When you purchase a ticket, whether it's for an event, a flight, or a concert, it's important to understand the insurance coverage that comes with it. In the event of unforeseen circumstances, such as flight delays, cancellations, or accidents, your ticket may trigger insurance benefits. These benefits can include refunds, rebooking assistance, or compensation for any losses incurred. Knowing the specific insurance coverage associated with your ticket can help you navigate potential issues and ensure you're protected when you least expect it.

What You'll Learn

- Direct vs. Indirect Damage: When a ticket causes direct damage to your vehicle, it's typically covered by insurance

- Ticket-Related Expenses: Insurance may cover costs like towing, repairs, and legal fees incurred due to the ticket

- Liability and Fault: Insurance claims often hinge on determining who was at fault, as per the ticket

- Ticket Validity and Age: Insurance companies may have policies regarding the age and validity of the ticket for coverage

- Ticket-Induced Accidents: If a ticket leads to an accident, insurance can cover damages and injuries, but details vary by policy

Direct vs. Indirect Damage: When a ticket causes direct damage to your vehicle, it's typically covered by insurance

When a ticket is issued, it often marks the beginning of a complex process, especially when it comes to insurance claims. The key to understanding when a ticket impacts your insurance coverage lies in the nature of the damage caused. In this context, we differentiate between direct and indirect damage, and these classifications are crucial in determining the extent of insurance coverage.

Direct damage refers to the physical harm inflicted on your vehicle as a direct result of the incident. For instance, if a ticket causes your car to collide with another object, the damage to your vehicle is considered direct. This type of damage is typically covered by your insurance policy, as it falls under the category of accidental damage. Insurance companies often have specific clauses in their policies that address such scenarios, ensuring that policyholders are financially protected against unforeseen events.

On the other hand, indirect damage is more subtle and less obvious. It occurs when the ticket indirectly contributes to a series of events that ultimately lead to vehicle damage. For example, a ticket for reckless driving might lead to a series of close calls, increased stress, and, consequently, a higher risk of accidents. In such cases, the insurance company may argue that the initial ticket did not directly cause the damage but rather set in motion a chain of events that did. This distinction is essential, as insurance policies often have limitations on coverage for indirect causes.

Understanding the difference between direct and indirect damage is vital for policyholders. When a ticket results in direct damage, the insurance claim process is generally straightforward, and the policy should cover the repairs or replacements. However, for indirect damage, the insurance company may deny the claim, leaving the policyholder to bear the financial burden. It is, therefore, essential to review your insurance policy and understand the terms and conditions to ensure you are adequately protected.

In summary, the impact of a ticket on your insurance coverage depends significantly on the type of damage it causes. Direct damage, which is a direct result of the incident, is typically covered, while indirect damage, which is a consequence of the incident, may not be. Being aware of these distinctions can help you navigate the insurance process more effectively and ensure that you receive the appropriate coverage when needed.

Auto Insurance Deductibles: Rising Costs?

You may want to see also

Ticket-Related Expenses: Insurance may cover costs like towing, repairs, and legal fees incurred due to the ticket

When it comes to insurance coverage for ticket-related expenses, it's important to understand the specific circumstances under which your insurance policy might kick in. While insurance can provide financial relief in various situations, the coverage for tickets can vary depending on the type of ticket and the insurance company's policies.

In many cases, insurance companies offer coverage for expenses incurred as a direct result of a traffic ticket. This can include costs associated with towing your vehicle, repairing any damage caused by the incident, and even legal fees if the ticket leads to a court appearance. For instance, if you receive a speeding ticket and your vehicle is towed due to parking violations, the towing fees might be covered by your insurance. Similarly, if the ticket results in vehicle damage, insurance can help with the repair costs.

The key factor here is the cause of the ticket and the associated expenses. If the ticket is a direct consequence of an accident or a violation that led to vehicle damage, insurance is more likely to cover the related costs. However, it's essential to review your insurance policy to understand the specific terms and conditions regarding ticket-related coverage. Some policies might have exclusions or limitations, so being aware of these details is crucial.

Additionally, insurance coverage for legal fees can be particularly useful. Legal proceedings related to traffic tickets can be complex and costly, especially if you need to hire an attorney. In such cases, having insurance that covers legal expenses can provide significant financial support. It's worth noting that not all insurance policies offer this coverage, and the extent of coverage may vary, so checking your policy is essential.

Understanding your insurance policy's terms is vital to knowing when and how ticket-related expenses will be covered. While insurance can provide assistance in various ticket scenarios, the specific coverage and limitations should be clearly understood to ensure you receive the appropriate financial support when needed.

