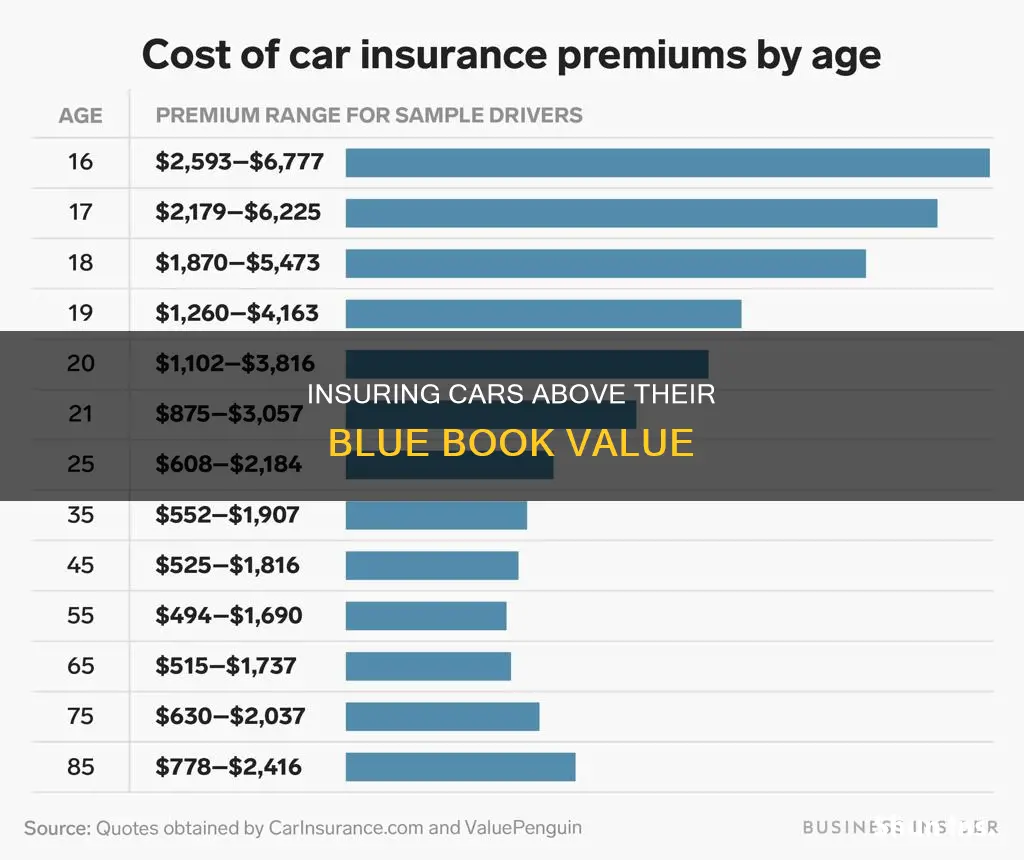

Kelley Blue Book is a popular and trusted buying guide for vehicles, offering insights on performance, specifications, and market pricing. While the Kelley Blue Book price is a good starting point when shopping for a car, it is not the only factor to consider. Various factors, including vehicle make, model, year, and typical mileage, contribute to the final price. It is also important to note that dealers or private sellers may price a car higher or lower than the Blue Book range due to factors such as supply and demand or vehicle condition. When it comes to auto insurance, the Blue Book Value can impact collision coverage, as insurers use it to determine the vehicle's worth. Ultimately, the decision to purchase auto insurance for more than the Blue Book Value depends on individual needs and preferences.

| Characteristics | Values |

|---|---|

| Kelley Blue Book (KBB) price | A good starting point when shopping for a car |

| KBB website | Input vehicle details to get a market range and fair purchase price |

| Dealer or private seller | May price the car higher than the Blue Book range |

| Vehicle in low supply or with hard-to-find options | Expect to pay more |

| Vehicle priced below market value | Could be a red flag or due to excess inventory |

| Negotiating a better deal | Do your research, use the trade-in value as a target, look up the vehicle's invoice price, pull out the KBB in private sales, get the car inspected, know what you don't know |

| Blue Book price | Favours the dealer |

| Policy discounts | Can cut your car insurance bill by 40% |

| Multi-Policy Discounts | Purchasing at least two types of insurance from the same issuer |

| Multi-Car Discounts | Insuring two vehicles together |

| Blue Book Values and pricing | Based on transactions in your area and ZIP code |

What You'll Learn

Multi-policy discounts

The amount you can save with a multi-policy discount varies. For example, bundling homeowners and auto insurance with Liberty Mutual saves policyholders an average of $947 annually. Multi-policy discounts can reach as high as 25%, according to Kelley Blue Book. Other companies offering multi-policy discounts include Allstate, Progressive, and GEICO. Allstate offers up to 25% when bundling home and auto policies, Progressive customers average an annual saving of $793 when bundling home and auto insurance, and GEICO offers up to 25% when bundling auto and homeowners insurance.

To get a multi-policy discount, simply contact your insurance provider and ask if the policies you're interested in are eligible for a discount. It's a good idea to shop around and compare quotes from different insurers to find the best deal.

