insurance coverage.

What You'll Learn

- Cost Comparison: Evaluate insurance premiums for single-driver policies versus multi-driver policies

- Driver Profile Impact: Understand how driver age, experience, and driving record affect insurance costs

- Policy Types: Compare liability, comprehensive, and collision coverage for single-driver vehicles

- Discounts and Savings: Discover available discounts for single-driver insurance, such as safe driver or loyalty rewards

- Add-Ons and Extras: Explore optional add-ons like rental car coverage or roadside assistance in single-driver policies

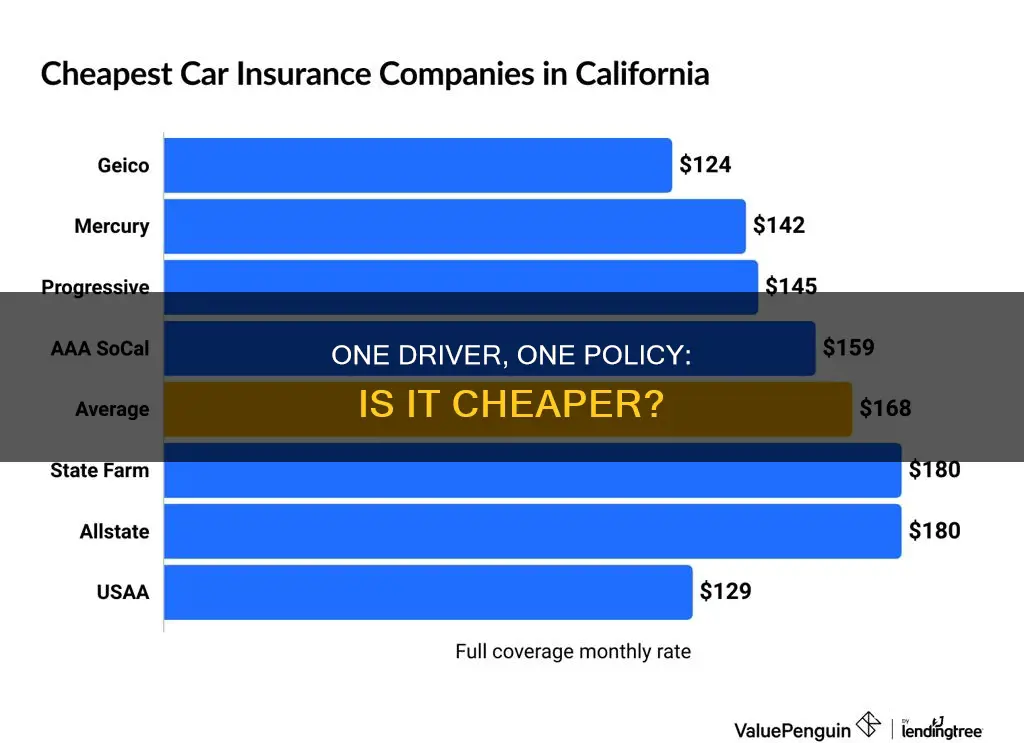

Cost Comparison: Evaluate insurance premiums for single-driver policies versus multi-driver policies

When considering car insurance, the number of drivers on a policy can significantly impact the overall cost. This is because insurance companies often use a risk-based pricing model, where the premium is influenced by the individual driving characteristics and the potential risks associated with each driver. In general, insuring a single driver is likely to be more cost-effective compared to a multi-driver policy.

Single-driver policies are typically cheaper because they involve lower risk. Insurance providers assess the risk of each driver based on various factors, such as age, driving experience, driving record, and the type of vehicle. When there is only one driver, the insurance company can more accurately predict the likelihood of accidents or claims, and this predictability often results in lower premiums. For instance, a young, inexperienced driver with a clean driving record is likely to pay less for a single-driver policy than an older, more experienced driver with multiple traffic violations.

In contrast, multi-driver policies can be more complex and expensive. With multiple drivers, the insurance company must consider the combined risk of all individuals. This can lead to higher premiums, especially if the drivers have different risk profiles. For example, if one driver has a history of accidents, the insurance company may charge higher rates for the entire policy, even if the other drivers are safe and responsible. Additionally, multi-driver policies often require more comprehensive coverage to accommodate the varying needs and risks of each driver.

To evaluate the cost-effectiveness of single-driver versus multi-driver policies, it is essential to consider the specific circumstances. If you are a young, single driver with a good driving record, you may benefit from a single-driver policy. However, if you have a family with multiple drivers, each with different driving habits and records, a multi-driver policy might be more suitable. In such cases, it is advisable to compare quotes from different insurance providers, as rates can vary significantly.

In summary, while single-driver policies are generally more affordable due to lower risk, the decision should be based on individual circumstances. Assessing the driving records, ages, and needs of all potential drivers is crucial. By carefully evaluating these factors, you can make an informed choice and ensure that your insurance coverage aligns with your budget and risk profile.