Auto Insurance: Understanding Adequate Coverage for Peace of Mind

You may want to see also

Liability and Fault: Insurance claims often hinge on determining who was at fault, as per the ticket

When it comes to insurance claims, the concept of liability and fault is crucial, especially in the context of traffic violations and accidents. Insurance companies rely on a clear understanding of who was at fault to process claims and determine coverage. This determination is often based on the details provided in a ticket or citation issued by law enforcement.

A ticket, also known as a citation, is a formal notice issued to a driver for violating traffic laws. It typically includes information such as the date, time, and location of the incident, as well as a description of the alleged violation. When a ticket is issued, it becomes a critical piece of evidence in assessing liability. Insurance adjusters and claims processors will carefully examine the ticket's contents to identify the driver's actions and any potential negligence.

The process of determining fault based on a ticket involves a thorough analysis of the circumstances surrounding the incident. This includes reviewing the ticket for details such as the speed at which the vehicle was traveling, whether traffic signals were ignored, or if the driver was under the influence of substances that impair judgment. Each state or region may have specific laws and regulations that define fault, and insurance companies must adhere to these guidelines.

In many cases, the ticket itself may not provide a definitive answer to the question of fault. This is where additional evidence and witness statements come into play. Insurance adjusters may request further information from the policyholder, such as witness contact details or any relevant security camera footage. This additional data helps to build a comprehensive understanding of what occurred and who was at fault.

Ultimately, the insurance company's decision regarding liability and fault will impact the claim's outcome. If the insurance provider determines that the policyholder is at fault, they may deny or limit coverage for certain expenses. Conversely, if the policyholder can prove their innocence or provide compelling evidence of the other party's fault, they may be able to successfully dispute the ticket and potentially avoid increased insurance premiums.

Towing and Auto Insurance Claims

You may want to see also

Ticket Validity and Age: Insurance companies may have policies regarding the age and validity of the ticket for coverage

When it comes to insurance coverage for tickets, the age and validity of the ticket play a crucial role in determining eligibility for compensation. Insurance companies often have specific policies and guidelines to ensure that the ticket is not only valid but also within the required age range for coverage. This is an important consideration, especially for travel insurance, as it ensures that the insurance provider can accurately assess the risk and provide appropriate protection.

The age of the ticket is a critical factor. Insurance policies typically specify a time frame during which the ticket is considered valid for coverage. For instance, a travel insurance policy might cover tickets that are valid for travel within the next 30 days. If the ticket is older than this specified period, the insurance company may deny coverage, as the risk of the event occurring (such as a flight cancellation or delay) is considered too low. This policy ensures that the insurance provider only covers tickets that are relevant and timely.

Additionally, the validity of the ticket is essential. A ticket must be valid for the entire duration of the trip for which coverage is sought. For example, if a traveler has a flight ticket that is valid for a specific date but the travel insurance policy requires coverage for the entire journey, the ticket may not meet the criteria. Insurance companies often require tickets to be fully valid, including all necessary connections and return flights, to ensure comprehensive coverage.

It is important for individuals to carefully review the insurance policy and understand the specific requirements regarding ticket age and validity. Failure to meet these criteria could result in a claim being denied, leading to potential financial losses. Therefore, travelers should always check the insurance provider's guidelines and ensure their tickets comply with the specified conditions to avoid any issues when making a claim.

In summary, insurance companies have policies that consider the age and validity of tickets to determine coverage. These policies ensure that the insurance provider can accurately assess the risk and provide appropriate protection. By understanding and adhering to these guidelines, travelers can ensure they have the necessary coverage and avoid potential claim rejections.

Vehicle Insurance Expired? Here's What to Do

You may want to see also

Ticket-Induced Accidents: If a ticket leads to an accident, insurance can cover damages and injuries, but details vary by policy

The concept of "ticket-induced accidents" might seem counterintuitive, but it is a real scenario that can occur when a driver receives a ticket for a traffic violation, which then leads to an accident. This situation can be complex and often depends on the specific circumstances and the insurance policy in place. When a ticket is issued, it typically indicates that a driver has committed a traffic offense, such as speeding, running a red light, or driving recklessly. While the ticket itself is not the direct cause of an accident, it can be a contributing factor, especially if the driver's behavior is influenced by the stress or distraction of receiving a ticket.

In many cases, insurance policies have provisions to cover accidents caused by ticket-related incidents. However, the coverage and compensation can vary significantly depending on the insurance company and the policy's terms. Generally, insurance companies consider the ticket as a trigger for a review of the driver's behavior and may adjust the premium or even cancel the policy if the violation is severe. But, if the accident occurs immediately after receiving the ticket, the insurance might still cover the damages and injuries, provided the policy covers such scenarios.

