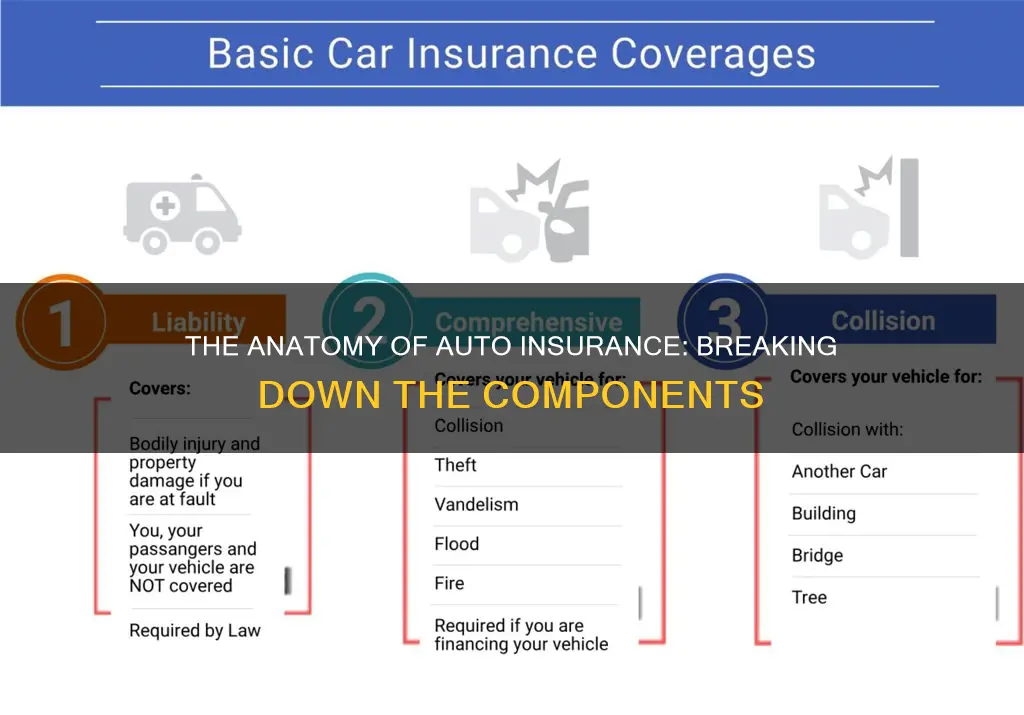

Auto insurance is broken up into several different types of coverage, each of which protects against different risks. For example, comprehensive coverage includes replacement or repair of your vehicle if it is stolen or damaged in a non-collision incident, such as a break-in or vandalism. Comprehensive coverage also includes broken windows, damaged locks, and dismantled ignition systems. On the other hand, liability coverage covers property damage and injuries caused to other people. There is also mechanical breakdown insurance, which covers repairs if your car has mechanical or electrical problems.

| Characteristics | Values |

|---|---|

| What auto insurance covers | Damage to the car, including broken windows, damaged locks, and dismantled ignition systems |

| What auto insurance does not cover | Stolen personal items and aftermarket components |

| What to do if your car is broken into | Document the scene, call the police, place a fraud alert on your credit record, call your insurance company |

| Comprehensive coverage | Covers damage to the vehicle in the event of a break-in or vandalism, including broken windows, cosmetic damage, and stolen aftermarket car stereos and accessories |

| Comprehensive coverage exclusions | Personal items and aftermarket components |

| Minimum car insurance | Does not protect against break-ins, only covers property damage and injuries caused to other people |

| Full coverage | Includes comprehensive and collision insurance, offers protection if the vehicle is vandalized or broken into |

| Collision insurance | Covers damage to the vehicle in the event of a collision with another object or vehicle |

| Liability insurance | Covers property damage and injuries caused to other people |

| Car repair insurance | Covers mechanical or electrical repairs, similar to an extended car warranty |

| Extended car warranty | Covers mechanical defects in the engine, transmission, and electronics, purchased from a dealership or third-party company |

What You'll Learn

Comprehensive coverage

When purchasing comprehensive coverage, there is no need to select a limit. The maximum payout is based on the actual cash value of your vehicle, and you will be responsible for paying your selected deductible. The deductible is the amount you agree to pay before the insurance company starts paying for damages. A higher deductible can result in lower insurance costs, while a lower deductible will lead to higher insurance costs.

Auto Insurance: Collision Coverage Optional?

You may want to see also

Stolen personal items

If you have personal items stolen from your car, your auto insurance will not cover their cost—only comprehensive coverage will pay for the theft of the vehicle itself and sometimes for the theft of specific parts. However, some insurance companies offer personal property coverage for an additional fee, which would cover the theft of personal items.

Comprehensive coverage is optional in every state, but if you finance or lease your car, your leasing company or lender will likely require you to carry it. It covers all non-collision damage or loss to your vehicle, including water damage, falling branches or objects, vandalism, extreme weather, and theft. It will also cover damage to your vehicle caused by a break-in, such as broken glass or damaged locks.

If you want to cover the cost of stolen personal items, you will need to take out personal property coverage. This is a standard part of most renters' and homeowners' insurance policies, covering personal belongings against theft and damage from perils listed in the policy, such as fire, smoke, windstorm, or vandalism. Personal property coverage applies to belongings regardless of where they are located, whether at home or away from home. This means that if something is stolen from your car while it is parked in your driveway or in a parking lot, you may be able to file a claim with your home insurer.