Switching Auto Insurance: When and How?

You may want to see also

Driver Profile Impact: Understand how driver age, experience, and driving record affect insurance costs

The cost of insuring a single driver can vary significantly, and several factors influence these insurance premiums. Understanding these factors is crucial for anyone looking to manage their insurance expenses effectively. Here's an in-depth look at how driver age, experience, and driving record impact insurance costs:

Driver Age: Age is a critical factor in determining insurance rates. Younger drivers, especially those under 25, often face higher premiums. This is primarily because they are considered high-risk drivers due to their lack of experience and the higher likelihood of accidents. Insurance companies statistically observe that younger drivers are more prone to risky behavior and may be less likely to adhere to traffic rules. As drivers age, their premiums tend to decrease, as they gain experience and become less risky. However, it's important to note that once drivers reach their late 50s or 60s, premiums may start to rise again due to health-related concerns and potential age-related driving challenges.

Driving Experience: The amount of time a driver has been on the road significantly impacts insurance costs. New drivers, who have limited experience, are often charged higher premiums. Insurance companies consider them less skilled and more likely to make mistakes, which could lead to accidents and subsequent claims. As drivers gain more experience, their premiums typically decrease. This is because they become more familiar with road conditions, traffic patterns, and safe driving practices, reducing the perceived risk. Additionally, experienced drivers are less likely to file claims, which further lowers their insurance rates.

Driving Record: A driver's record is perhaps the most significant factor affecting insurance costs. A clean driving record with no accidents, traffic violations, or claims will result in lower premiums. Insurance companies view these drivers as responsible and less likely to cause damage or injuries. Conversely, a history of accidents, speeding tickets, or other traffic violations will lead to higher premiums. Each violation or accident on a driving record can increase insurance costs for years, as insurers consider the driver a higher risk. Additionally, the severity of the violations matters; more serious incidents, such as causing a major accident, will have a more substantial and long-lasting impact on insurance rates.

In summary, the cost of insuring a single driver is influenced by various factors, with age, experience, and driving record being the most prominent. Younger and less experienced drivers often face higher premiums, while older, more experienced drivers with clean records tend to pay lower rates. Understanding these factors can help individuals make informed decisions about their insurance coverage and potentially save money by choosing the right driver profile for their insurance provider.

Dealerships: Test Drive Insurance

You may want to see also

Policy Types: Compare liability, comprehensive, and collision coverage for single-driver vehicles

When it comes to insuring a single-driver vehicle, understanding the different policy types is crucial for making an informed decision. The three primary coverage options are liability, comprehensive, and collision, each serving distinct purposes.

Liability coverage is a legal requirement in most places and is the most basic form of insurance. It protects you against claims made by others for bodily injury or property damage that you cause in an accident. This coverage is typically divided into three parts: bodily injury liability (BIL), which covers injuries to others, and property damage liability (PDL), which covers damage to someone else's property. For a single-driver vehicle, liability insurance is essential to protect your assets and ensure you meet legal requirements. The cost of liability coverage is generally lower compared to comprehensive and collision insurance, making it a cost-effective choice for drivers with limited coverage needs.

Comprehensive insurance provides broader coverage than liability and is designed to protect your vehicle from a wide range of non-collision incidents. This includes damage from natural disasters like storms, vandalism, theft, and even animal collisions. Comprehensive coverage typically covers the vehicle's value, ensuring you are financially protected in case of a total loss. While it offers extensive protection, it is usually more expensive than liability insurance. The premium for comprehensive coverage can vary depending on factors such as the vehicle's value, your location, and the specific perils covered by the policy.

Collision coverage, on the other hand, is designed to cover damage to your vehicle resulting from a collision with another vehicle or object. This type of insurance is particularly useful if you have a newer car or one with a higher value. Collision coverage can be especially beneficial for single-driver vehicles as it provides financial protection in case of accidents, regardless of fault. However, it is important to note that collision coverage often has a higher deductible, which means you pay a specified amount out of pocket before the insurance coverage kicks in. This deductible can impact the overall cost of the policy.

For a single-driver vehicle, the choice between these policy types depends on various factors. If you primarily drive in areas with a high risk of natural disasters or want extensive protection for your vehicle, comprehensive coverage might be ideal. Collision insurance is suitable if you want to ensure financial protection for your vehicle in case of accidents. Liability coverage, being the most basic, is essential for legal compliance and can be a cost-effective choice for those seeking minimal coverage.

In summary, when insuring a single-driver vehicle, it is essential to consider the specific needs and risks associated with your driving. Liability coverage provides the minimum legal protection, while comprehensive and collision insurance offer more extensive coverage for different scenarios. Assessing your priorities and budget will help you choose the most suitable policy type, ensuring you have the right level of protection without unnecessary expenses.

Direct General Insurance: Auto-Focused or Misnomer?