AAA and Salvage Vehicle Insurance

You may want to see also

Multi-car discounts

Multi-car insurance policies are a great way to save money if you have multiple vehicles in your household. By insuring multiple cars with the same company, you can take advantage of a multi-car discount, which typically ranges from 10% to 25% off your premium. Some popular insurance companies and the multi-car discounts they offer are as follows:

- GEICO: Up to 25% off

- State Farm: Up to 20% off

- Progressive: Up to 10% off

- Travelers: Up to 8% off

- Allstate: Multi-car discount offered, percentage not specified

- Farmers: Multi-car discount offered, percentage not specified

- Liberty Mutual: Multi-car discount offered, percentage not specified

- Nationwide: Multi-car discount offered, percentage not specified

- USAA: Multi-car discount offered, percentage not specified

It's important to note that the availability and specifics of multi-car discounts may vary by state and insurer. Additionally, some companies may require that the insured vehicles are garaged at the same address, while others allow for multiple addresses.

Multi-car insurance policies not only save you money but also streamline the insurance process. With a multi-car policy, you only need to manage one recurring payment and keep track of one policy renewal date. Furthermore, you can stack your insurance coverage, meaning that you can combine the total amount of your coverage in the event of an accident. For example, if you have two cars with $50,000 in uninsured motorist coverage each, you effectively have $100,000 in coverage protecting you at all times.

When considering a multi-car insurance policy, it's beneficial to shop around and compare quotes from different insurance companies. Additionally, keep in mind that the number of vehicles you can insure on one policy may vary between insurers, with some companies allowing up to six cars, while others allow up to nine or even twenty.

Verify Auto Insurance Coverage: Quick Guide

You may want to see also

Student discounts

Students can get discounts on their car insurance premiums, with most insurance companies offering discounts for students who achieve good grades or complete driver's education courses.

Good Student Discounts

Full-time students with good grades can get a discount of up to 25% on their car insurance. To qualify, students must be under 25 years old and have a GPA of 3.0 or above, or a "B" average or better. Proof of grades is required, and some companies may also accept good scores on standardised tests such as the SAT, ACT or PSAT.

Driver's Education Discounts

Completing a driver's education class can help reduce premiums for new and teenage drivers. Students can also get a discount for completing additional driver's education, like a defensive driving course. Some insurance companies, such as State Farm, offer their own driver training programs, which offer a discount upon completion.

Affinity Membership Discounts

Students who are members of certain fraternities, sororities, or honours societies may be eligible for a discount on their car insurance. GEICO, for example, offers an affinity membership discount for members of eligible organisations.

Distant College Student Discount

If a student attends college away from home, their parents may be able to get a discount on their car insurance. This applies when the student doesn't have their own vehicle and is only likely to drive their family car during school breaks.

Multi-Policy Discounts

Students can also save money by bundling their car insurance with other types of insurance, such as renters or homeowners insurance.

Zero Depreciation: Maximizing Auto Insurance

You may want to see also

Homeowner discounts

Homeowners insurance itself also has many discounts that can be applied to save money. Here are some common ones:

- Bundling/multi-policy discount: Getting your home and auto insurance from the same insurance company (bundling) can result in a discount.

- Being claims-free: Insurance companies may lower your rates if you go a certain number of years without filing a home insurance claim.

- Monitored security system: Many insurance companies offer reduced prices to homeowners with a monitored security system, as this reduces the chance of a break-in.

- Monitored fire alarm system: The faster the fire department can respond to a fire, the less damage your home will suffer, resulting in a smaller insurance claim.

- Impact-resistant roof: Having an impact-resistant roof lowers the chance of hail causing significant damage to your home, which may be eligible for a discount.

- Home improvements: Making improvements to your home in terms of safety, longevity, or structure can lead to discounts as they reduce the chances of making a claim. Examples include water shut-off devices and smart home technology.

- Living in a gated community: Living in a neighbourhood with an extra level of security, such as a neighbourhood watch or gated entrance, can reduce the chance of burglary and result in a discount.

- Mature homeowner's discount: Retired homeowners are often at home during the day, reducing the likelihood of burglary, and are more likely to be able to spot a fire and sound the alarm quickly.

- Marital status: Being married or widowed may qualify you for a discount with some insurance companies.

- New home discount: Getting insurance for a new home may make you eligible for a "new customer" discount if purchased within the last 12 months.

Arizona Gap Insurance: What's Covered?

You may want to see also

Customer loyalty discounts

Types of Customer Loyalty Discounts

- Renewal discounts: Some insurers offer a discount when you renew your policy, but requirements vary, and you may need to renew early.

- Loyalty discounts: Some insurers, like Progressive, offer a discount for staying with them for a specific time, and the discount increases the longer you're a customer.

- Multi-policy discounts: You can often get a discount for purchasing at least two types of insurance from the same issuer, such as auto and home insurance.

- Multi-car discounts: Insuring two or more vehicles together with the same issuer usually results in a lower rate than insuring them individually.

- Good driver discounts: Some insurers reward drivers with a clean driving record and no at-fault accidents with a discount.

- Accident forgiveness discounts: Some insurers may forgive your first at-fault accident if you've been with them for a while, although this may only apply if the accident causes minor damage.

- No-claims discounts: If you haven't filed a claim, you may receive a discount. However, paying for minor repairs out of pocket can help keep rates low and maintain this discount.

Pros and Cons of Customer Loyalty Discounts

On the one hand, customer loyalty discounts can save you money, especially when combined with other discounts. Additionally, staying with the same insurer can be more convenient than shopping around and switching providers.

On the other hand, insurance rates often increase over time, and loyalty discounts may not always keep up with these increases. In some cases, insurers engage in price optimization, offering a small discount while significantly raising rates. Therefore, it's essential to regularly compare rates and discounts from multiple companies to ensure you're getting the best deal.

Insuring Your Vehicle at DMV

You may want to see also