Personal property coverage may have lower limits for certain categories of items, such as jewelry, electronics, firearms, or cash. For example, if your policy has a $2,500 limit for electronics and your laptop and phone are both stolen from your car for a total value of $3,000, you would only receive $2,500 from your insurer. To increase the limits for these items, you may need to buy scheduled personal property coverage (SPP), which is an endorsement that you can add to your home policy for an extra cost. SPP coverage will pay for the repair or replacement of the scheduled items up to their appraised value.

It is important to note that personal property coverage may have a high deductible, meaning that if you only lost a few items, it may not be enough to file a claim. Additionally, personal property coverage usually has a deductible, which is the amount deducted from your claims payment. If a thief stole two laptop computers from your car totaling $3,000 in value, your home policy would reimburse you that amount minus your policy deductible.

Commercial Vehicle Insurance: Expense or Essential?

You may want to see also

Filing a claim

Filing an auto insurance claim is a relatively straightforward process, but it can be stressful if you're dealing with the aftermath of an accident. Here's a step-by-step guide on how to file an auto insurance claim:

- Document the Scene: After an accident, it's crucial to document the damage. Take pictures of the damage to your vehicle, including close-ups of any visible damage, such as broken windows or forced entry. Also, take pictures of the surrounding area and note the location, date, and time of the incident. If there are any injuries, take photos of those as well. If there are any witnesses, get their contact information as their perspective might be helpful when filing your claim.

- File a Police Report: Contact the police and file a report, especially if it's a car break-in or vandalism. Your insurance company will likely require a police report to process your claim. Have the following documents handy when filing the report: your driver's license, vehicle registration, auto insurance ID card, photos of the damage, and a list of stolen or damaged items.

- Gather Supporting Information: Your insurance company will want to know the details of the incident. Gather information such as the names, addresses, phone numbers, and insurance policy numbers of all involved parties. Also, note the weather conditions at the time of the accident and get a copy of the police report if available.

- Report the Incident to Your Insurance Company: Contact your insurance company as soon as possible, even from the scene of the accident, regardless of who is at fault. Report the incident by calling them, using their mobile app, or through their website. They will review your policy and inform you if the incident is covered. Be prepared to provide them with the information you gathered in step 3. Ask relevant questions, such as the claim process timeline, rental car reimbursement, and repair options.

- Understand the Timing and Documents Needed: Find out if there are any time limits for filing claims, resolving disputes, or submitting additional information. Also, inquire about the rental car policy if your car needs repairs. Your insurance company will require a "proof of claim" form and a copy of the police report.

- Provide Additional Information: Fill out the claim forms carefully and provide any additional information or documentation requested by your insurance company. Keep thorough records of everything related to the claim, including the names and contact information of everyone you speak with.

Remember, each insurance company's process might vary slightly, and it's essential to review your policy to understand your specific coverage and requirements.

Affordable Auto Insurance: Finding the Cheapest Rates

You may want to see also

Car repair insurance

Mechanical breakdown insurance covers repairs to various parts of your car, including convenience technology (such as a convertible top or sunroof), heating and cooling systems, electrical systems, and safety technology. It's important to note that this type of insurance does not cover routine maintenance, pre-existing damage, or damage caused by accidents or poor maintenance.

When purchasing mechanical breakdown insurance, you will choose a deductible, which is the amount you will pay out of pocket before the insurance coverage kicks in. The deductible can vary by insurer, with some companies offering deductibles ranging from $50 to $500. Additionally, eligibility for this type of insurance may depend on the age and mileage of your vehicle, as well as the guidelines of the insurance company.

Mechanical breakdown insurance is different from an extended car warranty, which is typically purchased from a dealership or third-party company. Car repair insurance is bought from an insurance company and added to your existing car insurance bill, allowing for more flexible payment options. It also provides broader protection from mechanical failures for the entire length of your term, whereas extended warranties may have varying lengths of coverage for different parts.

Before purchasing mechanical breakdown insurance, it's important to consider the cost of potential repairs, the age and reliability of your vehicle, and whether you already have a warranty in place. This type of insurance may be worth considering if you want additional protection against unexpected repair bills.

Double Insuring Vehicles: Legal or Not?

You may want to see also

Minimum car insurance

Auto insurance is broken up into different types of coverage, each with its own set of protections and costs. One of the most important types of auto insurance is minimum car insurance, also known as liability insurance. This type of insurance is required by law in most states and covers the basic costs of property damage and bodily injury to others in the event of an accident.

The minimum coverage requirements for car insurance vary by state, but typically include bodily injury liability and property damage liability. For example, in Washington state, the minimum requirements are $25,000 of bodily injury or death of one person in any accident, $50,000 of bodily injury or death of any two people in any accident, and $10,000 of injury to or destruction of property of others in any accident. These minimums ensure that drivers have some financial protection in the event of an accident, but it's important to note that they may not cover all costs associated with a crash.

In addition to liability insurance, there are other types of optional coverage that drivers can choose to add to their policies. One example is collision coverage, which pays for damage to your car if it hits another car or object, or if it flips over. Another is comprehensive coverage, which covers damage to your car that isn't caused by a crash, such as broken glass or fire damage. These types of coverage typically come with a deductible, which is an amount you must pay out of pocket before the insurance company will cover the rest.

It's worth noting that while minimum car insurance is essential, it may not be sufficient for all drivers. In some cases, it may be wise to purchase additional coverage, such as uninsured/underinsured motorist coverage, which protects you if you're hit by a driver who doesn't have enough insurance. Ultimately, the decision of how much and what type of car insurance to purchase depends on individual needs, budget, and state requirements.

By understanding the different types of coverage available and their benefits, drivers can make informed decisions about their auto insurance policies and ensure they have the protection they need in the event of an accident or other vehicle-related incident.

Gap Insurance: Australia's Ultimate Car-buying Protection

You may want to see also