You may want to see also

Discounts and Savings: Discover available discounts for single-driver insurance, such as safe driver or loyalty rewards

When it comes to insuring a single driver, there are several discounts and savings opportunities that can help reduce your insurance costs. Many insurance companies offer incentives to encourage safe driving habits and long-term customer loyalty. Here's an overview of some common discounts to consider:

Safe Driver Discounts: One of the most well-known and widely available discounts is the safe driver discount. Insurance companies often reward drivers who maintain a clean driving record. This typically involves no accidents, traffic violations, or claims for a specific period, often a year or more. By proving you are a responsible driver, you can earn a discount on your premium. The savings can vary, but it's a great way to lower your insurance costs if you consistently drive safely.

Loyalty Rewards: Insurance providers often appreciate long-term customers and may offer loyalty discounts to retain them. If you've been with the same insurance company for several years, inquire about loyalty rewards. These discounts can be applied to your premium as a token of appreciation for your continued business. Loyalty programs may also include other benefits, such as waived fees or access to exclusive customer services.

Other Discountable Factors: Besides safe driving and loyalty, there are other factors that can make you eligible for discounts. For instance, some insurers offer discounts for:

- Vehicle usage: If you primarily use your car for pleasure and not for business or commercial purposes, you might qualify for a usage-based discount.

- Good student discounts: Students with good academic records often receive lower insurance rates.

- Multiple policy discounts: Combining your auto insurance with other policies, such as home or life insurance, can lead to significant savings.

- Anti-theft device discounts: Installing approved anti-theft devices in your vehicle can make it less attractive to thieves and may result in lower insurance premiums.

To maximize your savings, it's essential to review the specific discounts offered by different insurance companies. Each provider may have unique criteria and terms for eligibility. Additionally, don't be afraid to ask your insurance agent or broker about available discounts and how you can qualify for them. They can provide tailored advice based on your driving history and personal circumstances.

Remember, while discounts can significantly impact your insurance costs, the overall price of coverage also depends on factors like the vehicle you drive, your location, and the insurance company's policies. It's a good practice to compare quotes from multiple insurers to find the best combination of coverage and savings for a single-driver insurance policy.

Protecting Your Teen Driver: A Guide to Auto Insurance

You may want to see also

Add-Ons and Extras: Explore optional add-ons like rental car coverage or roadside assistance in single-driver policies

When considering insurance for a single driver, it's important to explore the various add-ons and extras that can enhance your policy. These optional features provide additional benefits and can be tailored to your specific needs, ensuring you get the most value for your money. Here's a breakdown of some key add-ons to consider:

Rental Car Coverage: If you frequently rent cars, this add-on is a valuable investment. It provides coverage for rental vehicles in case of an accident, damage, or theft. Without this, you would be responsible for paying for repairs or replacements out of pocket. Rental car coverage typically offers a daily benefit, allowing you to rent a replacement vehicle while yours is being repaired. This is especially useful if you rely on a car for work or daily commutes.

Roadside Assistance: This service is a popular add-on for single-driver policies. Roadside assistance provides help when you're stranded due to a breakdown, accident, or flat tire. It covers expenses such as towing, tire changes, fuel delivery, and even battery jumps. Many policies also include a 24-hour hotline for immediate assistance. This add-on can provide peace of mind, knowing that help is just a phone call away, and it can save you from potentially costly roadside repairs.

Other optional extras might include coverage for custom parts and equipment, which is essential if you modify your vehicle, or personal injury protection, which covers medical expenses for you and your passengers. Additionally, consider the option to increase your liability limits, providing better protection in case of lawsuits. These add-ons can significantly enhance your insurance policy, making it more comprehensive and suitable for your individual circumstances.

When reviewing single-driver insurance policies, take the time to understand the available add-ons and how they can benefit you. Insurance providers often offer a wide range of options, allowing you to customize your coverage. By carefully selecting the appropriate add-ons, you can ensure that your insurance policy is tailored to your needs, providing the best value and protection for your single-driver vehicle.

Allstate: Smart Home and Auto Bundling

You may want to see also

Frequently asked questions

Yes, insuring for one driver can often be more cost-effective compared to insuring multiple drivers. Insurance companies typically offer lower premiums for single-driver policies as they pose less risk. This is because having only one driver associated with the policy means fewer potential claims and a reduced likelihood of accidents.

Insurance rates are influenced by the number of drivers on a policy. When there are multiple drivers, especially if they have different driving records and ages, insurance companies may consider it riskier. This can lead to higher premiums to account for the potential increased risk of accidents or claims.

While insuring for one driver can be cheaper, there might be some drawbacks. If the single driver is involved in an accident, the financial impact of the claim will be solely on the policyholder. Additionally, if the driver's driving record is poor, it could result in higher premiums for future policies.

Yes, you can consider switching to a single-driver policy if you have multiple drivers. However, it's essential to review your current policy and understand the terms and conditions. You may need to inform your insurance provider about the change and potentially adjust the coverage to ensure it meets your requirements.