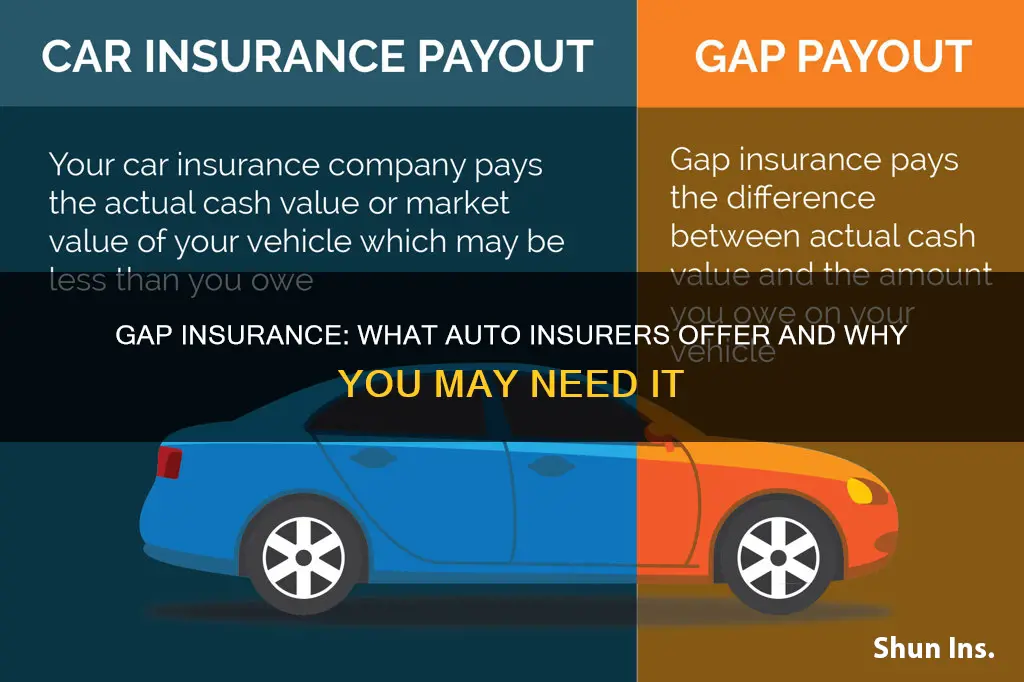

Gap insurance is an optional add-on to a car insurance policy that covers the difference between the value of a financed or leased vehicle and the amount still owed on it, in the event of theft or a total loss. This difference is referred to as the gap.

While not all auto insurance companies offer gap insurance, many do, including Travelers, The Hartford, Liberty Mutual, Nationwide, Progressive, State Farm, and Allstate. Gap insurance can also be purchased through a car dealership or auto lender when buying a vehicle. However, it's usually cheaper to buy gap insurance through an auto insurance company.

| Characteristics | Values |

|---|---|

| What is gap insurance? | Optional, add-on car insurance coverage that can help certain drivers cover the “gap” between the amount they owe on their car and the car’s actual cash value (ACV) in the event of an accident. |

| When to get gap insurance? | When you owe more on your car loan or lease than the car is worth. |

| When not to get gap insurance? | If your vehicle is not financed, there is no reason to purchase gap coverage. |

| When to drop gap insurance? | As soon as your car loan balance is less than the vehicle’s actual cash value. |

| Where to buy gap insurance? | From most major insurance companies, including Progressive, Nationwide, State Farm, and Allstate. |

| Cost of gap insurance | Typically $20-$40 annually when purchased from a standard insurer. |

| Cost factors | The actual cash value of the vehicle and where you buy the coverage. |

What You'll Learn

Gap insurance covers theft

If your car is recovered after being stolen, gap insurance will only pay out if the car is considered "totalled". Whether a car is considered "totalled" depends on the state, which will have different rules on what constitutes a total loss, based on the estimated price of repairs compared to the car's value.

To receive a gap insurance payout for a stolen car, you will need a copy of the police report, and you will need to file a claim with your standard insurer before filing a claim with your gap insurance provider. Gap insurance companies will thoroughly investigate claims for stolen cars to prevent fraud, so expect a wait before receiving a payout.

Gap insurance is a type of car insurance that covers the difference between a totalled car's value and the balance on a loan or lease. It is often included in many comprehensive auto insurance policies, and can be purchased directly from auto insurers, dealerships, or banks.

Auto Insurance Trackers: Worth the Cost?

You may want to see also

It doesn't cover engine failure

Gap insurance is an optional product that covers the difference between the amount you owe on your auto loan and the amount the insurance company pays if your car is stolen or totaled. It is important to note that gap insurance does not cover engine failure or mechanical breakdowns. This type of insurance is designed to protect you financially in the event of a total loss, not mechanical issues.

While gap insurance can provide valuable protection, it is crucial to understand its limitations. Engine failure due to mechanical problems or normal wear and tear is not covered under gap insurance. This means that if your car's engine fails and requires repairs or replacement, you will be responsible for the costs. Gap insurance will not cover these expenses.

In most cases, car insurance, including gap insurance, does not cover engine failure unless it is directly caused by an accident or another insured incident. If your engine fails due to a mechanical problem, you will need to explore other options for coverage or bear the financial burden yourself.