The key to understanding coverage is to examine the policy's fine print. Some insurance companies may explicitly state that tickets or traffic violations do not automatically trigger coverage for subsequent accidents. Instead, they might require a specific sequence of events, such as a driver's reaction to the ticket causing a distraction or stress that leads to the accident. For instance, if a driver receives a speeding ticket and then, due to increased road rage, they lose control of their vehicle and cause a collision, the insurance might cover the damages, but the policyholder may also face increased premiums or policy cancellations.

It is essential for drivers to be aware of their insurance policy's stance on ticket-induced accidents. If the policy explicitly covers such incidents, the insurance company will likely investigate the accident and its connection to the ticket. They may also consider the driver's response to the ticket and any potential behavioral changes that could have contributed to the accident. In some cases, the insurance might require a formal claim process, including providing evidence of the ticket and the accident, to determine the extent of coverage.

In summary, while a ticket is not the direct cause of an accident, it can be a contributing factor, and insurance coverage can vary. Policyholders should carefully review their insurance policies to understand the conditions under which ticket-induced accidents might be covered. Additionally, drivers should be mindful of their behavior after receiving a ticket to avoid any actions that could lead to accidents and potential legal consequences.

State of Confusion: Does Location Impact Your Auto Insurance?

You may want to see also

Frequently asked questions

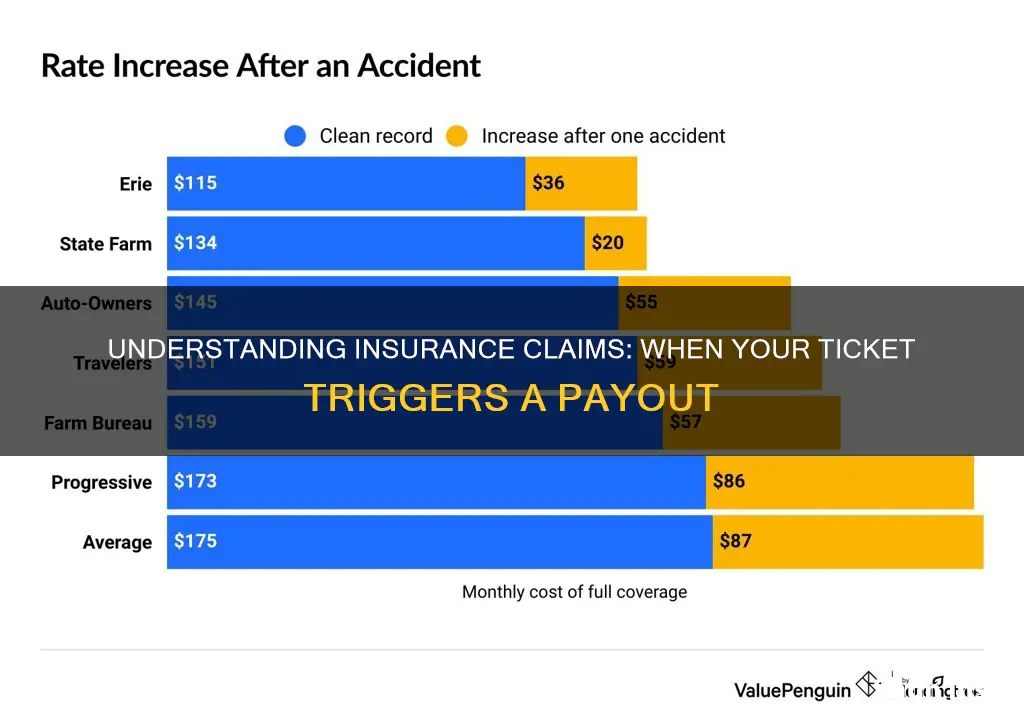

Insurance companies often consider traffic violations and moving violations when determining insurance rates. A ticket can affect your insurance rates if it is deemed a "covered incident" under your policy. The severity of the violation and your driving record will play a significant role in how much your rates may increase.

Not all tickets will result in immediate rate increases. The impact depends on the insurance company's policies and the specific violation. Minor tickets, such as a warning or a non-moving violation, might not significantly affect your rates. However, more serious violations, like speeding or reckless driving, could lead to higher premiums.

The duration a ticket remains on your driving record varies by jurisdiction. In many places, minor violations are removed from your record after a certain period, often three to five years. More severe offenses might stay on your record for a more extended period, sometimes indefinitely, depending on the state's regulations.

Yes, you have the right to dispute the impact of a ticket on your insurance rates. If you believe the violation was unjust or want to contest the insurance company's decision, you can file an appeal. It's essential to provide relevant evidence and follow the insurance company's appeal process to potentially mitigate the impact on your premiums.