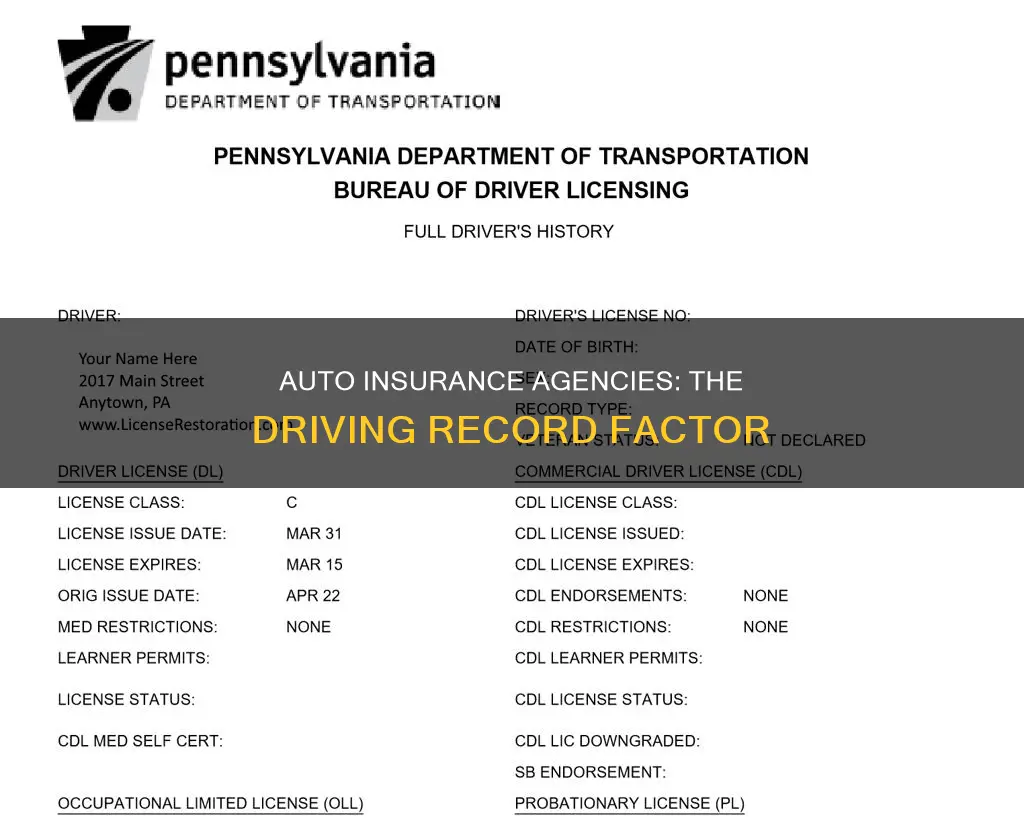

Auto insurance agencies do pull driving records when you apply for a new policy and at renewal. They use something called a driver's abstract or motor vehicle record (MVR) to do so. This record includes information such as driver identification details, total demerit points, active fine suspensions, driving convictions, and suspensions and reinstatements over the past three years. Insurance companies pull driving records to assess the risk of insuring a driver, and accidents or traffic violations are the main red flags that increase insurance rates.

| Characteristics | Values |

|---|---|

| When do auto insurance agencies pull driving records? | When applying for a new insurance policy, getting a new quote, or when an existing policy is up for renewal. |

| How do auto insurance agencies pull driving records? | Using a driver's license number. |

| What do auto insurance agencies look for in driving records? | Accidents, traffic violations, speeding tickets, at-fault accidents, DUI/DWIs, license suspensions, revocations, and restrictions. |

| How far back do auto insurance agencies look in driving records? | Typically 3-5 years, but it can vary depending on state laws and the insurance company. Some companies may look back as few as 3 years or as many as 10. |

What You'll Learn

Driving records are checked when applying for a new policy or at renewal

Driving records are a key factor in determining car insurance premiums. Insurance companies check driving records when you apply for a new policy and at renewal. They do this to assess the risk of insuring you. The higher the risk, the higher the premium.

When applying for a new policy, insurance companies will check your driving record to see how you drive and how responsible you are behind the wheel. They will factor in your driving history, employment status, any extra driving courses you took, and where you keep your vehicle. All of this information helps them determine your risk level. If you are found to be a high-risk driver, you will pay more for insurance. However, if the insurance company categorizes you as low-risk, you may save money on your premiums.

Insurance companies typically check your driving record when you apply for a new policy and at renewal. They may also check your driving record if you change the level of coverage, change your car, add an extra driver to your policy, or move to a new address.

Your driving record includes a variety of information, such as your name, address, driver's license number, license status, and any convictions related to motor vehicle violations. It also includes accident information and driver control actions, such as failure to yield or stop. Insurance companies use this information to assess the risk of insuring you.

Insurance companies typically look back at the previous three to five years of your driving record when setting insurance rates. However, this can vary depending on state laws and the insurance company. For example, in California, a DUI remains on your record for ten years, while an accident has a look-back period of three years.

If you have a history of accidents or traffic violations, you may be considered a high-risk driver and may have to purchase high-risk auto insurance at a more expensive rate. However, if you have a clean driving record, you may be able to avoid surcharges and even apply for safe driving discounts.

Auto Insurance Statements: How Long to Keep?

You may want to see also

Records are checked for accidents, claims, and tickets

When auto insurance agencies check your driving record, they are looking for any negative marks that may indicate you are a high-risk driver. This includes accidents, claims, and tickets.