To protect yourself from the financial strain of engine failure, you may want to consider purchasing mechanical breakdown insurance (MBI) or an extended warranty. These options can provide coverage for mechanical issues, including engine failure, giving you peace of mind in the event of unexpected repairs.

When purchasing a new or used car, it is essential to carefully review the terms of your auto insurance policy and consider adding additional coverage. While gap insurance can be beneficial in certain situations, it is important to understand that it does not cover engine failure or mechanical breakdowns. By exploring other options, such as MBI or extended warranties, you can ensure that you have the necessary protection in case of unexpected engine issues.

Mileage: Claim Auto Insurance?

You may want to see also

It doesn't cover medical costs

Gap insurance is a type of auto insurance that covers the difference between the amount owed on a loan or lease and the actual cash value of a vehicle if it is stolen or declared a total loss. While gap insurance is not required by law, it is often required by lenders or lessors as a condition of a loan or lease. It is designed for people who finance or lease their vehicles.

Gap insurance does not cover medical costs related to personal injuries or other accident-related expenses. It only covers the difference between the outstanding loan or lease balance and the vehicle's actual cash value. This type of insurance is intended to protect individuals from financial loss in the event of a total loss of their vehicle and does not provide coverage for medical expenses.

If you are seeking coverage for medical costs, you may need to consider other types of insurance policies or add-ons, such as personal injury protection (PIP). PIP is a type of coverage that helps pay for medical expenses, lost wages, and other related costs for the policyholder and their passengers if they are injured in an accident. It is important to carefully review the details of any insurance policy you are considering to ensure that it provides the coverage you need.

In summary, while gap insurance can provide valuable financial protection in the event of a total loss of your vehicle, it does not cover medical costs. If you are concerned about having adequate coverage for medical expenses, you should explore other types of insurance policies or add-ons that specifically include medical coverage, such as personal injury protection.

Burning Vehicle for Insurance: The 'How-To' Guide

You may want to see also

It's not needed if your vehicle is not financed

Gap insurance is an optional, additional form of car insurance coverage that can help certain drivers cover the difference between the amount they owe on their car and the car's actual cash value in the event of an accident. This type of insurance is designed for drivers who are leasing their vehicles or making payments on them.

Gap insurance is not needed if your vehicle is not financed. If you own your car outright, you are not required to have gap insurance. However, it is always a good idea to have comprehensive car insurance coverage to protect yourself financially in the event of an accident, theft, or damage to your vehicle.

When you finance a vehicle, the lender typically requires you to have collision and comprehensive coverage to protect their investment. Collision insurance covers repairs or replacement for your vehicle after a crash with another car or a stationary object. Comprehensive insurance covers repairs or replacement if your car is stolen or damaged by a non-collision event, such as a natural disaster or vandalism.

If you don't have a loan on your vehicle and own it outright, you have the option to choose the level of car insurance coverage that best suits your needs and budget. You can opt for liability coverage, which is required in almost every state, and/or additional coverages such as collision and comprehensive, depending on your preferences and the age and condition of your vehicle.

In summary, gap insurance is designed for drivers who lease or finance their vehicles and is not necessary if you own your vehicle outright. However, it is always a good idea to have adequate car insurance coverage to protect yourself financially in the event of an accident or incident. The level of coverage you choose will depend on your individual needs and circumstances.

Gap Insurance: Am I Covered?

You may want to see also

It's worth it if you have a small down payment

If you've made a small down payment on your car, gap insurance is worth considering. This is because gap insurance covers the difference between the amount you owe on your car loan and the car's actual cash value in the event of an accident.

When you buy a car, its value depreciates quickly, and if you've made a small down payment, you may owe more on your car loan than the car is worth. In this case, if your car is totalled in an accident, your auto insurance may give you a settlement based on the car's actual cash value, leaving you with a big bill to pay. Gap insurance can help cover this difference.

For example, let's say you buy a car for $20,000 and your down payment is $2,000. In this case, gap insurance might be worth it, but it's still a good idea to check the car's anticipated value after a year to determine if there will be a gap. If the car is worth $12,000 after a year but you still owe $15,000, gap insurance could be a smart investment. Without it, if your car is totalled, you'll still owe $3,000 even though you can no longer drive it.

Gap insurance is typically offered as an add-on to your comprehensive or collision insurance policy and only kicks in for covered insurance claims. It's worth noting that gap insurance won't cover normal wear and tear, mechanical breakdowns, or claims that your insurer doesn't cover.

When deciding whether to purchase gap insurance, it's important to research both the car's actual cash value and the amount you owe. Additionally, consider your financial situation and whether you could afford to pay off your loan or lease if your car is totalled or stolen.

Root Insurance: Gap Coverage Explained

You may want to see also

Frequently asked questions

Gap insurance is an optional, add-on car insurance coverage that can help certain drivers cover the difference between the amount they owe on their car and the car's actual cash value in the event of an accident.

Gap insurance covers the difference between the balance of a lease or loan due on a vehicle and what your insurance company pays if the car is considered a covered total loss. It also covers theft in the event your car is stolen and unrecovered.

Gap insurance is an optional insurance coverage for newer cars that can be added to your collision insurance policy. It may pay the difference between the balance of a lease or loan due on a vehicle and what your insurance company pays if the car is considered a covered total loss.

You can buy gap insurance from most major insurance companies, including Progressive, Nationwide, State Farm, and Allstate. You might also be able to purchase gap insurance through your car dealership.