Accidents and traffic violations are the main factors that will increase your insurance rates. One accident can increase auto insurance rates by an average of $80 per month, while one speeding ticket can raise your rates by $45 per month.

In addition to checking your driving record, insurance companies will also take into account your credit score, age, address, the type of car you drive, and other factors when determining your premiums.

When checking your driving record, insurance companies will typically look back between three and five years, although this can vary depending on state law and the company. They will usually check your driving record when you apply for a new policy and at renewal.

Your driving record includes information such as your name, address, driver's license number, license status, convictions related to motor vehicle violations, accident information, and driver control actions such as failure to yield or stop. It's important to note that pending charges for traffic violations will not show up on your record.

In addition to your driving record, insurance companies may also check your insurance history, which includes information on previous claims, accidents, violations, and cancellations. This information is used to assess the risk associated with insuring you and determine your insurance rates.

Insurance Surveillance: What to Do

You may want to see also

A poor driving record leads to high-risk insurance at a higher rate

Auto insurance companies pull driving records to determine whether a driver is high-risk. A poor driving record, including accidents, traffic violations, and DUIs, can result in a driver being deemed high-risk and having to pay higher insurance rates.

A driver with a history of accidents or serious traffic violations is considered a higher risk to insure and will likely pay more for car insurance. This is because insurance companies view these drivers as more likely to make a claim. The presence of any negative marks on a driving record indicates that a driver is high-risk.

High-risk auto insurance is a special type of policy reserved for drivers with less-than-stellar driving records. These drivers are considered more likely to cause an accident and more expensive to insure. High-risk drivers often have records containing moving violations, at-fault accidents, DUIs, or a combination of these.

The cost of high-risk insurance is typically associated with increased premiums. Those with high-risk auto insurance policies may pay up to 69% more than those who are not considered high-risk. The amount of the increase depends on the type and number of infractions. For example, a DUI conviction on a driving record can result in insurance rates doubling. Multiple speeding tickets or moving violations can increase insurance rates by up to 35%.

High-risk auto insurance is not a mandate handed down by a court but is instead based on an insurance company's calculation of risk factors. There is no set time period for how long a driver will be considered high-risk, but some infractions, such as accidents and DUI convictions, remain on a driver's record for longer and have a more significant impact on premium costs.

Drivers seeking to lower their premiums should focus on improving their driving record. While past infractions cannot be undone, adopting safer driving habits can help reduce risk levels over time.

Auto Insurance: How Much Coverage?

You may want to see also

Driving records are checked for license histories

Your driving record is a major factor in determining your car insurance premiums. Insurance companies use driving records to evaluate your driving habits and assess whether you are a high-risk or low-risk driver. They look for any negative marks on your driving record that may indicate you are a high-risk driver, such as accidents, excessive insurance claims, and traffic violations. These factors can lead to higher insurance rates.

In addition to your driving history, insurance companies may also consider other factors when determining your premiums, such as your credit score, age, where you live, and the type of car you drive. It's important to note that insurance companies typically check your driving record when you apply for a new policy and at renewal, so maintaining a clean driving record is crucial.

Gap Healthcare Insurance: Filling Coverage Gaps

You may want to see also

Driving records are checked for insurance history

Driving records are checked by auto insurance companies to determine a driver's risk level. This is done when applying for a new policy, getting a new quote, or renewing an existing policy. The records are also checked when a driver requests to change the level of coverage, change their car, or add an extra driver to the same coverage. A driver's motor vehicle report (MVR) contains all the accidents, claims, and tickets, giving the insurance company a full picture of their behaviour on the roads.

In the US, insurance companies use a driver's license number to retrieve driving records. They look for negative marks that indicate a high-risk driver, such as accidents, excessive insurance claims, and traffic violations. These factors contribute to higher insurance rates. The records also include license suspensions, revocations, and reinstatements.

In Canada, insurance companies use a driver's abstract or motor vehicle record (MVR) to check driving records. This includes driver identification details, license status, and driving convictions. Insurance companies are particularly interested in the 3- or 5-year driver's record to verify longer-term experience.

In both countries, insurance companies have access to databases that provide information on previous claims, accidents, violations, and long-term insurance history. This helps them assess a driver's risk level and set insurance rates accordingly.

It is important to note that driving records do not include criminal history beyond driving-related offences, and most non-moving violations do not impact insurance rates. Additionally, insurance companies cannot pull a full MVR but only a summary of recent tickets, accidents, and convictions.

Insuring Her Vehicle: What You Need to Know

You may want to see also

Frequently asked questions

Auto insurance agencies typically check driving records by accessing information from sources such as the Department of Motor Vehicles (DMV) or similar government agencies. They use this information to assess the risk associated with insuring you. The specific methods may vary, but common practices include electronic data exchange with the DMV, requesting driving record reports, and utilizing specialized databases.

Auto insurance agencies look for various items in driving records, including driver identification details such as name, address, and driver's license number; license status (valid, expired, suspended, etc.); driving convictions and accidents; driver control actions (e.g., failure to yield); license suspensions or revocations; and DUI/DWI convictions. They use this information to determine your risk level and set insurance rates accordingly.

The timeframe varies by state and insurance company, but auto insurance agencies typically check driving records from the past three to five years. Some states may only look back three years, while others can go back seven years or more for certain violations. It's worth checking with the insurer if you have any concerns about past violations.